Net outflows for Hong Kong’s crypto ETFs reached a record $39 million on Monday with bleeding felt across all six funds.

Cryptocurrency Financial News

Net outflows for Hong Kong’s crypto ETFs reached a record $39 million on Monday with bleeding felt across all six funds.

Despite the excitement around the Hong Kong ETF debut, the inflows are only a fraction of the selling from the U.S. ETFs. Could Bitcoin price revisit the $50,000 mark next?

Crypto investment products are now going through rough times, as shown by inflow and outflow data. The crypto market is known for its volatile market cycles of ups and downs. Investment products are now struggling, and confidence in the space seems shaken. Crypto funds have now seen outflows for three straight weeks, with investors pulling $435 million from digital asset funds last week, according to CoinShares data. The recent stretch of outflows highlights the souring investor sentiment around some digital assets after a bull run earlier this year.

CoinShares’ recent weekly report on digital asset fund flows has revealed the current sentiment among institutional investors. According to the report, investment funds witnessed $435 million in outflows last week to mark the biggest outflow since March. This comes on top of the $206 million and $126 million pulled out in the previous two weeks. Unsurprisingly, the majority of outflows came from Bitcoin funds. Of the total $435 million outflows, $423 million came from Bitcoin funds. Notably, a bulk of Bitcoin’s outflows ($328 million) came from Spot Bitcoin exchange-traded funds (ETFs) in the US.

A look into previous crypto fund flow data since the beginning of the year shows that the majority of the inflows recorded in January, February, and March can be attributed to the Spot Bitcoin ETFs. These ETFs recorded so much inflow of funds that investment products were able to record their best year on record in less than three months.

However, inflows into these ETFs have declined in the past few weeks, and the largest digital asset is now failing to attract inflows amidst interest rate stagnation in the US market. Grayscale’s GBTC, in particular, continued its run of withdrawals, recording $440 million in outflows. At the same time, the other ETFs failed to attract inflows during the week in order to offset these withdrawals. BlackRock’s IBIT, for instance, failed to register inflows for three days straight last week, bringing its 71-day run of inflows to an end.

Ethereum, the altcoin king, also witnessed $38.4 million in outflows last week to offset inflows into other altcoins. Inflow data shows investors pouring $6.9 million worth of inflows into multi-coin investment products. Solana, Litecoin, XRP, Cardano, and Polkadot witnessed $4.1 million, $3.1 million, $0.4 million, $0.4 million, and $0.5 million in inflows, respectively. Short Bitcoin products also witnessed $1.3 million in inflows, showcasing a glimpse into investors’ sentiment.

Investor sentiment can shift quickly in the fast-moving crypto space and the coming weeks may provide more clarity on the direction of crypto fund flows. Six Spot Bitcoin and Ether exchange-traded funds (ETFs) are set to launch in Hong Kong today April 30. Their entry into the Asian market has been long anticipated and is expected to surpass the first-day inflow record set by their counterparts in the US.

On Wednesday, January 10, the US Securities and Exchange Commission (SEC) finally approved the launch of spot Bitcoin ETFs, representing a remarkable event in US trading history.

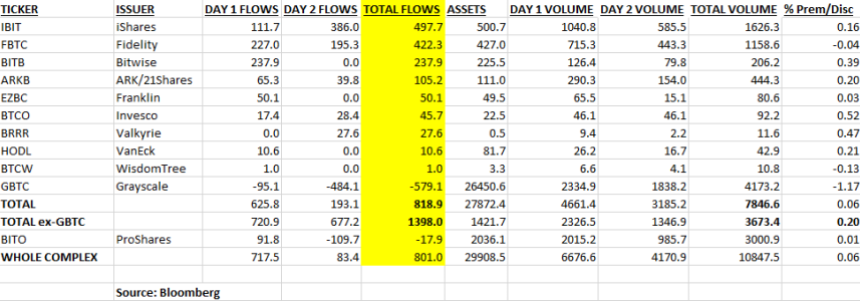

So far, market data on these investment funds have confirmed theories of increased institutional demand for Bitcoin, with over $800 million in total net inflows and $3.6 billion in trading volume recorded across the first two days of trading.

