Decentralized cloud is the stable end state for computing.

Filecoin Bull Run On The Horizon? Analyst Sees 250% Surge

Filecoin (FIL), a decentralized data storage network, has experienced a recent surge in value, grabbing the attention of cryptocurrency analysts. The price increase, coupled with bullish analyst predictions, has ignited optimism for FIL’s future.

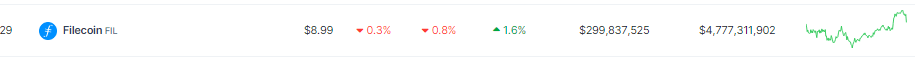

At the time of writing, FIL was trading at $8.99, down 0.8% in the last 24 hours, but managed to sustain a 1.6% increase in the last seven days, data from Coingecko shows.

Filecoin Price Poised For A Rally?

Technical analysis plays a crucial role in predicting cryptocurrency prices. Analysts like “World Of Charts” emphasize the importance of retesting key support levels. A successful retest, they argue, could pave the way for a significant bullish wave, with estimates ranging from 200% to 250% price increase for FIL.

$Fil#Fil Testing Key Support (Accumulation Zone) Real Move Can Start After Successful Retest Expecting 200-250% Bullish Wave Incase Of Successful Retest #Crypto pic.twitter.com/3n0BpklAxh

— World Of Charts (@WorldOfCharts1) April 7, 2024

In 2023, Filecoin experienced its peak performance, with FIL prices surging by 130% from $3.00 to $6.85. Conversely, 2022 marked its lowest point, witnessing a drastic drop of 90% from $34.20 to $3.05. Over the past five years, Filecoin has maintained an average yearly growth rate of 4.05%.

Typically, Filecoin tends to shine brightest in the first quarter, boasting an average gain of 190%, while its performance tends to falter in the second quarter, often resulting in a loss of 58%.

Analyst Shares His Views

This sentiment of World of Charts is echoed by other market observers. “Captain Faibik,” another analyst, encourages investors to capitalize on price dips, expressing confidence in FIL’s future appreciation. Such endorsements can significantly influence investor sentiment and contribute to the overall market dynamics for FIL.

$FIL #Filecoin Buy the dip Now, you’ll thank me later.

pic.twitter.com/9HLyZzteRu

— Captain Faibik (@CryptoFaibik) April 7, 2024

Will Filecoin Reach $20?

Meanwhile, analysis of Filecoin’s (FIL) potential ascent to $20 demands a comprehensive examination given its current dynamics. Despite FIL showcasing strengths like a 65% price surge over the past year and consistent trading above the 200-day simple moving average, several factors could hinder such a substantial climb.

Although FIL has seen 15 green days in the last month, indicating short-term bullish sentiment, it has been outpaced by 60% of the top 100 crypto assets, including leading ones like Bitcoin and Ethereum. Additionally, FIL remains -96% down from its all-time high, indicating a significant historical price decline.

Moreover, FIL faces challenges due to its high yearly inflation rate of 28.81%, despite its strong liquidity demonstrated by its market capitalization. Thus, while the $20 target for FIL isn’t out of reach, attaining it would likely necessitate a sustained positive market sentiment, improved performance relative to other assets, and effective management of inflationary pressures.

Featured image from Pixabay, chart from TradingView

Filecoin Liquid Staking Platform STFIL Claims Team Members Under Investigation by Chinese Police

Tokens on the platform were moved to an “unknown, external address” last week while its team members were under detention.

Filecoin (FIL) Surges Another 9.3%, Are The Bulls Getting Ready For More?

Filecoin (FIL) has been among the top gainers during the current market rally. Throughout February, FIL has shown a formidable performance fueled by the bullish momentum and its partnership with a major blockchain.

This performance has analysts and important crypto actors predicting a potential bullish run around the corner for the decentralized storage network’s native token.

Should Filecoin Investors Get Ready For A Bull Run?

Pseudonym analyst and trader Crypto Breakout highlighted that FIL broke through a crucial resistance in the 3-day timeframe, signaling that the “bulls return with force.” The chart shared by the analyst illustrates a downtrend pattern in FIL’s price since 2022.

