The Bitcoin rise above $69,000 before the fourth halving to reach a new all-time high of $73,000 in 2024 took many by surprise. However, crypto analyst BitQuant was not one of those people. In 2023, the analyst had correctly predicted that the BTC price would reach a new all-time high before the halving was completed. After the successful completion of his prediction, the crypto analyst has once again predicted where the Bitcoin price is headed, and how high it will go.

Crypto Analyst Says Bitcoin Price Will Reach $95,000

BitQuant has unveiled his latest prediction for the Bitcoin price, and the target being displayed will please many who continue to be bullish. Amid the choppy headwinds that have dominated the market, the analyst believes that the Bitcoin price will surge and reach $95,000.

Interestingly, the analyst does not expect the campaign to $95,000 to be a long, drawn-out move. Rather, BitQuant explains that the Bitcoin price can complete this target in a single move. Such a move would mean a 50% increase in price from its current level of around $62,000 and will no doubt trigger a ripple effect that will be evident in the market.

The post read:

$95K will be achieved in just one move, and that is quite obvious. Will that move start today, tomorrow, or the day after tomorrow? I don’t think anyone knows. If you can’t relax now and wait for #Bitcoin to perform as expected, then it’s better to leave the market to avoid the torture. Because in the coming months, there will be a lot of pain for those with weak nerves.

BitQuant’s prediction was in response to another crypto analyst, Mikybull, who identified the formation of a ‘cup and handle’ pattern on the Bitcoin crash. The analyst believes that this formation will precede a massive breakout that will send it to a “cycle top.”

Is $250,000 Still In Play?

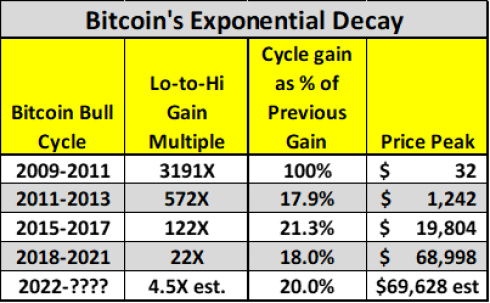

Back in 2023, when BitQuant made the initial prediction that Bitcoin would reach a new all-time high before the halving, he had set out a price target for the cryptocurrency. As the crypto analyst explained at the time, reaching a new all-time high before the halving, although it has never happened before, does not mean that it will peak by then.

Rather, the analyst expects the bull rally to continue well after the halving, which is when the price will peak. BitQuant’s target at the time was the price peaking at $250,000 at the top of the cycle. However, this target has not made an appearance in his analyses in recent times.

The most recent predictions circle around the $95,000 target and the analyst expects it to hit this price in May. In a prediction from April, BitQuant expects that the price will first go to $49,000, before recovering to $75,000, and then surge to $95,000.

First $49K,

Then $75K,

Now $95K.

What’s next will be revealed after we hit $95K and take a little break in the tent. #Bitcoin https://t.co/yvKyHZZWQw— BitQuant (@BitQua) April 25, 2024