Although these inflows are yet to be reflected in BTC’s price, as the premier cryptocurrency dipped by 2% in the last week, the spot Bitcoin ETFs have certainly kicked off with a blast which is indicative of potential gains for the world’s largest asset and the general crypto market.

In an X post on January 13, Bloomberg ETF analyst Eric Balchunas shared some insight on the impressive performance of the spot Bitcoin ETFs in their debut trading week.

Balchunas noted that of the 11 approved spot BTC ETFs, nine have recorded a total inflow of over $1.4 billion. Leading the lot is BlackRock’s IBIT, with an estimated asset inflow of $497.7 million, closely followed by Fidelity’s FBTC, which boasts about $422.3 million in investment.

The BTC spot ETFs of Bitwise and ARK/21 Shares have also produced a significantly positive performance attracting $237.9 million and 105.2 million, respectively. On the other hand, Grayscale’s GBTC has been the market outcast, recording a stunning $579 million in outflows over the first two days of trading.

Following the SEC’s approval on Wednesday, investors cashed in heavily on GBTC, which was recently converted from a closed-end fund to a spot ETF. SkyBridge Capital founder Anthony Scaramucci has already commented on this trend describing it as one of the potential reasons behind Bitcoin’s dip in the last week.

In total, the spot Bitcoin ETF market recorded an impressive net inflow of $818.9 million in its debut trading week. These figures are likely to improve in the next few weeks as selling volume eventually declines. Meanwhile, investors still anticipate the debut of Hashdex’s spot ETF – DEFI – which is undergoing fund conversion from the company’s Bitcoin futures ETF.

At the time of writing, Bitcoin exchanges hands at $42,980 reflecting a 0.73% loss in the last day. Meanwhile, the token’s daily trading volume has plummeted by 62.33% and is now valued at $16.9 billion. However, with a market cap of $842.23 billion, Bitcoin remains the largest cryptocurrency in the world.

Featured image from Yahoo Finance, chart from Tradingview

Inflows into digital asset products rose for a ninth consecutive week, according to CoinShares.

Bitcoin-related funds saw outflows of $13 million over the past week, reversing five weeks of bullish inflows, according to Coinshares analyst James Butterfill.

Bitcoin-related funds saw outflows of $13 million over the past week, reversing five weeks of bullish inflows, according to Coinshares analyst James Butterfill.

Attackers of this kind are supposedly “big game hunting” large-scale organizations with deep pockets to extract ”the most money possible” out of these firms.

Bitcoin investment products have experienced $310.6 million in inflows over the last two weeks.

While LidoDAO’s current inflows of about 1000 stETH are sufficient to cover operating costs for the time being, it’s worried that may not last.

Institutional investors have been quite neutral on both bitcoin and the crypto market at large for a while now. This has translated into a mix of inflows and outflows into various digital assets, alternating with each passing week even through the bear market. However, current net flow records show that these large investors are beginning to find their chosen position in the market and it is in the camp of the bears.

Bitcoin had been recording minor inflows in the last month-and-a-half which had been good for the digital asset despite not having much of an impact. This has now changed completely as the figures for last week show $13 million in outflows for the digital asset.

This bearish sentiment has been more prominent in the short bitcoin that is now on to its third consecutive week of outflows. The $7.1 million brought the total outflows from short bitcoin to $28 million. These outflows show that large investors are pulling out of the market more instead of taking one side over the other, an overall bearish development.

The digital asset outflows for the week came out to $15.6 million during this time. Furthermore, it was a bearish start to the month of November with $19 million in outflows already. So even though November has been a historically bullish month for the crypto market, investors do not seem to believe this will be the case this time around.

