Already a multi-billion-dollar sector of the crypto industry, the DePIN narrative is a promising one, according to experts.

DePIN Platform Uplink Raises $10M Led by Framework Ventures

The decentralized wireless platform offers a token-reward system to incentivize users to contribute to the network.

Helium (HNT) Heats Up: 21% Jump After Telefónica Deal Ignites Growth

In a landmark move, Telefonica, the world’s 27th largest telecom, has partnered with Nova Labs to roll out Helium mobile hotspots in Mexico. This initiative aims to address the persistent issue of limited internet access in underserved communities, leveraging a unique blockchain-powered network.

Helium’s Mexico Expansion Sparks Crypto Surge

The collaboration will see thousands of Helium hotspots deployed across Mexico City and Oaxaca, powered by Nova Labs’ blockchain technology. This technology incentivizes individuals to host hotspots by rewarding them with Helium’s cryptocurrency, HNT, for contributing to coverage. This “proof-of-coverage” concept aims to build a decentralized network with potentially lower infrastructure costs compared to traditional methods.

The news sent ripples through the cryptocurrency market, propelling HNT’s price up over 20%. This follows a similar surge in December when Helium partnered with T-Mobile for nationwide mobile service in the US.

“This program in Mexico is crucial for evaluating the performance and customer satisfaction of this solution,” said José Juan Haro, Telefonica’s Chief Wholesale and Public Affairs Officer. He sees it as a key step towards bridging the digital divide and unlocking new possibilities for individuals and businesses in remote areas.

The collaboration isn’t without its challenges. Scaling up the network and convincing users to switch to Helium connections will require careful planning and clear value propositions. Additionally, decentralized networks can face issues with coverage consistency and data speeds compared to centralized infrastructure.

“We are delighted to partner with Telefonica to integrate our Helium Mobile Hotspot technology and expand coverage for their customers. Alongside Telefónica, Nova Labs has solved one of the biggest challenges for telecoms and pioneered a solution that supports secure data offload that can be implemented around the world,” Amir Haleem, CEO of Nova Labs, said.

Telefonica Boosts Helium Initiative Credibility

Telefonica’s involvement adds significant weight to this initiative. Its market reach and brand recognition can bolster Helium’s credibility and drive adoption. The partnership is built on an open standard developed by the Telecom Infra Project, allowing select Movistar customers to seamlessly access the Helium network using their existing SIM cards.

While the long-term success of this venture remains to be seen, it represents a bold step towards a future where blockchain technology fuels innovative solutions for bridging the digital divide. Its success could pave the way for similar initiatives in other developing regions, offering an alternative model for network deployment and democratizing access to the internet for all.

This story is still unfolding, and its potential impact on both the telecommunications landscape and the wider blockchain ecosystem remains to be fully realized.

Featured image from iStock, chart from TradingView

Telefónica Partners With Helium to Roll Out Mobile Hotspots in Mexico

Helium’s native token is up by 5.71% over the past 24-hours.

Helium Token Balloons To 85% For A Yearly High – What Drove The Price Up

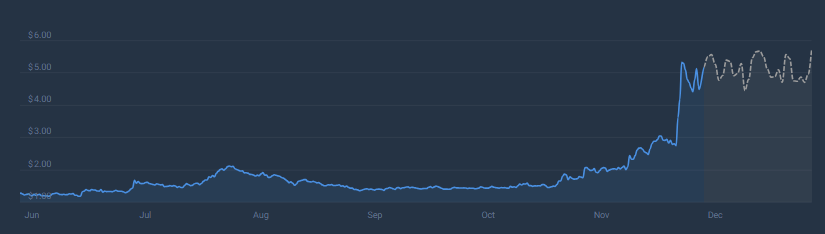

After rising sharply from the $2.00 bottom, Helium (HNT) demonstrated a strong upswing that further fueled the market’s positive attitude and increased the momentum of the advance.

