Layer 2 TVL has more than doubled over the past couple of months, hitting a new all-time high of $5.64 billion.

Cryptocurrency Financial News

Layer 2 TVL has more than doubled over the past couple of months, hitting a new all-time high of $5.64 billion.

More than $65 million worth of ETH is currently being burnt daily by the Ethereum network.

Layer-two’s surge to new heights, Bitcoin and DeFi EFT applications and Sushi’s mistaken bug — all coming to you this week in Finance Redefined.

“You’ll notice transactions happen much faster, and once you’ve created a Vault, you won’t have to keep claiming Moons every month,” said Reddit if the solution is migrated to the Ethereum mainnet.

The press releases are on fire today as Polygon has announcements firing out left and right. The platform has announced ‘Avail’ – described as “a robust general-purpose scalable data availability layer”. Additionally, the platform announced the launch of yield aggregator Pickle.Finance.

In a press release to kick off the week, Polygon has shared that Avail will look to target standalone chains, sidechains, and off-chain scaling solutions. The platform has been working on Avail since late 2020 and it’s currently in devnet stage with “testnet in the works”.

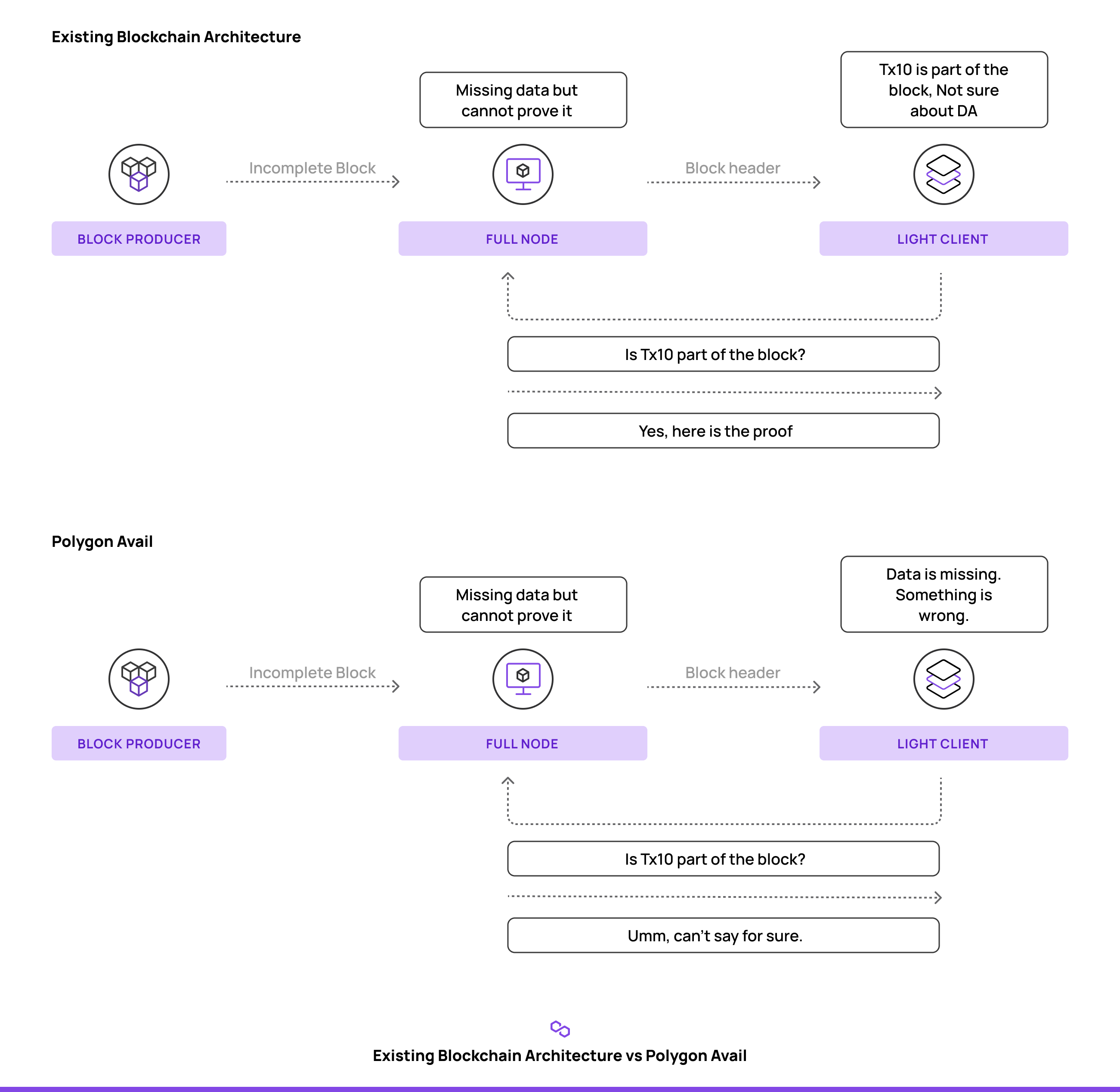

The press release goes on to break down the three main types of peers in present-day ethereum-like ecoystems: validator nodes, full nodes, and light clients as well as the executional architecture between the three.

