Memecoins rally, and PEPE hits a new all-time high shortly after GameStop stock trader Keith Gill posts to his Roaring Kitty X account for the first time in 3 years.

Cryptocurrency Financial News

Memecoins rally, and PEPE hits a new all-time high shortly after GameStop stock trader Keith Gill posts to his Roaring Kitty X account for the first time in 3 years.

GameStop, the video game retailer that took Wall Street by storm in 2021, has once again become the talk of the town as its share price surges 100%.

Fueling this rally is the return of the influential social media figure Keith Gill’s “Roaring Kitty.” After a long hiatus, Roaring Kitty’s recent activity on social platforms, including an image and video, has ignited excitement among investors and triggered a renewed frenzy for GameStop’s meme stock and the emerging world of memecoins.

The meme-stock phenomenon gained widespread attention in 2021 when cash-rich investors pumped up the stock market and bet against short-selling hedge funds.

Keith Gill’s “TheRoaringKitty” account and the subreddit “WallStreetBets” played a pivotal role in the meme stock frenzy, driving stocks like GameStop and AMC Entertainment to surge over 1,000% by the end of the same year.

While some early investors reaped rich returns, hedge funds such as Gabe Plotkin’s Melvin Capital Management suffered significant losses, leading to closures.

According to Bloomberg, short sellers betting against GameStop initially enjoyed gains in the year’s first four months. Still, the volatile nature of meme stocks quickly erased those paper gains. Per the report, “skeptics” were up an estimated $400 million from January to April before slipping into the red by Monday morning.

The percentage of GameStop shares sold short relative to those available for trading has remained at approximately 24%, a relatively high level for a typical company but significantly lower than the 140% levels witnessed during the 2021 mania.

As GameStop’s shares gained momentum, the cost to bet against the company increased. Recent data from S3 indicates borrowing costs exceeding a 10% annual financing fee range.

Roaring Kitty’s influence extended beyond GameStop, as Wolverine-themed memecoins flooded various blockchains. In response to a social media post featuring a video of Marvel superhero Wolverine, more than 30 new tokens were launched on platforms like Ethereum and Solana, as data by Dextools shows.

Notably, the newly minted “Roaring Wolverine” token on the Ethereum blockchain experienced an astonishing 80% surge within hours of its release.

Furthermore, the memecoin market has witnessed a notable resurgence, with tokens such as Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Dogwifhat (WIF), Floki Inu (FLOKI), and Bonk Inu (BONK) recording significant gains, according to CoinGecko data.

For instance, PEPE, the market leader, surged by 15% in the past 24 hours, complementing its 20% uptrend over the previous week. It reached a new high of $0.00001077 during early Monday trading.

Ultimately, GameStop’s meme stock resurgence, fueled by the return of Roaring Kitty, inflicted substantial losses on short sellers of the meme stock on Monday.

The impact of Roaring Kitty’s social media presence has extended to the memecoin market, with several Wolverine-themed tokens experiencing significant surges.

Featured image from Shutterstock, chart from TradingView.com

The Shiba Inu’s reign as king of memecoins may be facing a ruff patch. Dogecoin (DOGE) prices dipped this week after news broke of the US Securities and Exchange Commission (SEC) issuing a Wells Notice to Robinhood, a popular crypto exchange.

The notice, a precursor to potential enforcement action, alleges Robinhood violated multiple securities laws. This sent shockwaves through the crypto community, with many investors, particularly those holding large amounts of DOGE (often nicknamed “whales”), pulling their funds out of Robinhood.

The most significant outflow involved a whopping 164 million DOGE, worth roughly $25 million at the time, being transferred out of the exchange. This mass withdrawal by a whale investor likely contributed to the market jitters surrounding DOGE.

Another 164M $DOGE, worth $25M, have been transferred out of Robinhood.

These transactions occurred after the platform received a Wells notice from the SEC. #DOGE #Robinhood #CryptoNews

Source: MartyParty pic.twitter.com/oKxW1S8pTD

— Bitcoinsensus (@Bitcoinsensus) May 8, 2024

The price of DOGE tumbled 5.8% in the 24 hours following the Robinhood news. However, analysts caution against a knee-jerk reaction. While the legal troubles undoubtedly cast a shadow on Robinhood, the DOGE outflow, including the 164 million transfer, might not be the sole culprit behind the price dip.

Transferring cryptocurrency from an exchange to a personal wallet is often seen as a bullish move, indicating an intention to hold for the long term.

Another factor influencing DOGE’s price is its tight correlation with Bitcoin (BTC). Both currencies operate on the Proof of Work (PoW) consensus mechanism, which some see as outdated compared to newer, energy-efficient models.

The recent pullback in the broader crypto market, especially in Bitcoin, likely played a role in dragging DOGE down as well.

Rocky Road To $0.20? DOGE Faces Support Hurdle

DOGE enthusiasts were eyeing a price target of $0.20, but the recent drop presents a roadblock. The memecoin dipped below the crucial $0.15 support level, raising concerns about a further decline.

Analysts point to a potential support zone between $0.143 and $0.146, but a fall below that could trigger a more significant price correction.