Two years ago, as the chart below shows, the token traded at $11 before facing a pullback that shredded about 70% of the token’s value in the following months. By February 2023, the token recovered and broke through the $9 resistance level before repeating a similar downtrend.

Since 2023, the price has remained well below this level, only breaking through the $8 support zone once at the very beginning of 2024. Throughout January, FIL’s price had a turbulent performance, falling around 40%.

The price has picked up the crypto market uptrend, and, as the analyst highlights, it has been gaining positive momentum. The 3-day time frame shows that FIL has been following an upward trend that led to the token breaking through the crucial $8 support zone this Friday.

As the post suggests, this break out of the downtrend could signal FIL’s “beginning of an epic bullish rally” and that investors should “get ready for exciting moves ahead.”

Renowned crypto analyst Ali Martinez made a similar prediction. Earlier this week, Martinez highlighted Filecoin moving within a parallel channel on the 3-day chart. He suggested a successful breakthrough from the $8.50 barrier could catapult the token’s price to $25.5.

Artur Hayes Predicts $100 As FIL Continues To Rise

After the token’s recent surge, BitMEX co-founder Arthur Hayes shared his FIL prediction. On an X (former Twitter) post, Hayes forecasted that FIL’s price would rally to $100, also calling the arrival of the bull market.

Welcome to the bull market. May all things AI related levitate. $FIL = $100

Yachtzee

pic.twitter.com/oggCeY8IGc

— Arthur Hayes (@CryptoHayes) February 23, 2024

Filecoin, a decentralized storage network, recently integrated with Ethereum’s rival Solana to make its blockchain history more accessible and usable. According to the announcement, the integration is a significant move away from centralized storage solutions, which seek to improve reliability and scalability in the Solana blockchain.

This move has considerably fueled the ongoing upward momentum for FIL. The token has shown a considerable performance in recent weeks, with FIL increasing 53.9% in the last two weeks and 67.7% in 30 days.

The token trades at $8.19 at writing time, representing a 9.6% surge in 24 hours and 39.0% in the last seven days. FIL is currently the 25th largest cryptocurrency by market capitalization, at $4.2 billion, a 12.38% increase from yesterday. Its trading activity also saw a recent rise, with its daily trading volume at $895.2 million, 44% more than the day before.

FIL, GRT Rally Boosts CoinDesk Computing Index as Bitcoin Struggles

FIL’s market-beating surge to a 12-month high of $8.5 comes on the heels of Filecoin’s Feb. 16 announcement that it would host programmable blockchain Solana’s block history.

Crypto Analyst Predicts 10X Move For Filecoin (FIL) To $70, But Can It Reach ATH?

Over the last day, Filecoin (FIL) has seemingly emerged from the shadows to stage a price recovery of over 10%. This notable move has brought more attention to the altcoin, which had previously failed to follow the general crypto market recovery. On the back of this, one crypto analyst predicts big things for the altcoin, expecting a 1,000% increase in its price.

Filecoin Will See A 10X Rise To $70

In the analysis that was shared on X (formerly Twitter), crypto analyst “Tony The Bull” told his almost 20,000 followers that the Filecoin (FIL) price was gearing up for a massive recovery. The chart shared in the analysis tracks the movement of the coin over the last year, which saw it go from a low below $3 to over $.7, an almost 200% increase. Nevertheless, the crypto analyst believes there is more to come.

The prediction for the Filecoin price from the crypto analyst is that it will rally as high as $70. Now, given FIL’s current trading value, this would mean a 1,000% increase or a 10X increase from here. The analyst seems to believe that the altcoin is entering into a price discovery phase, saying, “I’m gonna find out.”

$FIL to minimum $70 for a 10x

Back to ATH is +20x

Price discovery = ?

I’m gonna find out pic.twitter.com/w2O5fgAzDi

— Tony “The Bull” (@tonythebullBTC) February 19, 2024

Tony is not the crypto analyst that forecasts a bullish future for the Filecoin price as analyst Ali Martinez also expects the altcoin to do well. Martinez revealed that FIL is currently trading in a “parallel channel on its 3-day chart” which is usually bullish for price.

However, for the move to be confirmed, the crypto analyst explains that the altcoin must break the “resistance posed by the channel’s upper boundary, set at $8.50.” If this happens, then Martinez expects the price to rise as high as $25.5.

