Fantom (FTM), a Layer-1 (L1) protocol, and its native token, FTM, have experienced significant gains and notable achievements in the first quarter (Q1) of 2024.

According to a comprehensive performance analysis conducted by Messari, amid the emerging crypto bull market, Fantom has emerged as one of the major beneficiaries, showing significant growth in key metrics and market capitalization.

FTM Market Cap Soars 101% QoQ

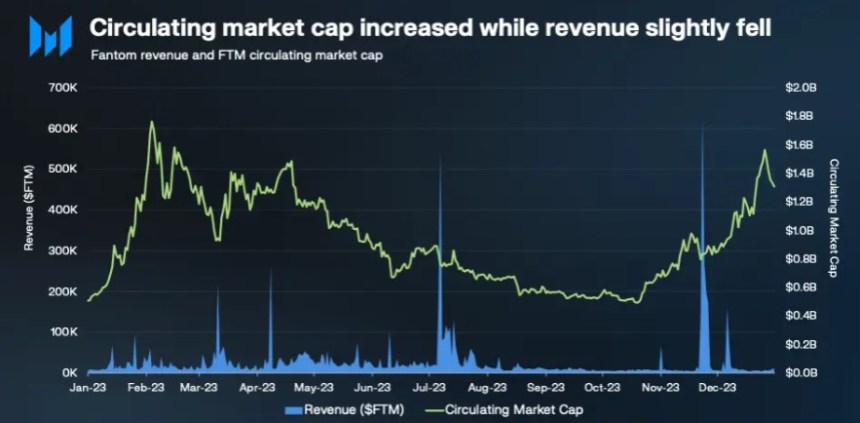

By the numbers, FTM’s circulating market capitalization saw a substantial 101% quarter-over-quarter (QoQ) increase, jumping from $1.3 billion to $2.6 billion, vaulting it up ten spots to 48th among all tokens (currently 58th). The token’s rally extended for two consecutive quarters, resulting in a fourfold increase since the end of Q3 2023.

Although Fantom experienced a decrease of 53% QoQ in revenue measured in FTM, amounting to 1.8 million FTM, revenue denominated in USD exhibited a 4% QoQ increase, reaching $1.2 million.

According to Messari, the revenue decline was primarily due to reduced inscription activity across all smart contract platforms in Q1.

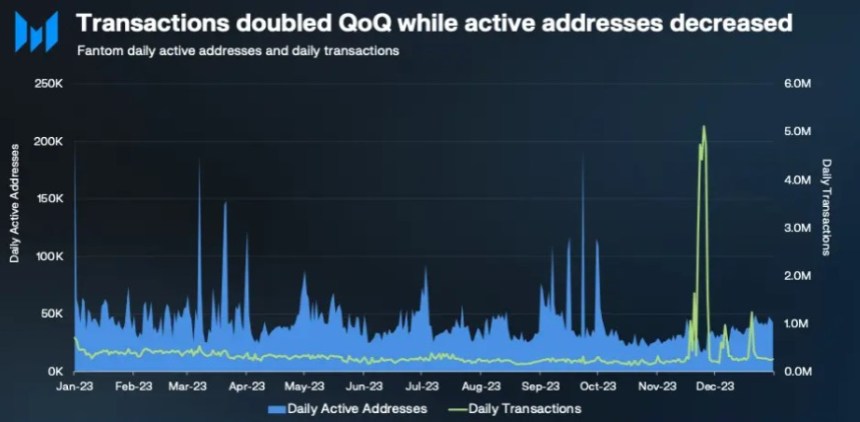

Despite this, Fantom maintained an upward trend in average daily transactions, excluding inscription-related activity, surpassing the Q3 average and reaching 247,000 daily transactions. Daily active addresses also rebounded, rising by 24% QoQ to 40,500.

In Q1, the staking requirement for Fantom validators was significantly reduced from 500,000 FTM to 50,000 FTM, aiming to increase accessibility. However, the number of active validators remained unchanged at 55.

Notably, the total amount of FTM staked increased by 17% QoQ, from 1.1 billion to 1.3 billion FTM, resulting in a 135% QoQ surge in the total dollar value of staked FTM, reaching $1.2 billion. Among proof-of-stake (PoS) networks, Fantom ranked 22nd in the dollar value of funds staked by the end of Q1.

Memecoin Mania Boosts Fantom On-Chain Activity

During the year’s first quarter, Total Value Locked (TVL) denominated in USD experienced a substantial 59% QoQ increase, rising from $810.8 million in Q4 to $1.28 billion.

Conversely, TVL-denominated in FTM decreased by 21% QoQ, indicating that the surge in USD-denominated TVL was partly attributed to FTM’s price appreciation.

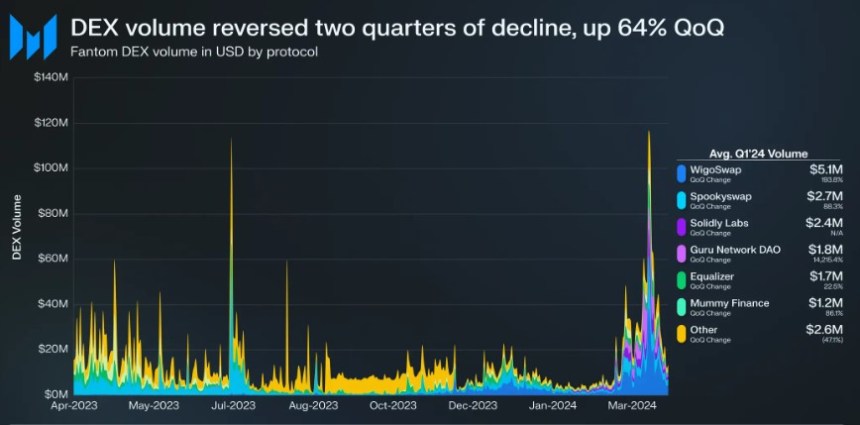

Fantom’s average daily decentralized exchange (DEX) volume surged by 64% QoQ, from $10.2 million to nearly $176.8 million. In Q1, the “Memecoin Mania” trend contributed to elevated on-chain activity across various networks, including Fantom.

Fantom’s monthly DEX volume surpassed $1 billion in March, marking the first time since March 2023. The number of DEXs on Fantom increased to 31 by the end of Q1, with no single DEX dominating more than 30% of the market share.

Lastly, following an exploit in the Multichain: Fantom Bridge, which affected stablecoins on Fantom in Q3 2023, the Fantom Foundation took steps to increase the liquidity of stablecoins.

As of Q1 2024, two independent third-party bridging solutions, Axelar (axlUSDC and axlUSDT) and LayerZero (lzUSDC and lzUSDT), have emerged. USDC remains the predominant stablecoin on Fantom, accounting for 98% of the stablecoin market cap. USDT also experienced considerable growth, with an 86% QoQ increase.

The FTM token is currently trading at $0.7037, reflecting an 8.7% increase in price over the past seven days. However, it has experienced a decline of nearly 20% in the monthly time frame.

Featured image from Shutterstock, chart from TradingView.com