Bullish Signs Amidst The Dip

Despite the short-term pessimism, there are glimmers of hope for DOGE. The buy orders for DOGE currently outweigh sell orders by a significant margin, suggesting continued investor interest.

Related Reading: Forget The Price Dip: Ethereum Network Activity Hints At Imminent Takeoff

Additionally, the memecoin’s Relative Strength Index (RSI) sits at a neutral 47, indicating there’s room for new buyers to enter the market. Furthermore, DOGE managed to maintain a weekly price increase despite the daily drop, hinting at underlying resilience.

Doge Day Delayed, But Not Doomed

The coming weeks will be crucial for Dogecoin. The outcome of Robinhood’s legal battle with the SEC and DOGE’s ability to regain lost ground will determine its short-term trajectory. However, long-term forecasts for the memecoin remain cautiously optimistic.

Featured image from Yahoo Finance, chart from TradingView

This represents a 15x increase compared to the S&P 500’s year-to-date returns.

The once-booming meme coin Pepe (PEPE) has hit a rough patch, experiencing a price drop of nearly 10% in the past 24 hours. This sudden downturn comes amidst a flurry of questions surrounding massive token withdrawals from a major exchange and the overall future of the meme-inspired cryptocurrency.

Just a few months ago, PEPE was riding high, capturing the attention of crypto enthusiasts with its rapid price surges. However, the tides seem to have turned. The recent price drop has cast a shadow of uncertainty over the meme coin’s future trajectory.

While some might attribute the dip to a typical correction in the volatile cryptocurrency market, recent on-chain data paints a more intriguing picture.

According to Etherscan, a blockchain analytics platform, a massive withdrawal of nearly 1 trillion PEPE tokens, valued at almost $8 million, occurred two days ago. The origin of the transfer remains shrouded in mystery, with a high-security Gnosis Safe Proxy wallet facilitating the movement.

This wasn’t an isolated event either. Data reveals another withdrawal of 322.48 billion PEPE tokens, worth around $2.7 million, from the same shadowy address just a day prior.

The timing of these hefty transactions couldn’t be more perplexing. They coincided with an unexpected 17% surge in PEPE’s price, leading to speculation and fear, or FUD, within the cryptocurrency community.

Theories range from market manipulation tactics to the possibility of unforeseen regulatory crackdowns, causing jitters among investors.

Community Sentiment: Bullish Despite The Wobble

Interestingly, despite the price drop and surrounding uncertainty, CoinGecko data indicates that the PEPE community remains largely bullish. This unwavering optimism is further bolstered by the influx of 703 new PEPE holders in the past day.

Prominent cryptocurrency figures like renowned analyst David Gokhshtein, who thinks PEPE will continue to be Dogecoin’s major rival in the imminent bull market anticipated later this year, are fanning the bullish flames.

I think you’ll see a crazy battle between $PEPE & $DOGE this meme season.

— David Gokhshtein (@davidgokhshtein) May 6, 2024

Investing In PEPE: Proceed With Caution

Meanwhile, as the community sentiment leans towards optimism, and some experts see significant growth potential, the recent price drop and the enigma surrounding the large token withdrawals highlight the inherent volatility of the cryptocurrency market.

Featured image from KnowYourMeme, chart from TradingView

Fantom (FTM), a Layer-1 (L1) protocol, and its native token, FTM, have experienced significant gains and notable achievements in the first quarter (Q1) of 2024.

According to a comprehensive performance analysis conducted by Messari, amid the emerging crypto bull market, Fantom has emerged as one of the major beneficiaries, showing significant growth in key metrics and market capitalization.

By the numbers, FTM’s circulating market capitalization saw a substantial 101% quarter-over-quarter (QoQ) increase, jumping from $1.3 billion to $2.6 billion, vaulting it up ten spots to 48th among all tokens (currently 58th). The token’s rally extended for two consecutive quarters, resulting in a fourfold increase since the end of Q3 2023.

Although Fantom experienced a decrease of 53% QoQ in revenue measured in FTM, amounting to 1.8 million FTM, revenue denominated in USD exhibited a 4% QoQ increase, reaching $1.2 million.

According to Messari, the revenue decline was primarily due to reduced inscription activity across all smart contract platforms in Q1.

Despite this, Fantom maintained an upward trend in average daily transactions, excluding inscription-related activity, surpassing the Q3 average and reaching 247,000 daily transactions. Daily active addresses also rebounded, rising by 24% QoQ to 40,500.

In Q1, the staking requirement for Fantom validators was significantly reduced from 500,000 FTM to 50,000 FTM, aiming to increase accessibility. However, the number of active validators remained unchanged at 55.

Notably, the total amount of FTM staked increased by 17% QoQ, from 1.1 billion to 1.3 billion FTM, resulting in a 135% QoQ surge in the total dollar value of staked FTM, reaching $1.2 billion. Among proof-of-stake (PoS) networks, Fantom ranked 22nd in the dollar value of funds staked by the end of Q1.

During the year’s first quarter, Total Value Locked (TVL) denominated in USD experienced a substantial 59% QoQ increase, rising from $810.8 million in Q4 to $1.28 billion.

Conversely, TVL-denominated in FTM decreased by 21% QoQ, indicating that the surge in USD-denominated TVL was partly attributed to FTM’s price appreciation.

