An Ethereum whale was recently revealed to have made $16 million from a single trade involving the second-largest crypto token by market cap. This whale’s story again highlights how conviction in an investment can be very rewarding in the crypto space.

How This Ethereum Whale Made $16 Million In A Single Trade

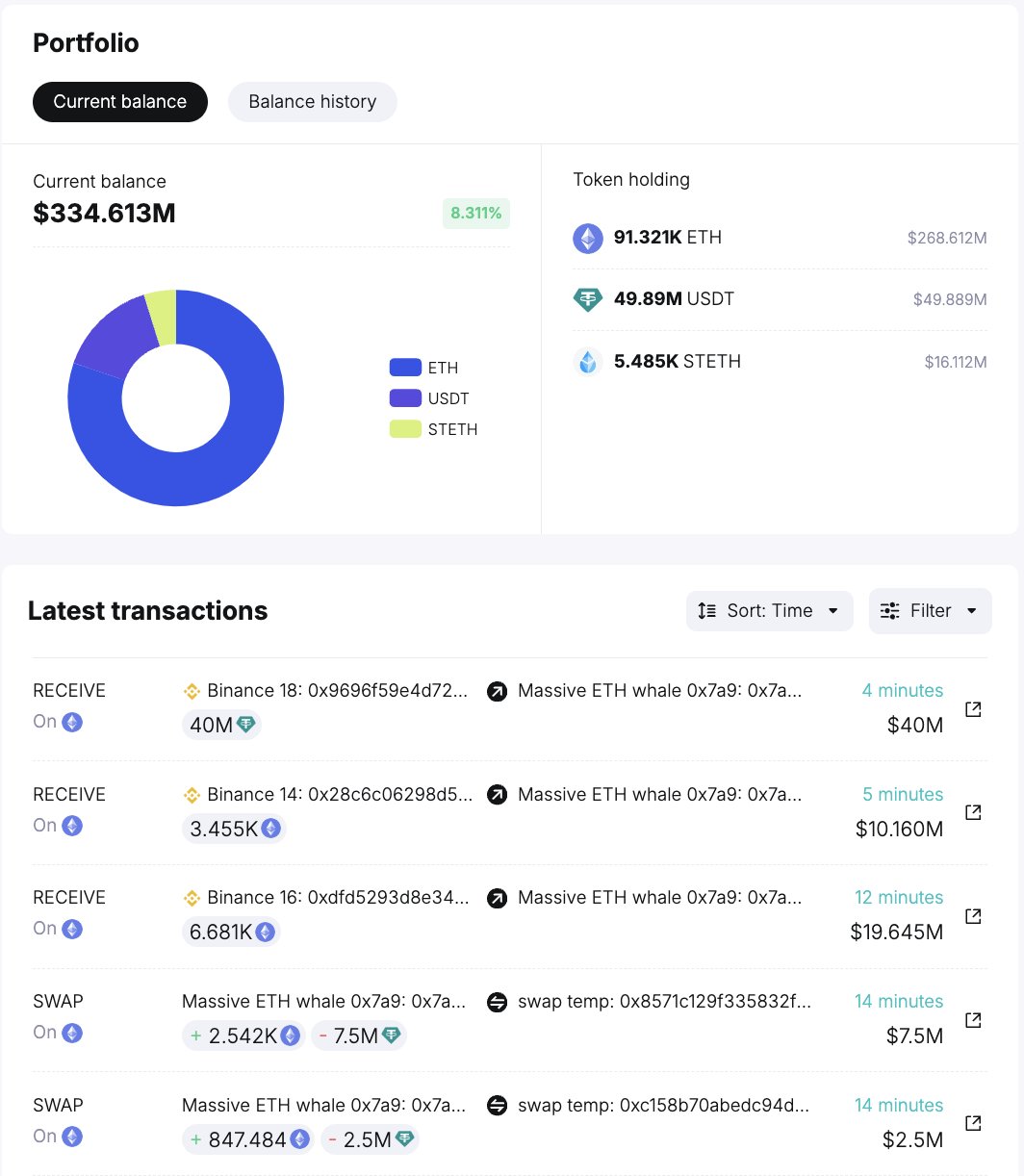

On-chain analytics platform Lookonchain revealed in an X (formerly Twitter) post that the whale withdrew 12,906 ETH ($24.39 million) from Binance when the crypto token was still trading at $1,890 a year ago. With Ethereum currently trading at around $3,100, the whale’s ETH investment is now worth over $40 million, signifying a profit of about $16 million.

Interestingly, his profits from this trade will likely be more than $16 million, as the trader deposited those tokens in the staking platform Lido when he withdrew them from Binance last year. That means he also earned significant staking rewards to go alongside his $16 million profit.

On-chain data shows the whale recently withdrew 7,000 ETH ($21 million) from Lido back to Binance but has yet to offload these tokens. However, that is something to keep an eye on as the whale offloading those tokens could have a negative impact on Ethereum’s price.

Tron’s founder, Justin Sun, looks to be another Ethereum whale that could make such significant returns on their ETH investment. Two wallets believed to belong to Sun are reported to have accumulated 295,757 ETH ($891M) at an average price of $3,014 since February 12. Since then, Sun has made some notable moves that could be profitable for him.

One such move is that the Tron founder recently deposited 120,000 eETH into Swell L2, a liquid restaking protocol. Although Sun claims that this move isn’t profit-motivated, he could still make huge profits from his venture, considering that restaking is one of the leading narratives at the moment.

The Bull Run Presenting A Lot Of Opportunities

There have been a lot of reports highlighting how crypto investors and traders have been making life-changing, which suggests that the bull run is already in full force despite Bitcoin’s unimpressive price action lately. One opportunity that these traders have taken advantage of in this market cycle is meme coins.

Before the bull run began, there was the belief that memes would be one of the leading narratives, and that has been the case. Bitcoinist recently reported two Solana meme coin traders turned $6,400 into $8 million. Meanwhile, Lookonchain revealed a Solana trader who turned 60 SOL ($8,673) into $1.26 million in 2 months, making a 144x return on his investment.

An

An  #Ethereum $ETH Amount of Supply Last Active 5y-7y just reached a 3-month high of 7,666,690.968 ETH

#Ethereum $ETH Amount of Supply Last Active 5y-7y just reached a 3-month high of 7,666,690.968 ETH