This week has witnessed bull action for the Solana-based Helium Network’s HNT coin, which has seen a 70% weekly rise to $4.86.

Based on the most recent data, HNT, which has a market cap of about $700 million and an amazing $10 billion in trading volume as of press time, quietly touched a yearly high of $5.12 over the weekend after seeing a commanding 85% price spike in only seven days.

Helium Climbs To Yearly High

Buyers demonstrated an upswing and were able to keep the price above both EMAs. The 200-day EMA, which shows strength in the most recent bull run, is about to cross paths with the 50-day EMA for helium. In the event that the crossing takes place, prices may reach new swing highs.

The price of helium has been more volatile this week due to a divergence in the Bollinger Bands. Indicating bull domination throughout the course of the week on the price of helium, HNT’s relative strength indicator is above its average line in the overbought area.

HNT was up from $2.73 to $5.78 in the first week of December, signifying a 70% increase in price. Just this past month, the token has increased by over 190%.

The most recent estimate for the price of Helium is that it may reach $5.75 this month, according to Coincodex.

For a network that has primarily dealt with bad press regarding its product and the transition from its proprietary blockchain to Solana, this price performance marks a turnaround.

HNT Among Top Crypto Performers

In the cryptocurrency market, Helium, a decentralized network that launched in 2019, has made significant progress. It is now among the best performers. Concurrent with this price increase is Solana (SOL), which has risen by over 50% over the past 30 days.

On November 12, 2021, HNT reached its highest point at $55.15. On the other hand, it fell to an all-time low of $0.200 on May 29, 2020.

The lowest recorded price since the all-time high was $1.16, and the highest was $5.75. The Fear & Greed Index shows a score of 72 (Greed), and the current consensus for Helium’s price prediction is positive.

Meanwhile, analysts say the $20 monthly phone plan from Helium Mobile, which gives customers unlimited data, voice, and text, is mostly the impetus for HNT’s price increase.

According to a recent survey, the average American spends about $150 a month on phone plans alone. Helium’s newest connectivity service is expected to provide a more affordable option than traditional service providers.

Featured image from Pixabay

Altcoins Heat Up With AVAX and HNT Leading the Way

Money is flowing into more speculative names following bitcoin’s big run higher.

Solana-Powered Helium (HNT) Spikes By 145%, Analyzing The Drivers Of The Surge

Helium (HNT), a decentralized network launched in 2019, has experienced significant gains across multiple timeframes, making it one of the top performers in the cryptocurrency market. This price surge comes alongside Solana’s (SOL) remarkable 56% increase over the past 30 days and other protocols built on Solana’s network.

HNT has achieved staggering gains over the past 30 days, surpassing 147%. This remarkable growth has continued with gains of 101% and 45% over the past fourteen and seven days, respectively.

In the 24-hour time frame alone, HNT reached a high of $5.008 and experienced a remarkable surge of 53%, a level not seen since October 2022. But what are the main catalysts behind this spike?

Helium’s Mobile Service Launch Ignites HNT Investor Frenzy

The recent surge in HNT’s price can be attributed to the announcement made by the Helium network on December 5. The network revealed that users across the United States can now enjoy unlimited data, voice, and text services for a monthly fee of $20 through their newly launched mobile service.

According to recent reports, Helium Mobile, a subsidiary of Nova Labs, introduced this no-contract nationwide mobile service, aiming to provide consumers with an affordable and unrestricted mobile experience.

This move comes when major carriers have been imposing data limits, increasing contract obligations, and raising prices, making Helium’s offering particularly appealing to users seeking more flexible and cost-effective options.

By offering unlimited data, voice, and text services for a flat fee of $20 per month, Helium Mobile aims to address the growing demand for affordable and unrestricted mobile connectivity.

According to the announcement, the company aims to empower customers by putting control back into their hands, challenging the practices of traditional carriers.