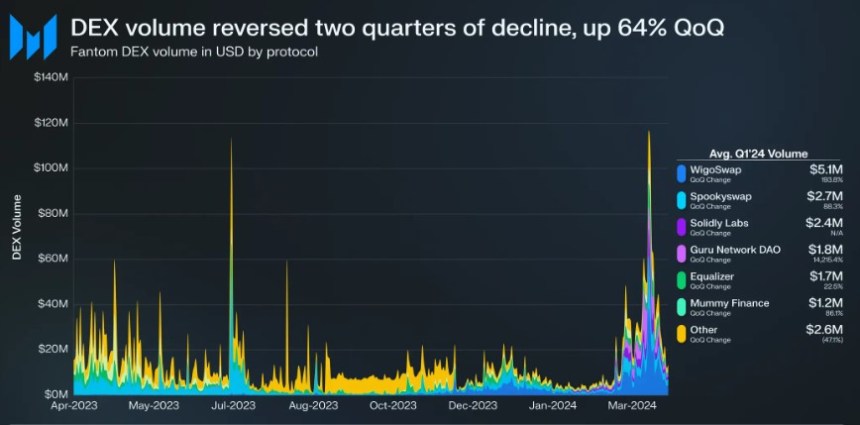

Fantom’s average daily decentralized exchange (DEX) volume surged by 64% QoQ, from $10.2 million to nearly $176.8 million. In Q1, the “Memecoin Mania” trend contributed to elevated on-chain activity across various networks, including Fantom.

Fantom’s monthly DEX volume surpassed $1 billion in March, marking the first time since March 2023. The number of DEXs on Fantom increased to 31 by the end of Q1, with no single DEX dominating more than 30% of the market share.

Lastly, following an exploit in the Multichain: Fantom Bridge, which affected stablecoins on Fantom in Q3 2023, the Fantom Foundation took steps to increase the liquidity of stablecoins.

As of Q1 2024, two independent third-party bridging solutions, Axelar (axlUSDC and axlUSDT) and LayerZero (lzUSDC and lzUSDT), have emerged. USDC remains the predominant stablecoin on Fantom, accounting for 98% of the stablecoin market cap. USDT also experienced considerable growth, with an 86% QoQ increase.

The FTM token is currently trading at $0.7037, reflecting an 8.7% increase in price over the past seven days. However, it has experienced a decline of nearly 20% in the monthly time frame.

Featured image from Shutterstock, chart from TradingView.com

Shiba Inu (SHIB) has demonstrated resilience despite recent market downturns. Data reveals that roughly over 700 trillion SHIB tokens held by more than 650,000 wallet addresses remain profitable, reflecting steadfast confidence among holders in the token’s long-term value.

Recent on-chain analytics have uncovered an interesting trend among Shiba Inu investors. Despite a general dip in SHIB’s market price, investors continue to hold a substantial volume of tokens—totaling 733 trillion—showing unrealized gains.

These holdings, maintained by approximately 653,530 individual wallets, were acquired at prices ranging from $0.000002 to $0.000022, averaging out at $0.000011.

This indicates not only a significant level of acquisition but also a broad base of investors who entered the market at lower valuations, positioning themselves in profit despite the coin’s fluctuating fortunes.

The “Break Even Price” indicator, a crucial tool derived from on-chain data, suggests that many SHIB holders are still in the green financially. This could point to a collective strategy among holders to weather short-term price movements, with an eye on potential long-term returns.

Such data reinforces the notion of SHIB as more than just a speculative asset, hinting at a deeper conviction among its community regarding the token’s future potential.

Despite a decline of 5.2% over the past week and 11.9% over the past month, Shiba Inu has seen a recent uptick of 3.3% in its price in the last 24 hours, trading at $0.00002389.

Notably, this upward trajectory in value mirrors the asset’s trading volume, which has also surged from below $400 million last week to above $600 million as of today.

This recovery aligns with significant developmental strides within the Shiba Inu ecosystem, particularly the completion of a hard fork in its Layer-2 blockchain solution, Shibarium.

The Shibarium hard fork, executed at block height 4504576, introduced enhancements aimed at improving usability and transaction efficiency. This was a response to community feedback advocating better performance and lower costs.

This upgrade is expected to boost transaction speeds and stabilize transaction fees on Shibarium, making costs more predictable for users.

Moreover, the recent hard fork’s dual focus—enhancing the Bor and Heimdall components of Shibarium—aims to refine the platform’s technical infrastructure.

1/ #Shibarium has successfully completed its hard fork at block height 4504576!

Get ready for:

•Blazing-fast transactions!

•Predictable gas fees!pic.twitter.com/oQrtF3OMTe

— Shibarium Network (@ShibariumNet) May 2, 2024

By improving the calculation of state sync confirmation and ensuring deterministic finality, the Shiba Inu team appears keen on improving the network’s reliability and scalability.

Featured image from Unsplash, Chart from TradingView

Memes might be the “most simplistic connection” between financialization, tokenization and culture, says Kain Warwick.

Shiba Inu (SHIB) is capturing significant attention following a colossal transfer of tokens and a prediction of a bullish breakout.

This event has piqued the curiosity of both traders and analysts alike, sparking debates and expectations about the future trajectory of this popular meme coin.

