The U.S. Securities and Exchange Commission has opened the window for comments on three ether spot exchange traded fund (ETF) proposals.

Bitcoin Final Dance: Analyst Eyes Final Peak Ahead Of Halving

Once again, there is hope for Bitcoin (BTC) as Michael Van De Poppe, a cryptocurrency expert, has spotlighted the potential for the crypto asset’s price to reach a new all-time high before the highly anticipated Halving event commences.

One Final All-Time High For Bitcoin Before Halving

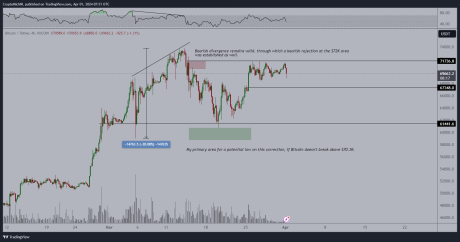

The price of Bitcoin is presently exhibiting new bearish activity, which might trigger negative sentiments in the market over the next few days. Despite the notable decline, Michael Van De Poppe is optimistic that BTC will attain a new height prior to Bitcoin Halving expected to occur this month’s end.

According to the analyst, the digital asset is currently in a consolidation zone. He further identified two distinct crucial levels within the lower timeframes such as the $67,000 threshold as a support level and the $71,700 mark as a final break out towards the peak.

It is worth noting that Michael Van De Poppe previously forecasted that Tuesday is probably when the real moves are expected to begin as Bitcoin consolidates. Thus, if the coin holds the $67,000 level, he will propose a one-last peak test ahead of the halving.

Poppe seems to be confident about his prediction now as he asserts that if one of the two aforementioned crucial levels develops, it will determine the direction of Bitcoin. Due to this, he believes BTC will experience one final pre-halving all-time high.

The post read:

Bitcoin is calmly consolidating. Crucial levels (lower timeframes): $67,000 to hold for support, $71,700 for a final breakout towards the ATH. If either of the two happens, probably direction is chosen. I think we will have one final ATH test before halving happens.

Following the recent decline, Poppe has issued a warning to the crypto community on how to interact with the price action. “You do not want to chase those massive green candles,” he stated.

He advocates entering the market when BTC‘s price is down by 15% to 40%. Additionally, he addressed those considering investing in altcoins, urging them to invest when altcoins are down by 25% to 60%.

Possible Triggers For The Correction

As of press time, Bitcoin’s price is trading at $65,843, demonstrating a decline of over 5% in the daily timeframe. Its trading volume has seen a significant uptick of 66% in the past day, while its market cap has decreased by 5%.

Since its peak of $73,000, achieved in early March, the price of Bitcoin has dropped by nearly 10%. One factor considered to have contributed to the retracement was the influx of funds into US Spot Bitcoin Exchange-Traded funds (ETFs), which has since started to calm down gradually.

Data from Wu Blockchain revealed that the products saw an overall net outflow of $85.84 million on Monday. BlackRock ETF IBIT recorded a net inflow of $165 million, while Grayscale ETF GBTC experienced a single-day net outflow of $302 million. Presently, the historical cumulative net inflow for the BTC spot ETFs is pegged at $12.04 billion.

Beyond Bitcoin ETFs: ‘There Are Other Players Controlling This Market’ – Says Analyst

Recent observations by Eric Balchunas, a senior ETF analyst at Bloomberg, suggest that the movements in Bitcoin’s price are influenced by factors beyond just the flows of spot Bitcoin Exchange Traded Funds (ETFs).

According to Balchunas, who shared his insights on X, “bigger forces at work” shape the largest cryptocurrency’s valuation. This indicates that the correlation between spot ETF flows and Bitcoin’s price action is less direct than some assume.

The ETF Influence And Market Movements

This analysis emerges amid a period of significant financial activity for Grayscale, which has seen substantial outflows, described by Balchunas as experiencing a “second wind” of departures.

Yesterday, Grayscale reported outflows of $281.57 million, marking a notable decrease in its Bitcoin holdings by more than 40% since the inception of spot Bitcoin ETFs on January 11.

This scenario highlights a broader narrative within the cryptocurrency investment sphere, where the relationship between ETF activities and Bitcoin’s market performance is complex and multifaceted.

Interesting is price of bitcoin still went up yesterday and yet it went down second half of last week when Ten saw net inflows = there are other players controlling this market. ETFs def a factor but bigger forces at work here.

— Eric Balchunas (@EricBalchunas) March 21, 2024

Despite the record outflows from Grayscale’s GBTC, Bitcoin’s market behavior has shown resilience. The cryptocurrency recently exceeded the $67,000 mark before experiencing a slight retracement, currently trading at a price of $66,106.

This movement coincides with comments from Federal Reserve Chair Jerome Powell, which seemingly spurred a rally across various risk assets, including cryptocurrencies.

Powell’s reassurances regarding the outlook on rate cuts prompted a slight recovery in Bitcoin’s price, demonstrating how external economic factors and sentiments can impact cryptocurrency markets. It is worth noting that Bitcoin traded below $65,000 before the announcement.

On-Chain Insights And Bitcoin Future Prospects

Further deepening the analysis, Charles Edwards, a crypto analyst, recently suggested that pullbacks are common in Bitcoin’s bull runs, with corrections of around 30% within the realm of possibility.

A normal Bitcoin bullrun pullback is 30%. Back in December, we were already in the longest winning streak in Bitcoin’s history. A 20% pullback here takes us to $59K. A 30% pullback would be $51K. These are all levels we should be comfortable expecting as possibilities.

— Charles Edwards (@caprioleio) March 19, 2024

In related news, data from the on-chain analysis platform CryptoQuant has recently indicated a nearly 40% reduction in Bitcoin’s supply on exchanges over the past four years.

This trend points towards a bullish sentiment within the Bitcoin ecosystem, suggesting that investors are inclined to hold onto their assets in anticipation of future value increases.

