MilkyBull, a well-known personality in the world of cryptocurrency analysis, has drawn attention lately for his analysis of Bitcoin’s price trajectory and his prediction of a situation that might cause more fear in the market.

MilkyBull’s analysis delves into the subtleties of Bitcoin’s movement, identifying patterns and trends that could have a big impact on investor mood.

Bitcoin Triggering Anxiety In The Market

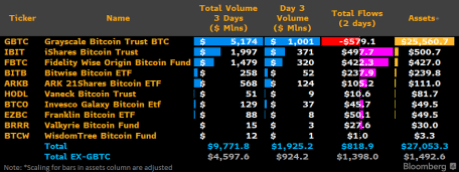

According to the analyst, the market will get even more fearful of the Bitcoin price path before it bottoms out and continues to rise. The analyst claimed that because of the current price of BTC, Blackrock iShares Bitcoin Trust (IBIT) saw its first-ever outflows since the approval of the Bitcoin Spot Exchange-Traded Funds (ETFs).

Furthermore, he reminded us that positive news always denotes the peak of a Bitcoin bull cycle, while negative news denotes the bottom. With this notion, investors could position themselves for the next trajectory BTC takes.

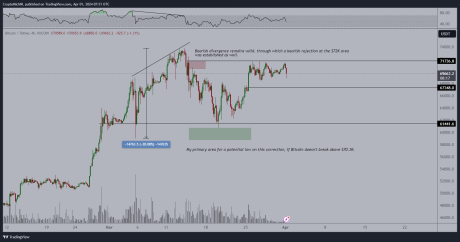

To further explore his narrative, MilkyBull drew attention to a previous analysis regarding Bitcoin’s final local bottom in this cycle. Given that BTC is following the PA (Price Action) of 2017, MilkyBull believes that the crypto asset might have bottomed out or come close to it.

Historically, the bull market support band strongly sustains the Bitcoin market in bull cycles. As a result, the analyst is confident that Bitcoin’s price may wick through the support and recover.

Another aspect highlighted by the expert is the Global liquidity during past bull cycles. Presently, Global liquidity is closely linked to Bitcoin at a level where it recovered in October 2022 and October 2023, which led to the inception of a massive surge in the digital assets markets, sparking a massive surge in the whole cryptocurrency market.

With the macro volatility on Tuesday, MilkyBull stated that Bitcoin is at a pivotal juncture for the last local bottom before it resumes its rise to the cycle peak. Though the market does not always respond to such expectations, the majority of members in the crypto space are requesting a correction to $48,000.

BTC Poised For A Breakout On The Upside

Another crypto analyst Captain Faibik has also spotted the largest cryptocurrency asset undergoing a price recovery lately. According to the expert, although BTC is currently seeing a rebound, it is still moving inside the falling wedge formation.

Related Reading: Bitcoin Loses Historical Level, Analyst Says “Reclaim And Bounce, Or Die”

Thus, Bitcoin’s bullish investors must overcome the $61,000 resistance level for the digital asset to break out from this formation. Should BTC break out from this formation successfully, Captain Faibik anticipates a notable move on the upside toward $78,000.

Given that BTC is already trading above $61,000, all eyes are now set on the $78,000 price level. At the time of writing, BTC was situated at $61,701, indicating a rise of over 5% in the past day. Data from CoinMarketCap shows that its market cap has increased by 5%, while the trading volume is down by 21%.