Recently, the crypto community witnessed an extraordinary transaction involving the movement of nearly two trillion SHIB tokens from the trading platform Robinhood to an undisclosed wallet.

This transfer, identified by Whale Alert, a blockchain tracking service, involved two tranches of 875 billion SHIB each, culminating in a total of 1.75 trillion SHIB. Valued at approximately $39.2 billion, this movement has led to rampant speculation about the potential implications for the SHIB market.

875,000,000,000 #SHIB (19,666,682 USD) transferred from #Robinhood to unknown wallethttps://t.co/hxSvwFxC0E

— Whale Alert (@whale_alert) May 1, 2024

The timing and scale of this transaction have raised questions about its motives, whether it be a strategic move by a major investor or simply a reallocation within diverse portfolios. The lack of clarity surrounding the destination wallet adds intrigue and uncertainty within the trading community.

Amidst this massive token movement, cryptocurrency analysts have been closely monitoring SHIB’s performance. Notably, Ali Charts, a respected figure in the crypto analysis sphere, has projected a potential bullish breakout for SHIB.

Ali suggests that SHIB could reach as high as $0.000072323 and advises traders to consider buying around the $0.000018343 mark to capitalize on the anticipated surge.

Meanwhile, Shiba Inu’s 8% decline last week, juxtaposed with a 7.8% increase in the past day, illustrates the volatile nature of meme coin investments.

Analysts like Bunchhieng have recently speculated that Shiba Inu could reach $0.0001. This projection is based on SHIB’s 2021 rally patterns, suggesting a repeat could propel the meme coin to new highs.

Bunchhieng emphasized that similar historical trends might lead to significant price movements for Shiba Inu, considering the increased burn rate that could positively impact its valuation.

Addressing skepticism regarding SHIB’s market cap and potential growth, Bunchhieng reassured that the crypto sector often defies conventional expectations, opening possibilities for substantial gains.

Adding to the optimistic forecasts, notable cryptocurrency investor Armando Pantoja predicted that SHIB could climb to $0.001 by the end of 2025, citing long-term growth factors and market dynamics.

My #crypto price targets for 2024-2025$BTC: $100k-$250k$ETH: $10k-$15k$XRP: $3-$6$SHIB: $0.001+$DOGE: $1$SOL: $500-$1000$AVAX: $100+$ICP: $100+$INJ: $100-$200$PRO: $10-$20$HBAR: $5-$10

— Armando Pantoja (@_TallGuyTycoon) April 24, 2024

Featured image from Unsplash, Chart from TradingView

Dogecoin (DOGE), the Shiba Inu-faced darling of the 2021 memecoin frenzy, has found itself shivering in the current crypto winter. Once a symbol of retail investor exuberance, DOGE has plummeted over 70% from its sky-high peak, leaving its future shrouded in uncertainty.

While Bitcoin, the heavyweight champion of the crypto world, grabs headlines with its recent wobble, the impact on memecoins like DOGE has been brutal. Unlike Bitcoin’s divided analyst opinions, the sentiment surrounding DOGE is decidedly bearish.

At the time of writing, the memecoin was trading at $0.132, down 5.4% up the last 24 hours but sustained a 20% loss in the last seven days, data from Coingecko shows.

Some analysts believe DOGE’s struggles are a canary in the coal mine for the entire crypto market. They said if even a historically high-flying memecoin like Dogecoin can’t hold onto gains, it raises serious concerns about risk appetite in the crypto space in general.

Whales Accumulating DOGE: A Glimmer Of Hope?

However, a glimmer of hope flickers for the dethroned meme king. On-chain data suggests an increase in large wallet purchases of DOGE, hinting at potential accumulation by wealthy investors. This “contrarian” behavior could be a sign that some whales are using Coinglass or similar platforms to track Dogecoin derivatives and believe the coin is undervalued and ripe for a comeback.

Coinglass, a popular cryptocurrency data provider, offers insights into factors that might be influencing the whales’ decisions. By analyzing metrics like open interest, funding rates, and liquidations on Coinglass, these investors might see an opportunity to buy DOGE at a discount.

Related Reading: Solana Crawls: Network Update Fails To Fix Traffic Jam, Price Feels The Pinch

In a similar development, Whale Alert, a well-known blockchain tracker, has reported that a DOGE whale arranged two large transactions in a single day. Some 150,000,000 Dogecoins were transferred in the first transaction, and an additional 76,316,694 DOGE were transferred in the second, for a total of almost 226 million DOGE. At the time, the meme cryptocurrency was worth around $40 million in fiat money.

150,000,000 #DOGE (21,281,922 USD) transferred from #Robinhood to unknown wallethttps://t.co/7U1CEfr2ZT

— Whale Alert (@whale_alert) April 29, 2024

Can Dogecoin Thaw The Crypto Winter?

The coming weeks will be critical for DOGE. The return of positive social media sentiment, coupled with continued accumulation by whales who might be strategically using Coinglass for market analysis, could be the spark that reignites the DOGE rally. However, if the broader market weakness persists, DOGE’s summer might be spent shivering in the doghouse.

Featured image from Pixabay, chart from TradingView

Fantom Foundation CEO Michael Kong hopes the blockchain can “replicate the success” of its peers by getting in on the memecoin hype.

