The two wallets acquired a total of 1,000 Bitcoin more than 10 years ago — when BTC was worth $134 each.

Cryptocurrency Financial News

The two wallets acquired a total of 1,000 Bitcoin more than 10 years ago — when BTC was worth $134 each.

Roughly 18 hours ago, an investor holding a large amount of ether transferred 12,000 ETH worth $42.8 million to Binance, according to Lookonchain.

Roughly 18 hours ago, an investor holding a large amount of ether transferred 12,000 ETH worth $42.8 million to Binance, according to Lookonchain.

Ethereum-based memecoin Shiba Inu (SHIB) has once again garnered the attention of the crypto community as the altcoin has witnessed a massive whale accumulation leaving the community to ponder on the reason behind the whale accumulation.

Recent data from crypto analytics firm Lookonchain has revealed that new buyers are stacking Shiba Inu on Binance and Gate.io. The analytics platform shared the data on the social media platform X (formerly Twitter).

As of the time of the report, over 1.44 trillion SHIB, valued at about $13.36 million, had left exchanges in less than 48 hours. With split purchases over a period of time, the accumulation was a clear move.

Lookonchain revealed that the unknown whale addresses 0xF633Cd….3493Bbac began the accumulation on the Binance platform. The whale reportedly moved 400 billion SHIB tokens from the platform to the wallet address.

Additionally, the whale received another 146,342,102,182.77 SHIB around an hour later. This brings down the total amount of SHIB withdrawn from Binance to 546,342,102,182.77, valued at approximately $5.18 million.

Furthermore, the analytics firm reported another massive Shiba Inu withdrawal from the crypto exchange Gate.io. Lookonchain shows that the whale started the accumulation from Gate.io with an initial batch of 32,913,563,627.61 SHIB tokens.

Meanwhile, the next whale accumulation which was the largest consists of 499,999,665,444.45 SHIB. The whale then completed the move with an additional 362,134,360,200.61 SHIB buy. This brought the total amount of SHIB amassed to a whopping 895,047,589,272.67 valued at about $8.5 million.

According to Lookonchain, the aforementioned wallet address 0xF633Cd….3493Bbac is responsible for the tokens withdrawn from both crypto platforms.

These transactions came at a time when the Shiba Inu was experiencing a price rebound. However, there is no solid proof that these transactions have affected the price of SHIB positively.

The Shiba Inu layer 2 blockchain platform Shibarium has experienced a significant drop in its transaction counts. The drop in transactions might suggest a broader change in users’s confidence and engagement.

According to data from Shibariumscan, the network’s daily transactions are currently pegged at 2.73 million. This is the lowest the network has seen in months now.

The network has been seeing a notable decrease in transaction counts since the close of the previous year. The drop in daily transaction counts indicates a decline in the network’s adoption.

Data from Shibarium Explorer shows that the network’s utilization is down up by 11%. However, this is a drop from the 30% network utilization it recorded on Monday, January 8.

As of the time of writing, SHIB was trading at $0.000009522, indicating an increase of 1.20% in the past 24 hours. Meanwhile, its 24-hour trading volume is currently seeing an uptick of 64%, according to CoinMarketCap.

In the last week, Ethereum (ETH) has attracted many investors’ attention as it gradually approaches the $1900 price region. Similar to many assets riding on the Bitcoin-fueled market rally, ETH, also known as Ether, is up by 5.85% in the last seven days, bringing its total price increase in the last four weeks to 15.17%.

Interestingly, a recent whale movement has now added more speculation around ETH, prompting suggestions that the largest altcoin may soon experience a price surge.

In a Sunday post on X, blockchain analytics platform Lookonchain shared that an ETH whale with the wallet address “0xb15” had just purchased 8,698 ETH, valued at $15.94 million, from the Binance exchange, depositing 31.8 million USDT in the process.

This transaction has drawn much attention due to the past antecedents of this Ether investor. Popularly known as a “smart” whale, Lookonchain notes that “0xb15” has conducted 8 ETH transactions since February 12, recording a win rate of 87.5% and an aggregate profit of $13 million.

The smart whale bought $ETH again!

The whale deposited 31.8M $USDT to #Binance and withdrew 8,698 $ETH($15.94M) 3 hours ago.https://t.co/heBjvbk1Oihttps://t.co/hDNN69qn3h pic.twitter.com/n0SmpqMsVI

— Lookonchain (@lookonchain) November 4, 2023

In particular, this smart whale is known for buying low and selling high. Most recently, they deposited 24,495 ETH ($45 million) on Binance on November 2, shortly after purchasing 24,548 ETH, valued at $39.8 million, leading to a profit margin of approximately $5.47 million.

Following the purchase made by “0xb15” on Sunday, many traders are likely on high alert as it indicates the whale is anticipating a continuous rise in Ether’s price over the next few days.

