Dallas Mavs fans who spend more than $150 worth of Dogecoin in one transaction will receive a $25 e-gift card that they can use for purchases on the team’s online store.

Cryptocurrency Financial News

Dallas Mavs fans who spend more than $150 worth of Dogecoin in one transaction will receive a $25 e-gift card that they can use for purchases on the team’s online store.

More than 400 teams are already building on Arbitrum One.

Venture funds and other strategic investors have recognized the value proposition of NFT marketplaces. Some of blockchain’s biggest investors are behind the Alethea AI token sale.

On-chain activity and trading volumes at major exchanges have analysts convinced that DOGE is turning bullish again.

New use cases and a massive token burn signal that the dog days of summer could be over for DOGE and SHIB.

The NFT marketplace plans to integrate Ripple’s XRP Ledger blockchain.

The Iron Finance stablecoin fiasco caused cries for regulation and shed light on the importance of complete collateralization.

Crypto.com has invested in a multichain NFT marketplace start-up, Hot Wheels are set to be tokenized, and you can now purchase NFT cosmetics.

After a bank run on the Iron Finance protocol cost him dearly, Mark Cuban is calling for regulation to define “what a stablecoin is and what collateralization is acceptable.”

Mark Cuban has been publicly bullish on Ethereum and DeFi. The billionaire has gone all-in on this sector. He believes dApps have great potential to build a new financial system. However, some protocols carry higher risk, sometimes that leads to a higher reward or a bigger loss, as Cuban himself just discovered.

The billionaire got into a protocol called Iron Finance (TITAN), an algorithmic stablecoin project. After a couple of days live, the protocol’s native token TITAN crashed to 0, as the team reported via their Twitter handle.

Since the price of titan has fallen to 0, the contract does not allow for redemptions.

We will need to wait for 12 hours for the timelock to pass before USDC redemptions are possible again.

— IRON Finance (@IronFinance) June 17, 2021

Cuban wrote about TITAN in a blog post titled “The Brilliance of Yield Farming, Liquidity Providing, and Valuing Crypto Projects”, published on June 13, 2021. There in he claims to be the only liquidity provider for the trading pair DAI/TITAN on QuickSwap with an initial $75,000 investment.

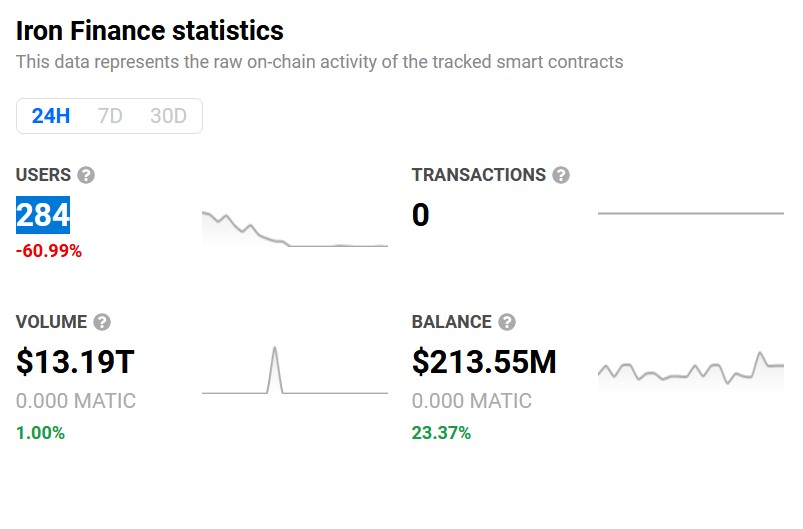

Data from DappRadar indicates that Iron Finance has lost more than 60% of its users in the past week alone and, at the time of writing, the protocol records 0 transactions.

Mark Cuban decided to participate by becoming a TITAN liquidity provider, but as he admitted in an interview with Bloomberg, he failed to see the shortcomings of the project:

In any new industry, there are risk I take on with goal of not just trying to make money but also to learn. Even thought I got rugged on this, it’s really on me for being lazy. The thing about defi plays like this is that it’s all about revenue and math and I was too lazy to do the math to determine what the key metrics were.

