Arbitrum (ARB), a layer 2 (L2) protocol has achieved yet another major milestone in its Total Value Locked (TVL) reaching new heights, following a surge in the crypto asset’s price.

Arbitrum Sees Surge In Total Value Locked (TVL)

According to the L2beat platform, Arbitrum’s TVL recently went past the $10 billion mark putting it in the spotlight. Data from the analytics firm reveals that the network’s TVL is currently at $10.36 billion.

L2beat’s report shows that Arbitrum One’s TVL soared by a remarkable 16.49% over the past seven days. With this accomplishment, the network is firmly established as the first Layer 2 network to surpass the $10 billion TVL threshold.

L2beat shows that Arbitrum is above Optimism (OP) by about 40% which comes in second place with a TVL of $6.44 billion. Optimism’s TVL has also increased significantly by 11.63% in the last 24 hours.

When analyzing Arbitrum’s TVL, Ethereum (ETH) makes up about 30% of the TVL, while the ARB token makes up about 23.68%. Meanwhile, stablecoins make up a substantial portion of 29% of the TVL, with the remaining 15.76% going to other assets. This diverse composition highlights the platform’s increasing popularity and attractiveness to a larger range of users.

In addition, L2beat has also revealed a surge in the network’s market share. The data shows that Arbitrum One’s market share has seen an increase of over 48%.

So far, the network’s token ARB seems to have experienced a rise in response to the rise in TVL. The digital asset price is currently set at $1.84, indicating a 2.82% increase in the past day.

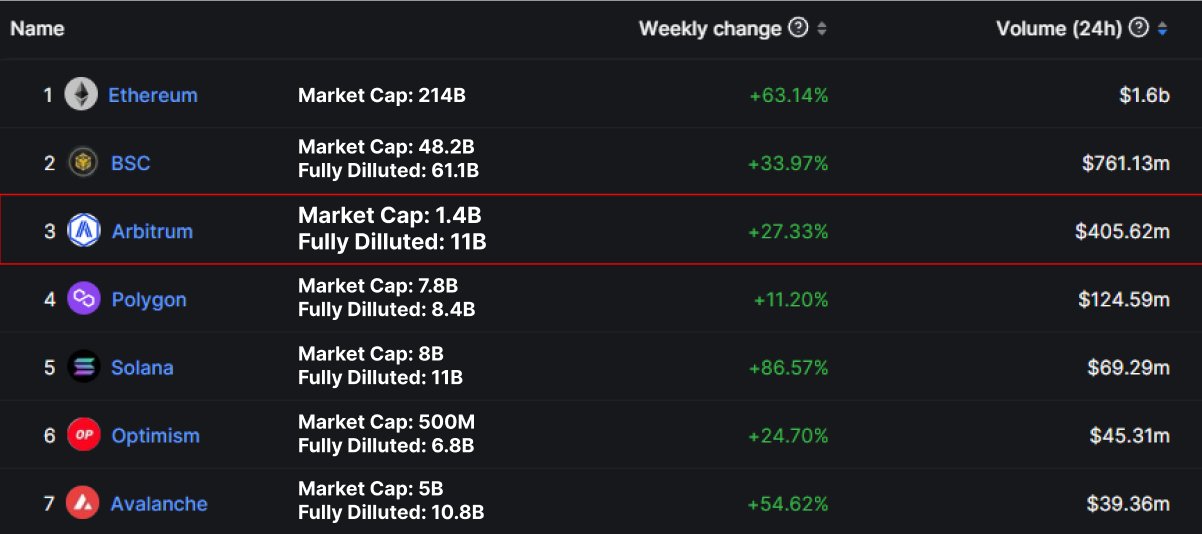

As of the time of writing, the network’s trading volume has increased significantly by 60% in the past 24 hours. Meanwhile, its market capitalization is up by 1% in the past day, according to data from CoinMarketcap

The price rise is indicative of investors’ increased faith and interest in Arbitrum’s ecosystem. The network’s success also highlights the growing need in the Ethereum ecosystem for scalable and affordable solutions.

Analyst Predicts A Clear Uptrend For ARB

Cryptocurrency analyst Michaël van de Poppe has predicted a clear uptrend for Arbitrum, signaling a possible breakout. The analyst shared his projections for the token on the social media platform X (formerly Twitter).

Related Reading: Arbitrum Network Faces Major Outage, ARB Token Faces 4% Decline

In his analysis, he noted that the uptrend is “taking place with beautiful retests of previous resistances, becoming a support zone.” Poppe further pointed out a possible retest optimal “go-to level” between $1.50-1.60.

This area denotes a tactical stage where the token might experience a retest before opting to breach the psychological barrier of $2. However, this will only take place if the ARB continues on the current upward path.

Lastly, Poppe highlighted a difficulty in the token initiating its first cycle when put against Bitcoin. “Against $BTC, this pair barely wakes up and starts its first cycle,” he stated.

With the recent price of Arbitrum sitting at $1.84, it appears that the analyst’s predictions will soon come to pass.