MATIC, the native token of Polygon, an Ethereum sidechain, is ripping higher, mirroring the general performance across the crypto scene, spearheaded by Bitcoin (BTC). As of November 9, MATIC is up roughly 5% in the past 24 hours and inching closer to July 23 highs, looking at the candlestick arrangement in the daily chart.

This upswing is at the back of rising trading volume and improving sentiment, which has seen the token expand 64% from October lows, a net positive for optimistic traders.

The 110 Million MATIC Grant

Looking at events in the past few trading days, the MATIC rally seems to have been catalyzed by Polygon Village’s recent announcement. The team said it plans to distribute 110 million MATIC to projects aiming to deploy decentralized finance (DeFi), gaming, and social media solutions on the sidechain.

Polygon said late-stage projects can receive direct grants of up to 2 million MATIC. Meanwhile, early-stage projects and startups, can apply via quadratic funding grants.

In this funding arrangement, the amount of MATIC sent to a project will directly depend on how popular the project is. Those that are popular among crypto holders will receive more funds. Still, it remains unclear how Polygon Labs will deal with bots when deciding how popular a given project is. Voting will be on-chain on Polygon, where MATIC will be the currency through which users can support their favorite projects.

Polygon Rising Stature: From POL To ZK-EVM

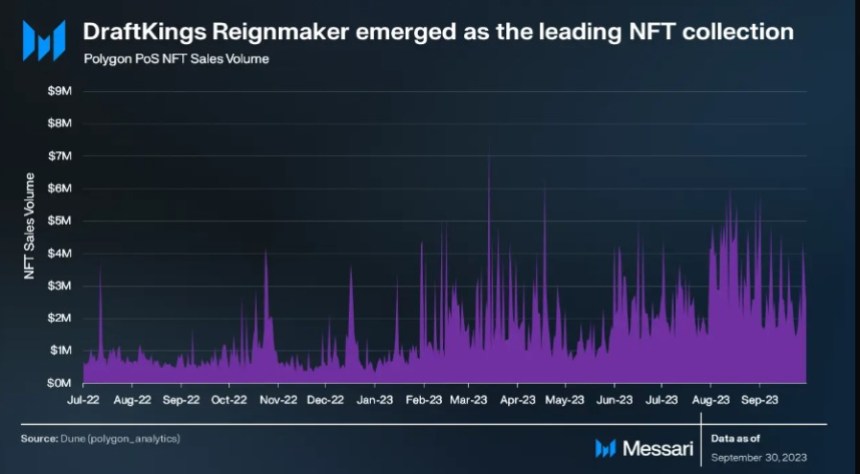

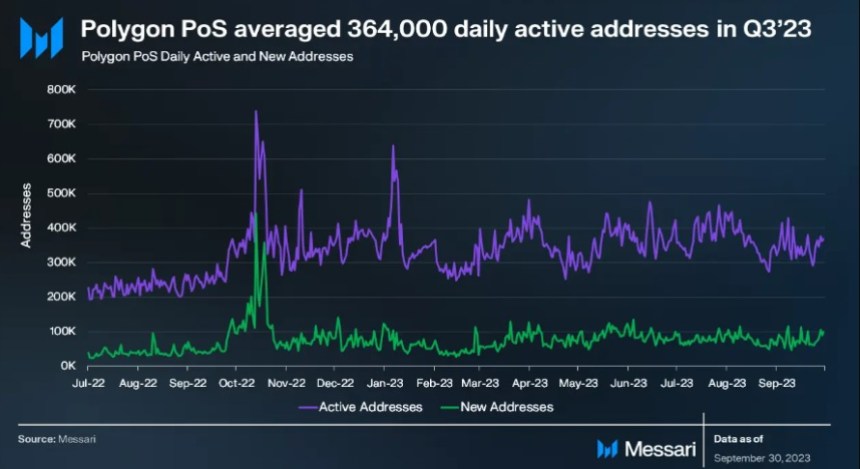

Over the years, Polygon has emerged as a popular scaling solution for Ethereum, looking at statistics and total value locked (TVL), especially in DeFi. The platform is compatible with the Ethereum Virtual Machine (EVM). Accordingly, it allows protocols launching on its rails to easily connect with the mainnet without sacrificing security.

By connecting with Polygon, projects can operate in a highly scalable environment with relatively low fees. This feature allows intensive dapps, including social media platforms or decentralized exchanges (DEXes), to operate seamlessly.

Polygon is also transitioning and, subject to the community’s approval, will gradually replace MATIC with POL. This token will power the broader ecosystem, including supernets and layer-2 networks relaying on Polygon’s infrastructure. In late October, the POL contracts went live on the Ethereum mainnet as part of Polygon 2.0. This transition will see Polygon integrate zero-knowledge (ZK) technology into all its products.

Manta Network said it would retool and integrate Polygon’s Chain Development Kit (CDK) in mid-October. Doing this, the protocol migrated from the optimistic rollup it initially launched on. Using Polygon’s CDK, Manta integrates zk Rollup technology to settle transactions faster and confidentially.

15,826,267

15,826,267