The Ethereum network had its cheapest day in over six months, which could suggest altcoins could rally “sooner than many may expect.”

Cryptocurrency Financial News

The Ethereum network had its cheapest day in over six months, which could suggest altcoins could rally “sooner than many may expect.”

Ethereum (ETH) has completed a major software upgrade, Dencun, that promises to make utilizing the network ecosystem more cost-effective. This update specifically targets Layer 2 (L2) networks, such as Arbitrum (ARB), Polygon (MATIC), and Coinbase’s Base, which are interconnected with Ethereum.

With Dencun, transaction costs on these networks have significantly decreased, with fees dropping from dollars to cents or even fractions of a cent.

Considered the most significant change in Ethereum’s end-user experience, the Dencun upgrade is expected to foster the development of new applications and services by significantly reducing expenses.

As NewsBTC reported on Tuesday, the update introduces a new data storage system, departing from the traditional approach of storing Layer 2 data on Ethereum itself. Adopting a new “blobs” repository reduces data storage costs since information is warehoused for only about 18 days instead of indefinitely.

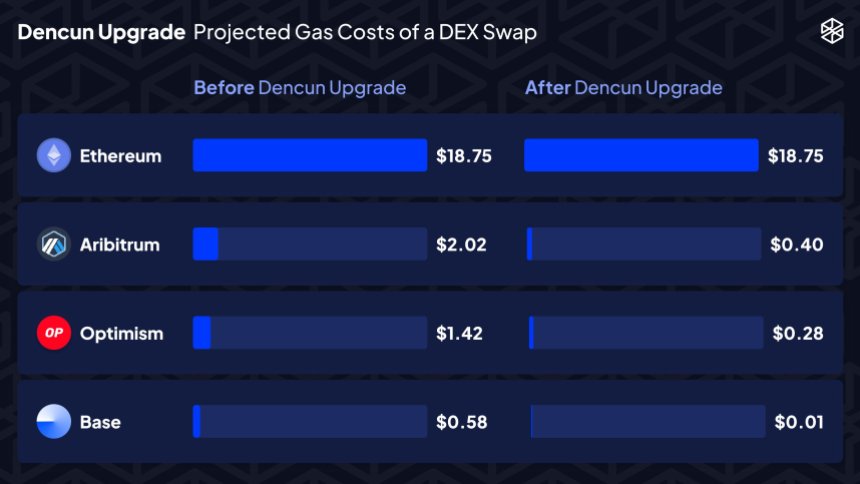

One of the notable benefits of the Dencun upgrade lies in its impact on decentralized exchanges (DEXs) and gas costs. For instance, projected gas costs for popular Layer 2 networks, such as Arbitrum, Optimism, and Coinbase’s Base, are set to be significantly reduced.

The projected savings translate into a reduction of Arbitrum’s swaps from $2.02 to $0.40, Optimism’s swaps from $1.42 to $0.28, and Coinbase’s Base swaps from $0.58 to $0.01, emphasizing the pivotal role of this upgrade.

As the upgrade was successfully launched on the mainnet, Tim Beiko, Ethereum Foundation core developer, expressed his satisfaction with the work accomplished and claimed:

Dencun is both the most complex fork we’ve shipped since the Merge, and tied for “most total EIPs in a fork” with Byzantium. There were more teams than ever involved in the process, and it somehow all worked out smoothly…! Grateful to work with all of them, onto the next one.

Layer 2 network Arbitrum has provided insights into the upgrade process. It will take around one to two hours for blob transactions to commence posting and for the new pricing changes specified by EIP-4844 to come into effect.

ArbOS Atlas, an upgrade that supports Arbitrum Chains, will introduce further fee reductions for Arbitrum One, set to be activated on March 18th. The updated configurations include a reduction in the Layer 1 (L1) surplus fee from 32 gwei to 0 per compressed byte and a reduction in the L2 base fee from 0.1 gwei to 0.01 gwei.

