Renowned crypto analyst Lark Davis recently shared insights into the world of altcoin and decentralized finance (DeFi), offering high-risk, high-reward options and established projects.

During a live stream, Davis discussed his current portfolio holdings, while emphasizing the volatility inherent in these markets.

High-Risk Ventures Altcoin And Established DeFi Projects

During his discussion, Davis advised against investing in Bitcoin SV (BSV), expressing doubts about Craig Wright’s claim to be Satoshi Nakamoto. He emphasized the importance of doing thorough research before investing in cryptocurrencies.

Additionally, he mentioned Bitcoin Cash (BCH) as a potential candidate for the next ETF approval in the US due to its slight variations from Bitcoin.

Regarding altcoins and DeFi, Davis highlighted different projects in his portfolio, including “Puff, Benji, and Foxy,” which he categorized as “high-risk, high-reward ventures.” Davis also mentioned DeFi projects like “Jup and Arrow,” which are known for their governance features and staking rewards.

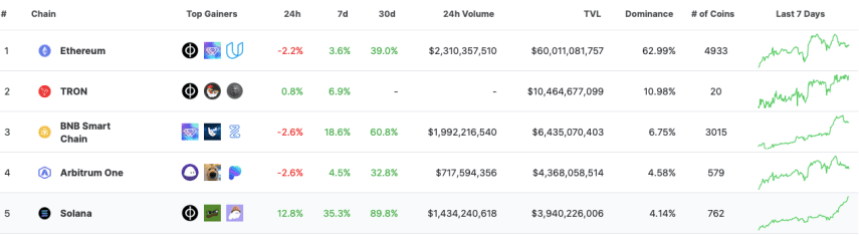

Furthermore, Davis discussed projects with considerable potential for growth, such as Solana, Trader Joe, and Mantle. However, he emphasized these investments’ volatile nature and recommended that viewers approach them cautiously.

In addition to Davis’s insights, Solana has recently become the fourth-largest cryptocurrency by market capitalization, surpassing XRP and Dogecoin. With a market cap of $68.7 billion and a price of $154.66 at the time of writing, Solana’s rise reflects growing interest in the project.

Analysts’ Perspectives On Altcoins

Meanwhile, analysts offer contrasting views on the future of altcoins. Altcoin Sherpa suggests that these alternative tokens may stagnate for 1-4 months, needing time to consolidate after a significant run.

It’s quite possible that altcoins are done for the next 1-4 months. There are certainly going to be outliers but I think that the majority need time to chill out and consolidate after such a big run.

The scary thing is that many alts didn’t even run that hard over the last few… pic.twitter.com/sGke8PT5yw

— Altcoin Sherpa (@AltcoinSherpa) April 16, 2024

However, Crypto Jelle presents an opposite outlook, suggesting that altcoins could rally massively in the coming months.

Crypto Jelle points to historical patterns, noting that altcoins typically consolidate after breaking out from a resistance zone before entering a new bull run. If history repeats itself, altcoins could demonstrate significant growth potential shortly.

It’s about time for #Altcoins to remind everyone what they’re capable of.

Looks primed to go on a massive rally in the coming months.

I’m ready. pic.twitter.com/qru4GksczF

— Jelle (@CryptoJelleNL) April 12, 2024

Featured image from Unspalsh, Chart from TradingView

Wen

Wen

(@weremeow)

(@weremeow)