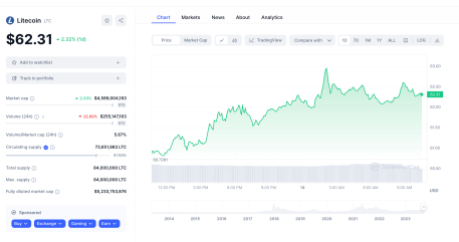

Litecoin (LTC), the digital currency often dubbed “silver to Bitcoin’s gold,” has been stirring in the shadows of its flashier counterpart. Despite a recent price dip from $112 to $83, analysts see glimmers of a potential surge in the coming months.

This renewed optimism follows Litecoin’s defiance during the highly anticipated Bitcoin halving event, where Bitcoin’s block rewards were cut in half, impacting the entire crypto market.

Litecoin Exhibits Resilience After Price Dip

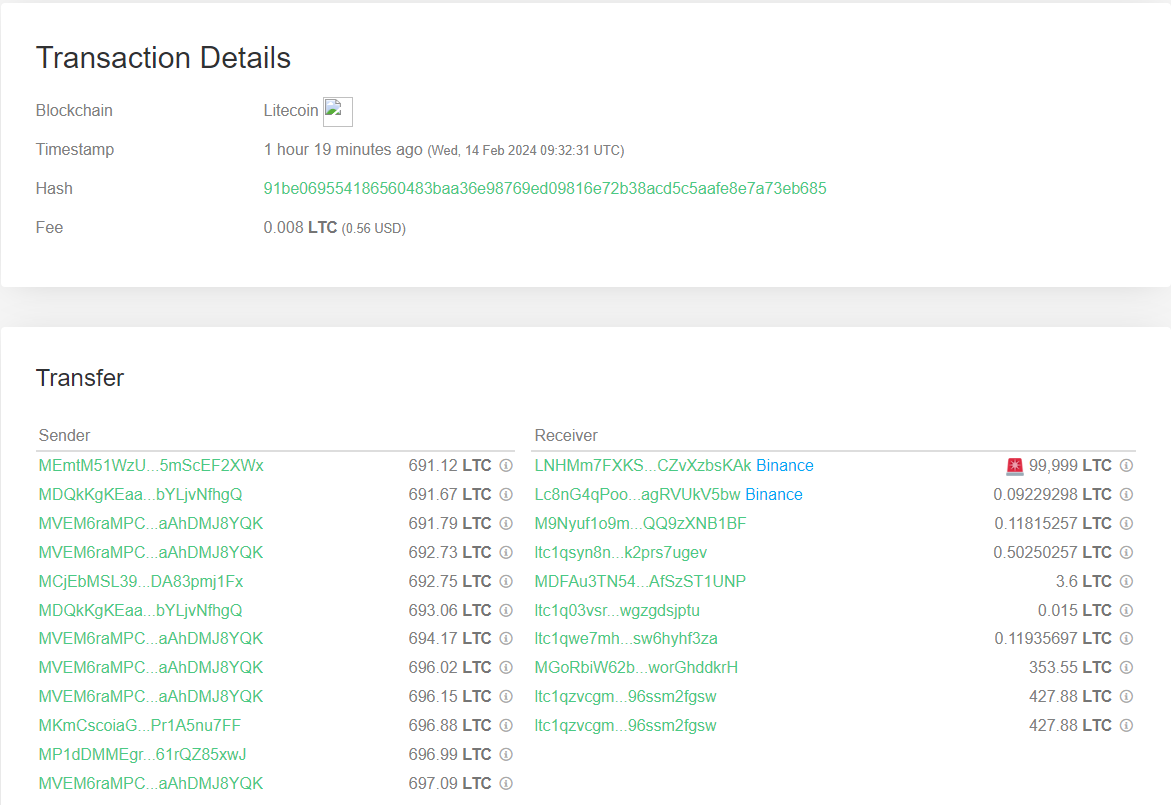

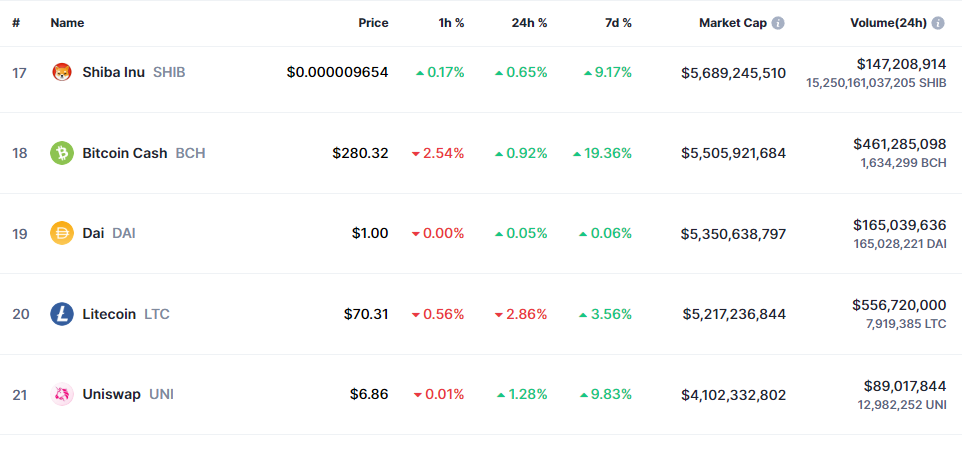

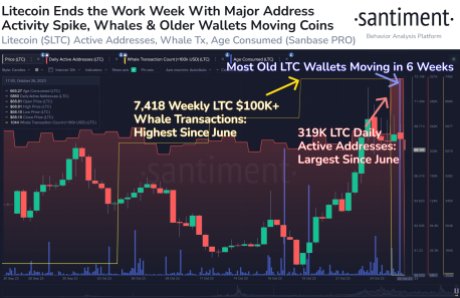

While some cryptocurrencies floundered after the Bitcoin halving, Litecoin displayed surprising resilience. This, coupled with a recent uptick in trading volume reaching $686 million over 24 hours, suggests a growing interest in LTC.

The cryptocurrency currently sits at a market capitalization of $6.18 billion, solidifying its position as a top contender.