The Dencun upgrade unlocks cost-saving opportunities for Layer 2 networks and addresses congestion concerns by freeing up more space on the Ethereum network for additional transactions. While the upgrade offers enhanced efficiency, it does come at the cost of no longer retaining a complete record of all data indefinitely.

However, as Layer 2 networks embrace this new update to the Ethereum ecosystem, the stage is set for accelerated adoption, usage, and broader accessibility within the Ethereum community and its underlying protocols.

Dencun Upgrade Fails To Propel ETH Above $4,000

Despite the successful upgrade, ETH’s price remains unaffected, continuing to consolidate below the $4,000 threshold. The token attempted to surpass this crucial resistance level on Monday and Tuesday but failed to sustain its position above it.

For over 24 hours now, ETH has been trading between $3,930 and $3,970. Nevertheless, it’s worth noting that ETH has maintained its upward momentum, with gains exceeding 18% over the past fourteen days and nearly 60% over the past thirty days.

Additionally, introducing the Dencun upgrade is expected to drive increased demand for ETH, potentially sparking a renewed uptrend that could bridge the gap between current trading prices and its previous all-time high (ATH) of $4,878, achieved in November 2021.

Featured image from Shutterstock, chart from TradingView.com

The new ERC-404 tokens have swiftly taken the spotlight, dominating the cryptocurrency market and consistently attracting interest from investors and traders. This surge in euphoria has led to a substantial increase in Ethereum gas fees, pushing costs to their highest levels in the past eight months.

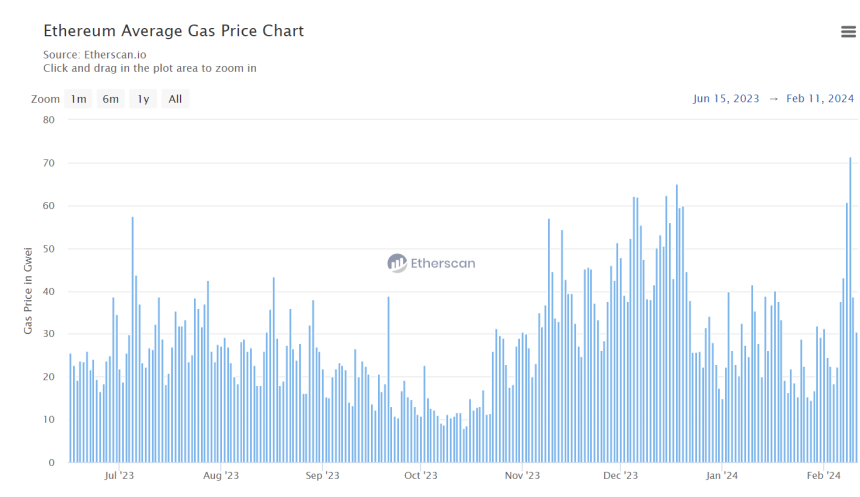

Ethereum gas fees have surged to record highs, reaching unseen levels since March 2023, when the average gas price peaked at 101.26 Gwei. The sudden spike in Ethereum gas prices has been attributed to the recent hype surrounding ERC-404 tokens, an experimental token standard that enables native fractionalization of Non-fungible Tokens (NFTs).

Presently, reports from Etherscan, an Ethereum block explorer and analytics platform, reveal that on Friday, February 9, 2024, Ethereum gas fees reached an average gas price of 71.4 Gwei, with a maximum and minimum gas price of 59,956 Gwei and 34.4 Gwei respectively.

This price is the highest Ethereum gas fees have reached since its explosive peak in May 2023, when the average gas price surged to 155.8 Gwei.

The popularity of the ERC-404 can be attributed to the Pandora team heralding the unofficial token and taking advantage of its high liquidity. Additionally, various cryptocurrency traders have shown immense interest in the new token, aiming to capitalize on its potential and maximize its liquidity.

One trader recently made $59,000 from the popular ERC-404 token. He revealed that his “secret to making money” was buying and selling the ERC 404 token, MINER, using the high gas fees as an advantage.