Moreover, CryptoQuant’s data reveals that Bitcoin’s demand has consistently outstripped its supply since 2020, a trend that supports the asset’s value on the premise that scarcity enhances perceived value.

This dynamic is expected to intensify following the upcoming Bitcoin halving event, which will reduce the miners’ supply by half, potentially leading to further increases in Bitcoin’s price.

Featured image from Unsplash, Chart from TradingView

Grayscale CEO Believes Bitcoin ETF Fees Will Drop Over Time: CNBC

GBTC has seen $12 billion in outflows since due in part to its high fees compared to its competitors.

Grayscale Submits Revised Application For Ethereum Spot ETF – What’s New?

Asset management firm Grayscale Investments has updated its application for an Ethereum spot ETF (exchange-traded fund) with the United States Securities and Exchange Commission (SEC).

Ethereum Spot ETF Case Just As Solid As Bitcoin’s, Grayscale Argues

According to a recent post on X by Craig Salm, Grayscale’s chief legal officer, the asset management firm has revised its 19b-4 form for an Ether spot ETF. Salm claimed that this move was “important” in an effort for Grayscale to list and trade shares of its Ether Trust on the New York Stock Exchange (NYSE) Arca.

The chief legal officer stated in his post that investors “want and deserve access” to Ethereum via a spot exchange-traded product, likening the situation to the Bitcoin ETF story. “We believe the case is just as strong as it was for spot Bitcoin ETFs,” Salm said.

The asset manager is amongst the numerous firms looking to issue the first Ethereum spot ETF in the United States, having filed an application with the SEC on October 10, 2023. However, these ETF applications have faced delays multiple times, with the most recent coming against BlackRock’s filing on March 4, 2024.

As a result, the likelihood of the SEC approving an Ethereum spot ETF has taken a nosedive in recent weeks. Once-optimistic Bloomberg ETF expert Balchunas even revealed in his latest analysis that the ETH funds now have only a 35% chance of approval.

SEC Chairman Faces Pressure Over Crypto Approval

Two US senators of the Democrat party, Sens. Laphonza Butler of California and Jack Reed of Rhode Island, have urged the SEC chairman to avoid approving crypto investment products. In a letter dated March 11, the lawmakers, who are also members of the Senate Banking Committee, asked the Commission to limit future crypto ETF applications.

The success of the BTC spot products clearly ruffling some feathers on the Hill. @SenatorJackReed and @Senlaphonza write to the @SECGov urging:-no further ETPs for other tokens-make life difficult (i.e. examinations/reviews) for brokers and advisers that recommend BTC ETPs pic.twitter.com/enxdumC02N

— Alexander Grieve (@AlexanderGrieve) March 14, 2024

Following the approval of 11 Bitcoin spot ETFs in January, the attention of the crypto public has somewhat turned to whether the SEC will do the same for the Ethereum versions. However, this latest letter from the senate seems to further hurt the chances of an ETH ETF approval.

A part of the letter read:

Retail investors would face enormous risks from ETPs referencing thinly traded cryptocurrencies or cryptocurrencies whose prices are especially susceptible to pump-and-dump or other fraudulent schemes,” they said. “The Commission is under no obligation to approve such products, and given the risk, it should not do so.

As of this writing, the price of the Ethereum token stands at $3,731, reflecting a 1.2% increase in the past day.

Bitcoin ETFs See Record $1 Billion Inflows, Pushing Price Over $73,500

Yesterday, the Bitcoin price journey resembled a high-intensity rollercoaster ride, initially soaring past the $73,000 mark before encountering a tumultuous liquidation event. This event saw over $361 million worth of leveraged trades unwound, compelling the BTC price to retract sharply to below $68,300.

The drastic price fluctuation primarily affected long position holders—investors who speculated on a continued price rise—with a staggering $258 million wiped out. Subsequently, Bitcoin’s price staged a remarkable V-shaped recovery, during which short sellers found themselves on the losing end, with just over $103 million in positions liquidated.

This data by Coinglass marks the event as the most significant purge of long positions since March 5. At that time, Bitcoin experienced a decline to $60,800 following its climb to a then all-time high of approximately $69,000.

