The Taiko project, distinguished for its “based sequencing” architecture, is one of several competing for relevance among a deep field of Ethereum layer-2 networks.

Protocol Village: Bitcoin Miner Marathon, Plans ‘Anduro,’ a Multi-Chain Layer-2

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Feb. 29-March 6.

Protocol Village: Wormhole Collaborates With AMD to Make Hardware Accelerators

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Feb. 22-28.

Protocol Village: QuickNode Adds Support for ZkSync Hyperchains

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Feb. 15-21.

Protocol Village: Order-Routing Protocol Flood Raises $5.2M Led by Bain Capital Crypto, Archetype

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Feb. 8-14.

Protocol Village: Prediction Market Zeitgeist Launches DLMSR-Based AMM

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Feb. 1-7.

Protocol Village: Space and Time Rolls Out Open-Source GPU Acceleration Framework ‘Blitzar’

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Jan. 25-31.

RippleX Announces Major Update For XRP Ledger EVM Sidechain, Can This Trigger A Price Recovery

The XRP Ledger ecosystem is currently buzzing with new exciting developments that could potentially propel the price of XRP to new heights. RippleX, an extension of Ripple and an open developer platform has announced new updates for the upcoming XRP Ledger Ethereum Virtual Machine (EVM) sidechain.

XRPL EVM Sidechain Signals Hope For XRP Price Resurgence

On Tuesday, RippleX released the latest developments and progress on the XRPL EVM Sidechain via an X (formerly Twitter) post. This significant update was shared by Peersyst Technology, a blockchain technology firm and an XRPL EVM developer.

Peersyst revealed on its official X handle that the XRPL ecosystem is getting closer to launching its highly anticipated sidechain. This advanced EVM sidechain is designed to bridge Web3 applications to XRPL and improve the functionality and scalability capabilities of the ledger.

Various XRP enthusiasts, including Patrick L. Riley, the Chief Executive Officer (CEO) of Reaper Financial, remain optimistic about the launch and integration of the EVM sidechain into the XRP Ledger. In a December 2023 interview with crypto market analyst Zach Rector, Riley predicted that “XRP will surpass Bitcoin as the number one cryptocurrency.”

According to Peersyst, the RippleX developer team has officially published the XChainBridge public amendment. This revision is currently open for voting and has already garnered seven validator votes out of 28, marking a crucial step in the launch of the XRPL EVM sidechain.

The blockchain company also announced a second update on the XRPL EVM, stating that the sidechain has successfully undergone stringent audit procedures by Bishop Fox, a leading provider of security solutions. Another audit has also been conducted with a prominent supplier, with details disclosed soon.

In addition, the blockchain firm has shared updates on the EVM sidechain’s progress to Cosmos, a blockchain network utilizing the support of Evmos, a scalable high throughput Proof of Stake (PoS) blockchain. Peersyst disclosed that a new version of the bridge is set to launch, allowing users to automatically connect any existing token in the EVM sidechain to the XRP Ledger.

Other updates on the EVM sidechain include the introduction of a new User Interface (UI) and the implementation of a Software Development Kit (SDK) for developers. Additionally, a better version of the Blockscout explorer is being developed, promising quicker inspections and explorations of transactions within the XRPL EVM blockchain.

Can This Trigger A Price Recovery?

The XRPL EVM emerges as a potential game changer for the price of XRP, introducing new updates that will enhance transparency, security, and speed within the XRP Ledger. Since this is a positive development, it could lead to renewed interest in the underlying XRP token.

If this interest is sustained and eventually leads to more demand for the token, it could trigger a price rally. At this point, the bulls will be looking to break the resistance, which bears have mounted at $0.55 to signal a resumption of the rally.

While other altcoins have been witnessing price surges, XRP has been struggling to rally. It is currently trading at $0.51, with a 9.63% loss in the last seven days, according to data from Coinmarketcap.