Crypto market suffers general bearishness | Source: Crypto Total Market cap on TradingView.com

While it has not had as much of a profound effect as expected, the result of the FOMC meeting has been largely influencing the behaviors of investors in the market. The fourth consecutive interest rate hike by 75 bps showed that the Fed was nowhere close to backing down on its hawkish stance against the high inflation rates.

As expected, such high interest rates will have an effect on markets such as crypto, greatly limiting their ability to grow, especially during a bear market. It is also no surprise that the United States led the outflows for the week since the Fed decision has the most impact in the region.

Nevertheless, there were still some inflows from across the point. Both Switzerland and Germany saw inflows of $6.8 million and $4 million respectively, most of which were focused on altcoins. Ethereum finally put an end to its outflow trends with inflows of $2.7 million. XRP followed this trend with inflows of $1.1 million, marking its third week of inflows.

Since that time, the crypto market has taken a turn so it is expected that there might be a change in institutional investor sentiment in the coming week. However, the general crypto market sentiment continues to skew largely into the negative, which means no significant inflows should be expected.

Featured image from BitIRA, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

Ethereum had been one of the largest winners of the rally that rocked the crypto market last week. The network had seen a boost when one of the developers of Ethereum announced that the upcoming Merge would likely happen sometime in September. It triggered a ripple effect that spread to the other digital assets in the space. But it seems Ethereum investors are nowhere close to being done, given the on-chain metrics from the last week.

Exchange Outflows Ramp Up

In the last week, large and small Ethereum investors alike have been ramping up in terms of accumulation. This shines through in the among of ETH that was recorded, leaving centralized exchanges versus the number that was going into them. The disparity between the two is stark and shows exactly how investors are feeling when it comes to investing in ETH.

Related Reading | MATIC Rises Again, Will It Target The Psychological Level Of $1?

Numbers for the last week have shown that $3.3 billion total in ETH had flowed into centralized exchanges. However, the volume of ETH flowing out was about 100% higher. Data from Glassine shows that $6.5 billion flowed out, leading to a -$3.1 billion net flow.

This shows that investors are accumulating by moving their ETH out of exchanges and presumably to personal wallets for safekeeping. It also points to long-term hold sentiment among these investors. Additionally, it means that the sell pressure that has weighed down the market over the last couple of weeks has begun to ease. In its place is now a high buying pressure, leaving investors to accumulate as much ETH as possible.

ETH price falls to $1,500 | Source: ETHUSD on TradingView.com

Ethereum Merge Draws Closer

The majority of the gains recorded by Ethereum over the last week have been attributed to the updates made about the upcoming Merge. Ethereum had gained more than 40% on the back of that announcement alone, but the price has not been the only thing affected by the announcement.

Related Reading | Bitcoin Crashes To 7 Days Low, Ethereum And XRP Also Drop

The ETH staked on the Ethereum network ahead of the Merge had been on the rise over the last couple of months but witnessed a jump after the announcement was made. At the time of this writing, the number of ETH staked on the network had reached a new all-time high of 13,152,149 ETH, and this number is expected to grow as the date draws closer.

This means that more than $20 billion in ETH is now being held in the ETH 2.0 deposit contract. Now, this is not the highest point it has been in terms of dollar value, but it is nonetheless significant given that the price of ETH is down more than 70% from its ATH.

Featured image from Financial Times, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

Institutional investors’ reactions to the bitcoin price crash have been quite similar to that of retail investors. After weeks of outflows, the tides have begun to change, largely credited to the low prices that offer a chance to get into the digital asset before a recovery. The past week saw inflows for the digital asset, although other assets tell a different story.

Bitcoin Sentiment Recovers

Bitcoin sentiment had declined far into the negative following the price crash of last week. With the digital asset reaching as low as $17,600, it triggered massive sell-offs across the space. However, not everyone in the space had seen the declining prices as a signal to sell. For some, it presented a unique opportunity to get some ‘cheap’ bitcoins which is what is seen across the institutional investors.

