The lawsuit, initially filed on May 9, alleges the firm and its CEO was involved in a price manipulation scheme tied to the TerraUSD stablecoin.

Cryptocurrency Financial News

The lawsuit, initially filed on May 9, alleges the firm and its CEO was involved in a price manipulation scheme tied to the TerraUSD stablecoin.

Federal securities laws only apply in the United States, but the protocols were developed overseas, argues Terraform Labs.

Terra Classic has made a significant move in the world of cryptocurrency with the passing of the LUNC Proposal 11487, and it’s leaving many wondering: what does this mean for the future of LUNC prices?

The proposal’s successful passage signifies a positive step towards achieving Terra Classic’s vision of a more decentralized and sustainable blockchain network. It also highlights the importance of community participation in shaping the future of the cryptocurrency.

With almost half of the voters showing their support, it’s clear that this decision has the potential to make a lasting impact on the Terra ecosystem.

The proposal aims to ascertain whether the LUNC community was in favor of moving forward with the USTC Repeg proposal and the accompanying Agora discussion strategy. This proposal is critical in helping the Terra ecosystem recover its former glory, which was damaged by the USTC crash last year.

$LUNC & $USTC outperforming the markets today! Looking good!

Perhaps it’s hype for the #USTC re-peg proposal? pic.twitter.com/pfx0vE4AsG

— Classy

(@ClassyCrypto_) April 29, 2023

To stabilize the value of USTC, the proposed divergence mechanism will impose fees on trades that deviate from the targeted peg. According to the proposal, the fee will vary from 0% when the peg is reached to 100% at a 50% deviation from the peg.

Now that the proposal has been approved, the L1 team will establish an actual timetable and implement the mechanism in four stages.

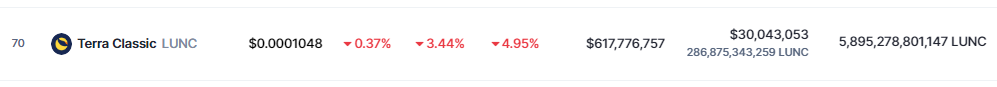

According to data by crypto market tracker CoinMarketCap, LUNC’s price registered a decline of 3.44% in the last 24 hours, trading at $0.0001048 at the time of writing. The crypto is down nearly 5% in the last seven days.

Despite the positive sentiment of the crypto community towards the Terra ecosystem during the voting process of the proposal, the growth of LUNC and USTC was short-lived.

The charts of both cryptocurrencies turned green on April 28, but the situation went south over the following days. The Terra ecosystem is currently struggling to maintain its positive momentum, and the decline in LUNC’s price is indicative of this struggle.

LUNC Outlook Post-Approval Of Proposal 11487

With the approval of Proposal 11487, the LUNC community has demonstrated its commitment to the stability and growth of the Terra ecosystem. The new divergence mechanism proposed is expected to stabilize the value of USTC and help the Terra ecosystem regain its former glory.

While the recent decline in LUNC’s price is a cause for concern for some investors, the implementation of the new mechanism is likely to restore investor confidence in the Terra ecosystem.

As the L1 team works towards implementing the mechanism in four phases, investors can look forward to a more stable and robust Terra ecosystem.

-Featured image from Unsplash

Shin currently faces multiple fraud charges, specifically concerning allegedly hiding risks associated with investing in the in-house tokens by Terraform Labs.

An attendee shared an image of a Terra banner at Washington National Park with the slogan “a decentralized economy needs decentralized money.”

The Terraform Labs executive reportedly established a company called “Codokoj22 d.o.o. Beograd” in Serbia, with its main business activity listed as consultancy services.

According to DappRadar’s February report, the catalysts for the huge spike include the ongoing NFT marketplace war and Yuga Labs’ loyal fans and successful launches.

The stablecoin yield platform is being sued for customer losses following exposure to the Anchor Protocol and UST collapse last year.

While the exact reason for the investigation hasn’t been revealed, it has been reported that the New York regulator plans on upping its efforts to protect consumers this year.

