Chainlink (LINK) has traders buzzing as its price has been up by 40% since the last week of January, massively outpacing the broader cryptocurrency market. Amidst this price spike, mysterious whale wallets have been topping up their holdings, as evidenced by on-chain data.

According to blockchain tracker Lookonchain, there’s been a massive outflow of LINK from crypto exchange Binance in the past two days, particularly with 49 new wallets receiving 2,745,815 LINK within this timeframe.

Massive LINK Accumulation Occurs On Binance Before Withdrawal

Details from Binance point to an ongoing accumulation of LINK from the crypto exchange. In the middle of this accumulation, a particular whale or institution has been going on a buying spree, gobbling up more than 2.7 million LINK tokens worth $49.9 million. This accumulation came days after the Lookonchain noticed that four new wallets had withdrawn over 119,583 LINK tokens worth over $2.15 million from Binance.

Whales/institutions continue to accumulate $LINK!

This mysterious whale/institution withdrew 2,745,815 $LINK($49.9M) from #Binance via 49 new wallets.

Whale”0x2A19″ withdrew 494,957 $LINK($9M) from #Binance in the past 10 days.https://t.co/QoP2waErBShttps://t.co/iaPHa9f0XB pic.twitter.com/GUW1S33NHf

— Lookonchain (@lookonchain) February 7, 2024

Similarly, Lookonchain noted that another whale address “0x2A19” has withdrawn 494,957 LINK tokens worth $9 million from Binance in the past 10 days. Notably, whale transaction tracker Whale Alerts has also noted some accumulation of LINK tokens from other crypto exchanges.

800,000 #LINK (14,701,915 USD) transferred from #Bybit to unknown wallethttps://t.co/RQEu3CxLVM

— Whale Alert (@whale_alert) February 7, 2024

Analytics platform Santiment also noted that LINK whale addresses have upped their activity amidst the price surge as large amounts of coins were moved by previously stagnant wallets. This influx of tokens back into the network’s circulation, coupled with a minor liquidation of wallets, seems to have contributed to the price spike.

#Chainlink has jumped ahead of the #altcoin pack after some previously dormant wallets created the highest Age Consumed spike (5.38B, calculated by multiplying coins moved by the amount of days those coins had been dormant). This influx of $LINK back into the

(Cont)

pic.twitter.com/eHVpeJz2HW

— Santiment (@santimentfeed) February 1, 2024

How Will New Chainlink Whales Impact Price Action Going Forward?

The crypto industry is currently going through a modest price gain led by Bitcoin recently breaking above the $44,000 level again. As a result, the industry is now up by 3.25% in the past 24 hours, with a 22.60% increase in trading volume.

LINK hasn’t been left out of this price gain, registering a 4.30% gain in the past 24 hours. However, LINK has been on a sustained breakout since January, reaching as high as $19.68 on February 5.

The price spike isn’t particularly surprising, as fundamentals of the Chainlink ecosystem point to a steady price growth for LINK. Chainlink’s role in DeFi and NFTs with its smart contracts oracles cannot be overstated. Chainlink also recently released its Staking v0.2 protocol in December, allowing investors to stake a minimum of 1 LINK for a base floor reward rate of 4.5% per year in LINK.

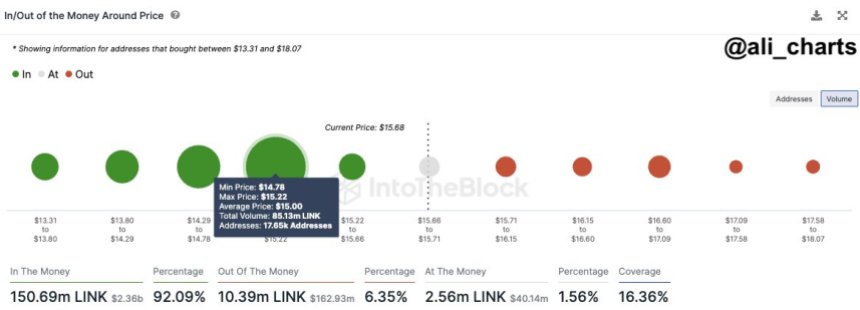

Consequently, the massive accumulation of LINK by whales is a very bullish signal for the token’s price action going forward. These large investors see LINK’s long-term value and potential and are loading up their bags in anticipation of higher prices.