Ethereum (ETH) stands at a crucial juncture, with its eyes set on the $4,000 price mark. Amid this ambitious pursuit, the digital asset faces a significant challenge that could influence its trajectory: scrutiny from the US Securities and Exchange Commission (SEC).

Despite this potential regulatory hurdle, some analysts remain optimistic about Ethereum’s prospects. A detailed analysis by Captain Faibik, a market watcher, highlighted a bullish pattern in ETH’s four-hour candlestick chart, suggesting that the $4,000 threshold is within reach.

Ethereum Eyes $4,000 Milestone

This optimism stems from a descending wedge pattern observed by Faibik, indicating an end to Ethereum’s consolidation phase and signaling a possible price breakout. The technical analysis paints a promising picture for Ethereum, suggesting that the asset could reclaim its lost valuation.

$ETH #Ethereum Descending Broadening Wedge Upside Breakout is Confirmed on the 4hrs timeframe Chart..

$4,000 incoming

https://t.co/qrKE5jiXon pic.twitter.com/MLIXefVsd8

— Captain Faibik (@CryptoFaibik) March 25, 2024

However, the recent market conditions have posed challenges for Ethereum, with the asset experiencing a more than 15% drop over two weeks, further exacerbated by the broader Bitcoin market correction.

This decline saw ETH trading below the $3,500 mark, with a significant dip to $3,070 on March 20, amid reports of the SEC’s increasing interest in classifying Ethereum as a security.

Particularly, reports indicate that the commission has been seeking financial records from US companies engaged with the Ethereum Foundation, intensifying the debate over Ethereum’s classification. Such regulatory scrutiny casts a shadow over Ethereum’s path to $4,000, introducing uncertainty into its future.

ETF analyst James Seyffart suggests that the SEC’s stance could lead to the denial of spot Ethereum ETF applications by May 23, 2024. He cites a lack of engagement on Ethereum specifics, contrasting with the approach taken for Bitcoin ETFs.

My cautiously optimistic attitude for ETH ETFs has changed from recent months. We now believe these will ultimately be denied May 23rd for this round. The SEC hasn’t engaged with issuers on Ethereum specifics. Exact opposite of #Bitcoin ETFs this fall. https://t.co/TyAzAOrAC5

— James Seyffart (@JSeyff) March 19, 2024

Ethereum’s Network Activity: A Silver Lining

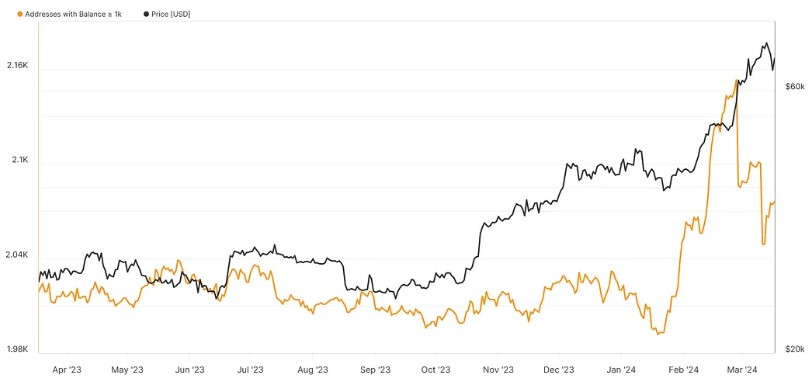

Despite these challenges, Ethereum’s network has witnessed notable growth, with increases in daily active users and transaction volumes signaling a bullish outlook for the cryptocurrency. An upsurge in network activity typically indicates heightened demand, a positive sign for Ethereum’s price potential.

From January 3, the number of daily active Ethereum addresses surged by over 46%, coinciding with a significant price rally. This increased activity and price appreciation period highlights Ethereum’s resilience and potential for growth, even in the face of regulatory uncertainties.

As Ethereum navigates through these regulatory and market challenges, the coming weeks will be critical in determining its ability to breach the $4,000 mark. The juxtaposition of technical bullish signals against the backdrop of SEC scrutiny presents a complex scenario for ETH.

However, the strength of its network and the increasing user engagement offer a glimmer of hope for Ethereum enthusiasts and investors.

Featured image from Unsplash, Chart from TradingView