Technical Breakout Hints At Bullish Future For Litecoin

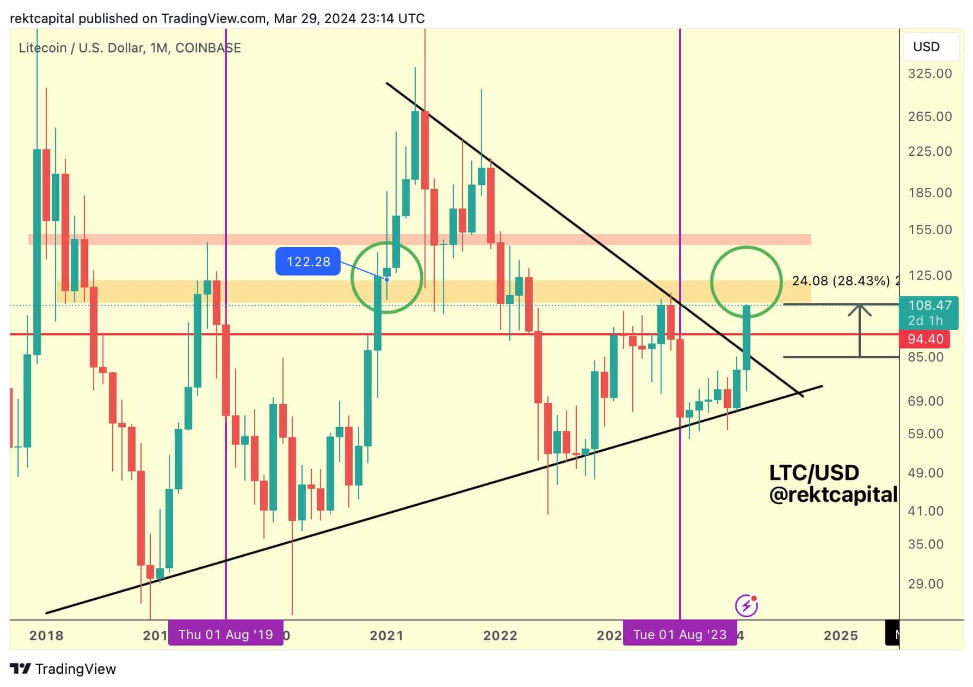

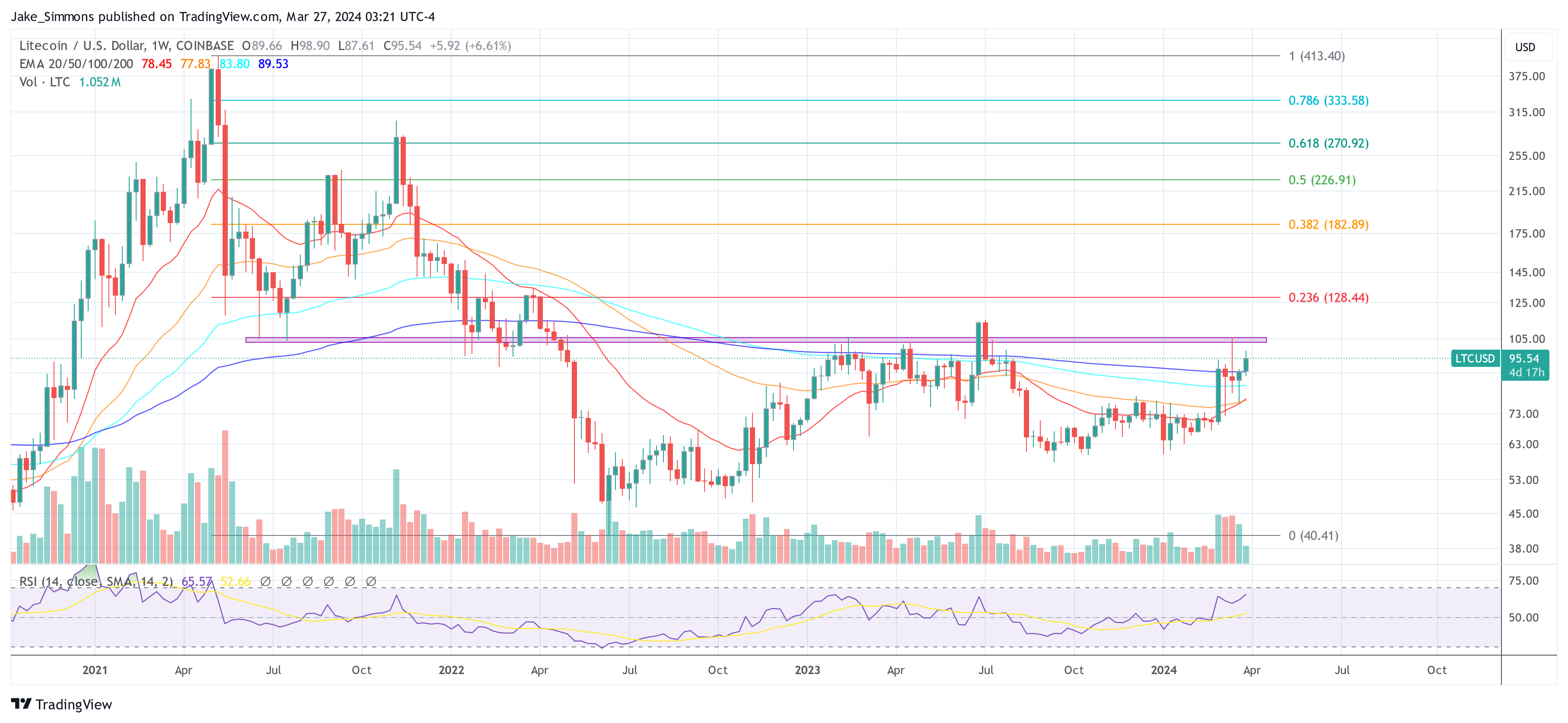

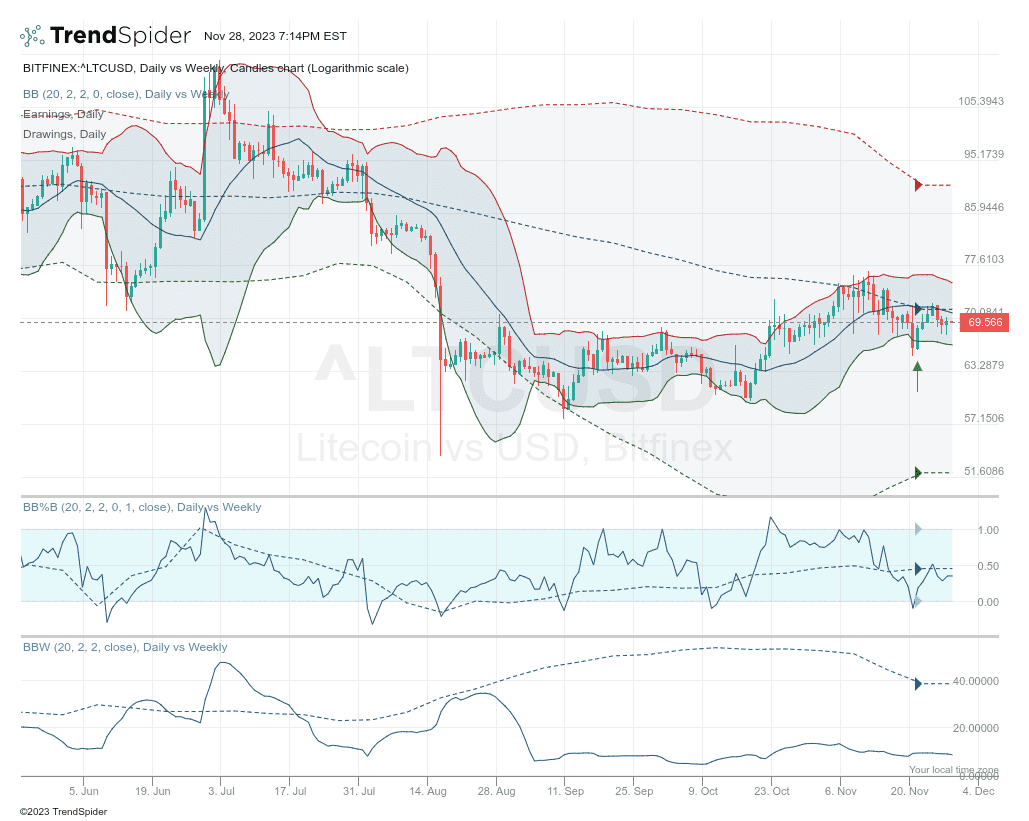

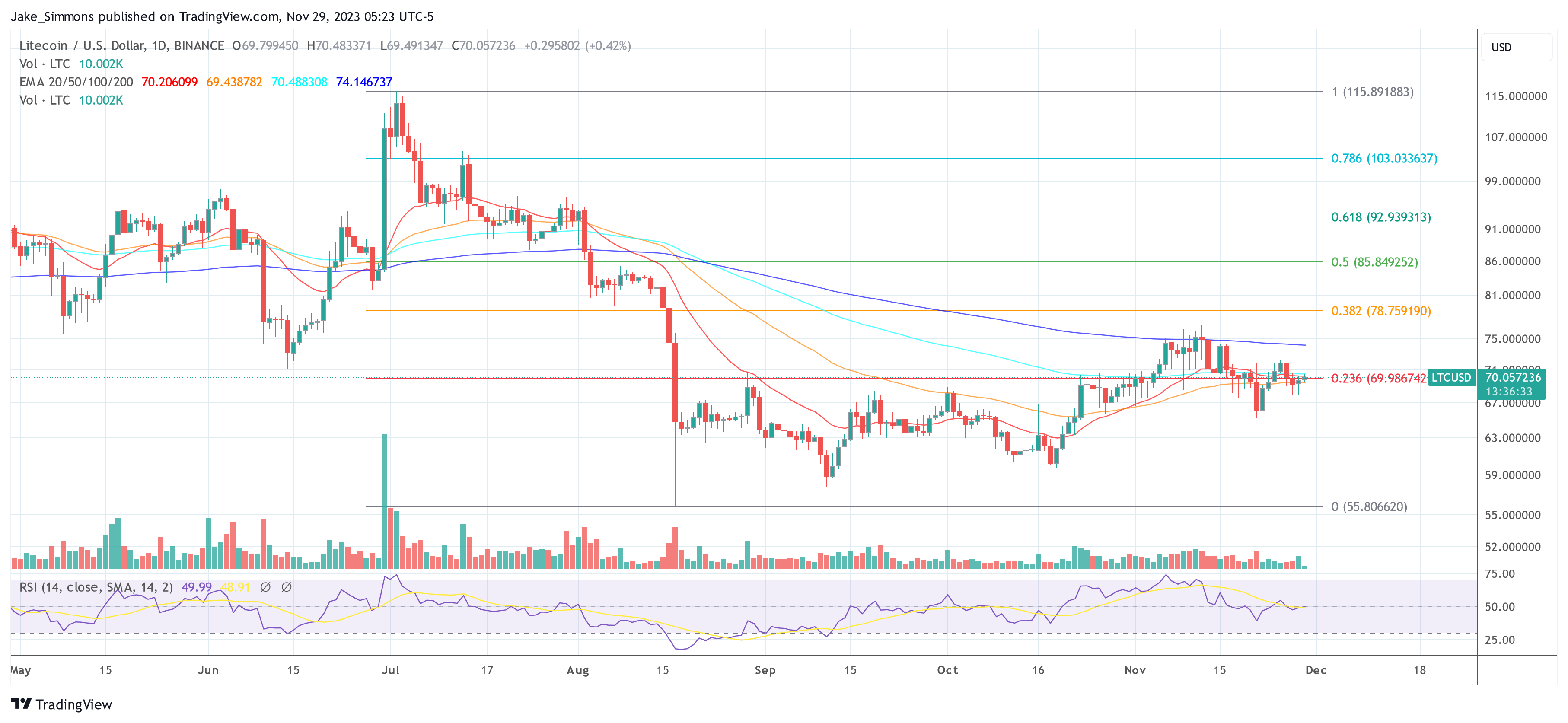

Technical analysts are particularly enthusiastic about a recent development for Litecoin. The digital currency appears to be breaking out of a multi-year symmetrical triangle pattern.

This technical indicator often signifies a shift in market dynamics and underlying strength within an asset’s structure. While a retest of the pattern is underway, a successful breakout could be a major turning point for LTC.

A well-known person in the crypto analytical world, World of Charts, has taken advantage of this technical advancement and made a daring prediction for Litecoin.