Bitcoin’s outflows had been ramping up over the previous week due to the low momentum in the market. This had turned for the better last week when the outflow trend had been canceled and money began to flow into the cryptocurrency.

Related Reading | Bitcoin Miner Liquidations Threaten Bitcoin’s Recovery

The leading cryptocurrency had benefitted the most from this turn in investor sentiment as its inflows came out to $28 million for the week. Now, this is not exactly an impressive figure when it comes to inflows for bitcoin. However, it is important due to not only the market sentiment but the fact outflows had characterized the market for the previous week. It brings the month-to-date inflows for bitcoin to a total of $46 million.

Nevertheless, the short bitcoin had gone the other day. This asset saw record outflows for the past week. With a total of $5.8 million, short bitcoin embodied the negative sentiment felt throughout the market recently, coming after reaching a new all-time high of $64 million just at the beginning of the week.

BTC begins another decline trend | Source: BTCUSD on TradingView.com

Outflows Rock The Rest

It would seem that bitcoin would be one of the solitary beneficiaries of the inflow trend for the past week. For the rest of the market, the sell-off trend had taken a stronghold and digital asset investment had seen inflows of $39 million. This brings the total assets under management to $36 billion. It is now sitting at its lowest point in more than a year, accounting for a 59% decline in the last six months alone. However, net flows remain positive at $403 million on a year-to-date basis.

Related Reading | By The Numbers: The Worst Bitcoin Bear Markets Ever

Ethereum is yet to be free from its bearish hold as outflows remain the order of the date. For the last week alone, Ethereum outflows had reached $70 million. The second-largest cryptocurrency by market cap has now seen 11 straight weeks of outflows with no reprieve in sight. Its year-to-date outflows now sit at a massive $459 million.

Multi-asset investment products and Solana would, however, go the way of bitcoin for last week. Both these asset classes maintain inflow trends stubbornly. Inflows for multi-asset investment products came out to $9 million while Solana saw inflows of $0.7 million, presumably from investors who are moving out of competitor, Ethereum, due to fears that the Merge would not be taking place according to schedule.

The crypto market has lost more than $100 billion since last week. It is currently sitting at $892.6 billion at the time of this writing.

Featured image from US News Money, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

With the crypto market’s decline, there have been a number of things that have changed drastically in the space. Mostly, investors have been rushing to get out of the market before the crash takes more of their funds. What this has led to has been a significant increase in the number of cryptocurrencies that are flowing to exchanges. Most notably have been Bitcoin and Ethereum, whose daily exchange inflows have touched billions of dollars.

Billions In Crypto To Exchanges

The data for the last 24 hours shows that the amount of funds that are being transferred into centralized exchanges is up over the last week. Instead of the sub-$1 billion figures that have usually been recorded, the volume has ramped up significantly.

Glassnode reports that more than $3 billion in Bitcoin had moved into exchanges over the last 24 hours. In total, there was $3.2 billion worth of BTC recorded to have flowed into exchanges, with $3.3 billion flowing out, leading to a negative net flow of -$103.5 million.

Related Reading | More Than 253,000 Traders Liquidated As Crypto Bloodbath Continues

The same was the case with Ethereum which had also seen $2.1 billion flowing in while $1.5 billion had flowed out. The positive net flow of $532.4 million for Ethereum is in line with the outflow trend that had been recorded for the digital asset over the last couple of months.

Interestingly, although high, the numbers for the last 24 hours are almost 50% below what was recorded on Sunday. This is understandable given that the majority of the market crash had happened in the late hours of Sunday, thus causing investors to want to move their funds.

Total market cap below $1 trillion | Source: Crypto Total Market Cap on TradingView.com

To put this in perspective, Sunday had seen $6.5 billion worth of bitcoin flow into centralized exchanges, while Ethereum’s numbers had clocked as high as $3.7 billion in the same time period.