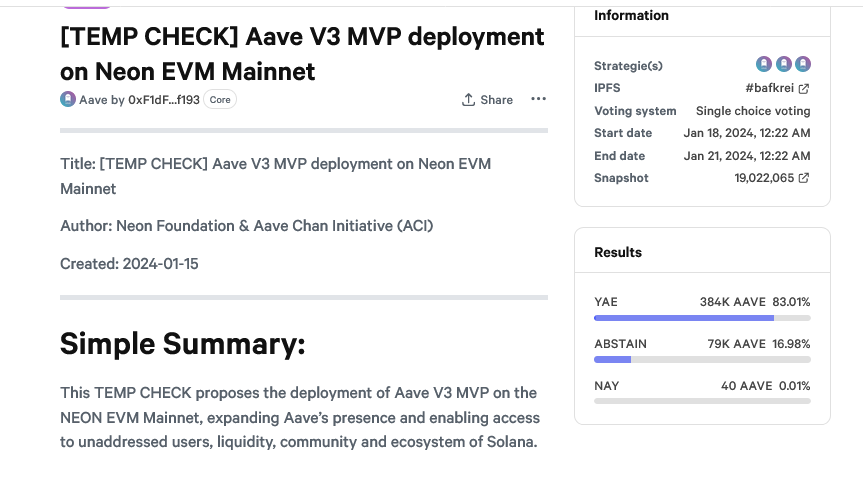

Aave V3 Ready For Solana After This Crucial Vote Passed

The Aave community has overwhelmingly approved a proposal that will set the ball rolling for deploying Aave V3 on Solana, a smart contracts platform. The motion, put forward by the Neon Foundation and the Aave Chan Initiative (ACI), passed with a majority vote of 83% based on results posted on January 21.

Solana Fast Rising, DeFi Ecosystem Active

Solana has been rapidly expanding, with its native currency, SOL, emerging as one of the top performers in 2023. To put it in perspective, SOL prices exploded from about $10 in 2023 to around $125 by the end of the year.

This surge saw SOL reverse losses of November 2022 while concurrently catalyzing events on the blockchain, spurring various activities, including the expansion of decentralized finance (DeFi), non-fungible token (NFT), and meme coin activities.

Related Reading: Bitcoin Price Turns Red, Why BTC Could Tumble Below $40K

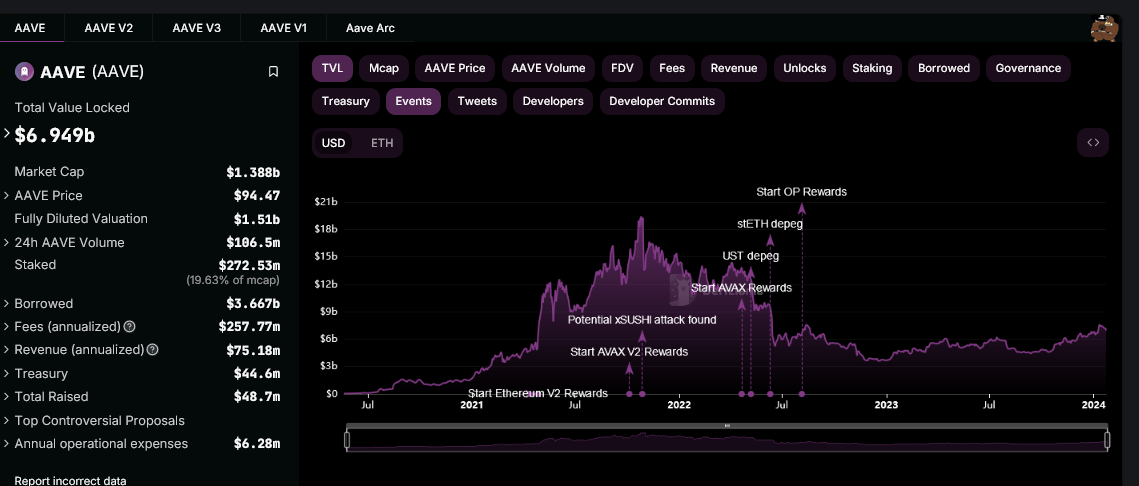

On the other hand, Aave has been expanding to multiple Ethereum Virtual Machine (EVM) compatible networks, emerging as one of the leading decentralized finance (DeFi) protocols. According to on-chain data from DeFiLlama on January 22, Aave manages over $6.9 billion worth of assets across ten chains. A big chunk, over 90%, comprises assets on Ethereum. Aave v3 has a total value locked (TVL) of $4.9 billion.