Mark Cuban didn’t reveal the exact amount of his loss. However, since the incident, he has called for more regulations. The billionaire believes regulators should define what is a stablecoin and what level of collateralization it’s acceptable for these types of digital assets. He added:

(…) should the math of the risk have to be clearly defined for all users and approved before release? Probably given stable coins most likely need to get to hundreds of millions or more in value in order to be useful, they should have to register.

The team behind Iron Finance has published a postmortem report on TITAN’s crashed. As the report claims, the chain of events that led to the crash begun at 10 am UTC on June 16th, 2021. At this moment, the team recorded activity from whales that started removing liquidity from the IRON/USDC trading pair.

The Whales later sold their TITAN holding for IRON and eventually sold them for USDC. This process caused IRON’s price, the stablecoin, to off-peg. As a consequence, TITAN’s price lost 50% of its value in less than 2 hours.

This process took place during the entire day. Eventually, users panicked, and the protocol began to operate with a negative feedback loop.

A classic definition of an irrational and panicked event also known as a bank run. At the time of writing this, the TITAN supply is 27,805 billion. The team claimed the following:

At some points, the price of TITAN became so low, close to 0 actually, which caused the redeem contract to revert the redeem transactions. We already queued the fix for this, so people can redeem again at 5pm UTC.

Despite the event, the team will work on new products (IronBank for lending and IronSwap for a pegged assets-focused swap solution). In addition, they disagree with Mark Cuban and don’t consider TITAN’s crash as a rug pull. A team member said:

There was no rug pull or exploits. What happened is just the worst thing that could possibly happen considering their tokenomics.

At the time of writing, ETH trades at $2,389 with minor losses in the daily chart.

Porsche announces NFT subsidiary, Chainlink oracles unlock special NFT content, and Mark Cuban continues to invest millions into companies targeting nonfungibles.

Michaal van de Poppe, a top crypto analyst, has offered his thoughts on the prospect of a new altseason, highlighting three cryptos that appear to be primed for new breakouts.

In a new video, Van de Poppe tells his 103,000 subscribers that despite the harsh late-May correction that saw Bitcoin tumble to $30,000, an altseason may be in the cards in the coming weeks.

The whole altcoin market cap is still above the 21-day weekly moving average (21 WMA), indicating that the cryptocurrency bull run is likely not done yet.

“We are still acting above the 21 WMA meaning that the chances of us continuing the grind to the upside are significant…Many altcoins are going to make new highs in their USD and Bitcoin pairs. That the altcoin market cap is currently holding above the 21 WMA is a very bullish trigger and a good signal of the momentum we have, through which the assumption [is] that we can continue grinding up and that we still have a very strong summer coming up for altcoins…

He noted that he still strongly believes that the alt season is not far off. The recent fall in the market is simply a stop gap.

“Are we going to get a big altcoin season? The thesis is still standing, and I’m still assuming that they’re going to continue their momentum. It’s time for you to start accumulating,” he said.

Van de Poppe claims that automated market maker Curve Finance (CRV) is on the verge of retaking the 100-day and 200-day moving averages in its Bitcoin pair (CRV/BTC) and continuing its ascent.

“CRV is currently in the resistance zone acting in one, but we can assume and expect that we are flipping back above the 100 and 200-day moving average, granting us support there. Then, we can start breaking out of this accumulation range towards new highs.”

After sliding below the 100 and 200-day moving average indications, the cross-chain lending platform KAVA is ready to hit new yearly highs versus Bitcoin (KAVA/BTC), according to the trader.

“We can see that we are making higher highs and higher lows and the momentum starts to switch… in which we are getting into a new cycle for KAVA. We are gaining back the losses we have made,” he added.

Related article | Is It Bitcoin Season or Altseason? Right Now No-one Knows

One of Cuban’s Ethereum wallets was uncovered in January when he minted an NFT on Rarible, a decentralized non-fungible token marketplace.

The wallet had a variety of decentralized finance (DeFi) currencies at the time, but the majority of his funds were dedicated to the lending protocol Aave.

Cuban seemed to have virtually exhausted the same wallet. It has over $26,000 worth of odd cryptocurrencies like Dogelon (ELON), Doge Inu (DOGI), and Bingo Inu, and about $2,000 worth of Ethereum (BINGO). It’s unclear if Cuban purchased these crypto assets or if they were given to him by holders looking to promote their own currencies.

