Base is already home to 46% of transactions related to SocialFi on-chain, but the asset manager says it has even more room to grow.

Cryptocurrency Financial News

Base is already home to 46% of transactions related to SocialFi on-chain, but the asset manager says it has even more room to grow.

Crypto users are increasingly turning attention to new SocialFi apps, but analysts say it’s probably too early to say whether “SocialFi season” has arrived.

Hayden Adams, founder of the Uniswap protocol, has shared his opinion on what characterizes a good distribution or rollout of a token. In a recent post on the X platform, the prominent crypto figure listed 10 qualities of good token distributions, highlighting the complexities surrounding the launch of a cryptocurrency.

Adams began his take on good token distributions by stating that projects should allocate “tokens, not points” to the community. This phrase implies that participants should receive actual tokens that hold value within a particular ecosystem or on a network, instead of receiving points that may have limited utility.

Not aimed at any specific project, but have seen a ton of discourse recently on the topic so figured I’d share my take on good token distributions:

1) tokens, not points

2) don’t farm the farmers – teasing and creating ambiguity around a token distribution to grow your numbers…

— hayden.eth

(@haydenzadams) May 4, 2024

Secondly, Adams warned against creating ambiguity or being vague about a token distribution to increase the number of participants or to “farm the farmers.” A good token distribution practice includes sharing real details when ready, according to the Uniswap founder.

Additionally, Adams criticized “low float tokens,” while calling them malicious. The prominent DeFi figure urged project teams to ensure sufficient tokens are available in circulation to prevent manipulation and allow genuine price discovery.

Adams also discouraged hyping a token’s price and how it will skyrocket before it launches. The founder believes hiring an influencer or a marketing company to promote a token’s value only depicts a get-rich-quick scheme rather than a genuine attempt at building real value.

What’s more, the Uniswap founder stressed the importance of free token airdrops during token distributions. “Don’t be stingy – give a significant amount away. If you don’t think the community deserves a significant amount, don’t release a token,” Adams said in his post.

Ultimately, Adams advised new crypto projects to be careful and thoughtful in their decision-making to avoid making mistakes that might put them at odds with the crypto community. “Create something you’re proud of and stand behind it,” the Uniswap founder added.

At the beginning of his post, the Uniswap founder clearly stated that the opinion is not aimed at any specific project. However, the timing is interesting, especially after social media platform Friend.tech’s “unsuccessful” token airdrop.

On Friday, May 3rd, Friend.tech airdropped its new FRIEND tokens to users in conjunction with the launch of the protocol’s version 2. While the token’s value quickly rose to $167 after launch, FRIEND’s price nosedived to below $2 within a few hours.

Analysts pinpointed liquidity issues and a mass sell-off as the primary reasons behind the downturn of FRIEND and, ultimately, the ineffectual token launch. Moreover, many users complained about how challenging it was to claim the token airdrop, as technical drawbacks reportedly frustrated the process.

The decentralized social network Friend.tech, launched in August 2023, is facing a significant setback as its native token, FRIEND, experiences a staggering 98.5% drop in value.

Investors who participated in the recent airdrop of FRIEND tokens have expressed serious concerns about the development, highlighting issues with token claiming and app functionality.

Upon its debut, the FRIEND token entered the market with a trading price of $169 per token, attracting 18,000 holders, and boasting a circulating supply of 14 million tokens.

However, the current trading price has plummeted to approximately $1.26, resulting in a market cap of $27.7 million and liquidity of $5.4 million, according to DexScreener data, leaving many investors frustrated.

The airdrop process, which aimed to distribute tokens to the community, has faced its fair share of challenges. Users on social media site X (formerly Twitter) expressed frustration over the declining value of their airdropped tokens.

Some claimants experienced difficulties claiming their tokens, while others reported watching the value of their holdings diminish significantly in hours.

One user even accused a prominent figure of orchestrating a rug pull, further fueling the community’s discontent.

Despite the current downturn, some crypto analysts predict a potential recovery for the FRIEND token. Notably, crypto analyst Daan Crypto Trades suggests that the token’s value may rise in the future, emphasizing that market sentiment may change once users start to see returns on their investments.

However, concerns remain regarding the functionality of the Friend.tech app, which experienced significant issues during its initial weeks.