CEO Amir Haleem Calls For Transparency In Mobile Industry

Amir Haleem, CEO of Nova Labs, emphasized the company’s belief that cell phones are essential and that unlimited data, text, and calls should be standard offerings.

Haleem criticized carriers for concealing high subscription rates, roaming fees, and additional data charges behind seemingly attractive phone upgrade options that often lock customers into costly plans for extended periods.

In addition to its mobile service, Helium Mobile supports a people-powered coverage model, allowing customers to become network owners and operators. Like platforms like Airbnb or Uber, the company believes that “reducing monopolies” and empowering customers can improve service quality, lower costs, and overall benefits for all stakeholders.

As the demand for reliable and affordable mobile services grows, Helium’s approach has positioned it as a key player in the industry. This announcement has propelled HNT’s price upward as investors recognize the potential of Helium’s approach in the mobile service sector.

The trading price of HNT stands at $4.153, marking a significant breakout from its downtrend structure of the past 11 months. The cryptocurrency is now targeting its next resistance level at $4.70.

However, should HNT fail to surpass this resistance, it will be crucial for the coin to maintain support at the $3.00 level to sustain its current bullish momentum.

Featured image from Shutterstock, chart from TradingView.com

Avalanche, Helium Lead Monthly Crypto Gains as Bullish Bitcoin Consolidation Spurs Altcoin Season Call

November brought explosive gains for altcoins as a wide range of smaller cryptocurrencies outperformed bitcoin, prompting call for an altcoin season.

Helium Expands IoT Coverage Through Amazon Sidewalk/Oxit Partnership

The partnership will enable IoT solution providers to benefit from Amazon Sidewalk’s network and Helium’s network.

Helium’s IOT Token Surges 370% Following Solana Migration

Helium’s newly-issued IOT token has risen by over 370% in the past 24-hours following the protocol’s successful migration to the Solana blockchain last week.

HNT Balloons As Token Gets 36% More Helium In Run-Up To Network Migration

Helium’s native token HNT has been bloating in price since the start of the year. According to CoinGecko, the token is up more than 36% in the past week. This means that the token is ready for more gains in the coming days or weeks as Helium merges with the Solana blockchain.

According to Helium’s tweet back on December 16th, the two blockchains will merge in the 1st quarter of this year. Will HNT continue its bullishness post-merge?

The Merge & External Developments On Helium

The Helium-Solana consolidation event is not just the only thing marked for investors and traders to watch. Nova Labs, formerly known as Helium, and T-Mobile announced a partnership back on September 20 last year.

Helium is migrating onto the @Solana blockchain ~Q1 2023. Did you know @Helium Hotspots will each be represented by an NFT on Solana—creating almost 1 million new Solana NFTs during the Helium #MintORama?

If you missed our Transition AMA on Dec. 1st, here’s a recap.

— Helium Foundation (@HeliumFndn) December 15, 2022

According to the press release, the partnership would enable Helium Network users to use the T-Mobile 5G network alongside with Helium’s own native 5G network. This would entitle users to opt-in of the MOBILE rewards system.

This system rewards users for sharing data about Helium’s dead spots location in the United States which would help them save on cellular data plans. The public beta launch of the rewards system will launch during the 1st quarter this year.

Helium and Solana’s merge event will also happen at the same timeframe. The upgrade would enable the ecosystem to give more back to hotspot owners as 2 million HNT would be allocated annually for rewards.

It would also make the network faster and reliable as the proof-of-coverage system of Helium gets buffed.

What Does This Mean For HNT?

As of writing, the token faced a rejection at $3.4 with the bears trying to reach the $2.8 support line. The first few months of this year could set up HNT for greater heights as the rewards system and the merge of Solana and Helium happens at nearly the same time.

With the token’s price at $2.9, HNT is expected to face challenges in the short to medium term as volatility enters the market. If the token’s current support is broken, investors and traders might have a hard time to revert back to its current price point.

However, with the onset of its merge with Solana and the rewards system public beta launch, we might see less pain in the medium to long term. Investors and traders should also watch the token’s high correlation with Bitcoin as this could influence the price of HNT strongly.

For now, investors and traders are safe to hold HNT as this rejection could be quickly dealt with with external bullish prospects.

Featured image: Crestline

4 ‘emerging narratives’ in crypto to watch for: Trading firm

The crypto trading firm sees NFTs becoming more intertwined with brand IP, while Web3 apps with “real world utility” gain traction.

Billionaire Bill Ackman Touts Altcoins Helium (HNT) And DIMO – Why?

Another billionaire shilling another shitcoin or a good advice on a legitimate crypto project with strong fundamentals? This is the question crypto investors are likely to ask about a recent thread about Helium (HNT) and DIMO by billionaire Bill Ackman.

Ackman is an American billionaire, investor and CEO of Pershing Square Capital Management who has been rather critical of cryptocurrencies in the past. In his new Twitter thread, however, he does an about-face.

“The telephone, the internet, and crypto share one thing in common. Each technology improves on the next in terms of its ability to facilitate fraud,” Ackman said, and continued:

I was initially a crypto skeptic, but after studying some of the more interesting crypto projects, I have come to believe that crypto can enable the formation of useful businesses and technologies.

The telephone, the internet, and crypto share one thing in common. Each technology improves on the next in terms of its ability to facilitate fraud. As such, I was initially a crypto skeptic, but after studying some of the more interesting crypto projects, I have come to

— Bill Ackman (@BillAckman) November 20, 2022

Helium And DIMO, Not Bitcoin And Ethereum

To support his thesis, however, Ackman did not necessarily pick the most popular and well-known cryptocurrencies. Not Bitcoin or Ethereum, but Helium and DIMO are his dubious picks.

According to him, the two examples show that cryptocurrencies can have “intrinsic value” and are not a version of a “modern version of tulip mania.”

Helium, Ackam says, is creating a global Wi-Fi network that “will be used by Lime and others to track devices around the world, as well as for other purposes that benefit from access to global Wi-Fi networks.”

Ackman also points out that the Helium network already comprises 974,000 hotspots set up by individuals to mine the HNT token. On the intrinsic value of the HNT token, Ackam writes that it comes from its usage.

Customers of the network need to buy and burn HNT, he says, creating “a two-sided market for HNT” in which miners buy hotspots and deploy them around the world to earn tokens. Users, in turn, buy HNT tokens to use the network.

The more demand for the network, the more demand for HNT. Given HNT’s ultimately finite supply, the balance between supply and demand yields a market price […]. As such, HNT becomes a valued commodity whose price is determined by supply and demand.

The choice of Helium is more than shady, as the crypto project recently flaunted fake partnerships.

Both the partnership with Lime (as cited by Ackman) and a partnership with Salesforce were merely made up by the Helium team, who placed their logos under the partnerships section on its website. Remarkably, that claim has been denied by both companies.

DIMO is an even lesser-known altcoin than Helium’s HNT. Ackman describes the crypto project as a pioneer in the automotive space.

“DIMO collects valuable automotive data from data ports in cars. It allows car owners to mint tokens by collecting data from their own cars. The data is valuable to the car owner as well as car manufacturers, suppliers, insurers, municipalities, etc.,” Ackman wrote.

The billionaire revealed that he is a small investor in DIMO, but not in Helium. Overall, his crypto investments account for less than 2% of his assets.

Bitcoin bull Michael Saylor was quick to question Ackman’s choice and suggested that the killer app for crypto is money as the best engineered network is Bitcoin. Ackman, for his part, has not answered Saylor what he thinks about BTC.

The killer app for crypto is money, and the best engineered crypto network to serve as money is #Bitcoin. It is economically, technically, & ethically superior to everything else, so I suggest you study Satoshi's protocol & Bitcoin's provenance before making major commitments.