The co-founder of Gaslite GG, identified as ‘Pop Punk’ on X (formerly Twitter), has also predicted that introducing ERC-404 tokens will lead to a continuous daily rise in the average Ethereum gas price.

Earlier Thursday, the market capitalization of ERC-404 tokens soared to $296 million, announcing their arrival in the crypto market. The token standard was launched on February 5 and has gained immense traction in crypto.

Although ERC-404 tokens remain unofficial due to the absence of a complete audit and endorsement by Ethereum developers, they have witnessed a significant surge in the days following their launch. One of the prominent ERC-404 tokens, Pandora, recently saw a rise of over 400%.

The experimental tokens have gained widespread popularity due to their unique approach of bridging the gap between fungible and non-fungible tokens for better liquidity and fractionalization.

Chart from Tradingview

Bitwise isn’t alone in its bullishness on stablecoins with Circle CEO Jeremy Allaire predicting the explosive growth of the sector due to a “huge appetite” for digital dollars.

A cryptocurrency wallet associated with the prominent trading platform, Binance, has seen massive activity in the last 24 hours, leading to abnormally high transaction fees on the Ethereum network.

A crypto wallet labeled “Binance 14” witnessed a significant transaction surge on September 21, rising above 140,000. As a result of this activity surge, transactions of the Binance-owned wallet consistently incurred gas fees of over 300 gwei, even though the network’s average fee was around 10 gwei.

This gas fee jump and significant wallet activity have resulted in around 530 ETH (equivalent to nearly $850,000) in gas used on the Binance 14 address today.

The increase in transactions on the Binance wallet had a broader, albeit temporary, impact on the Ethereum network. Gas fees on the blockchain momentarily jumped from less than 10 gwei to above 330 gwei per transaction, according to blockchain data tracker Etherscan.

Gas fees refer to the cost blockchain users incur or pay validators to conduct transactions or execute contracts on the Ethereum network. Fees depend on the blockchain’s demand and supply of processing power. This means when a network has many transactions, there is often a high demand for processing power, which increases gas fees.

In the wake of this incident, Wu Blockchain reported that Binance said it was carrying out its wallet aggregation process when the gas fees were low to facilitate withdrawals and ensure the safety of user funds. Nonetheless, some prominent crypto community members have weighed in on the situation, offering possible explanations for the gas fee spike.

Martin Koppelmann, cofounder of the Gnosis chain, said on the X (formerly Twitter) platform that Binance might be using a “really inefficient script” to consolidate, leading to high transaction costs.

Gas prizes spiking because of a ton of regular ETH transfers related to Binance.a) they are using a really inefficient script to consolidate funds and are massively overpaying transaction costsb) something fishy is going on

— Martin Köppelmann

(@koeppelmann) September 21, 2023

Blockchain analysts at Scopescan gave a similar prognosis on the gas incident. The on-chain analytics platform said:

Due to Binance consolidating funds from long-inactive deposit addresses, the Ethereum network is experiencing congestion, causing Gas fees to surge to 300 gwei.

Adam Cochran, a popular crypto investor, suggested that the abnormally high transaction fees might have been due to Binance’s subpar APIs. In his X post, Cochran criticized the exchange’s technological infrastructure while casting doubts on its capacity to safe-keep “hundreds of billions in coins across multiple protocols.”

According to CoinGecko data, the price of Ethereum currently sits below $1,600, reflecting a 2.8% decline in the past 24 hours. Nevertheless, Ether maintains its position as the second-largest cryptocurrency, with a market capitalization of over $190 billion.

Binance reportedly said that they were doing a wallet aggregation process to ensure the safety of user funds.

After reaching a level last seen in November 2020, the average Ethereum gas fee is now below $1.

Ethereum Gas Fees Falls

The Ethereum network experienced transaction fees as low as 69 cents on Saturday, which has not happened in the previous 19 months. The following day, gas prices reached $1.57 or 0.0015 ETH, which is equivalent to December 2020’s numbers. Transaction costs on the network today ranged from 20 cents to merely 20 cents, with 20 cents being the highest.

