Polygon (MATIC), a Layer 2 (L2) blockchain network, experienced remarkable growth in the third quarter of 2023. According to a report by Messari, the platform witnessed a significant increase in non-fungible token (NFT) sales, successful network upgrades, and the activation of a new token.

Polygon NFT Sales Skyrocket

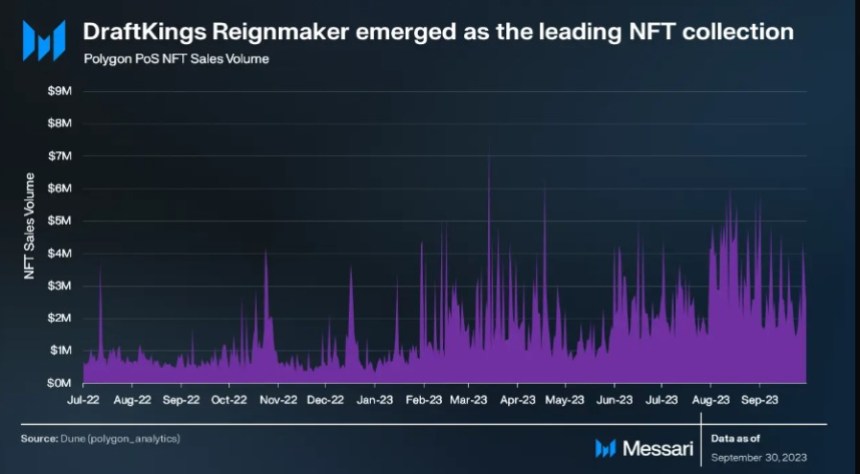

Per the report, in Q3 2023, Polygon witnessed a staggering 131% quarter-on-quarter increase in weekly NFT sales volume, reaching an impressive $20 million. This growth was primarily attributed to the success of DraftKings’ Reignmaker NFT collection, which became the top collection on the network.

The collection featured officially licensed cards from renowned sports organizations like the National Football League Players Association (NFLPA), Professional Golfers’ Association of America (PGA TOUR), and Ultimate Fighting Championship (UFC). Furthermore, through Q3, Polygon achieved significant milestones in terms of technological advancements.

Moreover, Polygon activated the POL token on its mainnet during Q3 2023. POL serves as an upgrade to the existing MATIC token and offers holders the opportunity to contribute to network security across various chains within the Polygon ecosystem through a native re-staking protocol.

The token features an inflationary model with an annual issuance rate that is subject to community governance, which, according to the report, enhances the overall security and decentralization of the platform.

Daily Active Addresses Surge Fueled By DeFi Dominance

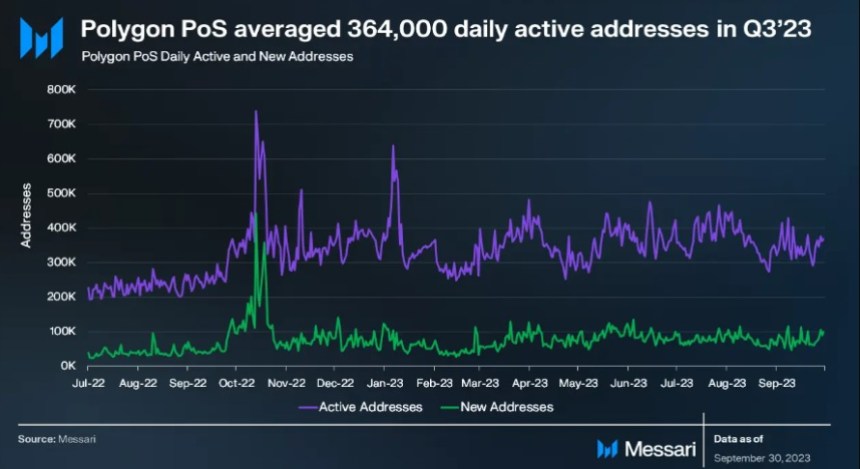

During Q3, Polygon experienced a 1.4% quarter-on-quarter growth in daily active addresses, reaching an impressive 364,000. The decentralized finance (DeFi) sector accounted for the majority of the active addresses on the network, showcasing the platform’s strength and popularity within the decentralized finance space.

What’s more, Polygon Labs unveiled Polygon 2.0, a comprehensive upgrade roadmap aiming to unify all Polygon protocols and blockchains using ZK technology. This initiative seeks to establish Polygon as the “Value Layer of the Internet” and introduces significant updates to protocol architecture, tokenomics, and governance.

One of the key upgrades includes transitioning the network to a zkEVM Validium network, ensuring enhanced security while sharing the same level of robustness as Ethereum (ETH).

Furthermore, according to Token Terminal data, Polygon has shown positive momentum in price performance, network fees, and circulating market cap.

The network’s native token, MATIC, has experienced an increase of 3.95% over the past 24 hours, trading at $0.6556, reflecting positive sentiment among investors.

Over the past 30 days, the coin has experienced a notable increase of 13.01%, signaling a potential recovery from previous market downturns.

However, the six-month data shows a decrease of 34.97%, indicating the impact of market volatility on the long-term value of the token.

Polygon’s circulating market cap currently stands at $6.00 billion, exhibiting a 15.36% increase. However, the fully diluted market cap of $6.49 billion, which considers the total supply of tokens, has grown by 12.79%.

The network’s fees over the past 30 days amounted to $1.21 million, representing a slight decline of 8.57%. However, on an annualized basis, the fees reached $14.68 million, indicating a downward trend of 20.24%.

Featured image from Shutterstock, chart from TradingView.com