Weekly On-Chain Exchange Flow

Weekly On-Chain Exchange Flow  #Bitcoin $BTC

#Bitcoin $BTC $6.5B in

$6.5B in $6.5B out

$6.5B out Net flow: -$9.9M#Ethereum $ETH

Net flow: -$9.9M#Ethereum $ETH $3.7B in

$3.7B in $3.5B out

$3.5B out Net flow: +$181.6M#Tether (ERC20) $USDT

Net flow: +$181.6M#Tether (ERC20) $USDT $3.5B in

$3.5B in $3.2B out

$3.2B out Net flow: +$339.4Mhttps://t.co/dk2HbGwhVw

Net flow: +$339.4Mhttps://t.co/dk2HbGwhVw

— glassnode alerts (@glassnodealerts) June 13, 2022

Tether Outflows Says No Accumulation

Tether is the largest of the stablecoins and possesses the largest range of crypto trading pairs that are present in the market. Its inflow and outflow trend has often helped to know if crypto investors were looking to purchase coins or were in fact dumping their coins.

Related Reading | Bitcoin Drops To 18-Months Lows, Has The Market Seen The Worst Of It?

The Tether inflows and outflows for the last two days show that instead of trying to accumulate, investors are heading for the safety provided by these stablecoins. On Sunday, USDT inflows were slightly above outflows, which does not spell good news for the crypto market. This trend has now continued as the last 24 hours have now seen inflows matching outflows.

What this indicates is that investors are not buying up bitcoin or Ethereum. Rather, they are converting their cryptocurrencies into stablecoins to escape the extreme volatility of the current market.

Featured image from Forbes India, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

With the market in turmoil, digital assets such as Bitcoin and Ethereum are seeing their prices challenged in ways that have sent shivers down the spines of investors. The downtrend had triggered massive sell-offs that had sent prices towards yearly lows. Despite the volume already being sold off, sellers look to not be done yet. This is evidenced by the volume of Bitcoin and Ethereum that has been making its way to centralized exchanges recently.

Bitcoin, Ethereum Rocked By Inflows

The inflows had been growing steadily recently and given the volume that has been going into exchanges, this growth is alarming. Top coins Bitcoin and Ethereum usually hold up best when it comes to markets like this, and though they have held up, investors seem unconvinced that they would continue to do so. This is one of the reasons why the inflows have been massive.

Data shows that more than $1.4 billion worth of Bitcoin has flowed into centralized exchanges in the last 24 hours alone. Although this is a decline from the previous day when $1.7 billion in BTC had been moved into exchanges, it significantly surpassed the outflow rate compared to the previous day.

Related Reading | How The Tether Peg Could Predict Raging Bitcoin Volatility

Outflows for bitcoin for the last 24 hours came out to $1.2 billion. What this led to was a positive net flow of $233 million.

Ethereum was not left out of this either. If anything, the second-largest cryptocurrency by market cap has been worse hit by exchange inflows. For the previous day, its inflows had touched $569 million. But unlike Bitcoin, it did not record enough outflows to offset this figure.

BTC continues downtrend | Source: BTCUSD on TradingView.com

This would continue into the Wednesday market which saw $658.2 million flowing into centralized exchanges. In the same time period, there was $651.1 million flowing out of the exchanges, which left a positive network of $7.2 million.

USDT Outflows Spell Selling

One way to indicate if investors are selling or buying Bitcoin, Ethereum, and other digital assets is through the stablecoin inflow, and lately, this flow rate has been anything but encouraging. Tuesday saw $1.1 billion USDT flowing into exchanges, marking a significant figure but the outflows came out higher. In total, there was $1.7 billion in USDT leaving exchanges, resulting in a negative $612.1 million net flow.

Related Reading | Funding Rates Fall To Yearly Lows Following Bitcoin’s Fall Below $29,000

What metrics like this show is that investors are likely turning their volatile cryptocurrencies into these stablecoins and moving them out of the exchanges for safekeeping. Mostly to provide shelter from a highly volatile market.

