The prices of LUNC and USTC have both seen a considerable boost in the past day. But although there has been a bit of a recovery in the crypto market, another reason entirely is behind this surge in price and it has everything to do with the currently incarcerated founder of the Terra blockchain, Do Kwon.

Terra Founder Gets Released

Do Kwon, the founder of the billion-dollar Terra blockchain, which collapsed in 2022, has been in prison in Montenegro for months now after being apprehended with fake travel documents. Since then, there have been numerous efforts by both the United States and South Korean governments to get the founder extradited for prosecution in their respective countries to no avail.

Between the two countries vying for extradition, there have been reports that the Montenegrin court is leaning toward extraditing him to South Korea to face charges for the collapse of the blockchain. Despite this, the founder remains in Montenegro as a final decision on his extradition has yet to be made.

While the courts deliberate on where to send the founder, Do Kwon has finally secured a release from prison in Montenegro. According to the release reports, Do Kwon is expected to remain in the country until the courts decide his fate.

Prison Chief Darko Vukcevic confirmed Do Kwon’s release from prison as he says that the disgraced founder has served the entirety of his sentence for the fake travel documents. He was reportedly released on Saturday, March 23, and is currently under house arrest.

LUNC And USTC React To Do Kwon’s Release

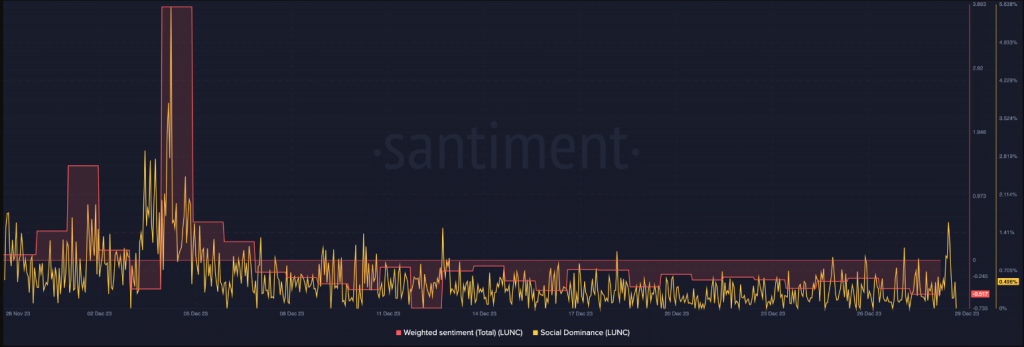

The prices of USTC and LUNC have reacted positively to the news of Do Kwon getting released on Saturday. After the news made the round, the prices of both altcoins saw a significant uptick, turning green despite the crypto market continuing to struggle.

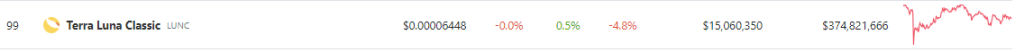

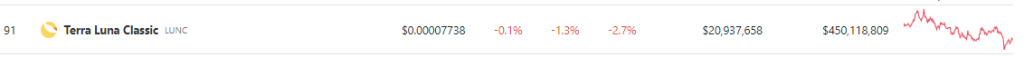

The LUNC price saw an over 10% jump from its Sunday lows of $0.00015, reaching as high as $0.000172 before correcting back downward. In the same vein, the USTC price also recorded a 10% increase during this time, going from $0.028 to peak at $0.031.

So far, both altcoins have been able to maintain their gains in the last day, which could signal a continuation in the uptrend. Right now, there is not much resistance for both assets and if Bitcoin continues to rise, then both USTC and LUNC are expected to follow.

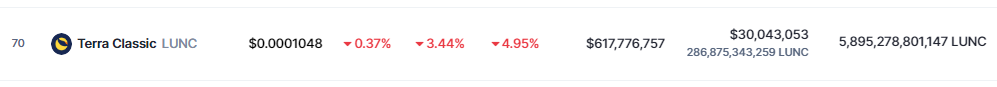

At the time of writing, LUNC is trading at $0.0001672 with a 24-hour gain of 9.4%, and USTC is trading at $0.0303 with a 24-hour gain of 5.39%, according to data from Coinmarketcap.

(@ClassyCrypto_)

(@ClassyCrypto_)