The Kenyan president announced the talks at an American business summit in Nairobi attended by the U.S. commerce secretary.

Cryptocurrency Financial News

The Kenyan president announced the talks at an American business summit in Nairobi attended by the U.S. commerce secretary.

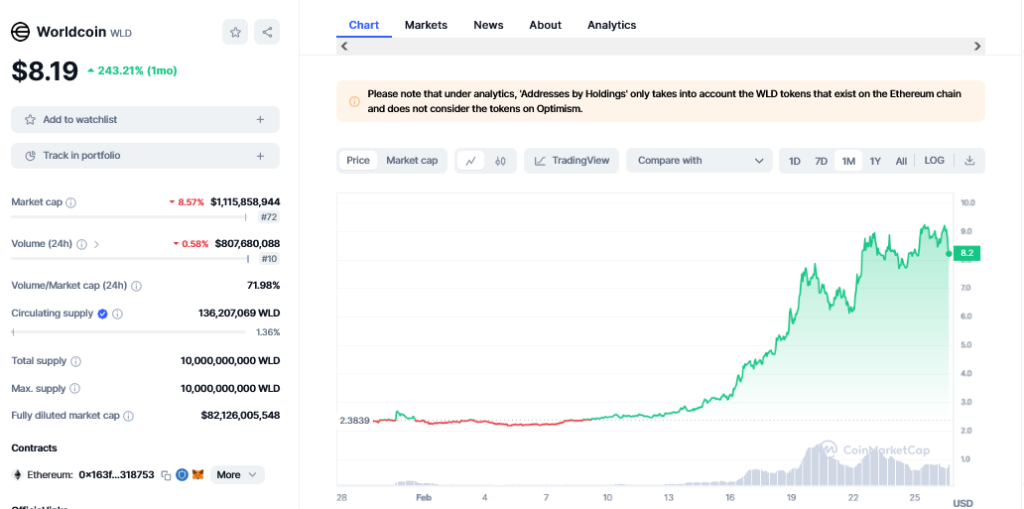

One analyst on X is concerned about the long-term sustainability of Worldcoin (WLD), a project aiming to build a universal digital identity system. While acknowledging the project’s innovative approach and recent upswing that has seen WLD more than 4X, the analyst thinks “Worldcoin will end in tears.”

In a post, the analyst points to a significant discrepancy between Worldcoin’s fully diluted valuation (FDV) of $82.1 billion and its current market capitalization of around $1.1 billion, as seen from CoinMarketCap. To compare, Ethereum (ETH), the most valuable altcoin, has an FDV of $369 billion, slightly less than the current market cap of around $362.1 billion.

The FDV shows the hypothetical market cap if all coins or tokens were in circulation. On the other hand, the market cap shows the total valuation of coins in circulation.

Typically, the higher the FDV, the higher the chance of the coins in circulation being diluted when locked assets are released. Prices will likely take a hit with the deluge of coins hitting the secondary markets. The sell-off would especially be intense if demand doesn’t increase proportionally.

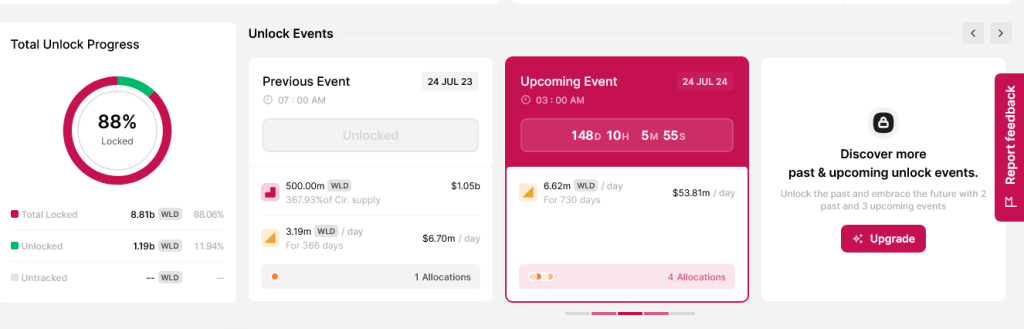

In Worldcoin’s case, the massive difference between FDV and the current market cap portends possible price dumps should a considerable chunk of WLD be released. And this will likely be the case, especially in light of what’s expected in the coming weeks.

A breakdown of its tokenomics shows that besides coins airdropped to users, a big chunk was allocated to venture capital firms and individuals like Alameda Research and Three Arrows Capital (3AC). Token Unlocks data show that more WLD will be unlocked in less than five months. The release, observers note, could heap pressure on the coin, possibly pushing it lower from the current valuation.

Worldcoin plans to release a universal digital identity system. This solution will run on the blockchain and, to a small degree, rely on artificial intelligence (AI). Although the project faced regulatory challenges in multiple countries, including Kenya, Worldcoin recently expanded into Singapore.

