An analyst has explained how a buy signal forming in the price of Polygon (MATIC) could lead to the asset rebounding towards these price targets.

Polygon Is Showing A TD Sequential Buy Signal Right Now

In a new post on X, analyst Ali has discussed about the a Tom Demark (TD) Sequential signal forming in the MATIC price chart. The TD Sequential here refers to an indicator in technical analysis that’s generally used for pinpointing probable locations of reversal in any given asset’s value.

This indicator has two phases to it, the first of which is known as the “setup.” In this phase, candles of the same polarity are counted up to nine, at the end of which the price may be assumed to have encountered a point of reversal.

Naturally, if the candles leading up to the completion of the setup had been red, the reversal would be towards the upside, while green candles would suggest a potential top for the asset.

Once the setup is done with, the second phase called the “countdown” begins. This phase works similarly to the setup, except for the fact that it lasts for thirteen candles instead of nine. After these thirteen candles of the same polarity are also in, the price may be considered to have attained another likely point of reversal.

Polygon has recently completed a TD Sequential phase of the former type. Below is the chart shared by Ali that shows the formation of this TD Sequential signal for the MATIC daily price.

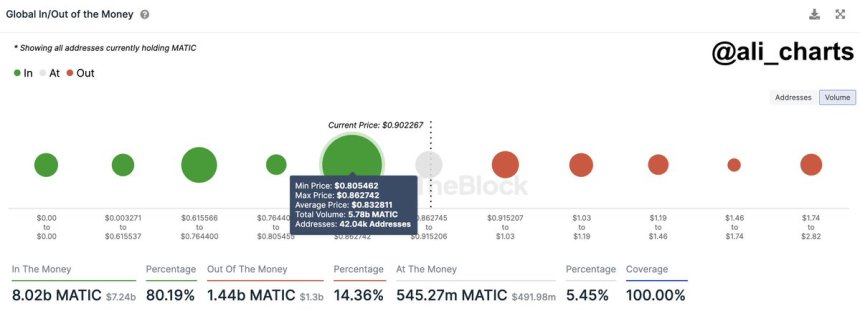

As displayed in the above graph, the Polygon daily price has finished a TD Sequential setup with a downtrend recently. This would suggest that the asset may be at a potential bottom at the moment.

“If MATIC stays strong above $0.87, we could see a rebound to $0.95, or better yet, $1!” says the analyst. A potential rally to the former of these targets would suggest an increase of more than 8% from the current price, while a run to the latter level would mean growth of almost 14%.

It now remains to be seen how the Polygon price will develop from here and if the TD Sequential buy signal will end up holding or not.

MATIC Price

The past few weeks have been a bad time for Polygon investors as the cryptocurrency’s price has slid down all the way from around the $1.3 level to now the $0.87 mark, corresponding to a drawdown of over 33%.

The chart below shows what the trend in MATIC’s value has looked like over the past month.

Amid this downward trajectory, the TD Sequential buy signal may perhaps end up being at least a glimmer of hope for the Polygon holders.

(@DrProfitCrypto)

(@DrProfitCrypto)  euroPeng

euroPeng  (@Pentosh1)

(@Pentosh1)

(@davthewave)

(@davthewave)

15,826,267

15,826,267