A recent report has revealed an upcoming significant event that will see the expiration of a notable amount of Bitcoin (BTC) and Ethereum (ETH) options contracts.

Bitcoin And Ethereum Options Contract Set To Expire

Global options trading service platform Greeks.live, took to X (formerly Twitter) to share data regarding the expiration of the crypto assets.

According to the platform, about 37,000 BTC options with a notional value of $1.58 billion are set to expire. In addition, Bitcoin’s current put-call ratio stands at 1.02 with a “Maxpain” point of $42,000.

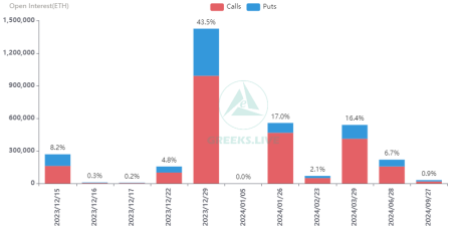

Meanwhile, for Ethereum, the data shows that about 268,000 options valued at $610 million are set to expire soon. In addition, the current put-call ratio for ETH stand at 0.66, with a “maxpain” point of $2,250. The post read:

Dec. 15 Options Data. 37,000 BTC options are about to expire with a Put Call Ratio of 1.02, a Maxpain point of $42,000, and a notional value of $1.58 billion. 268,000 ETH options are due to expire with a Put Call Ratio of 0.66, a Maxpain point of $2,250, and a notional value of $610 million.

Notably, the put-call ratio, to put it simply, contrasts the trading volume of put and call options. A ratio higher than 1 signifies a higher number of puts (sell) than calls (buy) options, implying a negative outlook among traders.

Furthermore, the price at which the highest number of options would expire worthless is known as the maximum pain (Maxpain) point.

Greeks.live asserted that this week saw a decline in the market, with BTC dropping close to $40,000 at one point. As a result, many hedge their positions, which led to a greater proportion of Put than Call positions this week. The bulk of trading is still concentrated on Bitcoin options even with the decline.

The platform also highlighted that the Implied Volatility (IV) has remained quite flat for about a month now. In addition, significant option moves are still going on.

The Crypto Assets Set To See Substantial Inflow

Cryptocurrency analyst Ali has recently revealed that billions of inflow are set to be poured into Bitcoin and Ethereum. The analyst shared this crucial information with the crypto community in an X post on Thursday, December 14.

According to Ali, over $19.7 billion is about to flow into the two major players in the cryptocurrency market. He also added that this capital inflow is comparable to what we observed in December 2020.

The X post was accompanied by a chart showing a virtual explanation of a similar scenario. Ali further highlighted that after the scenario, the price of BTC moved from $18,000 to $65,000.

With billions of dollars flooding into the two major crypto, the market might be poised for further profits.