The collapse of Terra Luna and algorithmic stablecoin TerraUSD in May was one of the biggest setbacks for the broader crypto market this year. The previously thriving Terra ecosystem was completely wiped out in a matter of days, except for the Terra Luna token, which was resurrected as Terra Luna Classic (LUNC) by the community.

Despite losing more than 99% of its value, the cryptocurrency still has one of the most active crypto communities on social media. And from it springs a rumor today that has pumped the price of LUNC by 6%. The rumor says that the second largest exchange in the world by trading volume, Coinbase, might buy the LUNC token in large quantities.

Within the LUNC community, the news that Coinbase has authorized the purchase of $245 million in LUNC is currently spreading like wildfire. The speculation also indicates that the American exchange will make the news public on January 3, 2023, and provide information about additional LUNC burns.

BREAKING NEWS

Coinbase has just authorized the purchase of 245 million dollars in $LUNC. Internal source says that on the 3rd to announce publicly listing more off-chain burns.

— WSB Trader Rocko

(@traderrocko) December 22, 2022

However, it is important to note that Coinbase has not yet issued an official statement on the matter. The various tweets also do not indicate a source, but merely make the claim based on a supposed source. Who this source of information is, whether it is someone internal, does not seem clear at the moment.

However, if the rumor turns out to be true, it could trigger the often-seen “Coinbase effect,” which causes altcoins to rise sharply before a listing on Coinbase. Remarkably, the rumor of a listing of LUNC is not new either.

Just two months ago, the Luna Classic community started a petition to list LUNC on Coinbase, as NewsBTC reported. The Terra community wants to follow in the footsteps of the Shiba Inu community, which managed to get the meme coin listed. The Coinbase effect provided SHIB with a short-lived 20% pump.

At press time, the LUNC price stood at $0.00013625, registering a 6% price increase in the last 24 hours. Along with the surge in price, the trading volume of LUNC has also grown noticeably. Within the last 24 hours, it amounted to $90 million, which is 56% higher than the previous day.

However, a look at the 4-hour chart reveals that LUNC remains in a deep bearish trading range. The short-lived rally ended just before the crucial resistance at $0.00014138. To set a bullish trend, LUNC needs to cross the trading range of $0.00013787 to $0.00015379.

If the rally is short-lived, the support zone at $0.00012612 could be an important mark. Otherwise, the all-time low of LUNC at $0.00012136 would probably be on the table.

Featured image from Depositphotos, Chart from TradingView.com

BNB has entered the breakdown stage of its prevailing ascending triangle pattern alongside some negative fundamentals that can push price further down.

Crypto needs to move on from the LUNA crash and start trusting algorithmic stablecoins again.

South Korean authorities have requested cooperation from the Serbian government in order to bring Kwon back to face charges in South Korea.

There is a group called the Terra Rebels whose goal is to restore the natural environment of Terra Classic.

On Twitter, a member by the name of Architect123 recently updated the community on the most recent developments in the ecosystem.

Let’s take a quick glance at some recent developments:

#LUNC #LUNCCcommunity $LUNC #flutter

The new alpha package for TerraDart is now ready!

Use this package to communicate with LUNC Blockchain for Flutter or Dart Environments. https://t.co/SCkWqkBQde— TheArchitect123 | CC & CCI (@AlphaGenius1237) December 5, 2022

The tweet implies that the TerraDart alpha package will make it possible for dApps to interact with the LUNC blockchain from within a Flutter or Dart environment.

The software development kit would help make developing dApps on-chain to be more streamlined.

Data from Santiment shows that because of this recent change, LUNA’s on-chain development activity has increased dramatically. Metrics and technological details, however, hint to a bleak future for the ecosystem.

The current price of one coin is $1.5807. Pearson’s R for the regression channel is 0.6221, which indicates strong bearishness despite the price being at a green candle. This portends a probable decline in price.

Nonetheless, a positive crossover in the RSI indicates some optimism. The data are also on the rise, confirming the creation of a price downturn. The MACD indicator is also approaching a bullish crossing, confirming a modest upswing.