Even so, the analyst is concerned that the lack of demand-side drivers, specifically adoption, could slow down the uptrend. WLD is in a sharp uptrend, looking at the development in the daily chart.

If the coin stays above $6, WLD could soar in the coming sessions.

The Capital Markets (Amendment) Bill will now be introduced to the lower chamber of the Kenyan parliament.

Kenya might become the first country in the world where the industry’s representatives would develop the regulatory framework for crypto.

The Kenyan government plans to roll out its digital identification system in December 2023 after the testing period, which will take a couple of months.

The committee’s recommendations included having the Kenyan government consider implementing a comprehensive framework for digital assets and virtual asset service providers.

The Kenyan government has set up a 17-member committee to investigate the operations of American-based cryptocurrency firm Worldcoin, due to its collection of biometric data not satisfying Kenya’s data privacy laws of the country.

The process requires a user to give his iris scans in exchange for a digital ID known as global ID and get free Worldcoin tokens as part of plans to create a new identity and financial network, and the Kenyan government saw this as a security risk.

Kenya’s National Assembly Speaker Rt Hon. (Dr.) Moses Wetang’ula, has ordered the Joint Ad Hoc Committee to investigate the activities of Worldcoin and report back to the House within 42 days.

The Joint Ad-hoc Committee’s investigations on Worldcoin kicked off on Monday after the movement was set afoot following a meeting to outline its Terms of Reference, and to determine potential experts and witnesses to appear before the legislators during its investigation.

Gabriel Tongoyo, head of the 17-member committee, stated that the potential experts and witnesses to appear before the legislators will include The Governor of the Central Bank of Kenya, the Cabinet Secretary for the National Treasury, The National Intelligence Service (NIS), the Directorate of Criminal Investigations (DCI), and the Ministry of Health.

These experts and witnesses will have to enlighten the legislators on the relationship between Worldcoin and crypto trading in Kenya, and the potential health hazards resulting from the reported iris scans.

Also, the office of the Attorney General, the Registrar of Companies, and the Data Commissioner are expected to answer MP Gabriel Tongoyo’s questions on the legal framework of the operations of Worldcoin in Kenya. This is to ensure that due diligence was taken in the registration process of Worldcoin in Kenya.

The committee has been given this very limited time to provide all the answers needed by the Legislators, as local media have reported that more than 350,000 Kenyans have signed up for Worldcoin in exchange for a free $49 worth of WLD tokens valued at 7,000 Kenyan shillings before the operation was suspended.

Worldcoin’s collection of biometrics data in exchange for its tokens reportedly failed to meet regulatory requirements in Kenya due to the requirement that disclosure of personal information should only be done in critical circumstances.

Immaculate Kassait, the Data Commissioner for Kenya stated that Worldcoin had not been upfront about its objectives during the registration process.

The Kenyan Capital Markets Authority also indicated that Worldcoin’s activities in the country were carried out without regulatory supervision, and this led to skepticism among the citizens in sharing their data with Worldcoin.

Due to this, the Interior Cabinet Secretary Kithure Kindiki gave the order to suspend every operation of Worldcoin in the country because of security concerns. Eliud Owalo, the digital counterpart of Kithure Kindiki, has also shared a few warnings about Worldcoin.

According to recent reports, a raid on Worldcoin’s facility in Nairobi was carried out two weeks ago by the Kenyan police, leading to the seizure of documents and equipment from the facility for the purpose of accessing the data that has been collected by Worldcoin so that proper investigations can be conducted.

However, Worldcoin stated that the company was willing to work with the authorities and outlined how it would restart its operations following the implementation of crowd-control measures.

The controversial crypto project’s launch has been marred into controversy and it’s already facing investigations in nearly half a dozen countries.

Kenyan police raided Worldcoin’s Nairobi warehouse and confiscated documents and machines on Saturday.

Kenya’s data watchdog found Worldcoin is compliant with its data protection laws, but has now find different problems with Sam Altman’s project.

Kenyan authorities want to make sure that Worldcoin poses no risks to the security of citizens before it allows the project to gather iris data.

Kenya is the first country to fully suspend Worldcoin operations. Data protection offices in Europe have started investigations.

Blockchains’ tracing capacities can help certify that crops weren’t grown by razing woodlands or harvested with child labor.

The law will officially enter into force at a date determined by Namibia’s Ministry of Finance.

The central bank released its statement in response to comments on a CBDC discussion paper published in February 2022.

The allure of the CBDC is fading and issuing one “may not be a compelling priority,” the bank said.

The blockchain and Web3 hub will serve as a center for knowledge exchange and collaboration between technology firms and government entities in Africa.

A bill introduced in Kenya could see a tax added to cryptocurrency and NFT transfers and has been met with a mixed reaction online.

Kenya’s Finance Ministry, the National Treasury, has proposed a 3% tax on the transfer of digital assets for the coming budget year.

Africa witnessed a 429% YoY increase in venture funding in 2022, with the majority of funding coming from Seychelles and South Africa.