Nevertheless, the USDT volumes from the last 24 hours are beginning to paint a slightly better picture. While outflows had reached as high as $738.5 million for the past day, inflows were $871.4 million, a positive net flow of $132.9 million. If this trend continues, then the current selling trend could well be turned around into a buyer’s that would hopefully trigger a recovery in the market.

Daily On-Chain Exchange Flow#Bitcoin $BTC

Daily On-Chain Exchange Flow#Bitcoin $BTC $1.4B in

$1.4B in $1.2B out

$1.2B out Net flow: +$223.0M#Ethereum $ETH

Net flow: +$223.0M#Ethereum $ETH $658.2M in

$658.2M in $651.1M out

$651.1M out Net flow: +$7.2M#Tether (ERC20) $USDT

Net flow: +$7.2M#Tether (ERC20) $USDT $871.4M in

$871.4M in $738.5M out

$738.5M out Net flow: +$132.9Mhttps://t.co/dk2HbGwhVw

Net flow: +$132.9Mhttps://t.co/dk2HbGwhVw

— glassnode alerts (@glassnodealerts) May 19, 2022

Featured image from News Central TV, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

The market continues to be in disarray as the price of bitcoin has now fallen to the low $30,000s. This had been preceded by declining faith in the market thus translating to fewer inflows/more outflows in the last couple of weeks. However, with the price now at the lowest, it has been this year, institutional sentiment towards the digital asset has changed and this has resulted in significant inflows into the digital asset for the first time in weeks.

$45 Million Flows Into Bitcoin

Bitcoin has now seen inflows following several weeks of outflows. The past week has proven to be good for the pioneer cryptocurrency which saw inflows as high as $45 million. It is a complete turnaround from the institutional investor side which has been pulling money out of the digital asset to presumably put towards their altcoin portfolios.

Related Reading | Bitcoin Exchange Inflows Hit Three-Month High As Market Braces For More Downside

Naturally, these institutional investors had been pulling out when indicators had been pointing towards a bear market, and have now returned to take their share of the pie with bitcoin trading at low prices. It marks the return of positive sentiment among these investors.

Short Bitcoin also followed this same trend and has ridden the wave into its second-largest weekly inflows on record. The past week saw $4 million total flow into Short Bitcoin which has now brought its total asset under management (AuM) to a new high of $45 million.

BTC struggles to find support above $31,000 | Source: BTCUSD on TradingView.com

Other digital asset investment products were not left out of the inflow galore. This time around, there was a total of $40 million flowing into digital asset investment products in a surprising turnaround.

Altcoins were not left out of this though even though outflows were more dominant for last week. However, Solana would break away from the mold in this regard to be the only altcoin that recorded any significant inflows with $1.9 million flowing into the Digital asset.

As for other altcoins, the outflows continue as negative sentiment continues to rock the cryptocurrency. It saw $12.5 million leave the digital asset in the one-week period. So far, 0.8% of the total Ethereum AuM has left the digital asset as its year-to-date outflows have now reached $207 million.

Related Reading | Bitcoin Price Crashes Below $30K As Markets Show Signs Of Paranoia

The inflows and outflows remained inconsistent across various market regions. The CoinShares reports show that investment products in the North American markets had recorded $66 million. Across the pond in Europe, outflows dominated with a total of $26 million leaving digital asset investment products in the region.

Nonetheless, the new trend of inflows coming into assets like Bitcoin and Solana prove that institutional investments had come out of the woodwork to take advantage of the price weakness that had been displayed in the market. This price weakness continues with bitcoin still struggling to establish a support level above the $31,000 price range.

Featured image from Investopedia, chart from TradingView.com

With the price of bitcoin still trading below $40,000, institutional inflows into the digital asset have slowed significantly. This has now flowed into other digital assets in the space. But what is most significant is the outflow rate which has neared one-year lows.