Looking at Ether’s daily chart, the altcoin is poised to break into the $1900 price zone if this buying pressure continues. However, investors should note the token’s Relative Strength Index (RSI) is now at 71.43, indicating it is now in the overbought zone and may experience a trend reversal.

In other news, centralized exchanges (CEXs) just recorded an outflow of $210 million worth of Ether in the last seven days, according to data from IntotheBlock. This marks the altcoin’s largest weekly outflow off CEXs since August.

This data only reflects the strong bullish sentiment surrounding the ETH market, as a reduction in the token’s supply on exchanges reflects an increase in purchasing activity by investors.

At the time of writing, Ether is trading at $1890.95, with a 2.61% gain in the last day. However, the token’s daily trading volume is down by 11.485 and valued at $6.02 billion. With a market cap of $227.4 billion, Ethereum remains the second-largest cryptocurrency in the world.

Unibot confirmed on X that it had suffered a token approval exploit in its new order router.

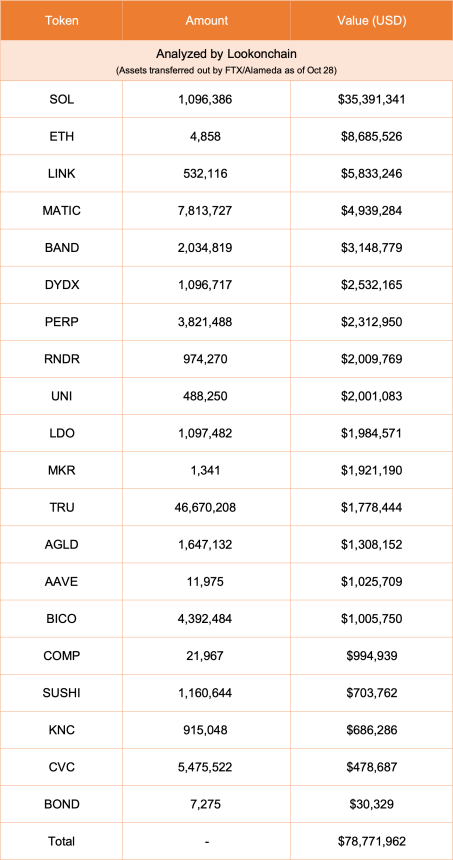

According to the latest on-chain data, wallet addresses linked to the now-bankrupt FTX exchange and Alameda Research have transferred substantial amounts in crypto assets over the past week. This series of funds movement was first brought to the limelight by prominent blockchain analytics firm Nansen, who reported that more than $60 million had been moved.

However, further on-chain revelation shows that nearly $80 million has been moved from FTX- and Alameda-linked addresses in the previous week.

On Friday, October 27, Nansen disclosed – via a series of posts on X (formerly Twitter) – that FTX has been transferring millions in digital assets, including Chainlink (LINK), Solana (SOL), Ethereum (ETH), Polygon (MATIC), etc, to various exchange addresses.

Prior to this development, the analytics firm initially reported that around $8.6 million were moved to a Binance address. According to the latest Nansen data, FTX subsequently moved $24.3 million in various tokens to different addresses on Coinbase and Binance.

Additionally, 943K SOL (just under $32M) has been moved from the FTX Cold Storage wallet

This is the address: 9uyDy9VDBw4K7xoSkhmCAm8NAFCwu4pkF6JeHUCtVKcX

That means the total funds that have moved from FTX and Alameda wallets this week is currently more than $60M pic.twitter.com/yNgakImsoV

— Nansen

(@nansen_ai) October 27, 2023

The now-defunct exchange would later transfer 943,000 SOL (worth around $32 million) from its cold storage wallet on Friday. Based on Nansen’s data as of October 27, the total funds moved from FTX and Alameda wallets was above $60 million.

On Saturday, October 28, another blockchain data tracker, Lookonchain, offered an update on the recent transfer activities of the FTX- and Alameda-associated addresses. In a post on the X platform, the analytics platform revealed that FTX and Alameda moved an additional $20 million in crypto assets on Saturday.

According to Lookonchain, FTX addresses transferred 309,185 SOL (worth around $10 million), 2 million Band Protocol tokens (equivalent to $3.15 million), 3.82 Perpetual Protocol tokens (worth about $2.3 million), amongst other crypto assets. Using Lookonchain’s data, this brings the total value FTX has moved this week to $78.7 million.

While the purpose of these transfers is unknown, it remains to be seen whether they are associated with the exchange’s bankruptcy proceedings. And it comes after the FTX estate recently staked $122 million worth of Solana tokens.

FTX exchange has been looking to conclude its pending Chapter 11 court case, with a recent proposal offering customers more than 90% of their missing assets toward the end of Q2 2024. Meanwhile, former CEO Sam-Bankman Fried is currently on trial for seven counts of fraud-related offenses.

ETH fell to as low as $1,547 last Thursday, its lowest price since June.