Gas prices in the Ethereum ecosystem ranged from $0.01 to $0.10 from July 2016 to May 2017. Users are now assessed a substantial cost; in May 2021, average transaction fees reached $69 per transaction. The highest gas price ever observed was $196.683 in May 2022.

Notably, the Ethereum blockchain has struggled to become widely used, much to the chagrin of users, due to the high cost of gas or network fees, payments necessary to complete a transaction on a blockchain. NFT holders are seen profiting from the decline as the numbers dwindle.

Source: Bitinfo charts

DappRadar reports that 50,466 people have traded their assets in OpenSea, up 10.14 percent from the previous day. At the time of writing, the largest NFT market’s trading volume increased by 34.18 percent to $15.92 million.

All of the top 20 collections, led by Ethereum Name Service, DopeApeClub, God Hates NFTees, Bored Ape Yacht Club (BAYC), and Mutant Ape Yacht Club (MAYC), were transacted within Ethereum, according to data from DappRadar.

Related reading | TA: Ethereum Close Below $1K Could Spark Larger Degree Downtrend

Price Slumps Further

The analysis of the price of ethereum is bearish due to consolidation near $1,050 and rejection of further recovery. As a result, ETH/USD is prepared to decline even further and surpass the $1,000 local support. After that is finished, the prior swing low at $900 should be challenged the following week.

The decline approached the $1040–$1000 area that serves as a close support and was accompanied by a sharp increase in demand pressure. The numerous smaller price rejection candles at this point represent attempts by sellers to break through this support that were unsuccessful.

Therefore, the renewed positive momentum could encourage buyers to again attack the overhead barrier of $1260, providing ETH holders with a chance for a recovery.

ETH/USD consolidates above $1k. Source: TradingView

At the start of the week, a significant new swing bottom was established in the price movement of ethereum. After falling by more than 21%, the price of ETH/USD hit a new low at $1,000.

From then, a swift upward reaction continued to the $1,115 level, where Friday’s rejection of further recovery was observed. Following sideways consolidation, lower local highs and lows were set.

Since then, the $1,050 level has functioned as the main trading range, with this morning’s denial of further gains. As a result, ETH/USD is prepared to drop even more and try to surpass the current low of $1,000.

If the traders continue to be persuaded by the sellers to break through the bottom support, the next decline could drive the price of ETH down by 12.56% to $880.

Related reading | Ethereum (ETH) Bends Toward $1,000 As Doubt Fills Crypto Markets

Featured image UnSplash, chart from TradingView.com

Despite Layer-2s offering relatively cheap transactions, Vitalik Buterin said that all transactions need to be under $0.05 to be truly acceptable.

On Saturday, April 30th, Bored Ape’s creators Yuga Labs broke Ethereum. Their new metaverse-inspired project, Otherside sold plots of virtual land to a roaring crowd of people yelling “Shut up and take my money!” In this case, the currency in question was the recently created ApeCoin. However, since Ethereum hosts ApeCoin and the land NFTs, the roaring crowd needed ETH to pay for the operations’ gas fees.

If you’re familiar with Ethereum, you already know what happened. According to IntoTheBlock’s Lucas Outumuro, “The Bored Ape’s Otherside land sale led to more fees being processed by Ethereum in three hours than in the previous two weeks.” Of course, all hell broke loose. The gas prices across the network went through the roof, many transactions failed causing people to lose their gas fees, and others just couldn’t afford to mint the NFT lands they were entitled to.

At the end of the day, the Otherside virtual plots NFTs, known as Otherdeeds, sold out. The Ethereum network pocketed around $125M just in gas fees. It didn’t survive the madness unscathed, though. Several Ethereum-based projects reported failed and/or slowed down operations and Etherscan, Ethereum’s block explorer, completely crashed. “We’re sorry for turning off the lights on Ethereum for a while,” Bored Ape’s creators Yuga Labs stated.

The Origins Of Otherside

Back in March, Yuga Labs raised an Andreessen Horowitz-led funding round of $450M to build Otherside. Apparently, it’s a Metaverse project in the vein of Decentraland and The Sandbox, but with a Play-To-Earn element built into it from the beginning. That same month, they created the now-defunct http://somethingisbrewing.xyz/ to ask people to KYC themselves and link their personal info to their Ethereum addresses.