Bitcoin Outflows Grows

For the past couple of weeks, the rate at which institutional investors have been pulling money out of bitcoin has been on an accelerated timeline. This is what has culminated in the outflows that were recorded for the digital asset last week.

In the space of a week alone, bitcoin had seen the majority of outflows from the market, which had come out to $120 million for the past week. These outflows had put it dangerously close to its one-year outflow record that was set back in June 2021, at $133 million leaving the digital asset.

Related Reading | ADA On Discount? Cardano Whales Go On $200M Shopping Spree

It was not the only asset to suffer outflows for the week though. Blockchain equities that had mainly been resistant to the outflow trend had finally succumbed. It had seen a total of $27 million left as negative sentiment continues to grow among institutional investors.

Ethereum also continued the outflow trend. A total of $25 million had left the digital asset, bringing its year-to-date outflows to $194 million.

BTC trending at $38,000 | Source: BTCUSD on TradingView.com

This marks the 4th consecutive week of outflows in the market. It now sits at a total of $339 million that has left the market in this 4-week period. It also reflects a generally bearish sentiment that is being felt across the market as the Fear & Greed Index had dived into the extreme fear territory.

Despite this overwhelming negative sentiment, not every digital asset in the space had suffered the same fate. FTX Token came out as the unlikely winner of the week by bringing in the largest inflows. The digital asset spearheaded the inflow trend with a total of $38 million moving into the asset last week.

Related Reading | Experts Say Ethereum Will Grow 100% To Hit $5,783 By Year-End

Other large altcoins mainly followed this trend through with big players such as Terra and Fantom. Although these digital assets had not done nearly as well as FTX Token but had seen inflows regardless. It had come out to $0.39 million and $0.25 million recorded respectively for both.

Bitcoin still remains an investor favorite despite the inflows though. It continues to hold steady at the $36,000 to $38,000 support level. Its price had briefly recovered above $39,000 in the early hours of Wednesday before declining to be trading at $38,935 at the time of this writing.

Featured image from MARCA, chart from TradingView.com

Ethereum has now cemented its position above the hard-won $3,000 level. This signals another bull rally for the digital asset given how the market has responded to its recent surge. More money is coming into the digital asset daily as investors clamor to take part in the gains. This is evidenced by the exchange inflows and outflows, which show a clear buy and accumulate trend on the part of these investors.

Ethereum Outflows Grow

For the past week, Ethereum, like its counterpart Bitcoin, has been on an outflow trend. This trend saw more of the digital asset leaving exchanges than have been coming in. Glassnode Alerts makes daily reports of exchange inflows and outflows, showing that Ethereum investors are choosing to remove their coins off exchanges, presumably to safer, personal wallets.

Related Reading | Malice Or Ignorance? The New York Times Keeps Printing Lies About Bitcoin Mining

In the one-week time frame, daily exchange outflows had consistently been above that of inflows. In total, there was a total of $5 billion worth of Ethereum that were moved into exchanges in one week. Compared to this is outflows, which came out at $6 billion in total leaving exchanges. This translates to 20% more ETH leaving exchanges than those being moved in to be too sold.

Weekly On-Chain Exchange Flow

Weekly On-Chain Exchange Flow  #Bitcoin $BTC

#Bitcoin $BTC $7.3B in

$7.3B in $7.7B out

$7.7B out Net flow: -$474.3M#Ethereum $ETH

Net flow: -$474.3M#Ethereum $ETH $5.0B in

$5.0B in $6.0B out

$6.0B out Net flow: -$1.1B#Tether (ERC20) $USDT

Net flow: -$1.1B#Tether (ERC20) $USDT $5.6B in

$5.6B in $4.9B out

$4.9B out Net flow: +$722.7Mhttps://t.co/dk2HbGwhVw

Net flow: +$722.7Mhttps://t.co/dk2HbGwhVw

— glassnode alerts (@glassnodealerts) March 28, 2022

It shows that investors have been accumulating their tokens over the past week. However, there has been a break in this streak recently. As markets open on Monday, ETH has seen this accumulation trend turn.

