On-chain data shows a Litecoin whale has made a large deposit to cryptocurrency exchange Binance, which could add to the coin’s decline.

Litecoin Whale Has Transferred 100,000 LTC To Binance Today

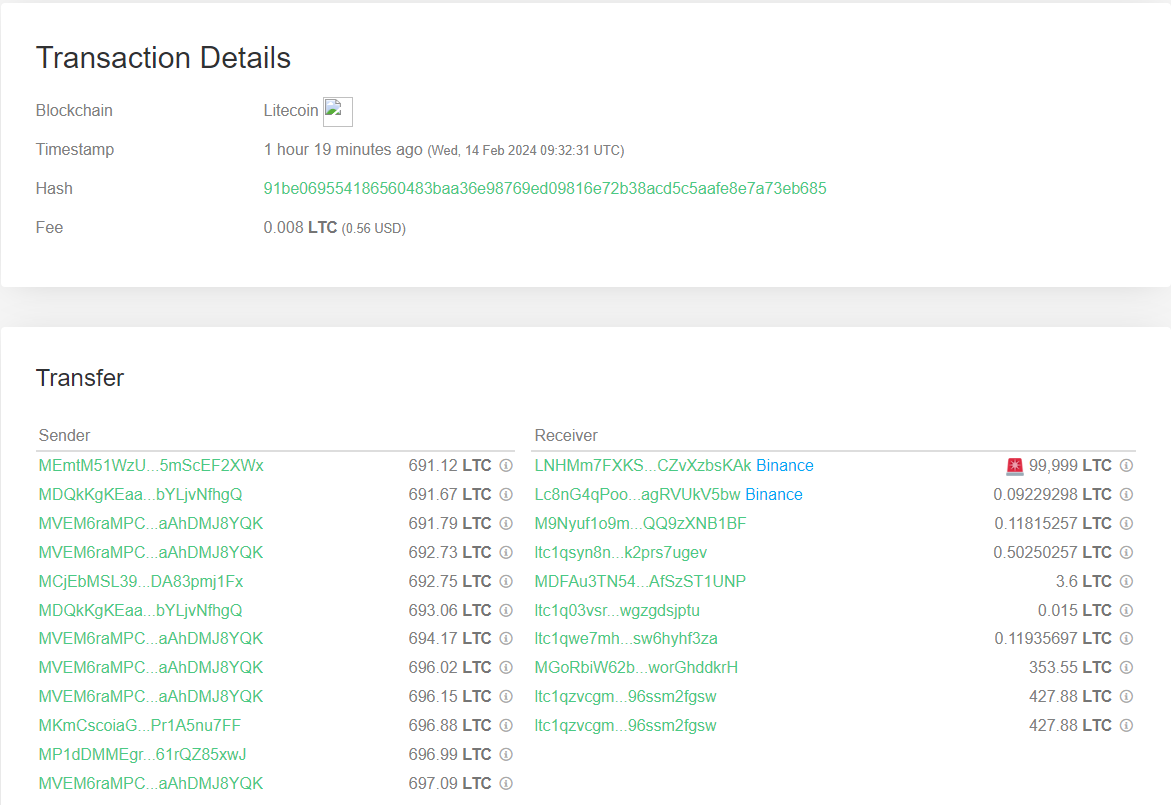

According to data from the cryptocurrency transaction tracker service Whale Alert, a large transfer has been spotted on the Litecoin network during the past day.

This transaction involved the movement of 100,000 LTC across the blockchain, worth more than 7 million US Dollars at the time of the move. Since the transfer scale is so large, a whale entity was likely behind it.

Generally, the transfers of whales can be something worth watching out for, as they may end up causing ripples in the market. How a move from such a humongous holder would affect the asset, though, depends on the intent behind it.

Here are some additional details regarding the latest Litecoin whale transfer that may provide a hint about why the investor made the move:

As displayed above, the whale transferred 100,000 LTC to wallets associated with the cryptocurrency exchange Binance in this move. The sending addresses were all unknown wallets that were unattached to any centralized platforms.

Such wallets are usually the investors’ addresses. Transactions like this, where coins move from self-custodial wallets towards exchanges, are called “exchange inflows.”

The latest exchange inflow from the Whale suggests that the investor wanted to use one of the platform’s services, which can include selling. As such, the transfer can be bad news for Litecoin.