Aave V3 On Solana, What It Means

The TEMP CHECK proposers are keen on Aave v3 deploying on Solana, considering the blockchain’s rapid growth in the past year. They observe that the blockchain’s DeFi TVL and broad user base would likely benefit the lending and borrowing protocol, cementing its position as a market leader.

If Aave is deployed on Solana, the protocol will access the deep liquidity on the blockchain. At the same time, users will access Aave services more conveniently. Subsequently, the proposers reiterated this move will cement Aave’s position as the leading liquidity market on-chain. Moreover, it will likely open up new opportunities for collaboration between the Aave, Solana, and other Neon EVM communities.

Neon EVM is a cross-chain bridge for users to transfer assets between Ethereum and other blockchains. Through this bridge, Aave v3 will go live on Solana without any major reconfiguration of the protocol’s codebase. Among the tokens that will be initially supported is SOL. Users will be free to borrow USDC, a stablecoin.

The passing of the TEMP CHECK also reflects Aave’s ambition to expand across multiple blockchains beyond EVM networks. So far, Aave has been deployed on various platforms, including layer-2s like Arbitrum and Base, Avalanche, and Ethereum’s sidechain, Polygon.

Protocol Village: Matter Labs, iCandy Plan New ‘Hyperchain’

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Jan. 18-24.

Protocol Village: Mobile Gaming Studio AOFverse Gets Grant from Arbitrum Foundation

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Jan. 11-17.

Protocol Village: EOS-Focused VC Invests in EZSwap for Gaming and ‘Smart Inscriptions’

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Jan. 4-10.

SEI What? Token Rules Top 100 Listing With 80% Rally As Crypto Market Wobbles

The SEI token from the Sei Network has witnessed a remarkable 80% increase in value in the past week, as most of the leading cryptocurrencies drown in red amid wild speculations about the approval of a Bitcoin ETF by the US Securities and Exchange Commission that wobbled the market.

SEI’s strong performance today has put its governance token at the top of the crypto 100 listing on Coingecko. The coin’s rally has been driven by the growing adoption of Ethereum Virtual Machine-compliant blockchains and the implementation of parallelization processes.

An EVM, or Ethereum Virtual Machine, serves as a digital platform for deploying smart contracts and Ethereum applications. An EVM-compliant blockchain refers to a network that has the capability to execute such applications.

SEI Token: Soaring Values, Decentralized Triumph

Token accessibility is improved by EVM compatibility, while scalability difficulties are tackled through parallelization, leading to increased transaction speeds.

The success of the SEI coin highlights its potential for continuous expansion and advancement, establishing it as a significant participant in the changing field of decentralized finance and blockchain technology.

At the time of writing, SEI was trading at $0.80, up 8% in the last 24 hours, marking a new all-time high for the token, data from Coingecko shows. Its market capitalization exceeded $1.8 billion, positioning the digital asset as the 47th largest.

The Sei cryptocurrency has had significant purchasing demand in recent months, resulting in a price surge from $0.09 in October to $0.80 at present. This represents an astonishing increase in price of 665%, surpassing the majority of well-established cryptocurrencies on the market.

The driving force behind this upward trend is a substantial surge in trading volumes, which have increased by over tenfold compared to their October levels.

The Sei Network, introduced in August 2023, is a blockchain platform specifically developed for trading purposes. It is supported by well-known investors and prioritizes fast transaction processing, minimal fees, and other functionalities that facilitate trading applications.