DeFi researcher DeFi Ignas expressed disappointment in Friend.tech’s V2 launch, describing it as a “massive flop.” Ignas criticized the app’s usability issues and questioned whether the team’s focus was misplaced during development. Speculation arose regarding whether the team deliberately orchestrated a price decline to prompt a subsequent surge in value.

Despite this, the self-proclaimed number one creator on Friend.tech’s platform, using the pseudonym “Captain Levi,” stated the following in support of the token:

The dump is brutal but actually healthy as jeeters sell at heavily discounted prices while real users have not even waken up to the full potential of V2 and money clubs given the app barely works. think we already saw bottom and price should slowly recover as users buy clubs

As Friend.tech grapples with the challenges surrounding the FRIEND token, the crypto community eagerly awaits improvements in app functionality and a potential revival of the token’s value.

Featured image from Shutterstock, chart from TradingView.com

The largest Friend.tech whale has sold all his holdings, causing the new token to fall over 50% in value while other users are still unable to claim the airdrop.

Making the token non-transferable could force users to pay the 1.5% Friend.tech platform fee in an “ironic” shift from the platform’s non-venture capitalist approach.

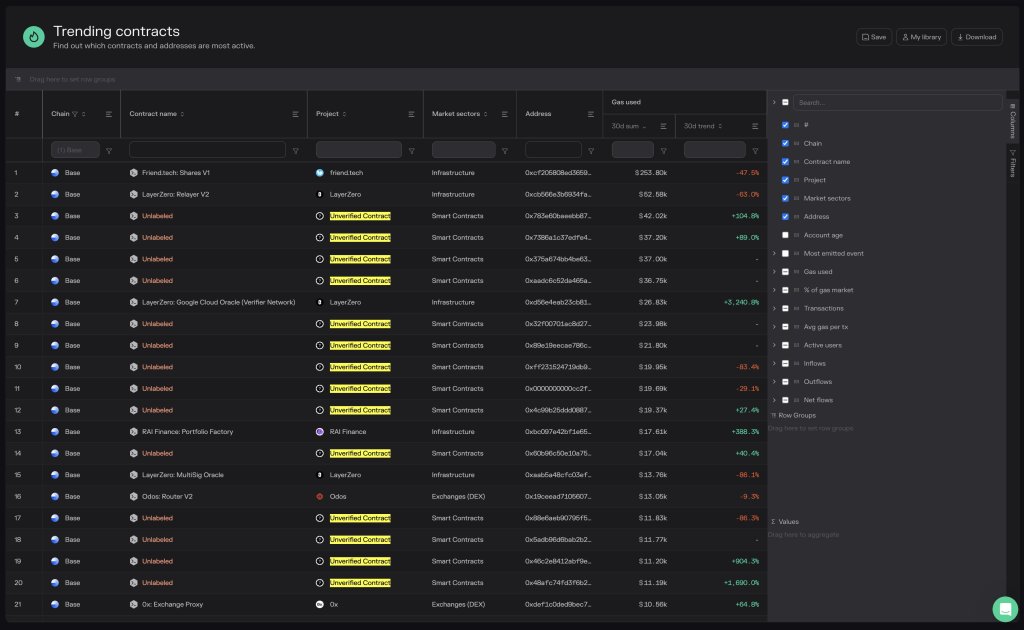

14/21, or 66%, of the top gas-consuming smart contracts on Base, a layer-2 platform for building and deploying smart contracts, are unverified. According to Token Terminal data on October 24, the same contracts are some of the most actively used, reading from gas fee trends over the last month.

Base is a layer-2 scaling solution and one of OP Mainnet and Arbitrum’s competitors. The platform relies on the Optimistic Rollup technique, allowing transactions to be batched off-chain before being confirmed on the mainnet. This is the same approach competitors, including Arbitrum and OP Mainnet, adopted.

As of October 24, the most gas-consuming protocol already labeled and known to be deployed from a given developer is Friend.tech. Still, the developer remains anonymous.

The decentralized social media protocol allows users to buy and sell keys to each other’s X accounts. In this way, trading parties can access exclusive in-app chatrooms and content by a given user.

By deploying on Base, Friend.tech users enjoy lower trading fees than they would have launched on the mainnet. Beyond fees, the protocol can also scale since the layer-2 solution can handle higher throughput than the mainnet.