— Michael Saylor

(@saylor) November 20, 2022

Billionaire investor Bill Ackman says ‘crypto is here to stay’

Bill Ackman’s conviction on crypto comes as much of the community attempts to regain confidence in the industry following the FTX fallout.

‘No basis’ for Binance’s partial delisting of HNT — Helium COO

Multiple trading pairs of the Helium Foundation’s token will soon be removed from Binance, with the exchange saying it delists assets if it no longer meets “high standards.”

Solana (SOL) Heats Up 7% In Last 24 Hours As Helium Eyes Merge

SOL, Solana’s native coin, has seen its value increase since the announcement of its impending merger with Helium. The developers of Helium came up with HIP 70, which aimed to relocate the entire Helium supply chain to Solana.

Developers behind Helium have stated that increasing the network’s scalability, stability, and speed were the primary motivations behind the merger.

According to a Medium post published by Solana on August 31, the company proposes migrating the Helium ecosystem from the L1 chain to its own “highly-scalable and fast blockchain,” which will allow for “higher uptimes, greater composability, and a faster user experience while maintaining the security and low cost of using the Helium Network.”

SOL Trading Volume Up A Decent 250%

Recent data shows that SOL’s trading volume has increased by an impressive 250 percent, from a recent low of $675,184 to today’s trading volume of $1,685,409.

When business volume rises, prices tend to rise as well. The price increased by 11.52 percent in just 12 hours on September 2. This most recent upward movement resulted in a price of $38.06.

On Wednesday, however, a fairly severe correction follows this bull pattern. A rising price carries with it the possibility of a sell-off, since some traders may seek to make a profit.

This occurred shortly after SOL’s price peaked at $38.82. The rapid reversal occurred just one day after the bull movement.

Solana-Helium Merge To Shape Investor Confidence

After the market’s upswing, the CCI and Stoch RSI values indicated that the coin was overbought, triggering sell signals.

This fall in price also increased the attractiveness of short positions. According to recent market data, the current panorama of traders is dominated by short sellers. The majority of the top nine cryptocurrency exchanges are dominated by short bets.

Chart: TradingView.com

The market is attempting to rectify the decline with a test of the 100 percent Fibonacci level, with the 50-day exponential moving average acting as support.

Chart: TradingView.com

With the current timetable of the Helium-Solana merger still in the voting phase, the event’s hoopla can be a precursor of either a greater rise or a lower fall.

The outcome of the vote will at least determine the sentiment of SOL’s investors. As the 18th of September approaches, it is only a matter of time before the voting results are known.

SOL total market cap at $11.5 billion on the daily chart | Source: TradingView.com

Featured image from Exodus Wallet, Chart: TradingView.com

Helium Coin Price Bloats 30% – Can HNT Expand Past $5?

Helium (HNT) has been flushed in green, standing out from all the reds in the crypto space.

- HNT price bounces back from key support at $3.4

- Helium intraday trading volume registers 378% plunge

- HNT price to sprint past the $5 level

Helium price has bounced back from its support key spotted at $3.4, prompting a new rally which can spike past the $5 level.

Based on the HNT technical chart, the token is showing a dip since it lost its grip on the key support found at $8.3 in August. HNT price has slumped by 59.6% as it nosedived to $3.32, its 52-week low so far.

Chart: TradingView.com

Regardless of how negatively the rest of the market is performing such as Bitcoin, which is dipped in red and fell under the $19,000 level, HNT price still reigns with the formation of an engulfing candle validating a bullish stance.

Apparently, the HNT price was able to recuperate from the $3.32 mark and skyrocketed by 30% hinting at a bullish reversal.

Helium Price Seen Rising 19%

According to CoinMarketCap, HNT price is up by 0.77% or $4.90 as of this writing,

The immense increase in terms of trading volume implies that buyers are going on an exciting shopping spree at discounted prices. With consistent buying pressure, Helium price may spike to as much as 19% before it taps on the psychological zone set at $5.

