On Monday, popular internet figure and trader “Roaring Kitty” made a surprise comeback to social media that sent the crypto market into shock and excitement.

His return post was followed by a series of cryptic videos, including catsm, which seemingly fueled a price increase for cat-themed memecoins in the past 24 hours.

Memecoin Frenzy And Market Reaction

Keith Gill, known as “The Roaring Kitty,” returned to social media after a three-year hiatus by posting the popular “leaning forward in the chair” meme.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

His comeback propelled GameStop’s meme stock (GME) price to rise 201% in the past day, as he was a major player during the 2021 meme stock frenzy.

Alongside the image, the trader shared a series of video edits that also fueled the memecoin market. As reported by News BTC, Wolverine-inspired memecoins soared after featuring the Marvel character in one of his edits.

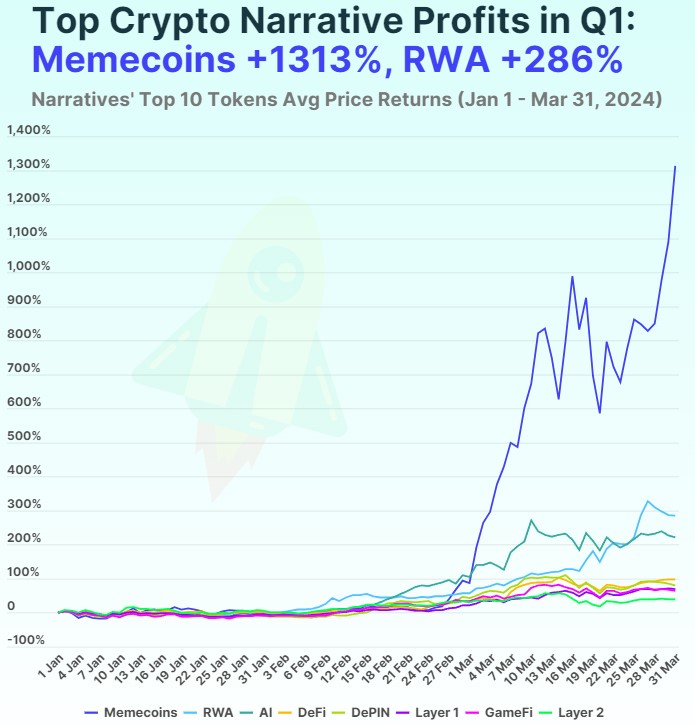

Other big players in the sector saw green numbers in the following hours, like Pepe (PEPE) and many of the top market cap dog-themed memecoins.

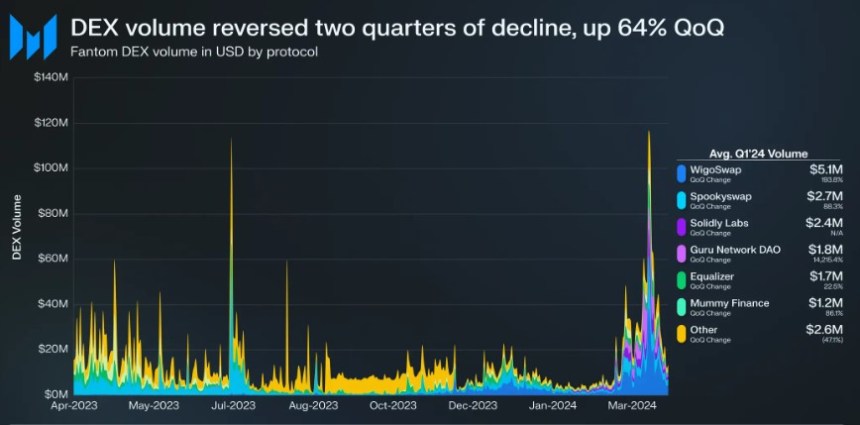

As part of the ripple effect, the largest frog-themed memecoin has flipped Solana (SOL) in its daily trading volume, registering a 238% increase in volume in the past day.