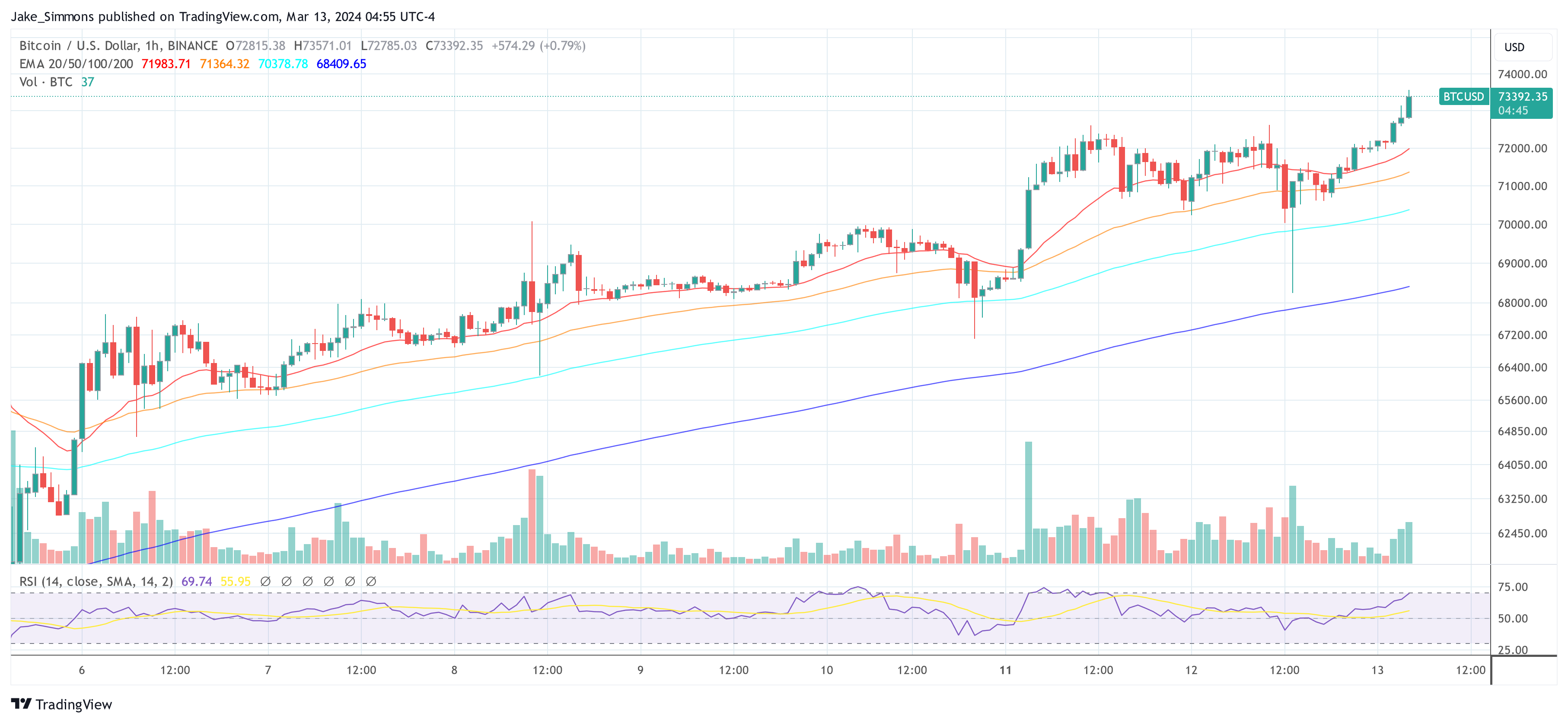

Bitcoin ETFs Register Record $1 Billion Inflows

Perhaps spurred by the opportunity presented by the price dip, investors in spot Bitcoin Exchange-Traded Funds (ETFs) engaged in a buying spree, unprecedented in its intensity. For the first time, spot Bitcoin ETFs witnessed a daily inflow surpassing $1 billion on Tuesday, March 12, primarily driven by an inflow of $849 million to BlackRock’s IBIT. According to detailed data released by Farside Investors, the total net inflows across all Bitcoin ETFs were at $1045 million (or $1.045 billion).

The second largest Bitcoin ETF to date, Fidelity, saw a rather quiet day with FBTC taking in only $51.6 million, while Ark Invest ($93 million), Bitwise ($24.6 million), Valkyrie ($39.6 million) and VanEck ($82.9 million) saw relatively strong capital inflows. Notably, Grayscale‘s GBTC saw a waning outflow of just $79 million.

Bitcoin analyst Alessandro Ottaviani shared his insights on X, underscoring the magnitude of these inflows, “1 Billy of Total net Inflow! ONE BILLION DOLLARS! […] In the last twelve trading days, The Nine inflow has been $9.2b, with an average of $768m per day. Just imagine if we keep this pace and it is confirmed that GBCT outflow is almost exhausted.”

Crypto Quant analyst Maartunn provided additional context to the inflow’s impact, revealing, “JUST IN: The Bitcoin Exchange-Traded Fund (ETF) has experienced its highest inflows ever, with an additional 14,706.2 BTC.” This statement further emphasizes the substantial increase in Bitcoin’s demand, potentially setting it up for a major supply squeeze.

JUST IN: The Bitcoin Exchange-Traded Fund (ETF) has experienced its highest inflows ever, with an additional 14,706.2 BTC. https://t.co/xg7wADbRzy pic.twitter.com/IUAyt1jzGE

— Maartunn (@JA_Maartun) March 13, 2024

Adding to the conversation, crypto analyst @venturefounder suggested potential future price movements based on the current trend, “Absolute Bitcoin madness […] The 5-day moving average net inflow has fully recovered to peak. So… probably HIGHER. If this continues, $80-90k by the end of month is not far fetched. No correction has lasted longer than 24 hours on the weekdays. Interestingly, the first major correction of the 2021 cycle came when price went 2x previous ATH. So could we see no major correction until $120k?”

At press time, BTC already surpassed the $73,500 mark and traded at $73,392.

Grayscale Plans Low-Fee GBTC Spinoff: the Bitcoin Mini Trust

Bitcoin ETF manager Grayscale is seeking permission from the SEC to spin out a percentage of GBTC shares to seed the new Bitcoin Mini Trust product, according to a filing on Tuesday.

Bitcoin ETF Giant Grayscale Introduces a Crypto Staking Fund

The Grayscale Dynamic Income Fund initially includes APT, TIA, CBETH, ATOM, NEAR, OSMO, DOT, SEI and SOL.

Grayscale GBTC Selling Accelerates but Bitcoin ETF Inflows Remain Positive, Led by BlackRock

Outflows from Grayscale’s bitcoin fund GBTC spiked Thursday, but inflows into U.S.-listed spot bitcoin ETFs remained positive, led by another strong day for BlackRock’s ETF.

800,000 ETH Flow Out Of Centralized Exchanges In 2024 – Bullish Sign For Ethereum Price?

The price of Ethereum has been a joy to watch since the start of 2024, climbing by more than 30% in less than two months. The latest on-chain revelation suggests that ETH investors are approaching the market with more confidence, as the cryptocurrency’s price rally seems to be far from over.

$2.4 Billion Worth Of ETH Leaves Exchanges: CryptoQuant

A pseudonymous analyst on CryptoQuant’s Quicktake revealed that significant amounts of the Ethereum token have been making their way out of exchanges in the last few weeks. This observation is based on the “Exchange Reserve” metric, which tracks the amount of ETH tokens in the wallets of all centralized exchanges.

When the value of this metric increases, it implies that investors are making more deposits than withdrawals of an asset (Ether, in this case) into centralized exchanges. Meanwhile, the metric’s decline means that more assets are flowing out than entering these platforms.

According to data from CryptoQuant, more than 800,000 ETH (equivalent to approximately $2.4 billion) has flowed out of cryptocurrency exchanges since the turn of the year. Typically, the movement of significant amounts of cryptocurrencies out of these platforms suggests a rise in investor confidence.

