The Kaspa (KAS) blockchain is a decentralized, open-source, and scalable Layer-1 solution often referred to as “Bitcoin 2.0” or “the next Bitcoin.” However, Kaspa is unique in its own way despite functioning very similarly to Bitcoin. Just like Bitcoin, Kaspa is a proof of work (PoW) cryptocurrency, but unlike other traditional blockchains, Kaspa implemented the GHOSTDAG protocol.

This protocol is unique in the fact that it does not have orphan blocks created in parallel. Rather, it allows them to coexist and orders them in consensus. This makes Kaspa the first of its kind to do this, with the blockDAG (Block Directed Acyclic Graph) protocol being a generalization of Nakamoto’s consensus.

The Founder And The Team Behind The Kaspa (KAS) Network

The founder of Kaspa is Yonatan Sompolinsky, a Ph.D. in Computer Science at Havard University and a member of the Maximal extractable value (MEV) research team. He was also in Ethereum’s whitepaper and rumored to be in Ripple’s whitepaper as well.

Sompolinsky had direct input in creating Ethereum’s technology design, having designed the GHOSTDAG protocol earlier. Interestingly, the founder’s 2013 paper on the GHOSTDAG protocol is cited in Ethereum’s whitepaper.

The development team is made up of very talented individuals such as Cryptography Researcher Elichai Turkel, Doctoral student Shai Wyborski, Developer Ori Newman, Master of Computer Science Michael Sutton, and Developer Mike Zak. They have all contributed to the implementation and ongoing development of the Kaspa blockchain network.

Differences And Similarities Between Kaspa (KAS) And Bitcoin (BTC)

At the very base of its technology, Kaspa is very similar to the Bitcoin network in the way it’s structured. Some of these similarities are outlined below:

- Utility: Bitcoin is a Layer 1 blockchain solution that functions as a store of value, often referred to as digital gold, functioning as a peer-to-peer cryptocurrency. Likewise, Kaspa is a Layer 1 solution purported to be a store of value and functioning as peer-to-peer cash.

Related Reading: What Are The Top 8 DeFi And Web3 Wallets To Use In Crypto?

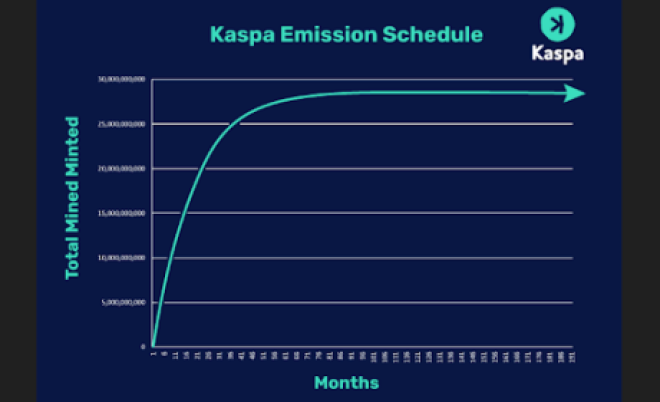

- Limited Total supply: Bitcoin has a maximum total supply of 21 million BTC to be ever mined, meaning new coins can never be created after all of these coins are mined. In a similar fashion, Kaspa has a maximum total supply of 28.7 billion coins, with a little over 22.5 billion in circulation.

- Halving Events: Both Kaspa and Bitcoin undergo halving, which slashes the block rewards for miners in half. However, while Bitcoin undergoes a halving event every four years, Kaspa uses a Chromatic Halving Schedule, “meaning that rewards smoothly decrease every month in a quantitative manner that results in a 50% emission reduction per annum,” according to its website.

- Decentralization/Proof of work: Both blockchains employ a decentralized proof of work mechanism, meaning that the network is secured by miners who solve complex mathematical equations to mine blocks and confirm transactions. Unfortunately, this also means that both networks are energy-intensive and require a lot of power to run.

One major difference between both networks is that Kaspa solves the issue of scalability that continues to plague Bitcoin. This means that while both networks use a proof of work mechanism, Kaspa is able to carry out transactions at a faster rate as well as cheaper fees.

How Does Kaspa The Blockchain Solve Trilemma Issues?

The Blockchain Trilemma refers to the three critical aspects of blockchain technology, which are security, scalability, and decentralization. This trilemma continues to plague leading blockchains such as Bitcoin and Ethereum, and they continue to battle these issues. This is because, in order to ensure security and decentralization, something had to give, and in both cases, it was scalability.

However, Kaspa, on the other hand, is one of the few blockchains to solve the blockchain trilemma, as it is decentralized, scalable, and secured. It solves the blockchain trilemma issues through its integration of proof of work (PoW) and the blockDAG structure.

How Does The Kaspa GhostDAG Protocol Work?

Most blockchains that digitally process transactions do so in the form of blocks, hence the name blockchain. Kaspa, however, deviates from this because it does not store digital transactions in blocks. Instead, it does so using a complex mathematical structure called a DAG (Directed Acyclic Graph).

In a DAG (Directed Acyclic Graph), vertices are present instead of blocks. So, instead of referring to different units as forming blocks, each different vertice forms edges when connected to each other. The blockchain then relies on present transactions to validate and confirm transactions that come after it.

