Injective (INJ) may be on the brink of a potential price surge following a recent wave of accumulation by crypto whales. This would undoubtedly be a much-needed relief for the INJ token, which has dipped significantly in the last seven days.

Crypto Whales Buy $24.8 Million Worth Of INJ

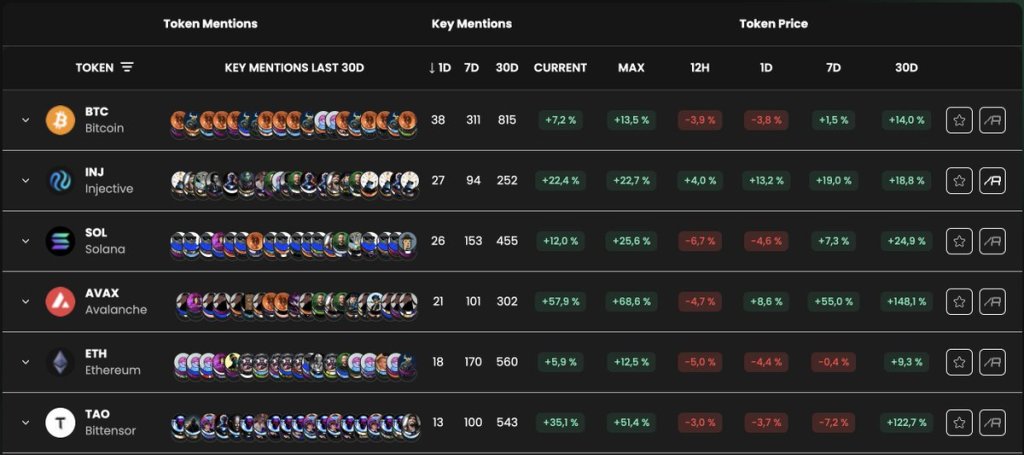

Data from the market intelligence platform Santiment shows that Whale Addresses recently bought $24.8 million worth of INJ, bringing their total holdings to 10.69 million INJ. This purchase is significant considering the impact that crypto whales have on the market. As such, a purchase of such magnitude could provide a much-needed boost to INJ’s price.

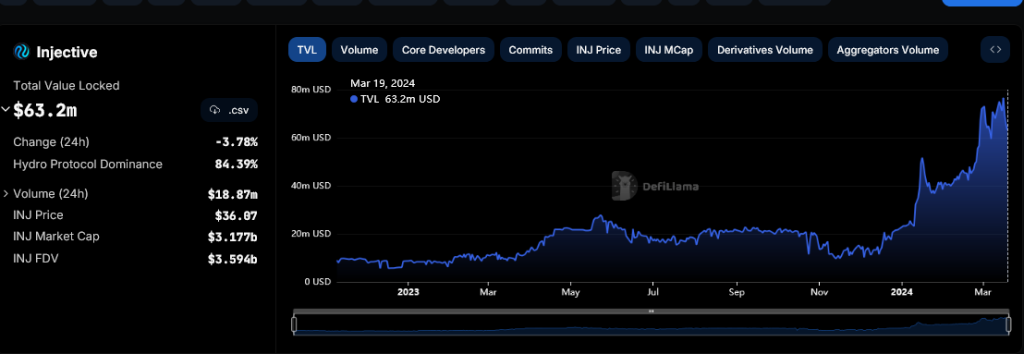

Injective, like the broader crypto market, has been on a steady decline over the last week, dropping by over 14% during that period. The crypto token has also suffered a reversal of fortune, as it currently has a year-to-date (YTD) decline of over 9%. That is shocking for a token that enjoyed a 3000% gain in 2023 and even outperformed Solana (SOL), whose rally was one of last year’s major talking points.

However, a major correction like this was expected for INJ’s price, which enjoyed a sustained rally last year, suggesting it was possibly overbought at some point. A price decline like this one is necessary for the crypto token to once again establish itself and make another move to the upside.

Injective Could Follow Solana’s Trajectory

Crypto analyst Crypto Dona recently suggested that Injective could follow a similar path to SOL’s price action in 2021. Back then, SOL is said to have been stuck between the $20 and $40 price range for more than 100 days. However, just when everyone was about to give up on SOL, it went on a massive run and saw a ten times increase in its price.

The crypto analyst expects something similar to happen with INJ’s price, stating that a 10x might be around the corner. Injective, being an AI (artificial intelligence) coin, is also likely to keep attracting much attention heading into the latter stages of this bull run. That could reflect positively on its price since more liquidity will flow into its ecosystem.

The recent purchase by these crypto whales also underlines the bullish sentiment toward the crypto token despite its current unimpressive price action. Members of the INJ community have also expressed optimism about the token’s future trajectory, with Crypto Dona, in particular, stating that its price is still going to three digits.

At the time of writing, INJ is trading around $32, down over 5% in the last 24 hours according to data from CoinMarketCap.