As the CryptoQuant Quicktake author noted, this reduction in Ether’s exchange reserve balance could be a bullish catalyst for the altcoin’s price. A sustained decline in the ETH’s supply on exchanges could trigger a supply crunch, potentially driving the Ethereum price higher.

As of this writing, the Ethereum price stands at around $2,920, reflecting a 1.8% decline in the past day. Nevertheless, the “king of altcoins” is still in the green on the weekly timeframe, with an almost 5% price jump over the last week.

Ethereum Price Rise Due To Anticipation Of Dencun Upgrade: Grayscale

In a recent report, Grayscale has offered commentary on Ethereum’s positive price performance so far in 2024. The asset management firm tied ETH’s bullish trajectory to the upcoming Dencun upgrade of the Ethereum network.

William Ogden Moore, Grayscale’s research analyst, wrote in the report:

We believe that recent price performance reflects the market’s anticipation of this upgrade, as Ethereum (up 26% YTD) has outperformed the broader Smart Contract Platforms Sector (up 3% YTD) since January 1st, 2024.

The Dencun upgrade, which is less than a month away, will aim to enhance Ethereum in terms of scalability and cost-effectiveness. It is also expected to help the network compete with “faster chains in the Smart Contract Platforms Crypto Sector, such as Solana.”

Another narrative that may be propelling the price of ETH is the approval of Ethereum spot exchange-traded funds (ETFs) in the United States. Interestingly, Grayscale is amongst the asset managers looking to debut an Ether spot ETF.

Bitcoin Hits $52,000 High: Are These Giant Sell-Offs About To Crash The Crypto Party?

According to a recent report from Spot On Chain, Bitcoin might be on the edge of a notable plunge. So far, the flagship cryptocurrency has recently broken through the $52,000 mark and traded above it for the first time since December 2021.

However, Spot On Chain reveals that Bitcoin faces potential challenges that could affect its immediate market performance. Two significant sell-off events loom on the horizon, potentially influencing Bitcoin’s price dynamics in the short term.

These developments have sparked speculation, prompting a closer examination of their possible impacts on the cryptocurrency market.

Major Bitcoin Sell-Off Events On The Horizon

The first of these events involves Genesis, a prominent crypto asset manager authorized to offload a significant portion of its Grayscale Bitcoin Trust (GBTC) shares. The second event is marked by the US government’s announcement to sell some of its Bitcoin holdings acquired from the Silk Road platform.

Genesis has received approval to sell 35 million GBTC shares, estimated to be worth around $1.3 billion. This occurrence mirrors an earlier liquidation event involving FTX, which notably impacted Bitcoin’s market price, illustrating the potential volatility such moves can introduce.

It is worth noting that the upcoming Genesis sell-off represents a significant moment for Bitcoin, as it tests the resilience of its recent price gains against the backdrop of large-scale disposals.

The #Bitcoin price has been on the rise for the past 7 days and finally broke the $52K mark again after 2 years!

However, there are two impending big threats to the short-term $BTC price. Can it overcome?

1. #Genesis was approved to sell 35M Grayscale Bitcoin Trust shares… pic.twitter.com/Qn7wbQXaDa

— Spot On Chain (@spotonchain) February 15, 2024

The US government’s decision to auction off 2,875 BTC, valued at $150.6 million, adds to the market’s cautious outlook. With the government holding one of the largest Bitcoin reserves globally, its actions have a marked influence on market perceptions and the cryptocurrency’s price stability.

Spot On Chain highlighted historical instances, such as the sale of 8.2K BTC through Coinbase, which have shown that government sell-offs can temporarily lead to fluctuations in Bitcoin’s price.

Optimism Amid Uncertainty

Despite these concerns, certain segments of the crypto community view these events as minor hurdles in the broader trajectory of Bitcoin’s growth.

Non event… ETFs buying in 300-500m a day lol

— Cryptamurai

I County Capital (@cryptamurai) February 15, 2024

Notably, the increasing involvement of Bitcoin spot exchange-traded funds (ETFs) in the Bitcoin market suggests a growing institutional interest that could offset the effects of the sell-offs.

CryptoQuant has recently highlighted that roughly 75% of new investments into Bitcoin are coming from spot ETFs. This is quite evident as BitMex research reported that the Bitcoin spot ETF market saw an inflow of over $340 million yesterday.

Bitcoin Spot ETF Flow – 14th Feb 2024

All data in. Another strong day, with +$340m net flow for all the Bitcoin ETFs pic.twitter.com/xy7t1hGhyw

— BitMEX Research (@BitMEXResearch) February 15, 2024

Featured image from Unsplash, Chart from TradingView

Bitcoin ETF Surges: Last 4 Days Inflows Outpace Initial Weeks

Bitcoin (BTC) Spot Exchange-Traded Funds (ETFs) are currently in the limelight as the products have seen massive net inflows in the past few days than in the initial weeks of introduction, dominating the market of crypto investment products.

Bitcoin ETF Inflows Surges In The Last 4 Days

Thomas Fahrer, the co-founder of Bitcoin tracking platform Apollo, took to the social media platform X (formerly Twitter) to share the development with the community. Fahrer pointed out that BTC spot ETFs are presently experiencing a “total acceleration” of inflows.

Meanwhile, the products in the past 4 days have witnessed an inflow of 43,000 BTC tokens valued at $2.3 billion. This latest surge in inflows suggests renewed adoption of the products from crypto players and investors.

Data from Apollo reveals that Grayscale is the leading firm in Assets Under Management (AUM). Registered as Grayscale Bitcoin Trust (GBTC), the company boasts a whopping $23.7 billion AUM.

However, this is a notable drop from $28 billion in assets it had on January 11, after transitioning to an ETF. This is due to the daily net outflows the fund has seen since it was approved by the US Securities and Exchange Commission (SEC).