Kaspa does not discard previous blocks of information; therefore, it is more secure and scalable. Its mining relies on kHeavyHash, which is a form of optical mining algorithm that is energy efficient and works well with mining equipment such as FPGAs and GPUs.

Prominent Features Of Kaspa (KAS)

Efficient Proof of Wook: Kaspa is a one-of-a-kind blockchain that has managed to maintain its Proof of Work mechanism while also solving the blockchain trilemma. To put this in perspective, blockchains such as Ethereum have had to move from Proof of Work (PoW) to Proof of Stake (PoS) in an effort to solve their scalability issues and make them faster.

However, since Kaspa already solved the blockchain trilemma, this makes it highly scalable while maintaining a truly decentralized system. Its utilization of the optical-mining-ready kHeavyHash algorithm also helps to ensure the consensus and security of the network.

Instant Transaction Confirmation: Kaspa was designed to be cheaper and faster than Bitcoin, where full confirmation of a transaction takes an average of 10 seconds, with each transaction visible to the network in one second. This is significant when compared to Bitcoin, which takes an average of 10 minutes to confirm a transaction.

Security: When it comes to security, Kaspa did not just employ the same security principles and methodology as Bitcoin, it took it a step further as it replaced the SHA-256 PoW encryption with kHeavyHash, while inheriting all the security properties of SHA-256. Thus, its network is still secured by a robust network of decentralized volunteers (miners) who validate and sign transactions just like Bitcoin.

Cheaper Fees: Not only does the Kaspa Blockchain network confirm transactions fast, but it is also significantly cheaper than Bitcoin. This is because the blockDAG network generates multiple blocks every second for posting transactions to the ledger, whereas Bitcoin generates one block every 10 minutes. Transaction fees on Kaspa cost less than a cent, while transaction fees on Bitcoin cost an average of $4 at the time of this publication.

Scalability: Kaspa solves scalability issues with its blockDAG network’s ability to generate and confirm multiple blocks per second, as mentioned above. But perhaps the most interesting part of what Kaspa does is that it is able to confirm so many blocks (vertices) per second without altering or giving up its decentralized nature.

What Is KAS Coin And What Are Its Uses?

KAS coin is the native token of the Kaspa blockchain, whose main objective is to power the whole network. It is used to pay for transaction fees and other forms of developer’s fees, and it is also used as an incentive to reward miners. Its block rates are rapid and promise swift rewards, as well as offering profitable mining with lower hash rate requirements compared to Bitcoin.

The Tokenomics of Kaspa (KAS)

Kaspa’s native cryptocurrency, KAS, has a maximum or total supply of 28.7 billion coins that are not pre-mined. This means all of the tokens in circulation have been free-mined by miners on the blockchain. It has a circulating supply of 22.5 billion at the time of publication, and estimates are that with the current halving model, the last KAS coin will be mined in 2037.

The Kaspa network utilizes an open crowdfunding and voting governance model, which means that KAS holders can contribute to the network for development, marketing initiatives, education, etc.

This sense of shared responsibility and ownership motivates the community to come together and work toward collective goals.

KAS Price History And Progress

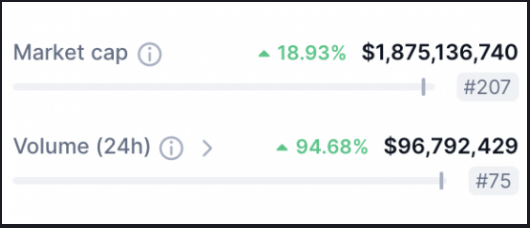

Kaspa launched its mainnet along with its token two years ago, on November 7, 2021. Initially, the price of its native token, KAS, remained stagnant until July 2022, when it pumped from $0.0001840 to $0.0005890. It then traded sideways for months before going on another rally, triggering a 694% increase in price.

Following this, the KAS price rose to almost $0.01 per coin in just a year after its launch in November 2022. The price dipped a bit and started off trading 2023 with $0.005278 per coin. KAS would then go on to hit a new all-time high of $0.154 in November 2023, exactly two years from the month it launched.

Kaspa (KAS) is up 61,331% since its all-time low of $0.00017105 on May 26, 2022, according to Coingecko. This is significant because the surge to its new all-time highs took place during a bitter bear market, causing the coin to outperform the rest of the crypto market.

This immense growth in such a short time has led to some of Kaspa’s investors referring to it as ‘Bitcoin 2.0’ or ‘The next Bitcoin.’ Its similarities with Bitcoin have also fueled the belief that it is the next Bitcoin. With a market cap of $2.38 billion, Kaspa is currently the 38th-largest cryptocurrency in the space and the 7th-largest Proof of Work (PoW) blockchain.

Conclusion

Kaspa (KAS) solving the blockchain trilemma with the ability to be scalable and still be decentralized gives it an edge over blockchains such as Bitcoin. Its native KAS coin also has important use cases like powering the entire Kaspa blockchain protocol and being used for transaction fees. This ensures that the coin is always in demand as the Kaspa network usage grows.

Additionally, features like fast transactions, top-notch security due to its encryption with kHeavyHash, and a robust network of decentralized volunteers (miners) who validate and sign transactions make it an appealing choice for investors looking for an alternative to Bitcoin while enjoying the security and decentralization of Bitcoin.