As the price of Bitcoin (BTC) continues to demonstrate a major fall in valuation, indicating a gloomy attitude toward the crypto asset, the bulls in the market are hopeful that the market will soon enter another Season for Altcoins.

Altcoins Showing Massive Buying Opportunity

Bitcoin’s recent dip signaled the beginning of the decline in the cryptocurrency market, causing several altcoins to drop significantly. However, many cryptocurrency analysts believe that the drop in these altcoin prices might serve as an opportunity for future gains since the alt-season is on the horizon.

Popular cryptocurrency expert and trader Michael Van De Poppe has revealed his optimism in the altcoin market, highlighting the significant opportunities of getting into these tokens before the alt-season begins.

According to Michael Van De Poppe, “some altcoins have now dropped by over 40%” in comparison to their past all-time high. As a result, Poppe believes that this is the right time for investors to purchase these digital assets to position themselves for future gains.

Poppe noted he normally invests in these tokens “during bull cycles when they are about 25% to 60% less expensive.” This demonstrates the crypto expert’s confidence in the assets to rally in the coming months.

While pointing out the massive opportunities in the market, Poppe has underscored Arbitrum (ARB) as one of the altcoins investors should watch out for. He believes that ARB could realize substantial gains in time, as the token is down and poised for a new leg UP.

Recently, there have been notable advancements in the crypto asset’s price, demonstrating momentum for an upward movement. As of the time of writing, ARB was trading at $1.70, indicating an over 10% increase in the daily timeframe.

However, in the weekly and monthly timeframe, ARB is down by 22% and 15%, respectively. Meanwhile, Arbitrum’s market capitalization has increased by roughly 10% to exceed the $4.5 billion threshold.

Top ALTs To Purchase After Bitcoin’s Retracement

On-chain analyticS platform Santiment has also highlighted the drop in altcoins as a shot to garner profits in the upcoming months. Santiment pointed out several altcoins that offer a “possible bullish opportunity,” following Bitcoin’s crash today to a two-week low of $61,700.

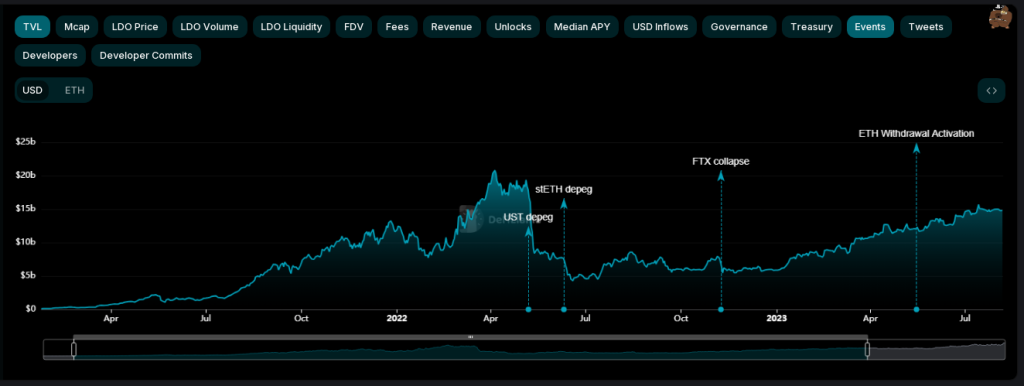

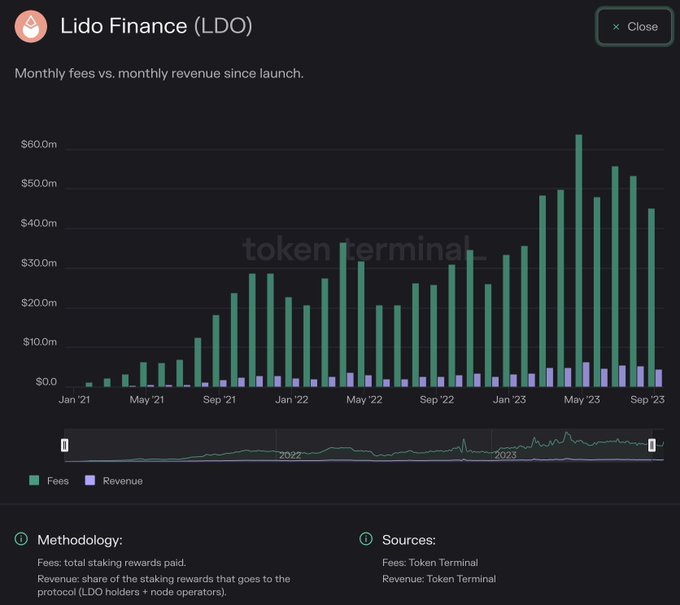

Some of the tokens listed by Santiment are BOUNCE, LDO, OMG, STORJ, and SNX. The MVRV Opportunity and Danger Zone Model, according to Santiment, shows that many altcoins have now declined to the point where mid-term trading returns are in an “opportunity zone.” However, when an asset’s 30-day, 90-day, and 365-day average wallet returns add up to be negative, “this zone is breached.”

Even with the recent general correction, the altcoins market appears to be headed toward a favorable long-term picture. Consequently, this presents an excellent chance for investors to purchase these digital assets at a reduced cost.