Blackrock comes in second after Grayscale, with an asset under management of over $5 billion since it started trading. It is followed by Wise Origin Bitcoin Trust (FBTC) and Ark/21Shares Bitcoin Trust (ARKB), which come in third and fourth place, respectively.

Investment firm Bitwise’s Bitcoin ETF (BITB) is the latest company to reach the billion-dollar milestone. As of the press, the company’s BTC ETF is the fifth largest behind the aforementioned asset management companies.

Blackrock Records Its Largest Inflow

On Tuesday, Blackrock recorded its largest inflow day ever since Bitcoin ET products were approved. A senior Bloomberg Intelligence analyst, Eric Balchunas, revealed information regarding the update on X.

He stated that Blackrock’s BTC ETF was booming on Tuesday, seeing almost “half a billion” inflow. According to the data shared by Balchunas, IBIT made $493 million in revenue during the trading day.

IBIT’s previous largest daily net inflow was $386 million, recorded on the second trading day of January 12. Consequently, Blackrock’s Bitcoin ETF overall inflow exceeded the $5 billion mark after the Tuesday event. So far, of all ETFs, Blackrock’s IBIT leads by “7% by size in just 23 days of trading.”

These developments came in light of the recent rally around Bitcoin in the past few days, which took BTC’s price above $ 50,000. Many market enthusiasts believe that a major factor in the rally is the reason surrounding the BTC ETF flows.

Ethereum ETF: Franklin Templeton Enters The Fray As ETH Rallies

Wall Street titan and Asset manager Franklin Templeton has applied for an Ethereum Spot Exchange-Traded Funds (ETF) after a struggle to gain approval for their Bitcoin Spot ETF in early January.

Asset Manager Files For Spot Ethereum ETF

Asset managers have gravitated toward the Ethereum spot ETF since the United States Securities and Exchange Commission (SEC) approved the Spot Bitcoin ETF. Franklin Templeton is the latest manager to apply with the SEC to get approval for this financial product.

The asset manager’s move came after successfully introducing the BTC spot ETFs. This is a notable step toward making more crypto investment products accessible to institutional and individual investors.

James Seyffart, a senior analyst from Bloomberg Intelligence, also shared the update with the crypto community on X (formerly Twitter). Seyffart’s X post included a screenshot of the asset manager’s filing and data regarding other applicants.

According to the post, Franklin Templeton is the eighth company in the cryptocurrency market to file for product approval. Previous asset managers to file applications for Ethereum ETFs include Hashdex, BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco, and Galaxy.

Per the official filing, a Delaware statutory trust is how the Franklin Ethereum Trust is set up. The ETF aims to give investors access to ETH in a regulated manner by allowing them to store it directly through a custodian.

It states in the company’s S-1 filing that the proposed “Franklin Ethereum Trust” will hold ETH and “may, from time to time, stake a portion of the fund’s assets through one of the more trusted staking providers.”

Staking is the act of locking up digital currency to maintain the operations of a blockchain network. They plan to stake some of the ETF’s ETH holdings to supplement its income through staking rewards.

The Price Of ETH Rallies Amidst The Update

Franklin Templeton’s spot Ethereum ETF application was made in light of the price of ETH experiencing an uptick. However, no solid proof exists that the latest development impacted the price of crypto assets.

Related Reading: Ethereum ETFs Approval Date Set For May 23, Forecasts Suggest ETH Could Reach $4,000

Ethereum was trading at $2,661 as of press time, indicating an increase of over 7% in the past 24 hours. Data from CoinMarketCap shows that its market capitalization is also on the upside, marking an increase of over 7%.

Meanwhile, its trading volume has increased significantly by over 172% in the past day. Due to the rise, ETH now ranks third in the entire crypto market by trading volume.

Grayscale Claims ‘Next Bitcoin Halving Is Different’: What’s Changed?

In Grayscale’s latest report, “2024 Halving: This Time It’s Actually Different,” Michael Zhao, provides an in-depth analysis of the evolving dynamics within the Bitcoin ecosystem as the next halving event approaches in mid-April 2024. The report argues for a significant departure from previous cycles, underlined by the advent of spot Bitcoin ETFs in the United States, evolving investment flows, and innovative use cases emerging within the Bitcoin network.

The Essence Of Bitcoin Halvings

Halvings, designed to halve the reward for mining Bitcoin transactions every four years, are pivotal in maintaining Bitcoin’s scarcity and disinflationary profile. Zhao articulates, “This disinflationary characteristic stands as a fundamental appeal for many Bitcoin holders,” emphasizing the stark contrast with the unpredictable supplies of fiat currencies and precious metals.

Despite historical price surges post-halving, Zhao cautions against assuming such outcomes as guarantees, stating, “Given the highly anticipated nature of these events, if a price surge were a certainty, rational investors would likely buy in advance, driving up the price before the halving occurs.”

Distinguishing Factors Of The 2024 Halving

Macroeconomic Factors

According to Zhao, macroeconomic factors have differed in each cycle, however, always propelling the BTC price to new heights. The researcher describes the European debt crisis in 2012 as a significant catalyst for Bitcoin’s rise from $12 to $1,100, highlighting its potential as an alternative store of value amidst economic turmoil,

“Similarly, the Initial Coin Offering boom in 2016—which funneled over $5.6 billion into altcoins—indirectly benefited Bitcoin as well, pushing its price from $650 to $20k by December 2017. Most notably, during the 2020 COVID-19 pandemic, expansive stimulus measures […] [drove] investors towards Bitcoin as a hedge, which saw its price escalate from $8,600 to $68k by November 2021,” Zhao states.

Thus, Zhao suggests that while the halvings contribute to Bitcoin’s scarcity narrative, the broader economic context is also always critically impacting Bitcoin’s price.

Miners’ Strategic Adjustments

Anticipating the next BTC halving in April, miners have proactively adjusted their strategies to counterbalance the impending reduction in block reward income amidst escalating mining difficulties. Zhao observes a strategic move among miners, noting, “There was a noticeable trend of miners selling their Bitcoin holdings onchain in Q4 2023, presumably building liquidity ahead of the reduction in block rewards.