At this point, the HNT price can validate whether buyers are seriously committed despite the resistance and at the same time, this also tests whether the price is flexible and can still soar.

Regardless, a sudden spike in price is regarded to be uncommon, especially amid a tough bearish market.

With that in mind, the Helium price is projected to slide from the $5.9 resistance to retest the support found at $3.26.

RSI for Helium shows an aggressive growth spurt coming from the oversold region which shows the increase in demand at discounted prices. Now, a crossover that will hover above the midline can validate recovery.

HNT EMAs Indicate Downward Trajectory

The 20/50/100/20 EMAs show a rather vicious downside movement. Meanwhile, the vortex indicator shows a noticeable gap in between the VI+ and VI- indicating extreme sluggishness in bearish movement despite the pump in price.

HNT’s market capitalization has plummeted by as much as 50% from $1 billion to $492 million.

A couple of days ago, HNT is seen to have nosedived shedding off as much as 9% of its value as seen overnight. On a 30-day timeframe, HNT price is seen to have slumped by over 57% in over a month or down by 94% from its ATH.

Crypto total market cap at $983 billion on the daily chart | Source: TradingView.com

Featured image from The Coin Republic, chart from TradingView.com

Helium (HNT) Deflates 15% After Proposed Transition To Solana

The Helium network, a blockchain-powered wireless system, may soon undergo significant revisions as its key developers consider switching to Solana.

The proposal by Helium’s core developers to switch from their own blockchain network to Solana’s was codenamed “HIP 70.”

Since developers revealed a plan to migrate the network to Solana, the value of HNT has plummeted.

The HIP 70 proposal to move to the Solana blockchain aims to improve data transit, network coverage, and dependability. Some of the network issues have been described in a recent post on Medium.

Helium Switch To Solana Aims To Solve Technical Issues

The post suggests that less Proof of Coverage activity occurred due to the network’s massive scale. They believed the blockchain’s inefficiencies were to blame for the lower than usual volume of transactions.

In particular, there are problems with data packet transfers and the overall network load between the blockchain and the validator.

The projected network-wide move was intended to resolve or significantly reduce the issues currently plaguing the network.

According to a blog post by the Helium Foundation:

“Thousands of developers across the world are working on apps that are only conceivable on Solana owing to its quick and cheap transactions, real-world NFT applications, business-to-business and business-to-consumer marketplaces, and more.”

The proposal’s goal was to build a network that was faster, safer, and more scalable, however the market rejected this idea. The primary token of the project, HNT, saw its price drop from $5.6778 to $4.6483 in the period of a few hours on August 31.

Since then, the token has not been able to recover. A rise in the volume of transactions is shown on CoinMarketCap and CoinGecko. Lower prices and higher volume indicate a sell off occurred between August 31 (the day of the release) and September 2 (the time of writing).

Major Consolidation In Crypto

In the present market for cryptocurrencies, pessimistic sentiment has been prevalent. Some investors and traders in HNT have been triggered by this, and the general reaction has not been favorable.

The Helium move to Salana is a massive consolidation in the crypto industry.

The goals of these changes are to increase trust among investors and entice new users to join their ecosystem. However, the news of the merger between Solana and Helium has done nothing to stop the market decline.

Only time will tell if the combination of the two will inspire trust among traders and entice new participants to the ecosystem.

Crypto total market cap at $959 billion on the daily chart | Source: TradingView.com

Featured image from Securities.io, chart from TradingView.com

The total crypto market cap continues to crumble as the dollar index hits a 20 year high

The total crypto market capitalization dropped by 6.9% in one week, while derivatives metrics reflect increasing demand for bearish bets.

Helium devs propose ditching its own blockchain for Solana

The transition to Solana would improve network scalability, which in turn would bring “significant economies of scale” to the network, according to Helium core devs.