Opposing Centralization in Ethereum Staking

Binance’s Liquid Staked Ether Jumps to $1.2B in TVL After Sudden $500M Inflow

Binance’s liquid staking ether (ETH) saw a sudden $500 million burst of inflows over the weekend, pushing its total locked value (TVL) to $1.2 billion.

Ethereum Liquid Staking Protocols Hit New Milestone Following Massive Inflows

Ethereum liquid staking platforms are making waves in the decentralized finance (DeFi) ecosystem. Recent on-chain reports have revealed that liquid staking protocols have recorded a new milestone in the number of Ether (ETH) staked, reaching a staggering 12 million ETH mark in just a few days.

Ethereum Liquid Staking Gains Momentum

With Ethereum 2.0 thriving, liquid staking protocols in the DeFi ecosystem have been growing rapidly despite recent market volatility.

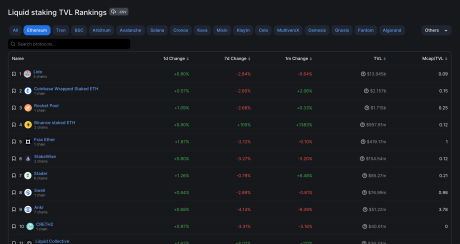

Research data from DeFi TVL aggregator, Defillama, revealed on Monday, September 25, the tremendous growth of Ethereum holdings in liquid staking platforms. According to the data, the ETH in liquid staking protocols has risen to approximately 12.31 million and may continue rising.

Reports uncovered that a staggering 370,000 ETH were staked in just five days, allowing liquid staking protocols to reach their current 12 million mark. Liquid staking platforms like Lido, Rocket Pool, Coinbase, and Binance are among the list of prominent protocols that led to the recent upsurge in Ether staking.

According to Defillama TVL rankings, Lido holds the top spot for the amount of Ethereum staked with a TVL of $13.997 billion in liquid staking. The protocol secured over 8 million Ether on September 20, and another 30,000 after that.

Coinbase is presently ranked second in Defillama’s TVL rankings, holding approximately $2.155 billion, a significant gap from Lido’s TVL.

Coinbase has about 1.3 million Ether presently in its reserve. Whereas, Rocket Pool holds the third position in TVL rankings and has increased its Ether holdings from 940,496 to 945,402.

Binance Liquid Staking Platform Takes The Lead

Binance liquid staking platform has been the driving force behind the recent spike in ether influx in liquid staking protocols in the DeFi ecosystem.

According to reports, Binance added a startling amount of ether to its already substantial ether reserves. The liquid staking platform which previously recorded 445,000 ETH in its reserve, added 318,605 ETH and now holds 764,105 ETH. Research data have revealed that Binance amassed a considerable amount of ETH tokens to support its staking token, Wrapped Beacon ETH (WBETH).

In the last three months, the DeFi ecosystem recorded a liquid staking valuation above $20 billion evaluating various protocols in the DeFi ecosystem. Following this, Defillama’s September data revealed liquid staking protocols now hold $20.5 billion in assets, increasing by a staggering 293% from previous lows in June 2022.

Although the key protocols steering the surge are Lido, Binance, and Rocket Pool. Other upcoming liquid staking protocols like Davos and InQubeta are persisting, driven by the Ethereum 2.0 upgrade and investors desire to maximize their earnings through Ethereum staking.

Defying The Crypto Crash: Liquid Staking’s $20 Billion Rise Amid Market Uncertainty

The crypto market has witnessed several fluctuations, but specific sectors’ resilience within this domain remains attractive. Recently, despite a noticeable dip in the broader crypto market, one area seems poised to touch its peak, demonstrating the potential and adaptability within the crypto ecosystem, per a report.

Liquid staking, a sector that facilitates rewards for token pledges supporting blockchain operations, shows signs of resurgence. This re-emergence occurs despite an overarching downturn in crypto assets.

Recovery Amid Crypto Crisis

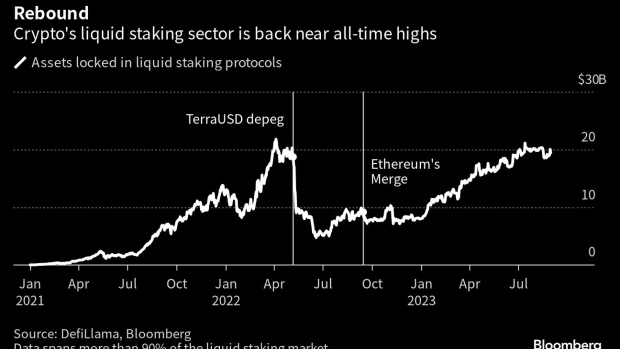

According to Bloomberg, citing data from DefiLlama, there is a roughly 292% surge in assets secured in liquid staking services, reaching a monumental $20 billion from a low in June 2022. This ascent is all the more significant considering the broader crypto slump during that period.