This foresight suggests miners are not merely reacting but are actively preparing to navigate the challenges ahead, ensuring the network’s resilience. “These measures collectively suggest that Bitcoin miners are well-positioned to navigate the upcoming challenges, at least in the short term,” the Grayscale researcher argues.

The Emergence Of Ordinals And Layer 2 Solutions

The introduction of Ordinal Inscriptions and the exploration of Layer 2 solutions have introduced new dimensions to Bitcoin’s functionality and scalability. Zhao emphasizes the significance of these innovations, stating, “Digital collectibles…have been inscribed, generating more than $200 million in transaction fees for miners.” This development has not only augmented Bitcoin’s utility but also provided miners with new avenues for revenue generation.

Furthermore, Zhao highlights the potential of Layer 2 solutions to address Bitcoin’s scalability challenges, pointing out, “The growing interest in Taproot-enabled wallets…indicates a collective move toward addressing these challenges.” This reflects a concerted effort within the Bitcoin community to enhance the network’s capabilities and accommodate a broader range of applications.

The Role Of ETF Flows

The approval and subsequent introduction of spot Bitcoin ETFs have significantly influenced Bitcoin’s market structure, facilitating wider access for investors and potentially mitigating sell pressure from mining rewards. Zhao articulates the impact of ETF flows, asserting, “Following US spot Bitcoin ETF approvals, the initial net flows…amounted to approximately $1.5 billion in just the first 15 trading days.”

This suggests that ETFs could play a crucial role in balancing the market dynamics post-halving by absorbing a significant portion of the typical sell pressure post-Halving. “In order to maintain current prices, a corresponding buy pressure of $14 billion annually is needed. Post-halving, these requirements will decrease by half: […] that equates to a decrease to $7 billion annually, effectively easing the sell pressure.”

A Promising Outlook for Bitcoin

According to Grayscale’s analysis, the next Bitcoin halving will be different for a number of reasons. Overall, the outlook is highly bullish:

Bitcoin has not only weathered the storm of the bear market but has also emerged stronger, challenging outdated perceptions with its evolution in the past year. While it has long been heralded as digital gold, recent developments suggest that Bitcoin is evolving into something even more significant.

At press time, BTC traded at $49,708.

Blackrock, Fidelity Bitcoin ETFs Have a Liquidity Edge Over Grayscale: JPMorgan

GBTC is expected to lose further funds to newly created ETFs unless there is a meaningful cut to its fees, the report said.

Genesis Seeks Approval to Sell $1.6B in Bitcoin, Ether Trust Holdings

Nearly $1.4 billion of Genesis’ assets were held in Grayscale Bitcoin Trust (GBTC), which has since converted to a spot exchange-traded fund (ETF).

BlackRock and ProShares’ Bitcoin ETFs Surpassed GBTC’s Daily Volumes

GBTC has led bitcoin ETF volumes, mostly in outflows, since the products started trading in early January.