#Filecoin is trading within a parallel channel on its 3-day chart. Watch out for the resistance posed by the channel’s upper boundary, set at $8.50.

A successful break through this barrier could significantly bolster $FIL‘s price, potentially tripling its value to reach $25.5! pic.twitter.com/Tgg0rZfRrs

— Ali (@ali_charts) February 19, 2024

Can FIL Reach A New All-Time High?

In addition to his analysis, Tony The Bull also posits that Filecoin is only 20X away from its all-time high price of around $230, so it is possible that the altcoin could see a run-up to this level. However, this was not well-received by community members, who countered that it would be impossible for FIL to reach a new ATH due to its inflation over the last year.

FIL’s circulating supply has risen drastically over the years, putting it way higher than what it was when it hit its all-time high back in 2021. Due to this, expectations that the altcoin could get back to this level are very low. “With its MASSIVE inflation over the last bear market, FIL will not be making a new ATH,” one user said in response to the crypto analyst.

Nevertheless, FIL continues to show strength in the daily chart. Its price is up 16% in the last 24 hours and 40% in the last seven days, according to data from Coinmarketcap. It is trading at $7.68 at the time of this writing.

Filecoin (FIL) Notches 10% Gain Following Integration With Solana

Filecoin (FIL) continues to enjoy investors’ interest following a 10.28% gain in the last day, according to data from CoinMarketCap. The altcoin has recently been the center of attention following a gradual price rise in the past week culminating in a 15.34% price gain. Interestingly, the spike in FIL’s price over the 24 hours appears to be fueled by exciting developments in the project’s ecosystem.

Filecoin Meets Solana

In an X post on February 16, Filecoin announced an integration with the popular Ethereum rival, Solana. Launched in March 2020, Solana is regarded as one of the most prominent smart contract-compatible platforms offering fast transactions and almost non-existent fees.

Solana’s integration with #Filecoin is a significant move away from centralized storage solutions and a remarkable step towards enhancing the reliability and scalability of the Solana blockchain.@solana is utilizing Filecoin to make its block history more accessible and usable… pic.twitter.com/1NcuaLNYT5

— Filecoin (@Filecoin) February 16, 2024

Ranked as the fifth-largest crypto project with a market cap value of $47.97 billion, Solana’s integration with Filecoin is aimed at migrating from its widely criticized centralized storage system to decentralized storage solutions, with the aim of improving its existing scalability and integrity.

Through this integration, Filecoin’s network will assist Solana in enhancing access to its blockchain history, which will be beneficial to developers, explorers, indexers, and other network users. In addition, Filecoin’s decentralized storage solutions will allow Solana to experience data redundancy, scalability, and a higher level of security while operating as a decentralized network.

Interestingly, this development created much excitement in the Filecoin user community as FIL surged by over 10%, reaching a value of $6.36. Meanwhile, FIL’s daily trading volume stands at $497.78 million, having recorded an astounding 178.42% gain.

FIL Price Prediction

FIL began 2024 on a turbulent note losing about 40% of its value between January 1 and January 23. However, in the last few weeks, the token has experienced a steady price recovery which is further aided by its most recent boost in price.

If the bulls are able to sustain the current buying momentum, FIL may hit the $8 price mark representing a return to the levels seen at the start of 2024. However, according to the token’s daily chart, the relative strength index has now crossed into the overbought zone. This indicates that there might be an incoming trend reversal. In that case, FIL’s price may fall as low as $4.90, which represents its next support level and a 23.71% decline from the current market price.

Filecoin (FIL) trading at $6.341 on the daily chart | Source: FILUSDT chart on Tradingview.com

Filecoin’s Liquid Staker Glif Raises $4.5M, Hints at Token Airdrop

Glif’s “liquid leasing” gives FIL holders a way to earn yield on their assets.

Filecoin: Rocky Start Hits Protocol With Slow New Year Progress – Here’s Why

Although the broader market is experiencing a strong start this year, Filecoin has opened the year at a snail’s pace. According to Coingecko, the token is up over 4% in the past 24 hours. However, the week started with FIL bleeding nearly 27%.