Bloomberg noted a recovery in liquid staking’s position as “the titan of decentralized finance (DeFi).” Thanks to blockchain-based automated software, this crypto framework enables individuals to trade, borrow, and lend without intermediaries.

Notably, once the crown jewel of DeFi applications, liquid staking has overtaken lending. Protocols specialized in liquid staking, such as Lido and Rocket Pool, witnessed their zenith in April of the previous year.

They amassed assets slightly exceeding $21 billion. However, this momentum was disrupted by the destabilization of TerraUSD, leading to a massive $2 trillion setback in the crypto market.

Despite the gloomy overtones in the crypto sector, where major tokens and a majority of DeFi services are yet to recover from the blows of 2021 and 2022, liquid staking stands out, showcasing a comeback, as seen in the chart below.

Global Regulatory Stance On Staking

Liquid staking plays a pivotal role, especially in the Ethereum blockchain. It offers a mechanism where users can stake their tokens and, in return, receive a liquid token representing their staked amount.

This process allows users to participate in securing the network while maintaining liquidity. Simply put, they can earn staking rewards without locking up their assets, ensuring flexibility and maximizing potential gains.

Kunal Goel, a research analyst at Messari, parallels these services to “the on-chain equivalent of government bonds.” The analyst elaborates that while these aren’t devoid of risks, they exude a comparatively lower risk profile and, thus far, have remained untainted by hacks or exploits.

This resurgence in liquid staking doesn’t go unnoticed and has been juxtaposed with regulatory decisions concerning crypto globally. The US, for instance, has intensified its regulatory lens on the crypto sector, especially on staking products.

Such measures prompted key players like Kraken and Bitstamp to halt their regional staking products. Richard Galvin, co-founder at DACM, noted:

The regulatory crackdown around staking products offered by centralized exchanges has definitely helped liquid staking.

Featured image from iStock, Chart from TradingView

Explaining Ethereum’s ‘Risk Free’ Rate of Return

Coinbase Ventures’ Strategic Investment Sends Rocket Pool Token Surging

The investment branch announced today the purchase of an undisclosed amount of Rocket Pool’s native token RPL, which has jumped more than 9% in the past 24 hours.

Mantle Introduces New Governing Body for Treasury Management

The new layer 2 network passed a governance vote that establishes the Mantle Economics Committee as well as introduces more liquid staking into the ecosystem by authorizing liquid staking protocol Mantle LSD and the allocation of 40,000 ETH from its treasury to stETH.

Lido Attracted 10K Ether Stakers to Protocol in July

The largest staking service provider also crossed $15 billion in total value locked, a level not seen since May 2022.

Ether Liquid Staking Protocols Could Double in 2 Years: HashKey

The amount of staked ether could reach between 31%-45% of the total supply by the end of Q2 2025.

Ethereum is about to get crushed by liquid staking tokens

The popularity of liquid staking tokens could usher in a new age for Ethereum and the rest of cryptocurrency — and play a key role in the new bull market.

Stablecoin Issuer Lybra Finance Launches Arbitrum Testnet Amid Quest to Be More DeFi-Friendly

Users can now interact with Lybra’s new companion stablecoin peUSD, which is said to be more compatible with decentralized finance protocols than the protocol’s main stablecoin eUSD.

Brevan Howard Joins $12M Round for Liquid Staking Protocol Alluvial

Ethereal Ventures and Variant co-led the round for Alluvial, creator of the enterprise and institution-focused Liquid Collective.

Lido, Rocket Pool team members argue over decentralization

A Lido team member claimed Rocket Pool is not really governed by its DAO, but Rocket Pool community members pushed back, claiming the protocol is becoming more decentralized.

Liquid Staking Frenzy Spreads to Solana as Drift’s ‘Super Stake’ Offers One-Click Leverage

Raft’s R Stablecoin Surges as Traders Embrace Liquid Staking Ether Products

While Raft is centered around its R stablecoin backed by Lido’s stETH, the team has had ongoing conversations about introducing RAFT, an additional token intended to empower community members and help decentralize the protocol

EigenLayer’s Restaking Smart Contracts Reach Max Limit on Same Day as Mainnet Launch, Pulling in $16M

Notable depositors into EigenLayer’s pools include one address that deployed the U.S.-sanctioned Tornado Cash money mixing tool and another address associated with Hassan Bassiri, former vice president of portfolio management at crypto hedge fund Arca, per Nansen.

DeFi Platform EigenLayer Rolls Out Restaking Protocol on Ethereum Mainnet

Seattle-based decentralized finance (DeFi) platform EigenLayer has deployed its restaking protocol on the Ethereum mainnet, according to a press release.

DeFi Protocol Maverick Raises $9M Led by Peter Thiel’s Founders Fund

The round was led by Founders Fund and included contributions from Pantera Capital, Binance Labs, Coinbase Ventures and Apollo Crypto.

New Stablecoin Issuer Raft Is Eschewing Fiat for Its Financial Backing

Its R stablecoin is collateralized by one crypto asset: liquid staking leader Lido’s staked ether (stETH).