The Solana memecoin frenzy has made many investors score a home run or be out of the game this cycle. Traders are looking for new projects that could be the next hit while the market enters a new re-accumulation phase.

Memecoins have been the narrative of this bull cycle. As a result, those who wanted to make big profits mainly invested in newly launched projects. While some have made millions by trading the week’s top gainers, others have lost significant amounts trying to climb the ladder.

Solana-based memecoins have been the most popular, with some, like dogwifhat (WIF) and cat in a dog’s world (MEW), leading the way. However, not all projects have achieved recognition and support for these tokens.

A considerable number of the Solana memecoins launched in the last two months have left investors empty-handed. The latest culprit is the recently launched Bonk Killer (BONKKILLER), which became the hottest topic on Monday for the wrong reasons.

The token surpassed the $100 trillion market capitalization only a few hours after launching. Nonetheless, the reason behind what could have been the most impressive feat in crypto history is no other than a honeypot scam.

As reported by SolanaFloor, the memecoin is a scam token that attracts investors with high-profit potential but prevents them from selling their holdings. Many realized they couldn’t move their tokens only after the project’s creator activated the “freeze authority.”

This action allowed the creator to avoid selling the token, which skyrocketed the market capitalization metric to $328 trillion. According to analytics platform Birdeye, the Solana-based memecoin registers a $318 trillion market cap at the time of writing.

It’s worth noting that the token isn’t backed by the amount reflected in the metric. As one X user pointed out, the token is worthless if you cannot sell it.

When you buy but can't sell. #bonkkiller pic.twitter.com/AjJokgptmw

— Bull.BnB (@bull_bnb) April 30, 2024

Unfortunately for investors, the creator didn’t use the freezing authority to boost the token’s market cap. The scammer took advantage of the function and stole nearly half a million dollars in BONKKILLER and SOL tokens.

The creator, who holds around 90.8% of the total supply, removed 30,500 BONKILLER and 1,561 SOL, worth around $420,000. According to Birdeye data, the token is valued at $32.81 as of This writing.

UPDATE: @solana memecoin BONKKILLER, a scam and honeypot token, has withdrawn liquidity worth over 3,000 $SOL after freezing token sales for users. pic.twitter.com/JO3E3RuXMW

— SolanaFloor | Powered by Step Finance (@SolanaFloor) April 30, 2024

Even after the community’s warning, some investors continued to buy the project. In the last 12 hours, investors have spent nearly $40,000 on the token. As some X users pointed out, the false market cap might be misleading inexperienced investors into buying the memecoin.

Although it’s not the first scam of this type, the increasing rate of new launches turning fraudulent seems alarming. As reported by NewsBTC, $27 million vanished over the last month after 12 projects were abandoned by their creators.

Ultimately, this incident highlights the importance of thoughtfully researching a project’s background and carefully deciding whether the possibility of massive gains outweighs the risks.

The world of cryptocurrencies is abuzz with speculation once again, this time centered around Shiba Inu (SHIB), the Dogecoin-inspired meme coin. Prominent Bitcoin investor Armando Pantoja has thrown down the gauntlet, predicting a price surge for SHIB, potentially reaching $0.001 by the end of 2025. This ambitious target has reignited discussions about SHIB’s potential and its ability to carve a niche beyond its meme-coin origins.

SHIB’s past is a story of remarkable growth. In 2021, the meme coin defied expectations, experiencing a meteoric rise of over 800,000%. This phenomenal journey minted crypto millionaires and captured the imagination of retail investors. However, unlike established players like Bitcoin and Ethereum, SHIB’s initial value proposition was primarily driven by its meme status and community enthusiasm.

My #crypto price targets for 2024-2025$BTC: $100k-$250k$ETH: $10k-$15k$XRP: $3-$6$SHIB: $0.001+$DOGE: $1$SOL: $500-$1000$AVAX: $100+$ICP: $100+$INJ: $100-$200$PRO: $10-$20$HBAR: $5-$10

— Armando Pantoja (@_TallGuyTycoon) April 24, 2024

However, the tides appear to be shifting. Recognizing the need for more than just viral appeal, the Shiba Inu team has been actively developing its ecosystem. A central initiative in this effort is the upcoming Shibarium hardfork, scheduled for launch on May 2nd. This upgrade aims to introduce Shibarium, a layer-2 scaling solution designed to address scalability concerns and enhance user experience.

The potential impact of Shibarium is drawing comparisons to the highly anticipated Ethereum 2.0 upgrade. Ethereum, the world’s second-largest cryptocurrency by market cap, has long grappled with scalability issues, leading to high transaction fees and network congestion.

Ethereum 2.0 promises to address these challenges by transitioning to a proof-of-stake consensus mechanism, offering faster processing times and lower fees. However, its development has faced delays, leaving a gap in the market for user-friendly alternatives.

Shibarium’s success could position SHIB as a more attractive option for developers seeking to build decentralized applications (dApps). By offering faster and cheaper transactions, Shibarium could potentially lure developers away from Ethereum, especially those focused on projects requiring frequent interactions and lower costs. This scenario could mirror the way Ethereum itself disrupted the dominance of Bitcoin in the early days of decentralized finance (DeFi).