With investors uninspired by the ongoing broader market rally, FIL might be in for a rough few months after ending 2023 on a positive note.

On-Chain Growth Prevents A Bigger Disaster

In their most recent blog post, they highlight the recent achievements of the ecosystem. Over 2,442 unique smart contracts deployed on-chain, with over 3,000 projects native on Filecoin. But overall, Filecoin has been fairly silent in terms of development, despite boasting an extremely active developer base with over 15,000 contributors on GitHub.

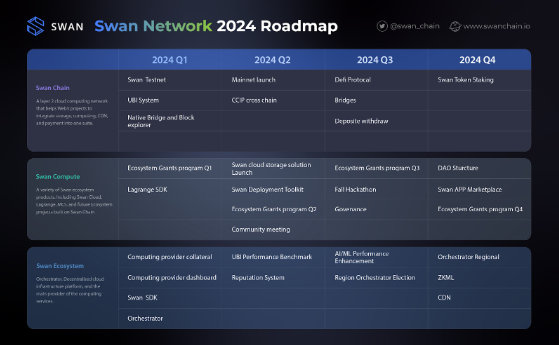

Swan Chain – a layer-2 protocol powered by Filecoin itself – is the one creating a positive noise. In their recent post on X, the protocol posted a roadmap for this year.

If Swan’s planned roadmap is followed and implemented, it may reverse the overall bearish attitude on FIL. However, this will inevitably take time, costing investors precious moments on the red rather than starting the year on the green.

But 2023 was a bountiful year for Swan Chain. In the blog post detailing the protocol’s achievements last year, their testnets Lagrange and Mars covered different aspects of the ecosystem and saw great success. This might be a sign that investors should be in for the long term rather than expect short-term gains.

Filecoin: More Pain In The Short To Medium-Term?

As of writing, the token is completely in the red after an impressive year-end rally. The bulls are now fighting over control of the $5.825 price level which will provide a better platform for higher highs in in the long term. However, this may not be the case in the next couple of days.

FIL’s market is dominated by the bears that will inevitably bring the token’s price to sub-$5 if the bearishness continues. But this also presents the opportunity for the bulls to slow the token’s descent until they find strong support for the long haul.

At the moment, $5.231 will be the point at which the bulls will slow FIL’s downward spiral. If they can hold on to this price level in the long run, investors and traders will see gains trickle in little by little.

Featured image from Shutterstock

Bitcoin's 8-week win streak is in danger, but ATOM, FIL, EGLD, and ALGO don't care

Bitcoin is set to break its eight-week winning streak, but that has not affected the prospects of ATOM, FIL, EGLD, and ALGO, which look strong on the charts.

Arthur Hayes Predicts Early 2024 Crypto Bull Run And Ascent Of Filecoin

On September 13th, Arthur Hayes, co-founder and former CEO of BitMEX, delivered a comprehensive analysis of the crypto landscape at Token2049 in Singapore. His insights, which spanned from macroeconomic trends to the intricate dynamics of AI, culminated in a bullish prediction for Filecoin, a decentralized storage solution in the crypto domain.

Why The Bitcoin And Crypto Bull Could Start Early 2024

Hayes began by dissecting the symbiotic relationship between debt, AI, and the intrinsic value of Bitcoin and cryptocurrencies. Historically, he noted, crypto bull markets have been propelled either by fiat currency liquidity or by groundbreaking technological advancements.

However, a simultaneous convergence of these two driving forces has been conspicuously absent. “Over the past decade, one of these two factors has always been the reason we’ve had a bull market in crypto. Yet, we haven’t witnessed a bull market where both were present at the same time,” Hayes remarked.

Assuming that both factors could play out next year, Hayes ventured a bold prediction for the crypto sector’s trajectory. “I believe the next bull market in crypto could commence in early 2024. This could potentially be the most significant bull market not only for cryptocurrencies but also for risk assets since the eras of World War II and the Great Depression,” he stated.

Diving deeper into global economic trends, Hayes highlighted the alarming acceleration of global debt, especially in the wake of the COVID-19 pandemic. He presented a stark picture of the US public debt maturity profile, emphasizing the looming challenges. “What do governments resort to when faced with a mountain of debt that needs issuance, but there’s a dearth of willing buyers at feasible interest rates? The answer is simple: they print money,” Hayes elucidated.