Those registered addresses had the right to mint two plots of land in the Otherside playground. Bored Ape’s holders received two free plots each. There are a total of 55K Otherdeeds. To mint each one cost 305 ApeCoin, plus the Ethereum network’s gas fees. Even though it was expensive, considering Yuga Lab’s successful track record, it seemed like a steal.

Until the gas prices rose to unpayable levels, that is.

ETH price chart on FTX | Source: ETH/USD on TradingView.com

Bored Ape’s Creators Yuga Labs Speak

After selling everything, breaking everything, and leaving humble collectors land-less, the Bored Ape’s creators responded to the controversy with this brief Twitter thread.

We know that the Otherdeed mint was unprecedented in its size as a high-demand NFT collection, and that would bring with it unique challenges.

— Yuga Labs (@yugalabs) May 1, 2022

Among other things, Yuga Labs stated:

We're sorry for turning off the lights on Ethereum for a while. It seems abundantly clear that ApeCoin will need to migrate to its own chain in order to properly scale. We'd like to encourage the DAO to start thinking in this direction.

— Yuga Labs (@yugalabs) May 1, 2022

We are still working on refunding all Otherdeed minters with failed transactions their gas. Note that you do not need to do anything – we will transfer it all back to your wallet and announce when it is completed. Don't click any links.

— Yuga Labs (@yugalabs) May 2, 2022

Even though it sounds like the Bored Ape’s creators are doing the right thing, its worth noting that the people receiving said refunds didn’t get to buy an Otherdeed NFT and the collection sold out. They can still get them in the secondary market at a premium, but the community is not pleased.

Bored Ape’s Users Speak

What follows is a narrow selection of opinions about the launch. Most of these people are Bored Ape’s rich and are heavily invested in the Yuga Labs ecosystem, but they’re worried. Let’s summarize what they said.

The drop went unbelievably poorly. That's the truth of it all. The initial thesis was that not enough KYC wallets exist for it to sell out in wave-1 .. not only was that incorrect … It sold out with 2+E in gas the entire way … a nightmare scenario …

— ap3father.eth (@ap3father) May 1, 2022

His conclusion is that “The community responded atrociously to this mint.” And his advice is to sell, “You may have millions in NFTs and that’s outstanding, but grab onto reality. When you die one day … they don’t bury you in the metaverse my friend. ” He has extra Bored Apes, though, so he’s not going anywhere. “I am excited to both sell some apes & continue my journey into the otherside.”

I spent 3 hours constantly refreshing and trying like many here. If you really want to spread to wallets let those KYC'd mint. We should've been given 2 weeks. And put on allowed mint list on contract. Similarly like Gary Vee did, Instead you chose PR nightmare.

— Irish (@Irishmikeys) May 2, 2022

Sure, maybe the mint could of gone better, we could of had a Cue/Raffle system, but at the end of the day every successful mint on ETH is a fucking shitshow, we all know this.

— 3433.eth

(@boredape3433) May 1, 2022

(@boredape3433) May 1, 2022

Vitalik Buterin Speaks

Don't think optimizing the contract would help. Regardless of contract details, tx fee goes up until list price + tx fee = market price. If gas usage per purchase decreased 2x, the equilibrium gas price would have just been >12000 gwei instead of 6000.

— vitalik.eth (@VitalikButerin) May 1, 2022

Nevertheless, the Bored Ape’s creators seem pretty determined to create their own blockchain. Some people even suggest that they orchestrated this whole situation to justify and market it.

Featured Image: Bored Ape’s metaverse Otherside logo from the site | Charts by TradingView

Data also shows that the average gas price on the Ethereum has been dropping rapidly since the start of the year, plunging from 218 Gwei on Jan.10 to 40.82 on March 9.

The SOL price rally also appeared in the wake of “Ignition,” a global hackathon to build new platforms on the Solana blockchain.