The price of Bitcoin took a nose dive on Saturday following reports of Iran launching missile and drone attacks on Israel. Alongside the market leader, many other prominent cryptocurrencies also experienced a significant selloff as news of a brewing international conflict in the Middle East circulated on the internet.

Bitcoin Suffers Major Decline For Second Consecutive Day

According to multiple reports on April 13, Iran commenced a drone attack against Israel in retaliation to an attack on an Iranian diplomatic building in Syria on April 1 which claimed the lives of nine Iranian officers, including a highly ranked general in Iran’s Islamic Revolutionary Guards.

This incident marked Iran’s first-ever direct assault on the Jewish state following years of rising political tensions between both countries. With the Iranian forces confirming further missile attacks on “specific targets” in Israel, it is likely that both nations may be heading for a full-scale war.

Following reports of the drone attacks in the Middle East, Bitcoin’s price dropped by 8.07%, falling from $67,132.1 to $61,710.58, reflecting a high selling pressure. Interestingly, this price action marked the second consecutive day the maiden cryptocurrency suffered a significant loss following a 5% decline on Friday amidst minor turbulence in the US stock markets.

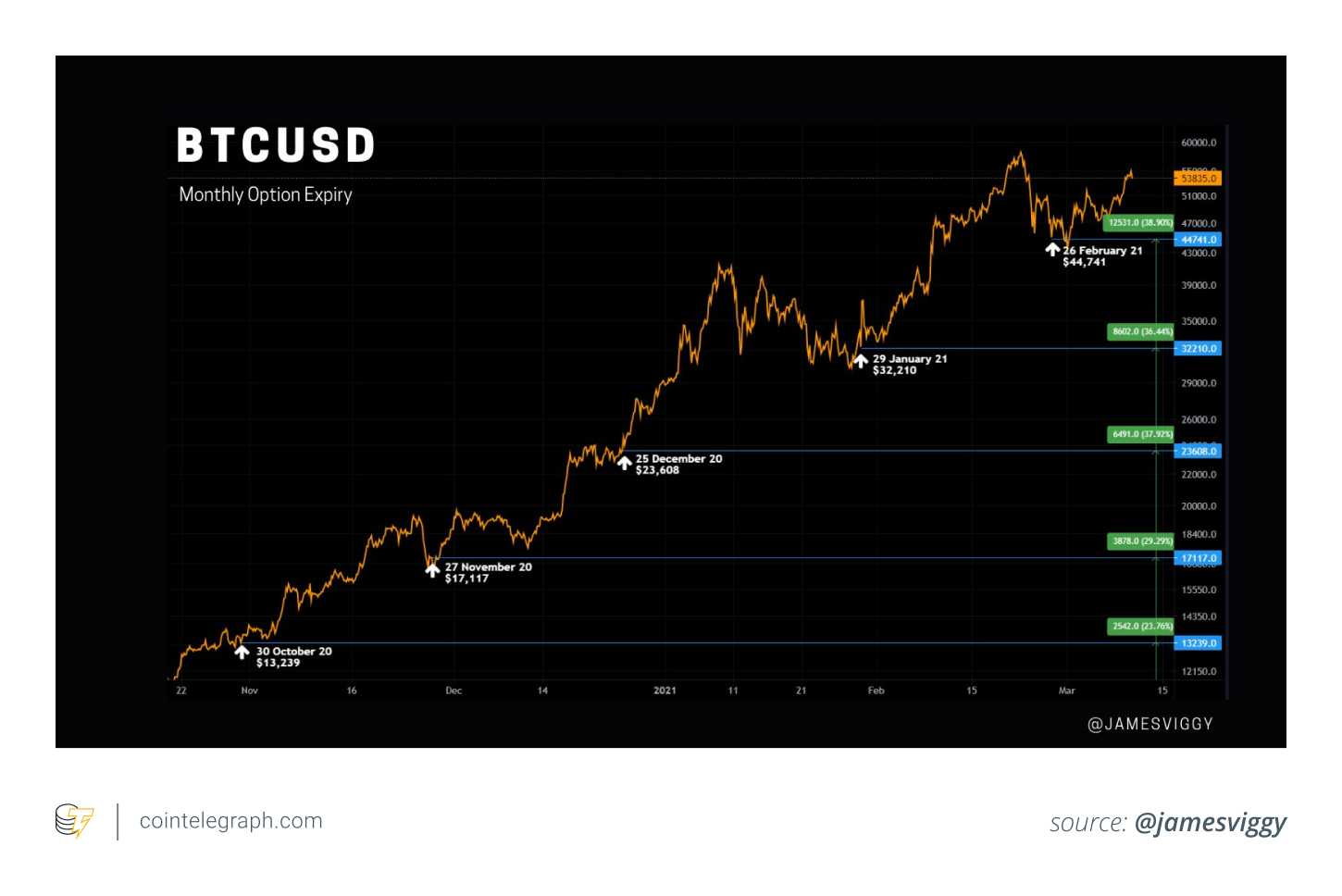

Generally, Bitcoin has shown an underwhelming performance in the past weeks, recording a 12.51% loss in the last month based on data from CoinMarketCap. The maiden cryptocurrency has struggled to replicate its bullish form seen at the beginning of 2024 when it achieved a new all time high price of $73,750.07. However, with the Halving event fast approaching, BTC investors are likely optimistic about a potentially massive price gain in the coming months based on historical price data.

Currently, Bitcoin trades at $63,943, showing a 3.61% gain from its earlier slump on Saturday. In tandem, the token’s daily trading volume is up by 22.46% and valued at $57.37 billion.

Altcoins Not Spared From Market Crash

Alongside Bitcoin, the price of altcoins also decreased significantly due to the escalated geopolitical tension in the Middle East. Ethereum, the most popular altcoin and second largest cryptocurrency, suffered a loss of 10.89%, falling as low as $2,880.16

Meanwhile, other prominent tokens such as Solana (SOL), XRP, and Avalanche (AVAX) also recorded price dips to the tune of 12.68%,18.11%, and 16.00%, respectively. Generally, the total crypto market cap declined by 7.78%, falling to around $2.2 trillion.