As the discussion transitioned to technology’s intersection with crypto, Hayes identified AI as the prevailing zeitgeist. Drawing parallels with past technological revolutions, he emphasized AI’s transformative potential within the crypto space. He cited the meteoric adoption of AI technologies, such as Chat GPT, and the burgeoning investments in AI-centric firms like NVIDIA as testament to this trend.

Will Filecoin Rise From The Ashes?

Hayes then meticulously connected the dots between AI’s demands and the indispensable role of decentralized storage in the crypto ecosystem. He posited that centralized storage solutions, while prevalent, pose significant risks, especially for burgeoning AI applications.

“Why does AI, a dominant force in the crypto and tech sectors, necessitate decentralized storage? Relying on centralized solutions like Amazon means entrusting vast swathes of data to entities that can unilaterally alter terms, hike prices, or even shut down services, potentially under governmental directives,” Hayes explained.

This line of reasoning led Hayes to spotlight Filecoin, emphasizing its significance in the crypto landscape. Despite its dramatic price decline from its zenith, Hayes championed the untapped potential of Filecoin. “Filecoin’s value in the crypto space isn’t merely speculative. It’s down nearly 99% from its peak of $300 to $3 today. Yet, its tangible utility is evident, with real customers actively using the network and significant data being stored,” he detailed.

Hayes further highlighted his investment in Seal Storage, a Filecoin storage platform. SEAL has undertaken a project named Atlas, associated with CERN, the renowned European particle accelerator. By leveraging SEAL, CERN aims to optimize data costs, and in return, SEAL garners rewards in Filecoin for hosting this data on the network. This synergy isn’t exclusive to CERN.

The University of California, Berkeley, recognizing the potential, has integrated SEAL for analogous purposes. Furthermore, SEAL’s innovative approach has caught the attention of other prestigious institutions, leading to collaborative ventures with NASA and various esteemed universities across the United States.

At press time, Filecoin (FIL) traded at $3.11

Filecoin Uphill Battle To $3.5 – What’s Holding It Back?

Filecoin (FIL) has been facing a long-term downtrend, marked by wavering buyer confidence and a series of concerning technical indicators. A recent price analysis reveals a bearish order block at $3.6 on FIL’s one-day chart, with a closely tested liquidity zone at $3 over the past month. This downward trend has persisted since early August, as evidenced by a sequence of lower highs and lower lows.

On the weekly chart, two key levels have held significant sway over FIL’s fortunes since June 2022. The resistance at $4.8 and the support at $2.42 have acted as formidable barriers and lifelines, respectively.

Analysis suggests that a breakthrough above the $4.8 resistance could signify the first step toward establishing a long-term uptrend. Furthermore, the presence of a bearish breaker block in the 1-week timeframe, spanning from $4.6 to $5.7, reinforces this notion.

Filecoin Bearish Signals Abound

The same analysis highlights that technical indicators have been unforgiving for FIL, with both the On-Balance Volume (OBV) and Relative Strength Index (RSI) painting a grim picture. The OBV has been in a consistent downward trajectory since mid-July, indicative of sustained selling pressure.

Meanwhile, the RSI exhibits bearish momentum, recording a reading of 31 and consistently residing below the neutral 50 mark since late July. These combined signals strongly suggest that FIL may experience a drop below $3 and trend towards $2.4 in the weeks ahead.

As of the time of writing, the current CoinGecko price for Filecoin (FIL) stands at $3.04. Over the past 24 hours, FIL has experienced a decline of 1.7%, while the seven-day period has seen a slump of 4.3%. These recent declines add to the challenges that FIL has been facing in its price action.

Filecon seven-day price movement. Source: Coingecko

Investor Perspective: A Silver Lining For Filecoin

Despite the prevailing challenges, some seasoned investors are turning their attention to Filecoin. A report cites Filecoin’s unique value proposition, an accomplished team, and an incentivized mechanism as reasons for optimism.