In the last month, Friend.tech generated over $253,000 in gas fees. The execution fee, often known as layer-2 fee, on Base, which uses Optimism, is set by the network and is flat.

The fee prevents users from spamming the network and rewards nodes that prove all transactions submitted on the platform. The other fee is the approximate for confirming the same transaction batch on the mainnet. This fee is generally higher than the execution fee.

While gas fees generated by Friend.tech is over $253,000, it is down over 47% in the last month. This could suggest that trading activity fell since the fee generated by a network is directly proportional to how frequently it is used.

Friend.tech fees, when writing, remain suppressed, underperforming the activity of unverified smart contracts, looking at fees generated over the last month. Over the previous 30 days, one unverified contract has seen a 104% increase in trading fees, reaching $42,000. Another contract has increased by 1,690%, exceeding $11,000 in the same period.

As the name suggests, these unverified codes have yet to be confirmed by a third party. This can mean there is no guarantee that the same developer built and deployed code on Base. At the same time, the code might contain malicious code that could steal from addresses it interacts with.

Stars Arena negotiated with the attacker over the course of four days, eventually recovering 90% of funds in exchange for an agreement not to prosecute.

The exploiter of the Web3 social media platform agreed to keep a 10% bounty in exchange for returning the remainder of the stolen funds.

Stars Arena, a decentralized social media platform built on the Avalanche network, has suffered a major security breach, resulting in the loss of a significant amount of cryptocurrency. This comes barely a day after the decentralized application (dApp) reportedly fixed a loophole in its smart contract.

On Thursday, October 5, the Stars Arena team said – via a post on X (formerly Twitter) – that it has averted a security exploit, which could have led to the loss of over $1 million worth of funds.

On Saturday, October 7, a pseudonymous X user raised the alarm about the suspicious movement of Avalanche (AVAX) tokens from the Stars Arena contract.

A few minutes after this, the protocol’s team confirmed – via a post on X – that there has been a “major security breach with its smart contract.”

There has been a major security breach with the smart contract.

We're actively checking the issue.

DO NOT deposit any funds.

Stay tuned for updates.

— Stars Arena (@starsarenacom) October 7, 2023

This exploit has also been flagged by blockchain security firm PeckShield, who disclosed that around $2.9 million in AVAX has been drained from the decentralized social media application.

An initial breakdown by the security company identified a reentrancy issue on the Stars Arena Shares contract. “The reentrancy is abused to update the weight when the share/ticket is issued so that 1 share can be sold at a much higher price of approximately 274,000 AVAX,” PeckShield said.

As earlier noted, Stars Arena has been gaining some popularity in the past few days. In fact, the recent activity uptick on the Avalanche network has been attributed to the rise of the decentralized social application.

However, this latest hack represents a significant deterrent to Stars Arena’s growth. According to data from DeFiLlama, the protocol’s total value locked has plummeted from $1.26 million to $0.47 in the past day, reflecting a 100% decline.

Stars Arena went live on Avalanche C-Chain – the blockchain component specifically designed for running smart contracts on Avalanche – in late September. Although the Friend.tech-like platform experienced some traction after launch, recent security concerns seem to be stirring skepticism around its growth.

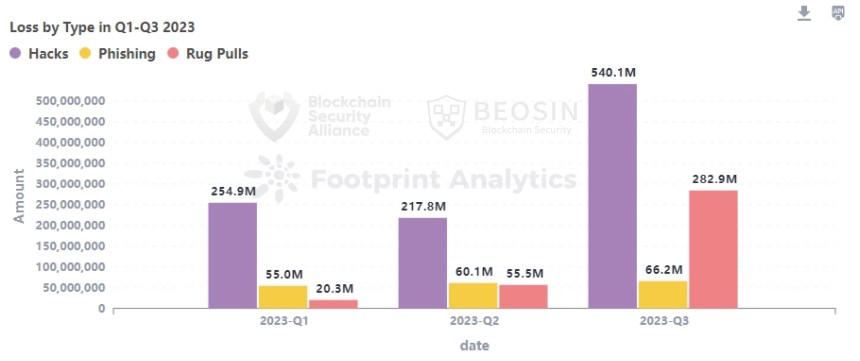

This latest exploit will serve as an unfriendly reminder of the growing security concerns in the crypto space. Particularly, the cryptocurrency industry saw a significant surge in exploits and security breaches in the third quarter of 2023.