Nonetheless, a retreat would not be sufficient for a complete recovery. The EMA ribbon remains bearish, functioning as a dynamic resistance. The $1.5457 support is underpinning the recent retreat, therefore investors and traders should keep an eye on it.

In the coming days, the Bollinger band is also in the process of developing a crunch zone, which would be another obstacle to a complete recovery.

According to TradingView’s technical analysis of the cryptocurrency, investors should sell since a decline is inevitable.

This is further supported by a significant drop in LUNA’s MFI value, which indicates that the present upward price trend will be subject to a quick reversal.

Certainly, the new developments have an effect on the price of LUNA. Sadly, this is insufficient to halt the pessimism around the asset. Messari has a Sharpe ratio of -4.34, indicating that LUNA’s returns compared to its risk are close to zero or negative.

Currently, a short position after a bearish breakout at $1.5457 would be profitable for investors and traders in this extremely unfavorable market situation.

Crypto total market cap at $796 billion on the daily chart | Featured image: CoinQuora, Chart: TradingView.com

As part of a broader inquiry into FTX’s collapse, federal prosecutors are looking at the role that FTX and Alameda may have played in the fall of Terra LUNA.

With the implosion of the LUNA coin, the Terra ecosystem was devastatingly hit within a few days in May 2022. The successor, Luna Classic (LUNC), currently once again surged in price.

LUNC briefly rose to $0.00019439, registering a 20% price increase. At press time, the LUNC price showed a correction. However, LUNC was still at $0.00018 and showed a price increase of 11% over the last 24 hours.

The background for the sudden pump was the fact that Binance destroyed more than 6 billion LUNC in the sixth batch of the Terra Classic token burn on Thursday. Binance sent $1 million worth of LUNC tokens to a dead address, wiping out 12.77 million LUNC.

With the current token burn, Binance has now destroyed nearly 20 billion LUNC tokens.

Burn alert! 6,389,199,628 #LUNC ($1,038,309) burned to Luna Burn Wallet! https://t.co/Z6PZLanME4 #LunaBurn #BurnLuna

— LunaBurnTracker (@LunaBurnTracker) December 1, 2022

The leading crypto exchange introduced the Terra Classic (LUNC) burn mechanism for trading fees in September this year. It was a response to a LUNC community proposal.

All trading fees for LUNC spot and margin trading pairs are burned by Binance by sending them to the LUNC burn address. The specific amount of LUNC burned and the on-chain transaction ID are published each month.

With the token burn, the LUNC community aims to make the token deflationary by destroying tokens and thus reducing the overall supply.

According to the supply/demand theory, an increase in value occurs when the supply decreases and the tokens become rarer. For the moment, this seems to work quite well as LUNC has seen green daily candles on most occasions when the burn took place.

In other Terra ecosystem news, Terraform Labs Pte. Ltd. co-founder Shin Hyun-Seung, also known as Daniel Shin, and seven other Terra employees are facing a court hearing in South Korea today.

The hearing from South Korean prosecutors is for the issuance of an arrest warrant for the eight individuals. To that end, hearings began today for Shin and the other Terra employees.

According to the Korea Times, Shin is accused of making illicit profits of over 140 billion Korean won, the equivalent of about $107 million, from the cryptocurrency LUNA.

He is accused of promoting the Terra stablecoin as a payment method despite multiple warnings from regulators and misusing the private data of Chai Corporation users to promote Terra Luna.

South Korean prosecutors accuse Shin and his partners of violating the Capital Markets Act and the Electronic Financial Transactions Act, as well as dereliction of duty.

Shin denies the charges, claiming that he sold over 70% of his LUNA holdings before the price spike. Also, he’s claiming that he still held a significant amount of LUNA during the May collapse.

A decision is expected either in the late Friday evening hours in South Korea or on Saturday.

Remarkably, Terra CEO, Kwon Do-hyung, better known as Do Kwon, is still on the run. South Korean authorities issued an arrest warrant for Do Kwon in September.