Filecoin, as a decentralized data storage system, allows users to securely store and retrieve data in a decentralized manner. Its expert team is committed to ensuring its continued development and success. Moreover, the incentive mechanism rewards users with FIL tokens for sharing their storage space, fostering a robust and self-sustaining ecosystem.

Filecoin’s technical indicators may currently signal a challenging road ahead, with a downtrend seemingly in progress. However, some investors remain undeterred, recognizing the project’s unique strengths and the potential for a brighter future. As the cryptocurrency market is ever-volatile, only time will reveal whether Filecoin can overcome its current obstacles and thrive in the long run.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from CryptoSlam

The Relationship Between Bitcoin and Interest Rates Is Breaking Down: Arthur Hayes

The steepest Fed rate hike cycle in decades should have killed bitcoin and other risk assets, but a new relationship between the two are forming, Hayes argued in a Tuesday keynote at the ongoing Korea Blockchain Week.

Save a Tree, Use Web3

Distributed technologies can reshape supply chains, and help consumers and businesses to make more responsible decisions.

Bitcoin’s dull price action ignites buying interest in LINK, FIL, SNX and THETA

LINK, FIL, SNX and THETA are starting to look bullish right as Bitcoin prepares for a volatile price move.

Filecoin storage utilization surpasses 7% in Q2: Report

Although utilization rose, protocol and supply revenue declined, as more providers slashed fees to incentivize adoption.

Bitcoin price gathers strength as SOL, AVAX, FIL and EOS prep for a breakout

SOL, AVAX, FIL and EOS price are beginning to look attractive, especially if Bitcoin opens the week with a renewed attack on the $31,000 level.

Storj, Filecoin and Solana Lead First Week of July Crypto Market Gains

STORJ, the native token of the crypto-backed, cloud storage platform, rose 15% on the week, far outdistancing bitcoin and ether, among other digital assets.

Universities use blockchain-based storage to protect and democratize data

Decentralized solutions can make academic research more secure and more accessible.

SEC Junks Grayscale’s Filecoin Trust Application Over ‘Security’ Label

Filecoin, a decentralized storage platform based on blockchain technology, has recently found itself entangled in a regulatory debate as the United States Securities and Exchange Commission (SEC) raises concerns over its classification as a security.

Grayscale Investments, a prominent digital asset management firm, has been instructed by the SEC to withdraw its application for a Filecoin Trust, citing potential securities implications.

Grayscale’s intent to launch an updated Filecoin Trust product was initially disclosed through a Form 10 application submitted to the SEC on April 14. However, in a recent announcement, Grayscale revealed that the regulatory body has expressed reservations about Filecoin’s categorization, asserting that it could fall under the definition of a security.

Grayscale Pushes Back Against SEC Filecoin Securities Claim

Grayscale has revealed that it received a comment letter from the SEC on May 16. In the letter, the regulatory body cautioned that Filecoin (FIL), the underlying asset of Grayscale’s proposed Filecoin Trust, meets the criteria for being classified as a security under federal law. As a result, the SEC requested that Grayscale withdraw its application for the trust product.

The intended transformation of Grayscale’s existing Filecoin Trust into a more public company-like entity, as outlined in the Form 10 application, would have entailed the filing of quarterly reports detailing the financial activities of the trust. However, the SEC’s recent warning has cast doubt on the regulatory viability of such a structure.

In response to the SEC’s assertion, Grayscale expressed a differing viewpoint. According to the firm, Filecoin should not be classified as a security under federal securities laws. Consequently, Grayscale intends to promptly submit a detailed explanation to the SEC staff, outlining the legal basis for its position.

SEC Definition Of Securities; Implications For Crypto Industry

The comment letter received by Grayscale Investments from the SEC sheds light on the regulator’s perspective regarding the classification of Filecoin (FIL) as a security.

The SEC’s definition of securities is crucial in determining the regulatory framework and compliance requirements for various financial instruments.

Securities, as per federal law, encompass a broad range of tradable financial assets, including stocks, bonds, and investment contracts, which are typically subject to specific disclosure and registration regulations.

The implications of the SEC’s position extend beyond the specific case of Filecoin and Grayscale Investments. It remains to be seen how this particular case will play out and what implications it will have for the broader regulatory approach to cryptocurrencies and blockchain-based assets.

-Featured image from Depositphotos