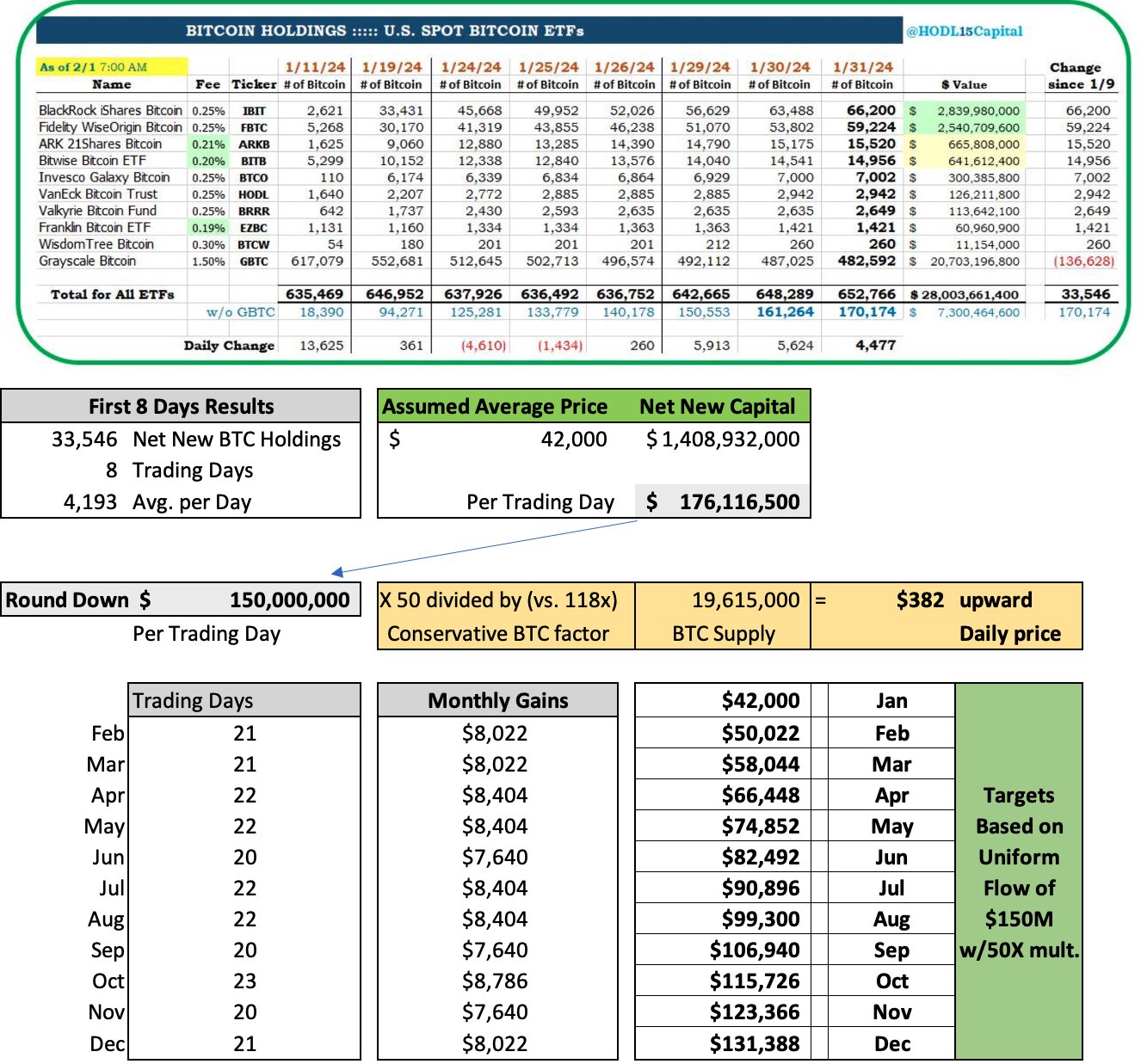

Analyst Predicts Shocking Bitcoin Price By Year-End Based On ETF Inflows

In an analysis released via X, Thomas Young, managing partner at RUMJog Enterprises, is projecting a staggering upward trajectory for Bitcoin’s price by the end of the year, basing his predictions on the influence of Bitcoin Exchange-Traded Funds (ETFs) inflows. As NewsBTC reported, Grayscale’s GBTC outflows have slowed down significantly recently, resulting in constant net inflows over the past five consecutive days,ranging from $14.8 million to $247.1 million.

The 118 Multiplier Concept

The crux of Young’s analysis hinges on the concept of the ‘118 multiplier’, a metric introduced by Bank of America in March 2021. This multiplier posited that an investment influx of approximately $92 to $93 million was needed to move Bitcoin’s price by 1%. At that time, Bitcoin’s market capitalization was approximately $1.09 trillion, corresponding to a unit price of around $58,332.

Young’s forecast revisits and modifies this concept, emphasizing its non-static nature. He notes, “The Multiplier is a result of several interacting variables, including the volume and velocity of capital inflow, the readily tradable supply of Bitcoin, and external factors affecting risk metrics in the broader market.” Thus, the 118x multiplier is suggested to be a dynamic, rather than a fixed, indicator.

Drawing on data from HODL15Capital, Young observes a consistent growth in Bitcoin ETFs, averaging an influx of 4,193 BTC per day. This translates to approximately $176 million of net new capital daily. For forecasting purposes, Young adjusts this figure to $150 million daily, spread uniformly across the trading days of each month (typically 20-23 days).

Bitcoin Price Could Reach $131,000 By EOY

Applying a more conservative multiplier of 50x, as opposed to the original 118x or 100x, Young calculates an estimated monthly upward price pressure of $8,000 per Bitcoin. This calculation leads to a year-end price target of at least $131,000 for Bitcoin. Young states, “This $131K represents the lower bound of the forecast, acknowledging that actual capital flow may not be uniform and other factors could increase the multiplier.”

The adjusted analysis also takes into account the irregularities observed in January, particularly the one-time selling of GBTC. Young revised the January data to provide a more accurate representation of the trend for the remainder of the year. He suggests, “A rule of thumb: the daily average BTC gain across all ETFs times $2 gives a conservative estimate of the ETF growth’s price effect.”

Based on this model, Young’s monthly Bitcoin price predictions, assuming ETF inflows continue at the rate observed in the first 15 days, are as follows:

- January: $42,000

- February: $50,022

- March: $58,044

- April: $66,448

- May: $74,852

- June: $82,492

- July: $90,896

- August: $99,300

- September: $106,940

- October: $115,726

- November: $123,366

- December: $131,388

This meticulous analysis from Young not only highlights the potential impact of ETF inflows on Bitcoin’s price but also underscores the complexity and dynamic nature of cryptocurrency markets. However, other events that affect supply and demand dynamics, such as the next BTC halving, as well as macroeconomic developments (Fed rate cuts), among others, are other factors that make price predictions incredibly difficult.

At press time, BTC traded at $43,021.

Ethereum to $20,000: Analyst Sees Spot Ethereum ETFs Fueling Bull Run

A crypto analyst, Eric, believes Ethereum (ETH) could spike to $20,000 in the upcoming bull run. The analyst said the potential launch of spot Ethereum exchange-traded funds (ETFs) in the United States will propel this upswing.

Ethereum To $20,000 Possible

In a post on X, Eric cited Ethereum’s historical tendency to mirror Bitcoin (BTC), albeit with a one-cycle lag. In the previous bull market, the analyst noted that Bitcoin surged 22-fold from $3,100 to $69,000. Therefore, if Ethereum follows a similar trajectory, reaching $20,000 would be a realistic possibility.

As the analyst noted, Ethereum’s recent bear market bottom of $880 in 2022, if extrapolated using the 22x growth rate seen in BTC, places the coin at $19,360. However, the analyst believes Ethereum might surpass expectations, making $20,000 a base and a psychological round number to monitor closely.

Supporting this forecast is the possible approval of a spot Ethereum ETFs. Like the spot Bitcoin ETF, this authorization will likely attract institutional investors and significantly boost Ethereum prices and liquidity. Institutional investors can gain exposure to Ethereum through these complex derivative products without the complexities of directly trading or storing the coin.

While the optimism remains, the United States Securities and Exchange Commission (SEC) will likely follow the same path it took before approving the first spot of Bitcoin ETFs in January. For context, the strict agency failed to approve any spot Bitcoin ETF for over ten years, citing market manipulation risks and the absence of proper monitoring tools.

Will The US SEC Approve A Spot Ethereum ETF?

However, in a recent statement by The Block, Standard Chartered, a global bank, said the US SEC will likely approve Ethereum ETF’s first spot in May 2023. By then, the bank added, ETH prices will be trading at around $4,000, propelled by general market optimism.

