Ethereum (ETH) has completed a major software upgrade, Dencun, that promises to make utilizing the network ecosystem more cost-effective. This update specifically targets Layer 2 (L2) networks, such as Arbitrum (ARB), Polygon (MATIC), and Coinbase’s Base, which are interconnected with Ethereum.

With Dencun, transaction costs on these networks have significantly decreased, with fees dropping from dollars to cents or even fractions of a cent.

Ethereum Dencun Upgrade And Cost Savings

Considered the most significant change in Ethereum’s end-user experience, the Dencun upgrade is expected to foster the development of new applications and services by significantly reducing expenses.

As NewsBTC reported on Tuesday, the update introduces a new data storage system, departing from the traditional approach of storing Layer 2 data on Ethereum itself. Adopting a new “blobs” repository reduces data storage costs since information is warehoused for only about 18 days instead of indefinitely.

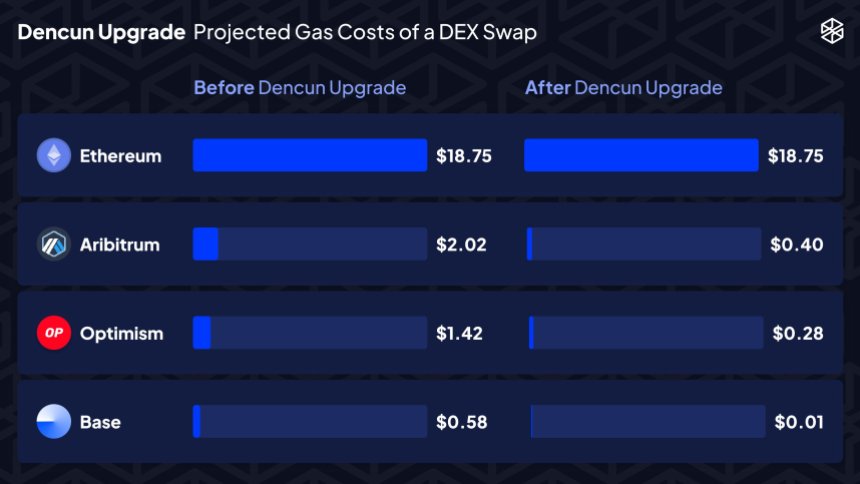

One of the notable benefits of the Dencun upgrade lies in its impact on decentralized exchanges (DEXs) and gas costs. For instance, projected gas costs for popular Layer 2 networks, such as Arbitrum, Optimism, and Coinbase’s Base, are set to be significantly reduced.

The projected savings translate into a reduction of Arbitrum’s swaps from $2.02 to $0.40, Optimism’s swaps from $1.42 to $0.28, and Coinbase’s Base swaps from $0.58 to $0.01, emphasizing the pivotal role of this upgrade.

As the upgrade was successfully launched on the mainnet, Tim Beiko, Ethereum Foundation core developer, expressed his satisfaction with the work accomplished and claimed:

Dencun is both the most complex fork we’ve shipped since the Merge, and tied for “most total EIPs in a fork” with Byzantium. There were more teams than ever involved in the process, and it somehow all worked out smoothly…! Grateful to work with all of them, onto the next one.

Blob Transactions And Pricing Changes

Layer 2 network Arbitrum has provided insights into the upgrade process. It will take around one to two hours for blob transactions to commence posting and for the new pricing changes specified by EIP-4844 to come into effect.

ArbOS Atlas, an upgrade that supports Arbitrum Chains, will introduce further fee reductions for Arbitrum One, set to be activated on March 18th. The updated configurations include a reduction in the Layer 1 (L1) surplus fee from 32 gwei to 0 per compressed byte and a reduction in the L2 base fee from 0.1 gwei to 0.01 gwei.

The Dencun upgrade unlocks cost-saving opportunities for Layer 2 networks and addresses congestion concerns by freeing up more space on the Ethereum network for additional transactions. While the upgrade offers enhanced efficiency, it does come at the cost of no longer retaining a complete record of all data indefinitely.

However, as Layer 2 networks embrace this new update to the Ethereum ecosystem, the stage is set for accelerated adoption, usage, and broader accessibility within the Ethereum community and its underlying protocols.

Dencun Upgrade Fails To Propel ETH Above $4,000

Despite the successful upgrade, ETH’s price remains unaffected, continuing to consolidate below the $4,000 threshold. The token attempted to surpass this crucial resistance level on Monday and Tuesday but failed to sustain its position above it.

For over 24 hours now, ETH has been trading between $3,930 and $3,970. Nevertheless, it’s worth noting that ETH has maintained its upward momentum, with gains exceeding 18% over the past fourteen days and nearly 60% over the past thirty days.

Additionally, introducing the Dencun upgrade is expected to drive increased demand for ETH, potentially sparking a renewed uptrend that could bridge the gap between current trading prices and its previous all-time high (ATH) of $4,878, achieved in November 2021.

Featured image from Shutterstock, chart from TradingView.com