In a significant development, defunct cryptocurrency exchange FTX has unveiled a reorganization plan to reimburse almost all of its customers.

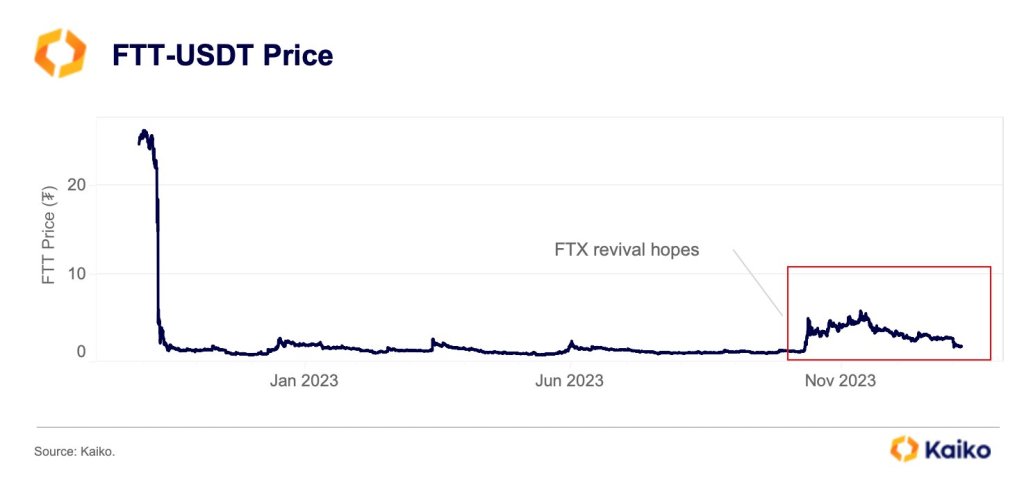

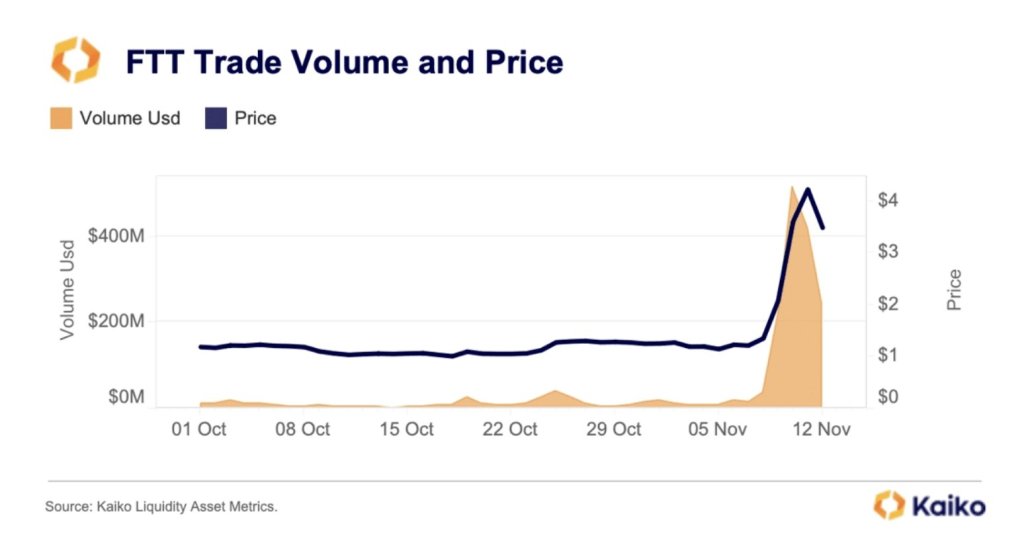

The announcement has sparked a substantial surge in the exchange’s native token, FTT, which recorded an uptrend of 52% over the past seven days, reaching a monthly high of $2.29 during Wednesday’s early trading session.

FTX Unveils Debt Repayment Strategy

FTX estimates its outstanding debts to creditors to be approximately $11.2 billion, as revealed in the reorganization plan published late Tuesday. The company has disclosed that it possesses between $14.5 billion and $16.3 billion, which it intends to distribute among the creditors.

Under the proposed plan, customers with $50,000 or less claims will receive approximately 118% of the allowed claim amount. This compensation is slated to be disbursed to around 98% of the creditors, relieving FTX customers who have experienced locked funds since the exchange filed for bankruptcy protection in November 2022.

FTX stated in a press release on Wednesday that the company could not utilize the appreciation of the missing tokens during the Chapter 11 cases. Instead, FTX had to identify other recoverable sources of value to repay creditors.

Following the departure of founder Sam Bankman-Fried, FTX appointed John Ray III as CEO. Ray, speaking on the matter in November 2022, expressed his astonishment at the “complete failure of corporate controls and such a complete absence of trustworthy financial information” witnessed at FTX. Ray further stated in the press release on Wednesday:

We are pleased to be in a position to propose a Chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors.

FTX’s founder, Sam Bankman-Fried, faced legal consequences, being convicted on seven criminal counts, including charges related to embezzling billions of dollars from FTX’s customers. Bankman-Fried was subsequently sentenced to 25 years in prison.

FTT Bulls Eyeing $2.55 For Potential Breakout Continuation

As of the latest update, the price of FTT has corrected to $2.050 after reaching its monthly high. This breakout occurred after consolidation between the $1.17 and $1.48 levels.

At the current price level, FTT faces a significant resistance at $2.169, which has led to the ongoing correction. If FTT sustains its bullish momentum, the next resistance level to watch is $2.55 in the token’s daily chart.

A successful breakthrough of this level could potentially lead to a retest of the $3 mark, which has not been revisited since January.

On the other hand, if the price experiences a further correction, FTT bulls should closely monitor the $1.95 and $1.765 levels, as they serve as crucial support levels. It is essential to prevent a loss of the gains achieved over the past month, which amounts to an 18% increase during this period.

Featured image from Shutterstock, chart from TradingView.com