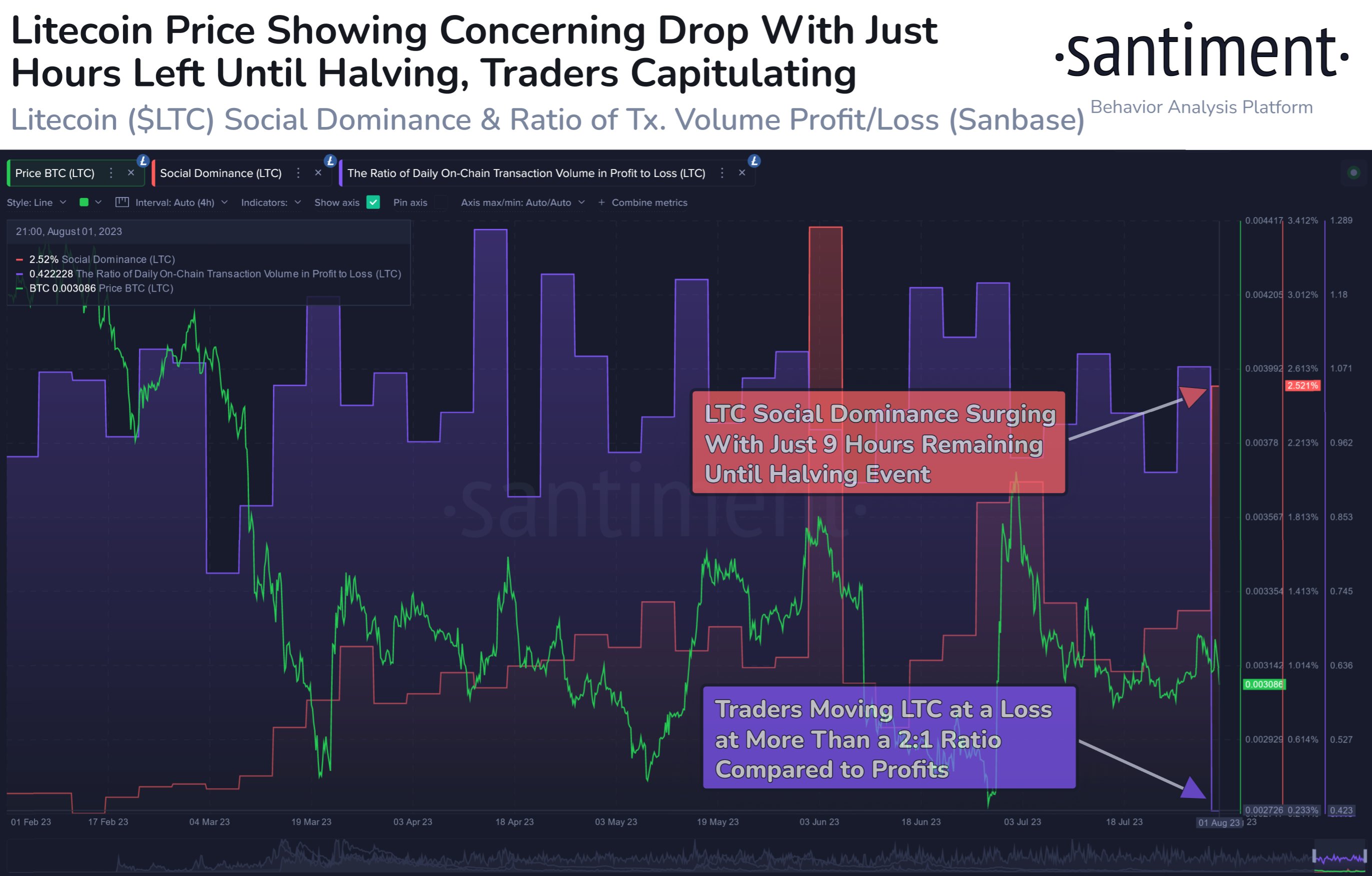

LTC Has Gone Down 3% In Past 24 Hours Despite Market Surge

While most cryptocurrency sectors have enjoyed profits during the last day, Litecoin has been the odd one as it has registered negative returns.

As the chart below displays, LTC plunged from above the $73 level to the $68 mark during its latest drop.

Litecoin has registered a bit of a rebound since its low, though, as it has returned above $70. Despite this increase, however, the coin has still been down around 3% in the past 24 hours.

Given the timing of the Binance inflow transaction made by the whale, it’s possible the move was for selling after all, as it coincided with this rebound in the cryptocurrency.

The whale may be using this small surge to exit from the asset, potentially for moving into the greener pastures the rest of the market seems to be providing.

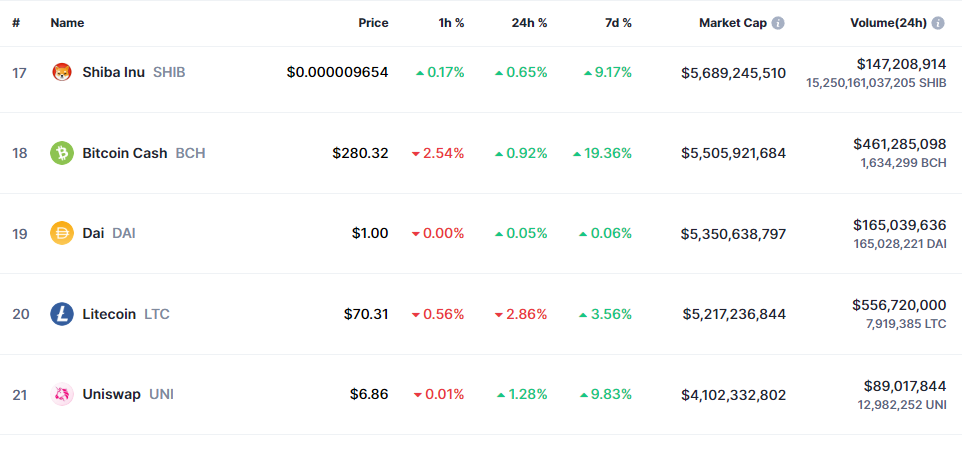

Regarding the market cap, Litecoin has fallen to just the 20th spot on the top cryptocurrencies list, meaning there are nineteen larger digital assets than it currently. There is still some gap between LTC and 21st-placed Uniswap (UNI), so the coin may not be at risk of slipping further, at least for now.