1/ SHIBARMY, we are on the brink of a transformative upgrade for Shibarium.

Through an upcoming hard fork expected to go live on May 2nd, we’re introducing a suite of new features designed to enhance user experience and empower our community of innovators and developers.

— Shib (@Shibtoken) April 25, 2024

Despite the optimism surrounding Shibarium, reaching $0.001 by 2025 remains a significant hurdle. The cryptocurrency market is inherently volatile, and unforeseen events can drastically impact prices. Widespread adoption of Shibarium is crucial for long-term growth, and its success hinges on attracting developers and users to build a robust ecosystem.

As of the time of publication, Shiba Inu is trading at $0.00002459, indicating a decrease of 9% over the previous day. For Shiba Inu to potentially reach a price higher than $0.001 this year, it needs to increase by nearly 4,000%.

Meanwhile, some analysts remain cautious. While acknowledging SHIB’s past gains, they point to the dominance of established cryptocurrencies like Ethereum and the overall market conditions. Platforms like Telegaon offer a more conservative outlook, predicting a maximum price of $0.0000728 for SHIB by 2025, falling short of its all-time high.

Featured image from Pixabay, chart from TradingView

The top memecoins are far from previous highs, yet retail investors may view them as fairer opportunities than VC-backed coins with high fully diluted valuations.

The chief technology officer of VC firm Andreessen Horowitz said that memecoins are like risky casinos that deter real builders from the crypto ecosystem.

Two Solana-based memecoins, Bonk (BONK) and Dogwifhat (WIF), have registered substantial gains over the past 24 hours. BONK recorded a 35% increase, while WIF climbed by 19%, positioning them among the top three gainers in the top 100 cryptocurrencies by market cap today. Only Hedera Hashgraph (HBAR) surpassed them, with a notable 44% rise during the same period.

The significant uptick in these Solana memecoins is closely linked to the recent improvements in the Solana network’s performance. A tweet from SolanaFloor earlier today indicated, “BREAKING: Solana’s congestion issues have been completely resolved, with block production back to normal. Transactions confirming in under 2 seconds.” This announcement marks a pivotal moment for the network which had been plagued by congestion issues.

Source A: https://t.co/2TVnbaPNlHSource B: https://t.co/GfHxy8dC1B

— SolanaFloor | Powered by Step Finance (@SolanaFloor) April 24, 2024

On April 15, Solana developers rolled out crucial updates designed to alleviate these problems, urging validators to adopt version v1.17.31. This version introduces changes in the treatment of validators based on their stakes. Further enhancements are anticipated with the release of version v1.18 next month, which will include a new scheduler, albeit disabled by default.

Andrew Kang, founder of Mechanism Capital, remarked a few days before the fix, “Let’s also not forget that the Solana congestion issues have weighed down SOL and Solana-based memecoins significantly. It’s not a question of if but when the network is significantly improved. That’s your springboard.” Kang’s comments now seem prophetic as the resolution of network issues has indeed acted as a springboard for memecoin valuations.

Specifics On Rally Of Dogwifhat (WIF) And BONK

The price of WIF soared to a 24-hour high of $3.43 on April 24, buoyed by an impressive 96% increase in trading volume. This influx was fueled by notable acquisitions from whales like Ansem, who capitalized on the positive market sentiments.

The breakout above the resistance level at $3.18, after a week of sideways trading between $1.97 and $3.18, was a significant trigger. WIF formed a two-week-long ascending triangle, a bullish chart pattern that indicated a continuation of the previous upward trend. The breakout was widely discussed in the crypto community, with trader Bluntz Capital confirming the pattern’s resolution and sparking further bullish sentiment.

2 week long ascending triangle forming here on $WIF, i think the breakout is imminent pic.twitter.com/S0OZWBsq6u

— Bluntz (@Bluntz_Capital) April 24, 2024

BONK is registering a dramatic 35% rise, with a remarkable 304% increase in trading volume. The price action successfully breached the 0.236 Fibonacci retracement level at $0.000020727, and continued its upward trajectory to the 0.5 Fibonacci level, signaling strong buying interest and bullish momentum.

This rally probably gained additional support from the recent listing of BONK by the global neobank Revolut, which was announced on April 22. This inclusion in Revolut’s trading platform, which features over 150 digital currencies, provided significant exposure and legitimacy, further enhancing investor interest and market activity around BONK.

In a recent Bloomberg report, it has come to light that the hedge fund industry is increasingly drawn to the allure of the memecoin sector, given the recent price increases and substantial profits that surpass those of Bitcoin (BTC) or the largest altcoins in the market.

One example of the appeal of memecoins to traditional finance institutions is Newport Beach-based Stratos, which launched a liquid fund with the Dogwifhat token in December.

The Solana-based memecoin Dogwifhat, known for its mascot – a beanie-wearing dog – became a major player in the crypto world, with its price increasing more than 300 times.

This substantial spike reportedly helped Stratos achieve a staggering 137% return in the first quarter of 2024, outperforming gains in the broader crypto market. However, Dogwifhat has since retraced more than 35% from its March 31 all-time high (ATH) of $4.83 and is currently trading at $3.09.