Lark Davis, a crypto analyst and influencer, also weighs in on the contents of Cuban’s various crypto wallets, pointing out that the Dallas Mavericks owner previously stated in an interview that he maintains 60% of his crypto portfolio in Bitcoin, 30% in Ethereum, and 10% in other altcoins.

Davis said:

“From what we know, from what we’ve gathered and from what we can see on the blockchain, he has Aave, Rarible (RARI), SushiSwap (SUSHI), Polygon, Serum (SRM), Injective and Fantom (FTM)…

The coins I just mentioned are likely not his full portfolio but are the coins that he has publicly admitted to owning or we can see in his addresses.”

Related article | Which Altcoins Are More Likely To Catch The Bounce?

Featured image from Pixabay, Charts from TradingView.

The Ethereum-based scaling solution recently appeared on the Mark Cuban Companies website, seemingly affirming his investment in the project.

In a tweet reply over the weekend, billionaire businessman and crypto advocate Mark Cuban described the current price action as part of the “great unwind”. The comment was in response to Larry Cermak, Director of Research at The Block, and emphasized the implications of over-leveraged traders leading to ‘unwinding’.

In a response to Newsweek about the tweet specifically, Cuban elaborated, “if there is one thing crypto enthusiasts lose track of, it’s that at its base, there are a lot of participants from token holders to validators, miners and others all get rewards”.

Mark Cuban is no stranger to crypto. The Dallas Mavericks owner, ‘Shark Tank’ regular, and serial entrepreneur has been outspoken about smart contracts, NFT projects, and more.

In a detailed email exchange published by Wall Street Journal columnist Andy Kessler, Cuban describes present-day NFTs as “proof of concepts” for what’s to come. Cuban pressed further when asked about smart contracts’ use case in things like mortgages, “smart contracts on blockchains, particularly Ethereum, is an enormous game changer that every company will use”.

Mark Cuban, of course, has put his money where his mouth is too, as an early investor in crypto tools like OpenSea, CryptoSlam.io, and others; additionally, he’s doubled down recently on allowing his Dallas Mavericks to accept bitcoin, ethereum, and dogecoin for ticket sales in light of Elon Musk’s comments surrounding Tesla and bitcoin.

According to Mark, it’s all “no different than the internet of 1995 where people weren’t quite sure but eventually they saw the network effect and value. Smart contracts are going to eat a lot of the software-as-a-service world.”

Related Reading | Cuban Expects Number Of Bitcoin Hodlers To Double, But Ban Fears Still Linger

Cuban insists that the best projects will persevere. Nonetheless, it’s likely that the rollercoaster ride of ups and downs will continue.

The crypto ‘fear and greed index‘ recently hit a resounding level 12, a level rarely seen. In March of 2020, the index scored around 10, and in April 2018, a record level 16 was hit. The index currently sits at 10 (“extreme fear”) at time of writing.

Volatility is nothing new, but been exacerbated recently| Source: CRYPTOCAP on TradingView.com

Cuban undoubtedly understands that bitcoin is the most established store of value in the crypto space currently, but the projects being built on ethereum seem to be one of the most exciting major players in the crypto space – emphasized by his public statements and by his private investments.

Cuban has said the impact of Ethereum 2.0 “could be greater than we currently imagine” and has invested in ethereum-based projects, such as Polygon.

Despite the rocky ride, Cuban seems to have his eyes laser-focused on the long-run.

Related Reading | This Is Why Mark Cuban thinks Ethereum Is A “True Currency”

Featured image from Pixabay, Charts from TradingView.com

The billionaire is bullish on DAO participation, networks with real usage, and mass adoption on the horizon.

The Dallas Mavericks owner contends that Bitcoin replacing the legacy financial system will be a net positive for society and the environment.

Mark Cuban said the Dallas Mavericks are selling more merchandise in a day with DOGE than in a year with Bitcoin or Ether.

“I’m interested in Dogecoin, and I really want to know more about this,” DeGeneres said to her more than one million viewers.

The price of the meme-based cryptocurrency is at an all-time high as it approaches $0.20.

Being a “cute” and meme-like cryptocurrency has not prevented Dogecoin from seeing some serious, record-breaking price action amid the crypto market rally this week.