Sei’s rapid settlement capability allows it to process a remarkable 20,000 orders per second, a substantially greater rate compared to other chains.

Sei Network: Surging Metrics, Growing Confidence

The on-chain metrics for the network are showing increased activity, as evidenced by the rise of ecosystem tokens such as SEIYAN and SEILOR, as well as a surge in SEI futures open interest. These indicators suggest a growing interest in the network.

In addition to its price surge, the total value locked (TVL) on Sei has also increased. According to data from DefiLlama, the current value is $5.6 million, which represents a significant increase of 3,500% compared to the figures from August.

Simultaneously, market confidence is increasing on a daily basis, fueled by the token’s very cheap worth in relation to other layer-1 chains like as Ethereum and Solana.

Sei possesses strong foundational elements and is experiencing an expanding community of developers, positioning it favorably to sustain its appeal as traders actively pursue tokens with significant growth potential in the beginning of 2024.

$SEI is the new hot narrative of 2024, stunning everyone with a jaw-dropping 700% growth in just 2 months.

But we are still early!

– Ecosystem Overview

– Growth Catalysts

– How to get in

– Projects, airdrops, memecoins, and how to capitalize on them

pic.twitter.com/QVgTiHTdXX

— AlΞx Wacy

(@wacy_time1) January 2, 2024

Meanwhile, srong price action for the token indicates that SEI may surpass $1 in the coming days or weeks, as the favorable momentum continues to accelerate.

Alex Wacy, a Twitter analyst, even referred to it as the new trending story of 2024.

Featured image from Shutterstock

Sei V2 Code Is “Functionally” Complete, Audit Ongoing: New All-Time High Incoming?

Taking to X on January 2, Jay Jog, the co-founder of Sei, Sei V2, is functionally “code complete” with Zellic and OtterSec, two blockchain security firms, auditing the code base. This development comes as the platform’s native coin, SEI, continues to surge, reaching all-time highs just four months after the launch of the high-performance blockchain in August.

What’s The Big Deal About Sei V2?

Once it launches in Q1 2024, Sei V2 will introduce a parallelized Ethereum Virtual Machine (EVM). According to developers, this model combines the best features of Solana and Ethereum, possibly driving Sei adoption and propping up SEI prices.

Of note, the Sei V2 code base will introduce three major upgrades. One is that Sei Network will now be compatible with Ethereum following the planned support for the EVM. Herein, Sei aims to leverage Ethereum’s popularity, especially among developers, tooling, and wallets.

The goal, Jog explained in a post on X, is to ensure the integration is smooth without compatibility issues. With V2, Sei users will connect with the mainnet using popular Ethereum and EVM-compatible wallets like MetaMask.

However, a big addition in Sei V2 will be the actualization of Optimistic Parallelization. This feature will give developers more flexibility and leeway, preventing them from defining dependencies between transactions. Instead, Sei developers say this option allows the blockchain to automatically handle parallelization for transactions to be processed efficiently and cheaply.

To enhance full node efficiency and mitigate state bloat, Sei V2 introduces SeiDB as a new storage method. Implementing this update is expected to maintain Sei Network’s resilience while improving its performance.

Sei To Outperform Ethereum Layer-2s, Will Prices Follow Suit?

How SEI prices will react once this update is integrated remains to be seen. For now, developers are upbeat, claiming that Sei V2 will drastically enhance the mainnet capability, allowing it to process transactions faster than Ethereum layer-2 solutions like Base and Arbitrum. In November, Jog claimed that Sei V2 had a theoretical throughput of 12,500 TPS.

Ahead of this, SEI bulls are resilient, and prices continue to trend higher. SEI is already up 11X after launching in August 2023, trading around all-time highs.

Looking at the candlestick arrangement in the daily chart, buyers are pushing higher, with the bull bar of January 1 thrusting the coin to new levels. For traders, key support levels to watch in the days ahead are $0.55, marking January 1 lows, and $0.40, if there is a cool-off.