According to a quarterly report by blockchain security firm Beosin, the losses incurred only in Q3 2023 were larger than the total for the year’s first half. A total of $889.26 million was lost to various attacks in the last quarter, compared to the $663 million lost in 2023’s first six months.

Beosin’s report revealed that $540.1 million was lost to hacks, with decentralized finance (DeFi) accounting for 18% of this value. Notably, DeFi peer-to-peer service Mixin Network lost $200 million due to a compromise in its cloud service provider database.

Stars Arena announced that attackers were draining funds through a loophole, but the contract has been patched to prevent further damage.

Leaked mobile phone numbers have given scammers an easy way to drain Friend.tech user accounts.

In a short period of time, four friend.tech users reported their accounts were compromised and drained after hackers seized control of their mobile numbers.

As per DeFi Llama data, Solana’s TVL has decreased by 9.64% over the past month to sit at $358.96 million, while Base’s TVL has surged to $397.32 million.

Base, the Coinbase-incubated Ethereum layer 2 (L2) network, has seen rising adoption since opening its door to the public barely a month ago. While the blockchain platform has gained significant traction, its pool of users and protocols has also witnessed substantial expansion.

In a testament to this rapid growth, Base recently registered its highest number of transactions in a single day.

According to data from IntoTheBlock, Base has seen its daily transactions soar to a new all-time high. The blockchain platform registered a total of 1.88 million transactions on Thursday, September 14.

Lucas Outumuro, head of research at IntoTheBlock, revealed that Base recorded more transactions than the sum of Arbitrum and Optimism transactions (780,000 and 370,000, respectively) on the same day.

The network fees is another metric that reflects the apparent surge in Base’s on-chain activity in recent days. Data from TokenTerminal showed that the blockchain generated more network fees than Arbitrum and Optimism.

Furthermore, Base notched its peak transaction throughput in the past week. According to L2beat, the network recorded a significant 21.29 transactions per second (TPS) on Thursday, September 14.

This figure placed Base above other L2 chains and Ethereum in terms of transaction throughput. Nevertheless, the network remains in the top spot, with a current TPS of 19.58.

These feats underscore the positive performance of the Coinbase-incubated network in the past few weeks. Base has managed to stake a strong claim for a place amongst the top L2 blockchains, as demonstrated by its surging on-chain activity.

However, it is worth noting that Base still lags behind Arbitrum and Optimism regarding total value locked (TVL). According to DefiLlama, Base has a TVL of nearly $373 million, while Arbitrum and Optimism boast roughly $1.7 billion and $650 million, respectively.

The latest surge in on-chain activity on the Base network has been linked primarily to the renewed hype of the decentralized social network, Friend.tech.

IntoTheBlock made this connection in a report, saying, “Interestingly, it is not DeFi applications nor NFT marketplaces driving the surge in Base’s activity. Instead, a significant portion of usage can be attributed to a new social application, FriendTech.”

Friend.tech is a decentralized social media platform built on Base. It allows users to trade “keys” of X (formerly Twitter) accounts and interact with social media personalities in a closed, group chat format.

The Friend.tech platform, once pronounced dead by critics, sprung back to life in the past week. The decentralized application seems to be enjoying renewed user interest, with its TVL surpassing $30 million in the last few days.

Friend.tech has been experiencing an uptick in activity, shattering its trading volume record two days in a row. Meanwhile, the platform has seen an increase in capture fees, which reached an all-time high of about $2 million on September 14.

3LAU noted that there risks were necessarily high, but that he has a “responsibility” to avoid any regulatory gray areas.

Friend.tech, a decentralized social network, has witnessed a sharp resurgence barely two weeks after critics pronounced the platform dead. The platform is enjoying renewed user interest, with its total value locked (TVL) surpassing $20 million a few days ago.

Thanks to this growing momentum, Friend.tech has seen its trading volume and platform fees rise to new peaks.

Decentralized application (dApp) Friend.tech has witnessed significant activity in the past few days. This has been reflected in the social media platform’s daily active users, which grew to nearly 16,000 on Wednesday, September 13.

As a result of this upward trend, Friend.tech also reached its highest trading volume of $18.51 million on Wednesday, according to Dune Analytics data. The platform recorded $1.9 million in capture fees, representing another all-time high on the same day.