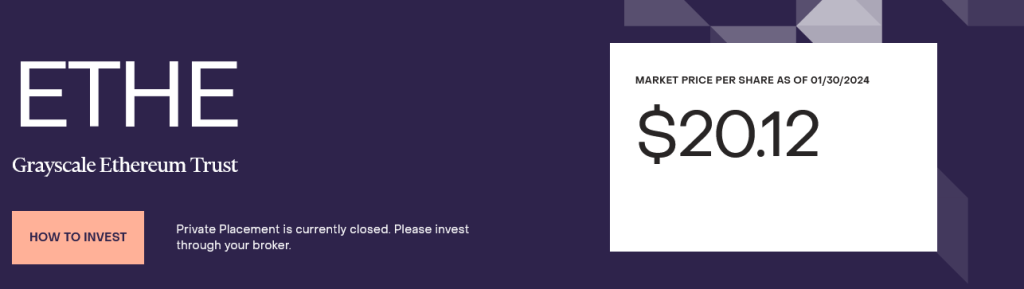

The bank notes that the failure of the agency to classify ETH as a security further adds weight to this expectation. At the same time, Grayscale Investments, which is issuing Grayscale Ethereum Trusts (ETHE), wants to convert this product into an ETF. Each share traded at around $20 as of January 30.

Earlier, Grayscale won against the US SEC’s arguments, wishing to prevent the conversion of their Bitcoin Trust into an ETF. This win set the ball rolling for the eventual approval of the first spot Bitcoin ETFs in the United States.

Additionally, the fact that Ethereum Futures ETFs were recently approved and listed on the Chicago Mercantile Exchange is a net positive, paving the way for a potential listing in May 2024.

Bitcoin ETFs Experience Day 12 Reversal, GBTC Selling Slows, Fidelity And Blackrock Garner $400 Million

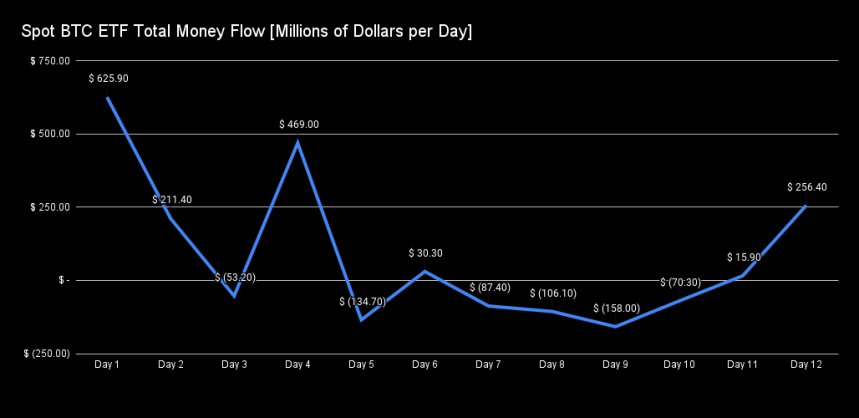

Bitcoin has witnessed a positive turn of events as it reclaimed the $43,000 mark on Tuesday, thanks to a significant reduction in selling pressure from asset manager Grayscale. The reversal in Bitcoin ETFs during day 12 of trading has seen more inflows than outflows. Fidelity and Blackrock recorded a combined $400 million across their Bitcoin ETFs under the ticker names FBTC and IBIT, respectively.

Bitcoin ETFs Record Third-Largest Money Day

According to market expert James Mullarney, Grayscale Bitcoin Trust (GBTC) has experienced a noticeable reduction in selling pressure, as reflected by the slowing down of GBTC selling.

Day 12 of trading showed a substantial inflow compared to outflow, marking the third-largest money day ever in net money flow, bringing in $256 million.

Mullarney further states that adding new Bitcoin ETFs has contributed to a net positive of $1 billion in ETFs, with an estimated 25,000 Bitcoin added to the market. The new Bitcoin ETFs now hold a total of 150,000 BTC in aggregate.

Miners Sell Most Coins Since May 2023

Despite these positive developments with Bitcoin ETFs, there is an ongoing increase in selling pressure from miners. A recent CryptoQuant report reveals that miners have sold the most coins since May 2023.

The flow of coins from miner wallets to spot exchanges reached its highest value since May 16, 2023, with over 4,000 Bitcoin amounting to approximately $173 million in selling pressure.

Although miners have increased their selling activity, CryptoQuant asserts that the market has absorbed this pressure “calmly”. It is important to note that the reserves in mining portfolios have remained at the same level since the beginning of January.

CryptoQuant highlights that it is crucial to consider that these actions do not necessarily indicate a “dump” by miners. The firm concluded:

It is true that there were several interactions with exchanges during this period, some quite significant, but this does not correspond to a “dump” on the part of these entities. Furthermore, it is necessary to be careful when reading messages like “miners are dumping coins”, this analyzes may not take into account the return of these coins to miners’ wallets.

New All-Time High For Bitcoin After November?

Renowned crypto analyst, CryptoCon, cautions against the belief that “this time is different” for Bitcoin, highlighting the recurring nature of its market cycles. With three completed cycles and a fourth underway, CryptoCon emphasizes that historical patterns, including the launch of Bitcoin ETFs, have consistently influenced Bitcoin’s price trajectory.

CryptoCon emphasizes that Bitcoin’s price movements have followed distinct cycles, and he warns against the notion that each cycle will deviate significantly from the preceding ones.

Despite the anticipation surrounding the launch of ETFs, historical evidence suggests that they have coincided with local price highs rather than instant new all-time highs.

CryptoCon argues that the repeated occurrence of such patterns should serve as a reminder that “this time is different” often proves to be an illusory belief.

According to CryptoCon’s analysis, a period of sideways movement is expected to commence soon after the completion of the ongoing correction, which saw BTC retrace to the $38,500 level on Tuesday, January 23.

This phase is predicted to last approximately four months, culminating in a second early price peak in June 2024, according to Crypto Con.

Following this, the analyst foresees the possibility of new all-time highs occurring after November 28th, 2024. However, it is crucial to note that the cycle’s peak will occur within approximately 21 days from this date, around November 28th, 2025.

Featured image from Shutterstock, chart from TradingView.com