$Ltc#Ltc Showing Strength In Recent Days Also btc Halving Completed Its Massive Event For Crypto Markets Ltc Recently Breaks Multi-year Symmetrical Triangle & Retesting It Still Expecting 300-400% Bullish Wave In Midterm Incase Of Successful Breakout pic.twitter.com/toOgtjQ6jZ

— World Of Charts (@WorldOfCharts1) April 20, 2024

Their prediction depends on how well the present breakout goes. World of Charts forecasts an incredible “middle bullish wave” for LTC if it can continue to gain strength and break free of the triangular pattern. This might result in a possible increase of 300–400% over the course of the next few months.

Experts Remain Cautious Despite Optimism

The cryptocurrency market, however, remains a land of unpredictable twists and turns. While analyst predictions like World of Charts’ are certainly attention-grabbing, industry experts urge caution. The inherent volatility of the market means even well-supported forecasts can be thrown off course by unforeseen events.

Furthermore, some analysts point out that Litecoin faces competition from newer, faster-growing altcoins vying for investor attention.

Whether LTC can recapture its past glory and establish itself as a true silver lining in the ever-evolving crypto market landscape remains to be seen.

The Road Ahead For Litecoin

The coming months will be crucial for Litecoin. A successful breakout from the symmetrical triangle pattern, coupled with sustained investor interest and trading activity, could propel LTC towards a significant price increase.

