South Korea’s local media, Newsis, recently reported the case of certain crypto traders who had sent about $3 billion overseas in a bid to profit from the ‘Kimichi Premium.’ Interestingly, the court found 14 out of 16 of these traders not guilty despite their alleged actions.

How This Group Of Crypto Traders Operated

These crypto traders are said to have sent these sums of money through local banks under the guise of these transactions being foreign exchange remittances. However, this was allegedly not the case, as they would then use the funds to purchase virtual currencies abroad and send those crypto assets back to domestic exchanges, where they eventually offload them.

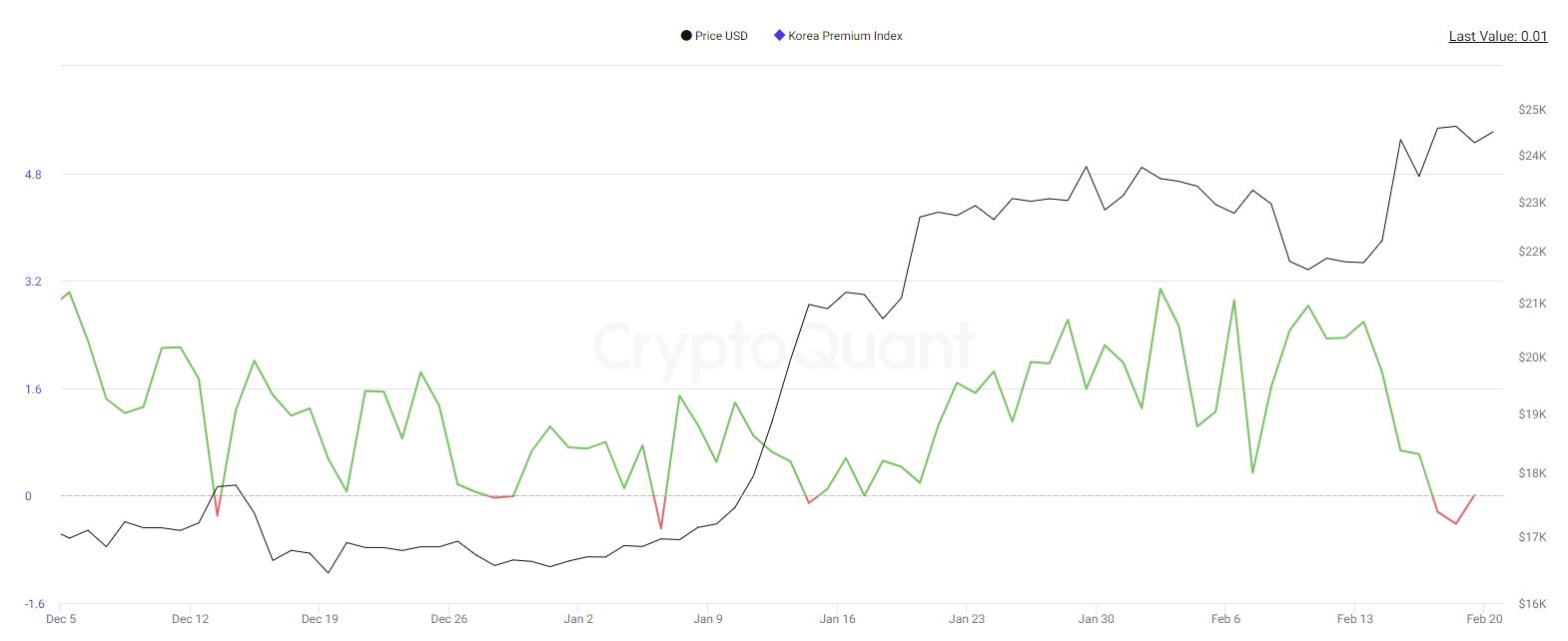

This was done to allegedly profit from the ‘Kimichi Premium.’ This phenomenon occurs when crypto assets are more expensive in South Korea than overseas due to the country’s particular regulations.

This has created an arbitrage opportunity that crypto traders have sought to exploit. Meanwhile, the Korean government has tried to prevent traders from doing so.

That is why the prosecution charged 16 people, including someone referred to as Mr. A in the news report, with violating the Specific Financial Information Act. Mr. A and others were accused of illegally transferring foreign currency worth 4.3 trillion won ($3 billion) overseas between April 2021 and August 2022 to exploit the Kimichi premium allegedly.

The prosecution believes these crypto traders made a market profit of as much as 210 billion won ($158 million). In their defense, the defendants argued against any wrongdoing since they weren’t precisely the ones facilitating the foreign exchange business but the bank.

The traders argued they were platform users, not virtual asset business operators. The bank involved also tried to absolve itself from the case as it claimed it carried out the transaction based on the “false evidence” the defendants submitted.

Court Finds The Defendants Not Guilty

The court agreed with most defendants’ arguments, acquitting 14 (including Mr. A) out of the 16 persons charged. A local Judge who ruled over the case opined that their actions didn’t violate the objective of the Foreign Exchange Transactions Act and, therefore, could not be punished under that law.

The Judge added that there was “nothing to suggest that the defendants operated as virtual asset business operators.” If the reverse was the case, they could have been punished for not registering their business or making certain disclosures as required by the law.

Interestingly, Judge Park further distinguished the current case from a Supreme Court precedent as he noted that the highest court did not “explicitly judge the issues in this case.” The prosecution already submitted an appeal, dissatisfied with the court’s ruling.

Chart from Tradingview