Interestingly, Stratos is not alone in venturing into memecoins; other hedge funds are also doing so.

Asset manager Brevan Howard, for instance, has reportedly made a “tiny” investment in memecoins. Pantera Capital, a crypto fund, recently emphasized the staying power of memecoins and the “enormous” trading opportunities they present.

Despite the enthusiasm from some hedge funds, the report notes that many crypto participants remain skeptical of memecoins.

Quinn Thompson, the founder of Lekker Capital, a hedge fund experimenting with trading memecoins, likened the current frenzy to the speculative fervor seen in traditional markets with stocks like GameStop.

In addition, Thompson described memecoins as the “tip of the spear for speculation” and emphasized the “gambling-like” nature of their trading.

Still, Cosmo Jiang, a portfolio manager at Pantera Capital, noted the evolution of memecoins beyond mere jokes, calling some “culture coins” that symbolize membership in a particular group or belief system.

The report notes that the ease of creating and launching memecoins has increased with the availability of apps like Pump.fun, which allow users to mint coins in minutes. Blockchains like Solana and Coinbase’s Base, which offer low trading fees, have been flooded with these tokens.

In light of these developments, Josh de Vos, research lead at CCData, highlighted the improved infrastructure supporting memecoins, including increased liquidity and the development of advanced futures markets on centralized exchanges (CEX).

As more hedge funds take memecoins seriously, Rennick Palley of Stratos anticipates a growing focus on these crypto assets.

Drawing parallels to the initial skepticism surrounding cryptocurrencies, Palley suggests that meme-only funds may emerge, mirroring the creation of non-fungible token (NFT) funds.

To further demonstrate the interest and adoption of these emerging tokens, in the first quarter of 2024, memecoins emerged as the most profitable crypto narrative, delivering massive average returns of 1312.6% across its top tokens, according to a recent study conducted by CoinGecko.

Currently, the largest memecoin on the market, Dogecoin (DOGE), is trading at $0.1616, up 5% in the last seven days. It has a market cap of $23 billion.

Featured image from Shutterstock, chart from TradingView.com

Crypto trading sensation Ansem, known on X (formerly Twitter) as @blknoiz06, has directed the market’s gaze towards the Bitcoin Runes ecosystem, labeling it as the nascent grounds for the next 100x crypto opportunity, as NewsBTC reported yesterday. Ansem, whose prowess is well-documented through his previous astronomical gains of 170x on Solana (SOL), 520x on dogwifhat (WIF), and 80x on Bonk (BONK), stirred the crypto community with his recent Dogecoin comparison.

On the cusp of Bitcoin’s highly anticipated halving today, Ansem doubled down on his initial assessment, particularly highlighting two tokens within the Bitcoin Runes ecosystem: Bitcoin Wizards (WZRD) and PUPS. He equates WZRD with Dogecoin, suggesting it has the potential to mirror Dogecoin’s viral success. In contrast, he compares PUPS to the lesser-known but highly profitable dogwifhat (WIF).

Related Reading: Elon Musk Latest Tweet: How Much Did Dogecoin Gain From It Today?

In a tweet that caught the eye of both investors and enthusiasts, Ansem elaborated on his reasoning behind the picks, stating:

Great thread, been saying, I believe Runes are next asymmetric 100x opp in crypto. The meme that got DOGE founder interested in Bitcoin & the phrase magic internet money is still used today – representative of bitcoin culture. DOGE equivalent = WZRD, WIF equivalent = PUPS.

Ansem references a thread on X by Immutable Edge (@ImmutableSOL), who delved into the historical and cultural significance of the “Magic Internet Money” meme, originally sparked by mavensbot’s viral Reddit ad.

The “Magic Internet Money” meme dates back to February 18, 2013, when mavensbot, a digital artist, submitted a hand-drawn depiction of a blue wizard to promote Bitcoin on Reddit. This ad, created during Bitcoin’s early adoption phase, was crucial in cultivating a cultural ethos around Bitcoin.

It resonated deeply within the community, encapsulating the whimsical yet revolutionary nature of Bitcoin’s rise. The ad’s simplicity and authenticity resonated with the Reddit community, propelling Bitcoin from a niche internet experiment to a major financial phenomenon. Within weeks of the ad’s debut, Bitcoin’s value surged from $27 to a record high of $1,132 by November 2013.

Bitcoin Wizards, one of the highlighted tokens, aims to rekindle this original spirit. The token leverages the iconic imagery and cultural narrative of the “Magic Internet Money” meme to foster a new wave of interest and adoption. The creators of WZRD are not only paying homage to Bitcoin’s roots but are also embedding this storied meme within the mechanics of a modern cryptocurrency, aiming to capture both nostalgia and innovation.

The Bitcoin Wizards project is part of the broader Bitcoin Runes ecosystem, which reached a lot of hype prior to its launch. According to Ansem, WZRD’s history and deep roots in memes give it the perfect ingredients to become the next Dogecoin, just on Bitcoin Runes.

Moreover, the analyst assessment comes at a critical time for the crypto market, which is often influenced by the narratives that capture the community’s imagination. As the Bitcoin halving event unfolds, many eyes will be on the Bitcoin Runes ecosystem to see if it can indeed replicate the meteoric rises seen in BRC-20 tokens and Ordinals.