In October, his passport was declared invalid by South Korean authorities. Rumors have it that Do Kwon was in Singapore, Dubai and Europe in the meantime.

It’s time for NYDIG to chip in. The FTX fiasco is the theme of the month in the crypto world, and the show’s just beginning. The NYDIG research team avoids the temptation to summarize the whole saga and goes straight to the implications of the fall of Sam Bankman-Fried’s empire. “Some signs of contagion have appeared but a full accounting of the damage and regaining of investor confidence will likely take time,” they say understating the harsh reality.

Taking a page from NYDIG’s book, let’s skip the intro and go straight to the conclusions.

Speaking about “signs of contagion,” NYDIG mentions BlockFi and the Genesis/ Gemini combo. However, there might be much more to come.

“Several other service providers have piqued the curiosity of crypto sleuths as potential next dominoes, but we hesitate to speculate too much without hard evidence. Regardless, industry participants are on edge for even the slightest signs of stress and continue to pull balances off exchanges.”

In the contagion section of the paper, we find a rare mention of a conspiracy theory that’s making the rounds in crypto twitter. Rarely do big players bring this up. Of course, NYDIG ends up doubling down on the thesis about Terra/Luna that they put out in a previous paper titled “On Impossible Things Before Breakfast.”

“There have been accusations that Alameda caused the initial de-peg of UST, and while that may have been the case, uneconomic rates paid by the Anchor Protocol and insecure economic design of LUNA/UST ensured its ultimate destruction, destroying $60B worth of crypto wealth in a few short days.”

In the previous paper, NYDIG printed a great segway to the next section. “DeFi is not decentralized. The Terra ecosystem was not decentralized. Terra initially sourced funding from LUNA token issuance apportioned to Terraform Labs at inception.”

FTT price chart on Bitstamp | Source: FTT/USD on TradingView.com

Even though they’re clearly not fans of DeFi, NYDIG gives them some credit. “Most DeFi protocols operated as advertised through the volatility this year, minus the ongoing hacks within the ecosystem.” True, but the ongoing hacks are not a minor factor. It’s a billion-dollar problem with no apparent solution available. However, according to NYDIG, this time the problem lies with centralized finance, and those companies “did the rest of the damage” by engaging in these behaviors:

“Poor risk controls, conflicts of interest, excessive leverage, unclear accounting, counterparty risks, and poor management were just some of the factors at play. Furthermore, the use of an equity-like token, FTX Token (FTT), as collateral exacerbated the issue.”

According to NYDIG, the industry was expecting “improved regulatory clarity for US investors.” However, thanks to the FTX crash and Sam Bankman-Fried’s political lobbying, “the path in DC has grown more complicated. Regulators will now be on their toes and increasingly more likely to use their current authority to enforce existing regulations and possibly issue new ones.”

It is what it is, however one has to take into account that “FTX.com wasn’t even a US entity, which raises the question of how impactful improved US regulations would have been, at least with respect to preventing the specific recent events surrounding FTX.” That’s true, but FTX was in business with several US fully regulated entities. If effective, shouldn’t Silvergate’s AML procedures have detected Sam Bankman-Fried’s shenanigans?

A related question would be, shouldn’t the due diligence of the highly regarded entities that invested in FTX have detected that something was off?

Featured Image by Kaleidico on Unsplash | Charts by TradingView

The Terra Classic LUNC has been putting more effort into resuscitation its new position in the crypto space. Unfortunately, the algorithmic stablecoin Terra and LUNA collapse in May caused a massive loss in the industry. The crisis intensified the crypto winter of the year, leading to the loss of billions of dollars.

However, the new Terra ecosystem is gradually building against its previous loss. One of its distinctive approaches is the protocol’s burning mechanism. This action brought about the 1.2% tax burn for on-chain LUNC transactions, as proposed by one of the Terra community members.

The Terra community has embraced the burning mechanism in line with its plans. According to a recent report, the district has burned almost 25 billion Terra Classic till now.