Avail looks to take a unique approach, one that will likely be incorporated in Ethereum 2.0, leveraging data availability checks. As the team describes it, “Avail reduces the problem of block verification to data availability verification”, so that a block with consensus is only valid if the data behind the block is available.

Avail looks to change the common architecture seen in many ethereum-based blockchains. | Source: Polygon Medium

Related Reading | Polygon (MATIC) Releasing Development Kit For Ethereum-Connected Chains

In another announcement to kick off the week, Pickle Finance is launching on Polygon after previously operating primarily on Ethereum.

Pickle utilizes ‘Pickle Jars’ to compound user returns from other protocols, and ‘Pickle Farms’ for rewarding the users for staking their Jar tokens. A variety of farms allow users to a variety of staking assets to earn PICKLE token rewards.

As part of the announcement, Polygon will be providing MATIC rewards worth $12,500 USD each week for eight weeks.

Polygon has been a tear this year and continues to announce new projects, user growth, and DeFi engagement. Today’s announcements continue that sentiment for the team after the $MATIC token hit an all-time high less than two months ago. Despite a ‘return to earth’, the $MATIC token is still up nearly 6,000% this year, and looks poised for continued growth.

Adoption also continues at a steady pace, user growth is strong and investments have come by way of major names such as Mark Cuban – who is integrating the platform into his NFT website, Lazy.com. DeFi has been a major throughput for the platform, and the low fees relative to Ethereum mainnet have made the chain an attractive choice for many. Cuban said in a statement around the Polygon investment, “I find myself using it more and more”.

The $MATIC token has seen substantial success this year. | Source: MATIC-USD on TradingView.com

Related Reading | Polygon ($MATIC) Sees 75K Active User Growth

Featured image from Pixabay, Charts from TradingView.com

Stablecoins use a variety of techniques to keep their value fixed, generally to a specific fiat currency like the U.S. dollar.

Safe to say, Polygon has been on a tear lately. On the heels of a DappRadar report noting more than 75,000 active users and nearly $1B in value flows through their layer 2 protocol, the Polygon team has announced a new developer SDK for streamlined app creation. In the past month, our team at NewsBTC anticipated continued success for MATIC, and now the protocol is unleashing more developer-friendly materials.

Polygon’s SDK

Polygon-tracked apps continue to grow with regards to DeFi and Exchange-related categories. Today’s announcement will allow developers to continue that growth. Polygon announced that they will be launching a new software development kit (or SDK) for developers to unleash their own Ethereum-connected blockchains. The SDK will include a number of different plug-and-play modules and the team has stated it was designed to reflect a “Polkadot on Ethereum” approach.

The SDK is set to include modules like consensus, synchronization, TxPool, JSON RPC and gRPC. An initial version of the SDK will allow developers to create standalone chains with complete interoperability with Ethereum; a following version of the kit will enable dev teams to create layer 2 protocols directly connected to Ethereum mainnet.

Related Reading | How Polygon Became The Indian Tiger Of Blockchain Platforms

Compatibility with Ethereum as the protocol optimizes is clearly top of mind for the Polygon team. While scalability for Ethereum is a major talking point, Polygon is at the forefront of the conversation in terms of protocols addressing scalability concerns, while still looking to implement interoperability. In a statement surrounding the SDK’s release, co-founder Sandeep Nailwal noted that “with advanced ‘layer 2’ solutions, Ethereum 2.0 all coming online now or soon, the need for a comprehensive interoperability framework is stronger than ever. With the Polygon SDK, we are solving pressing needs for Ethereum’s multi-chain future, including ease of deployment and inter-L2 communication”.

$MATIC has seen a strong recovery after the recent market-wide slide | Source: MATIC-USD on TradingView.com

As DeFi continues a high-flying emergence, Polygon looks to continue to be on the forefront. The protocol emphasizes lower gas fees relative to Ethereum, and fast transaction speeds. The aforementioned user growth, along with the protocol’s transaction speeds, have led to increased market attention. The protocol also took a vocal approach in a re-brand from Matic in recent months. Accordingly, billionaire Mark Cuban has is a recent investor, and is quickly implementing it into his NFT portfolio company Lazy.com. Other recent partnerships include computing network Aleph.im, with a focus on security and permanence in the NFT market.

Following the news, $MATIC has continued to show strong growth with prices nearing record-highs, and is looking to crack the top 10 in crypto in terms of market cap.

Related Reading | How Aave’s Integration With Polygon Will Maximize Users’ Profits

Featured image from Pixabay, Charts from TradingView.com

China’s leading blockchain network to fund startups willing to develop on it.

Liquidity provider fees for Uniswap have surpassed BTC network revenue on a seven-day average.

While the world waits for Ethereum 2.0, trailblazing developers are taking matters into their own hands with innovative solutions.

Polygon is building a Layer 2 aggregator for sidechains, rollups and even whole blockchains in a bid to fix Ethereum’s transaction limitations.

Polygon is building a Layer 2 aggregator for sidechains, rollups and even whole blockchains in a bid to fix Ethereum’s transaction limitations.

Bitcoin is no longer limited to a single chain, meaning altcoins like ether are trending towards irrelevancy, says the neuroscientist and DeFi entrepreneur.

Statechains offer another way to scale bitcoin payments. New exploration has uncovered that statechains could boost Bitcoin privacy as well.