At press time, WZRD traded at $12.15, up 70% in the last 24 hours.

In the volatile landscape of cryptocurrency markets, Shiba Inu, the popular meme coin, has once again captured the attention of investors with a notable surge in value, despite losing 4% of its value in the last day. The memecoin reached a high of $0.00002296 after experiencing a temporary dip to $0.00002092 just the day before.

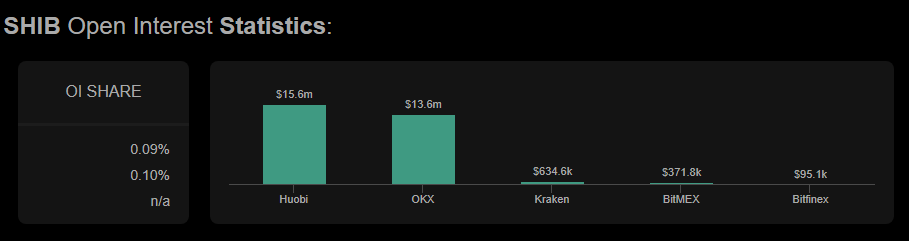

A key indicator of this newfound interest in Shiba Inu lies in the surge of open interest observed across major exchanges. Leading the charge are exchanges like Huobi and OKX, where Shiba Inu’s open interest soared to nearly $16 million and $15 million, respectively.

This surge in open interest reflects heightened market activity and suggests a growing number of investors are actively engaging with Shiba Inu futures contracts.

Despite the surge in open interest and the subsequent price rally, sentiment among traders remains mixed. While there is evident optimism driving the market, reflected in the increase in open interest, the Long/Short Ratio paints a nuanced picture.

Currently standing at 0.94, the Long/Short Ratio indicates that more traders are betting on a potential price drop for Shiba Inu. This divergence in sentiment adds a layer of complexity to the market dynamics surrounding Shiba Inu.

Leveraged Trading Statistics And On-Chain Indicators

Examining the market, statistics on leveraged trading offer additional insights into the current state of SHIB. Across exchanges like Bitget, CoinEx, BingX, Huobi, OKX, Kraken, and BitMex, open interest for Shiba Inu futures contracts stands at a staggering 2.40 trillion SHIB tokens. While exchanges like Bitget lead the pack with significant gains in open interest, others like BingX and CoinEx also show notable increases.

Furthermore, on-chain indicators present a bullish outlook for Shiba Inu, despite the fluctuations in price and market sentiment. A consistent decline in SHIB tokens held on exchanges since the onset of the bull market in October 2023 suggests that long-term investors maintain confidence in Shiba Inu’s potential. This trend persists even amidst recent market dips in March and April, highlighting the resilience of Shiba Inu’s investor base.

Navigating Shiba Inu’s Market Dynamics

While the recent surge in price and open interest signals renewed interest and activity, the divergence in trader sentiment underscores the inherent uncertainty of the market. Nevertheless, with on-chain indicators pointing towards long-term confidence, Shiba Inu remains a cryptocurrency to watch closely in the days to come.

Featured image from Pexels, chart from TradingView

On-chain data shows the percentage of the PEPE investors currently in the green has fallen to 69% after the 26% plunge the memecoin has seen in the past week.

In a new post on X, the market intelligence platform IntoTheBlock has posted an update on how the investor profitability is looking for the memecoin PEPE currently.

The analytics firm’s metric gauges whether a holder is in profit or not by reviewing their address’s on-chain history. Based on when the wallet acquired the coins, the indicator calculates the investor’s average cost basis using the spot price of the asset at the time of those purchases.

If the current spot value of the cryptocurrency is higher than this average cost basis for any address, then that particular investor is carrying net gains currently. IntoTheBlock categorizes such addresses to be “in the money.”

Similarly, investors with a cost basis higher than the latest price are considered “out of the money.” Naturally, the two values being exactly equal would suggest the holder is just breaking even on their investment or is “at the money.”

Now, here is the data shared by the analytics firm that shows how this investor breakdown looks like for PEPE at the moment:

As is visible above, 69% of the total addresses holding PEPE have their cost basis higher than the current spot price of the coin, while 27% are in losses. 4% of the investors are sitting on their cost basis right now.

This profitability ratio isn’t that high, as, for example, 89% of Bitcoin investors are currently in profit, according to IntoTheBlock data. The reason behind the lower profits for the memecoin is that its price has seen a steep drawdown recently.

Historically, the addresses in the green have been more likely to sell to harvest their gains. As such, when the market profit-loss balance is overwhelmingly towards profits, a mass selloff can occur.

Naturally, this means the chances of a top being hit increase with increasing investor profits. However, a low percentage of investors being in profits can be conducive to bottoms forming, as profit-selling exhausts at these levels.

At present, PEPE is neither dominated by green investors nor red ones. In bull runs, however, profitability levels generally remain higher, so any cooldown can help prices rebound.

Thus, the fact that investor profitability has returned to the 69% level for the memecoin could be a sign that a bottom is close if the bullish regime has to continue.

PEPE has returned to the $0.0000050913 mark after having declined more than 26% over the last seven days. The chart below shows the memecoin’s performance over the past month.