Dune data dashboard revealed that fees on Friend.tech accounted for more than 35% of the gas cost on the Base blockchain on September 13.

Moreover, the population of traders on the decentralized application experienced a significant increase, with unique buyers surpassing 155,000. Meanwhile, the number of unique sellers climbed above 75,000 on Wednesday.

As of this writing, Friend.tech has a total value locked of nearly $34 million, according to DefiLlama. This figure represents an almost 30% rise in the past 24 hours.

Friend.tech went live on Coinbase’s Ethereum layer-2 network, Base, in August. The decentralized application allows users to trade “keys” of X (formerly Twitter) accounts and interact with social media personalities in a closed, group chat format.

Following its launch, Friend.tech gained prominence within a short span. However, activity on the platform slumped abruptly before the end of August, with its trading volume nosediving by 94% at some point.

Fortunately, Friend.tech appears to have recovered from the decline. Although there is no evident catalyst for the platform’s latest activity surge, various theories have emerged from different angles of the crypto community.

Notably, a recent TokenTerminal report proposed that several factors may be responsible for Friend.tech’s growth. Specifically, the blockchain analytics site highlighted that Friend.tech has no direct competitor, with X (a Web2 application) being its closest rival.

Additionally, the report pointed to the social media platform’s strategic takeoff, which coincided with the public mainnet launch of Base. TokenTerminal suggested that the timing of Friend.tech’s launch was to maximize activity on both the dApp and blockchain.

Another possible reason for the latest resurgence was explained by popular crypto trader Hsaka. According to the trader’s post on X, the platform’s total value locked soared since users discovered they could receive rewards for depositing crypto assets.

User activity on friend.tech has witnessed a major resurgence after briefly fizzling last week.

Decentralized social networks have always faced significant challenges to gain mainstream adoption. Such is the apparent case of Friend.tech, a new decentralized app that enjoyed explosive growth earlier this month.

Just barely two weeks after its launch, Friend.tech saw its trading fees grow to rival top cryptocurrencies like Bitcoin and Tron. However, the euphoria is starting to subside, as activity and trading fees on the social media app have crashed by 94%.

Friend.tech’s model had raised concerns from some crypto investors, with some arguing about its long-term viability. Their criticism has been proven to be accurate as the situation at Friend.tech has started to deteriorate.

Friend.tech allows users to buy and sell shares of influential accounts and social media profiles, and the platform reportedly registered over 35,000 and 4,400 ETH ($8.1 million) in trading volume in its first 24 hours.

However, data from Dune Analytics show that trading volume has fallen since then, with less than $200,000 in fees generated in the past 24 hours. Trading activity has also been down from over 35,000 to less than 6,000 users. This has been reflected in trading costs, as revenue has decreased by more than 94% since the exchange first opened its doors.

Friendtech buyers and sellers tanking to 0

GG Friendtech? pic.twitter.com/jmXKu41KDd

— Boxmining (@boxmining) August 28, 2023

Friend.tech’s business model relied heavily on charging users a 10% fee for every buy and sell of shares. Friend.tech surpassed Bitcoin in terms of trading fees, recording almost $1.4 million in revenue during the height of the platform’s trading activity. However, data from DeFiLlama shows that trading fees are now at $160,000 in the past 24 hours.

Friend tech is dead because of greed and poor execution. We can see that after the initial influencer pump volume has fallen off a cliff. Let’s dig into how this failure came to be

pic.twitter.com/WDQncTQJ21

— Lisandro (@TheRealLisandro) August 27, 2023

Friend.tech also incorporates Maximal Extractable Value (MEV) bots, which are automated trading bots designed to exploit rapid price movements. Although these bots have generated over $2 million in profits, they have been credited with discouraging content creators and users.

Decentralized social media have been touted to be the future of the internet. However, platforms have been faced with many challenges and have struggled to gain a firm footing in the market. One of the challenges is the expansion of the user base. Overcoming these challenges will be key to disrupting the status quo and achieving the promise of decentralized social media.

At the time of writing, Friend.tech has a TVL of $6.4 million and has generated fees of over $7.8 million to date. But while Friend.tech is still operating, critics have likened its imminent failure to the fall of BitClout, another decentralized social media app.