Glassnode Alerts reported in the early hours of Monday that exchange inflows had topped that out of outflows. On the daily chart, exchanges saw $441 million worth of ETH flow in, while only $418 million of ETH flowed out, recording a net flow of +$22.8 million.

There is no telling if this is the new trend as it is too early to tell. However, this makes sense given that investors who have been holding through the period of consolidation would want to realize some profits given that the price is up significantly.

ETH On The Charts

As expected, Ethereum has had one of the best runs out the weekend rally. The digital asset which had been struggling to hold above $3,000 finally got the boost it needs to shed the impacts of the bears. This pushed it high with a soft landing above $3,300.

ETH breaks above $3,300 | Source: ETHUSD on TradingView.com

With this recent move, trends for the digital asset in the short term have all turned bullish. Buy pressure has cranked up to 92% on investors as the cryptocurrency prepares to test the next significant resistance which lies above $3,500.

Related Reading | TA: Ethereum Gains Traction, A Strengthening Case For More Gains

At the time of this writing, Ethereum is trading $3,324 with a market cap of almost $400 billion.

Featured image from Admiral Markets, chart from TradingView.com

Bitcoin and the crypto market at large had suffered outflows that coincided with the massive sell-offs that rocked the market. This contributed to the downtrend that saw bitcoin touch towards six-month lows while investors who had gotten into the market later suffered massive losses. This outflow trend is beginning to reverse so as bitcoin and other digital assets begin to record inflows after a long drought.

Bitcoin Inflows Back Up

The past week for bitcoin has been an encouraging one. The digital asset is nowhere near its previous highs but had managed to recover from its recent lows. It had run up to $38,000 once again, reinstating some level of faith back in the market. On the institutional investors’ side, this trend, albeit a bit slower, is the same as investors begin to gradually move back into the cryptocurrency.

Related Reading | Bitcoin Funding Rates Remain Negative For More Than A Week

In the latest CoinShares report, we see that bitcoin has begun to record market inflows once more. This is a deviation from the end of 2021 and the beginning of 2022 where outflows reached record highs. Greatly impacted by the minutes released by the Fed, bitcoin alone had recorded outflows to the tune of $107 million in a single week, setting a new record.

BTC recovers from market crash | Source: BTCUSD on TradingView.com

However, in the past two weeks, the tide is turning towards inflows as CoinShares reported the first week of inflows after massive outflows. This past week continues to mirror this trend as inflows have continued.

Inflows to bitcoin were reported to total $22 million for last week. A small number compared to what had become the norm by the third quarter of 2021, but a reassuring figure nonetheless. It’s a step up from last week when BTC’s total AuM crashed to a six-month low of $29 billion.

Altcoins Continue To Suffer

Altcoins have not mirrored this movement of bitcoin this time around. Instead, altcoins continue to bear the brunt of the market onslaught as outflows continue to be the order of the day.

Leading altcoin Ethereum has now marked its 8th consecutive week of inflows. In this time period, the altcoin has seen a total of $272 million flow out of the week, marking some of the highest negative sentiment towards the digital asset.

Related Reading | The Uber Rich Investors Are Picking This Altcoin Over Bitcoin

Other altcoins like Cardano, Solana, and Polkadot, which are fast-becoming investor favorites, did not fare well for the week either. All of these digital assets saw another week of outflows.

Multi-asset funds and Blockchain equity investment products deviated from the performance of altcoins. Following in the footsteps of bitcoin, each of them recorded inflows for the week, $32 million for multi-asset funds, and $15 million for Blockchain equity investment products.

Featured image from Bitcoin News, chart from TradingView.com

Bitcoin dropped below $60,000 on Sunday after new all-time highs, but stablecoin inflows show this is not a big concern.