Solana opened this month on high momentum, consistently posting notable gains over the past few days. SOL scored a weekly high of $45.36 on November 1 before receding. But after a brief decline to the $40 price level, the bulls have regained momentum, intent on pushing closer to $50 this time. But it remains to see if SOL bulls have enough momentum to rally that high.

SOL Bucks All Odds As It Vies For Higher Highs

Despite the high volatility in the altcoin market, Solana (SOL) has refused to back down. The Ethereum killer has continued its uptrend in the past two weeks, making it one of the top-gaining cryptocurrencies today.

SOL graces the top gainers’ list as the fifth-highest gainer in today’s trading session. Solana is trading at $43.23, with over 3% price increase in the last 24 hours.

Solana Bulls have continued to fight off significant sell pressure caused by FTX-related transfers. The crypto exchange is selling millions of crypto assets to pay its debts to customers as it seeks a fresh start.

Reports revealed that the court approved FTX to sell $3 billion worth of crypto assets frozen on the exchange since last year. On-chain data from Spot On Chain shows that the defunct crypto exchange FTX owns millions of SOL coins. According to Spot on Chain’s latest updates, FTX and Alameda have transferred approximately $223 million worth of Solana coins to exchanges.

However, these large inflows of Solana in the market didn’t cause a decline. Instead, SOL’s price entered a rising channel, initiating an uptrend.

The most significant upturn was when the crypto breached the critical resistance at $22 in mid-October. SOL has been unstoppable since then, crossing the $30 price mark and rising above $40, a position it has maintained in the last few days.

Solana’s price is now over 86% higher than its past month’s value, with a 9.70% seven-day price increase, according to CoinMarketCap data.

SOL Market Outlook As It Flips Over A Multi-month Trendline

As depicted on the chart below, SOL has broken from a multi-month trendline channel, flipping a significant resistance level at $27.58 to support. The $27 price level is the new trendline pivot as it forms a new channel.

If SOL manages to remain above the $42 price level, given the ongoing bullish momentum, the next target price is $46.83. Maintaining this level could facilitate more rallies to $50 in the coming days. But buyers have to apply more pressure to remain in control.

However, if the bears fail to maintain the $42 price, SOL could decline to $39 and subsequently to $31.43 if the bears mount more pressure.

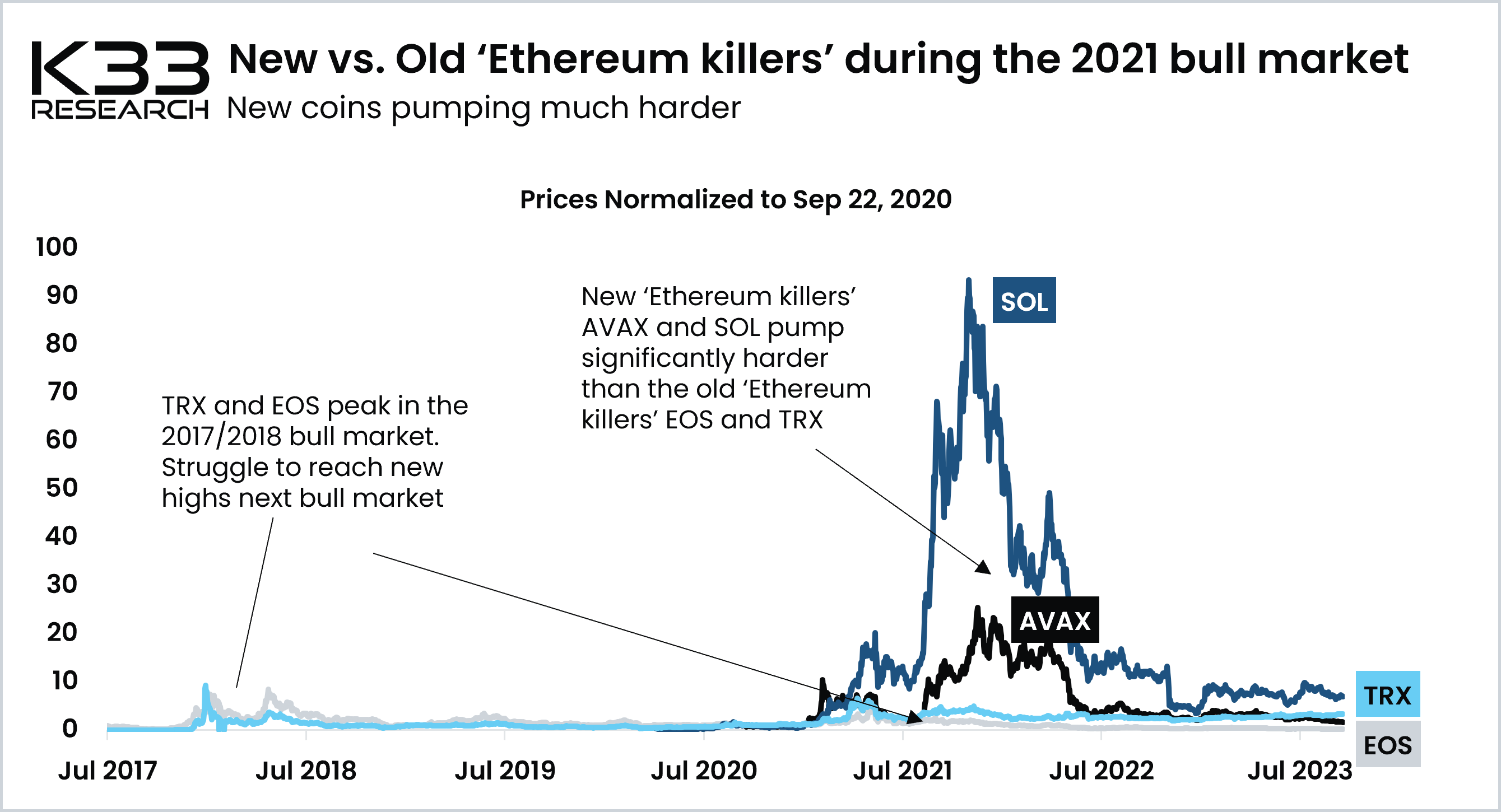

Meanwhile, SOL continues to live up to its alias, the Ethereum Killer. An update from on-chain data provider Kaiko shows that SOL has outperformed Ethereum since September.

The increase in the SOL/ETH ratio since September confirms this assumption. The SOL/ETH ratio has climbed from 0.011 to nearly 0.025 and is now back to the pre-FTX collapse levels.