Protocol Village: Bitfinex Securities Announces First Tokenized Bond on Liquid Network

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Dec 21-Jan. 3. (EDITOR’S NOTE: We will be taking much-needed time off around the end of the year, so updates will be less frequent. Happy holidays!)

Ledger Commits To Full Restitution For Victims Of $600,000 ConnectKit Attack

Hardware wallet manufacturer Ledger has responded to a recent security breach resulting in the theft of $600,000 worth of user assets.

The company has pledged to enhance its security protocols by eliminating Blind Signing, a process where transactions are displayed in code rather than plain language, by June 2024.

Ledger Takes Responsibility For ConnectKit Attack

In a statement, Ledger emphasized its focus on addressing the recent security incident and preventing similar occurrences in the future.

The company acknowledged the approximately $600,000 in assets that were impacted by the ConnectKit attack, particularly affecting users blind signing on Ethereum Virtual Machine (EVM) decentralized applications (dApps).

Furthermore, Ledger pledged to make sure affected victims are fully compensated, including non-Ledger customers, with CEO & Chairman Pascal Gauthier personally overseeing the restitution process.

According to the statement, Ledger has already initiated contact with affected users and is actively working with them to resolve their specific cases.

In addition, by June 2024, blind signing will no longer be supported on Ledger devices, contributing to a “new standard of user protection” and advocating for “Clear Signing,” which refers to a process that allows users to verify transactions on their Ledger devices before signing them across dApps.

On this matter, Ledger’s CEO Pascal Gauthier stated:

My personal commitment: Ledger will dedicate as much internal and external resources as possible to help the affected individuals recover their assets.

Heightened dApp Security Measures

According to an incident report released by the hardware wallet manufacturer, the attack exploited the Ledger Connect Kit, injecting malicious code into dApps utilizing the kit.

This malicious code redirected assets to the attacker’s wallets, tricking EVM dApp users into “unknowingly signing transactions” that drained their wallets.

Ledger addressed the attack by deploying a genuine fix for the Connect Kit within 40 minutes of detection. The compromised code remained accessible for a limited time due to the nature of content delivery networks (CDNs) and caching mechanisms.

Ledger acknowledged the risks faced by the entire industry in safeguarding users and emphasized the need to continually raise the bar for security in dApps.

The company plans to strengthen its access controls, conduct audits of internal and external tools, reinforce code signing, and improve infrastructure monitoring and alerting systems.

Additionally, Ledger will educate users on the importance of Clear Signing and the potential risks associated with blind signing transactions without a secure display.

Notably, with Clear Signing, users are presented with a clear and readable representation of the transaction details, enabling them to review and validate the transaction before providing their signature.

This added layer of transparency and verification helps users mitigate the risks associated with front-end attacks or malicious code injected into decentralized applications

Featured image from Shutterstock, chart from TradingView.com

Why a gold rush for inscriptions has broken half a dozen blockchains

Some suggest EVM inscriptions are the latest way for retail to access low-cap coins, while others argue it’s an over-hyped fad. Whatever it is, it’s clogging up the blockchain.

Daily gas spent on EVM inscriptions surges to record high of $8M

Bitcoin is not the only network getting clogged up with Ordinals inscriptions, with weekend activity on EVM chains also spiking.

Protocol Village: Metagood, por trás dos NFTs OnChainMonkey, levanta rodada inicial de US$ 5 milhões

O que há de mais recente em atualizações de tecnologia blockchain, anúncios de financiamento e negócios. Para o período de 14 de dezembro a dez. 20, com atualizações ao vivo por toda parte.

Protocol Village: Metagood, dietro gli NFT OnChainMonkey, raccoglie un round di seed da 5 milioni di dollari

Gli ultimi aggiornamenti sulla tecnologia blockchain, annunci di finanziamenti e offerte. Per il periodo dal 14 dicembre al 14 dicembre. 20, con aggiornamenti in tempo reale ovunque.