Featured image from Pixabay, chart from TradingView

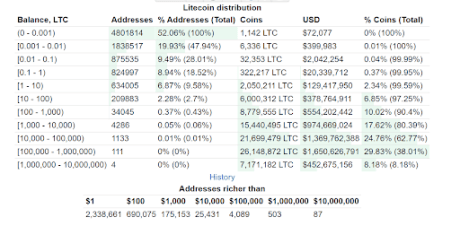

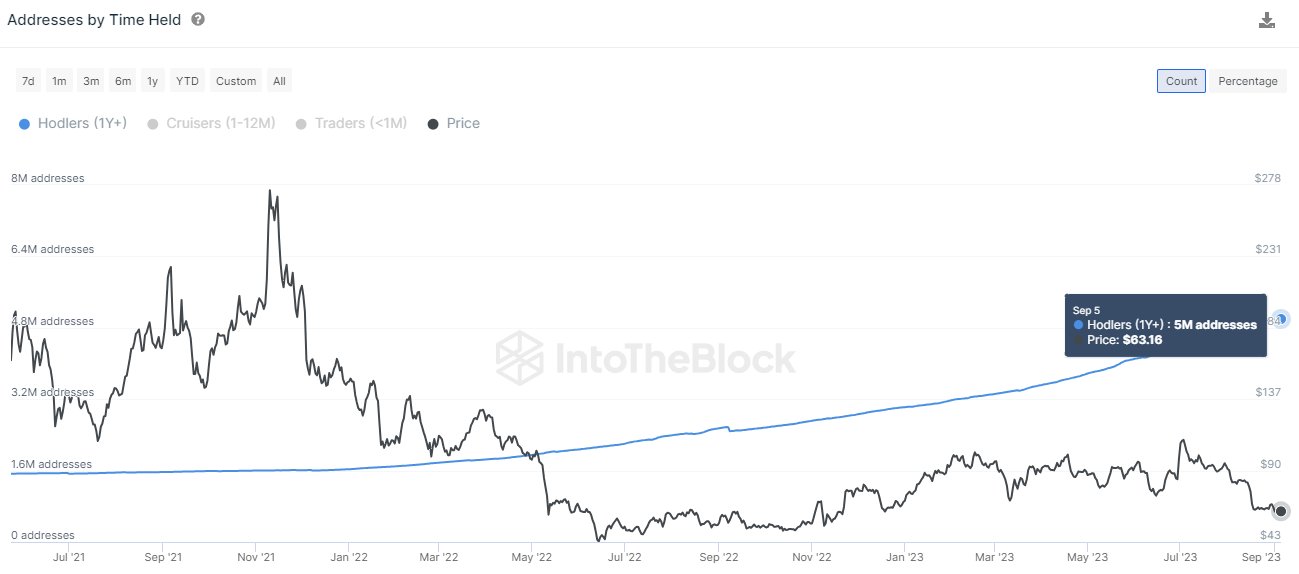

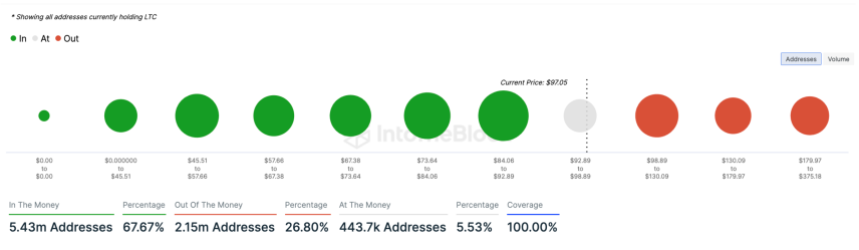

The network now counts over 5 million long-term holders of

The network now counts over 5 million long-term holders of  This figure represents 62.5% of all Litecoin addresses with a balance.

This figure represents 62.5% of all Litecoin addresses with a balance.

SCOOP (with fixed ticker)

SCOOP (with fixed ticker)  : Hearing rumblings on the institutional level about possible interest in a Litecoin ETF. The logic is that because of

: Hearing rumblings on the institutional level about possible interest in a Litecoin ETF. The logic is that because of