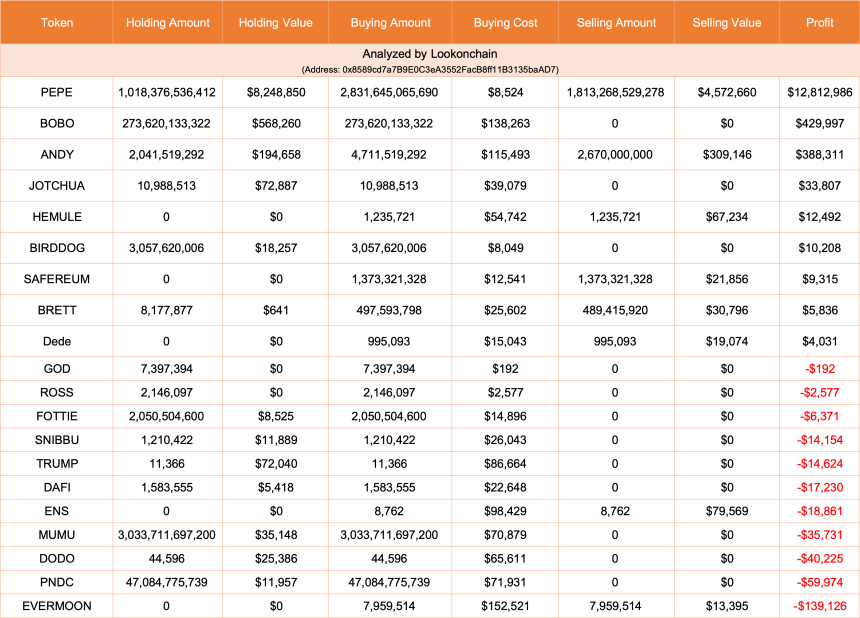

Moreover, smart traders benefited from the surge after buying large token amounts. According to Lookonchain, one whale bought 195 billion PEPE, worth $1.98 million, and had already made $236,000 in unrealized profit a few hours later.

Dog Days Are Over, Cat-Themed Memecoins Gain 16%

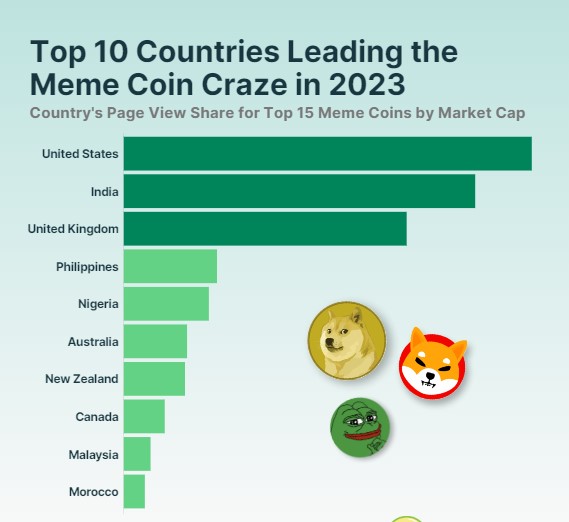

The impact of Roaring Kitty’s return didn’t stop at the dog-themed memecoins. Several images and references to cats were part of the trader’s edits, fueling a 16% surge in the cat-themed sector.

Feline-inspired memecoins have been gaining popularity during this cycle, with tokens like cat in dog word (MEW) and Popcat (POPCAT) joining the top-ten memecoins list in the past month.

One of Roaring Kitty’s edits included a fragment of Florence + The Machine’s song “Dog Days Are Over.” Alongside the video, the trader emphasized the lyrics, “The dog days are over, the dog days are done.”

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

Additionally, he added cat images, seemingly insinuating that a future memecoin rally could be led by cat-themed memecoins instead of the usual dog-themed ones.

Whales Hear The ROAR

Lookonchain reported that, alongside GME, the memecoin Roaring Kitty (KITTY) skyrocketed 13,000%. Other feline-themed tokens, including POPCAT, MichiCoin (MICHI), and Roaring Kitty (ROAR), also saw a significant surge.

Popcat has registered a 24.4% and 276% increase in the one-day and monthly timeframes, while MichiCoin surged 38.9% in the past day and 333.5% since its launch on April 26. Both tokens also saw an 80% increase in the daily trading volume.

Among the top gainers were the tokens inspired by the trader. The Ethereum-based SOAR skyrocketed over 1162% in hours, going from $0.00024830 to $0.0031338. This surge also represented a massive 3216.8% increase in the weekly timeframe, with a similar daily trading volume increase of 826%.

Per the report, whales took advantage of the momentum and loaded their bags with these tokens. One whale withdrew SOL from Binance and bought 490,400 POPCAT, worth around $235,472.

Another big player, who had previously made 2,170 SOL, about $320,000, on POPCAT, spent another 4,000 SOL, approximately $592,000, to buy POPCAT and MICHI tokens. The whale acquired 587,3830 POPCAT for 2,000 SOL and 626,616 MICHI for the same amount.

the risks and rewards, and their predictions for the future of memecoins

the risks and rewards, and their predictions for the future of memecoins

UPDATE:

UPDATE: