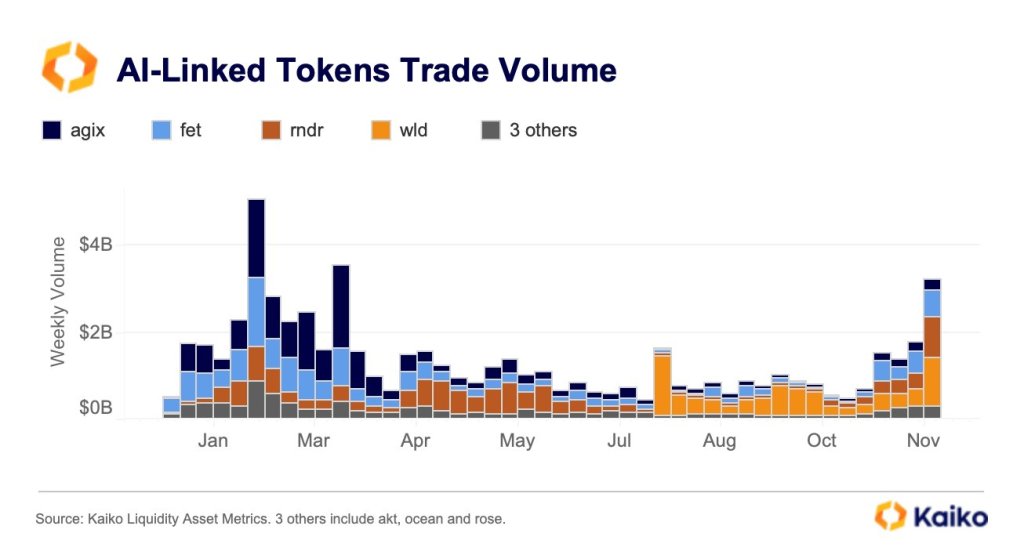

Excluding Bitcoin, memecoins were the biggest narrative of this cycle. However, Artificial Intelligence (AI) tokens also performed remarkably during the first quarter of 2024.

The crypto market recovered over the weekend from the May 1st retrace, with AI tokens showing significant gains. As a result, many industry experts think that the sector is poised for a ‘Round 2’ this cycle.

AI Sector Recovers By 8%

Crypto analysts highlighted AI tokens alongside memecoins as the hottest topic of 2024, responsible for most of the massive gains during this cycle.

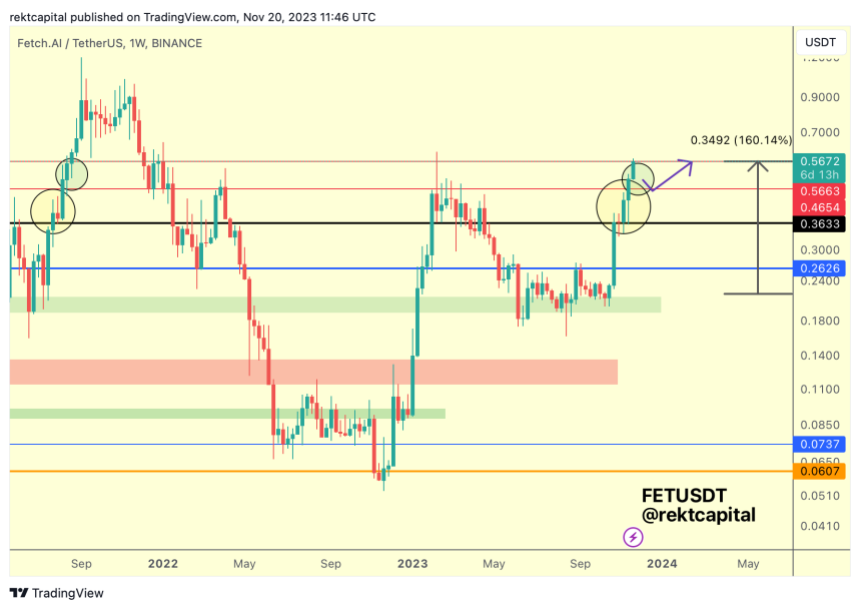

According to CoinGecko’s report, AI was one of the three sectors that delivered three-digit returns in Q1. Moreover, the largest AI token by market capitalization, Fetch.ai (FET), saw gains of 378.3% during this period.

As a result, some analysts deem the AI sector to be the next main narrative of the cycle. Trader John Walsh, known as CryptoGodJohn, considers “The future of AI coins preparing round 2.”

Walsh added that the AI season is “extremely obvious” and will go “so much higher” based on the developments in the sectors, including Nvidia earnings, Apple AI, and Microsoft’s $100 billion AI fund.

To this, crypto analyst MacroCRG replied that a massive AI growth “will be obvious in hindsight,” considering that the sector’s market capitalization is “just” $27.3 billion.

AI mcap still just $27B

It will be obvious in hindsight https://t.co/HH0Tb86fNY pic.twitter.com/71qgdwdM1C

— CRG (@MacroCRG) May 6, 2024

According to a MacroCRG post, the AI market cap had increased 8% by Monday morning, and its daily trading volume was around $1.9 billion. On Tuesday, the market cap surged to $27.8 billion, a 2.3% increase from 24 hours ago.

In comparison, memecoins $54.4 billion market cap doubles AI’s. However, its market cap decreased by 2.8% in the last day, with the top ten memecoins showing red numbers in the past 24 hours.

Is Artificial Intelligence About To Bloom Or Ruin the World?

Despite the remarkable performance, some figures think the sector has a more pessimistic future. According to memecoin trader Murad, the developments in the industry will “be replacing more & more jobs every year.” As a result, there will be an increase in “Anxieties and desperate attempts to ‘make it.’”

To the trader, the industry will serve as a push for the memecoins sector, as “Growing AI capabilities will be one of the big forces accelerating the Memecoin Bubble.”

Financial giant Warren Buffett shared a more skeptical view on Saturday. The Co-founder and CEO of Berkshire Hathaway revealed he is not sold yet by artificial intelligence. To the CEO:

We let a genie out of the bottle when we developed nuclear weapons. AI is somewhat similar — it’s part way out of the bottle.

Despite this, Buffet recognized the potential for AI technology to change the world positively.

On The Brink Of A Millionaire Boom

“The AI industry is on the brink of a multi-trillion-dollar boom,” stated Alex Wacy. The analyst believes the reasons behind this are the vast and diverse potential of applications.

Moreover, the expert highlights that interest in the sector has steadily increased over the last year. A crypto and AI combination could potentially “create a market valued in the trillions.”

According to the post, the market is projected to reach nearly $2 trillion by 2030, which suggests that the crypto industry should not overlook it.

Tokens like RNDR showed a remarkable performance over the past week, with the price soaring by 45%. RNDR regained the $10 support zone this week after struggling to retest it over the last month.

In the past 24 hours, the token’s price surged 6.4%, and its daily trading volume increased by 16.8%, with over $455 million being traded.

FET is “a top performing AI coin headed into the Nvidia earnings,” as stated by John Walsh. The trader forecast that the token is “looking for a next leg higher up” after successfully retesting the $2.35 resistance level.

$FET break retest now looking for next leg up higher

FET will be a top performing AI coin headed into the nvidia earnings pic.twitter.com/Agl0eqB9mD

— Johnny (@CryptoGodJohn) May 6, 2024

FET broke above this level over the weekend, rising to $2.5 on Monday and remaining above the $2.40 support zone since.

At writing time, the token is trading at $2.42, representing a 2.4% increase in the last 24 hours and a $22.9% surge in the past week.