Also, a report noted that the crypto exchange giant, Binance, has tremendously moved in LUNC burns. Recently, Binance announced burning over 1.34 billion Terra Classic in the fourth batch of its weekly burns. It quoted 2.68 million coins as the transaction for the burn.

Binance pledged its support for Terra’s burning mechanism. So far, the exchange has burned almost 12.5 billion LUNC tokens through its trading fees on spot and margin trading pairs.

But Binance noticed a drop in its weekly burning of LUNC tokens. This made its CEO CZ suggest a reduction in the burning tax to increase both on-chain and off-chain transactions.

Recently, the Terra Luna Classic community voted for a change in the tax burning of tokens. The change was from 1.2% to 0.2%, as contained in Proposal 5234. The community expressed its enthusiasm over the new tax burn resulting in its massive voting.

Terra community has adopted the tax burn as a process that facilitates the growth of LUNC price. The mechanism will destroy 10 billion LUNC from the token’s total supply. The new tax burn change took effect on October 19.

It has not been quite easy for LUNC amid the bearish trend in the crypto market. But the token is showing a formidable strength during the drastic period.

Today’s reclaiming in the crypto market gave the token another great price movement. At the time of writing, LUNC is trading at $0.00241, depicting an increase of 5.50% over the past 24 hours.

The token saw 13 out of 30 (43%) green days over the past 30 days, with a 9.86% price volatility. Using some technical indicators, the LUNC sentiment currently reads Neutral. LUNC has 15 indicators that show bullish signals and 14 that indicate bearish signals.

Featured image from Pixabay, Chart: TradingView.com

It’s time to listen to the other side. Fat Man Terra used to be a cog in the Terra machine, but nowadays he’s the protocol’s biggest critic. He’s also a researcher, and his investigation lead him to believe that Terra was a scam from the very beginning. Of course, Laura Shin’s Do Kwon interview rubbed Fat Man Terra the wrong way. So, exercising his right to reply, he went to the same platform and told his side of the story.

If what Fat Man Terra says is true, the Terra/ Luna story is a horror film.

A court will probably decide if he’s right or wrong, though. Let’s explore his allegations, taking into account that this is just the investigator’s interpretation of the facts. He might know more about the Terra/ Luna case than everyone on Earth, though.

This is the introduction to the episode titled “Fat Man Terra Speaks: Do Kwon Is a ‘Sociopath’ and a ‘Charismatic Manipulator”:

“Fat Man Terra, the anonymous Twitter account dedicated to bringing Do Kwon to justice, reacts to my recent interview with Do Kwon and says what he thinks it revealed about his personality.”

This is the video:

Fat Man Terra Presents The Case

The investigator also thinks that Do Kwon is “not able to stick to one story.” That’s a characteristic that fraudsters often exhibit. And he claims there’s a reason that regulators all over the world are looking at Terra specifically. Some things don’t add up, and this case is far from over.

LUNA price chart on Eightcap | Source: LUNA/USD on TradingView.com

Opinions About Do Kwon’s Character

Respectfully, Fat Man Terra goes for the throat. He’s been studying Do Kwon and his diagnosis is that the man is:

According to Fat Man Terra, it all comes down to that. “If you really believe in UST, why did you cash out so much,” he asks Do Kwon. Also, why did he made up statistics and inflated the network’s numbers?

The investigator will “start to believe he’s sorry” when Do Kwon starts making affected Terra investors whole from his own pocket.

Fat Man Terra Is Still Optimistic

The parasites will always be there, surrounding the crypto space. According to Fat Man Terra, if the industry wants to survive we have to start “calling out scammers” and “pushing for justice.” He believes the industry will develop “failsafe mechanisms” to filter out bad actors and, in general, he’s “optimistic about the future of the space.” Make no mistake, though. Despite the optimism, the investigator claims that “Terra was a scam at every level.”

According to Laura Shin, Do Kwon will be back to answer the allegations in the future.

Featured Image: Laura Shin screenshot from the interview | Charts by TradingView

A retail investor group is trying to track down Terraform Labs co-founder Do Kwon following the crash of the Terra ecosystems’ cryptocurrencies.