Following Bitcoin’s spot exchange-traded fund (ETF) approval on January 11, market speculation has grown around the possibility of similar investment vehicles for major cryptocurrencies, including a spot XRP ETF. However, certain requirements and regulatory considerations must be met before such a development can occur.

Regulatory Prerequisites For Spot XRP ETF

FOX reporter Eleanor Terret clarifies the matter, stating that launching an XRP spot ETF would first require the establishment of a futures ETF.

In the case of Bitcoin, the approval of spot ETFs was conditional upon the Securities and Exchange Commission (SEC) concluding that the Chicago Mercantile Exchange (CME) Bitcoin futures market provided sufficient surveillance against fraud and manipulation.

Terret suggests that for XRP to have a spot ETF, a futures ETF must first be established, marking a step in the right direction.

Bloomberg ETF expert James Seyffart shares a similar sentiment, stating that he does not anticipate an XRP ETF launching this year. Seyffart cites the ongoing SEC case against Ripple as a factor influencing his stance, suggesting that an XRP ETF is more likely to emerge once the regulatory matter is resolved.

Seyffart adds that XRP futures trading on a regulated platform like the Chicago Mercantile Exchange would be a prerequisite for the SEC to consider any applications for a spot XRP ETF. Seyffart hints that an XRP futures ETF could also be advantageous in this context.

The SEC has maintained a cautious approach towards spot ETFs involving crypto assets due to concerns about potential market manipulation. Seyffart emphasizes that the availability of XRP futures trading on a regulated platform, such as the CME, would provide a favorable framework for the SEC’s consideration of a spot XRP ETF, especially given previous court rulings highlighting the correlation between futures and spot markets.

Amidst the ongoing speculation, blockchain firm Ripple seems to be preparing for potential involvement in the ETF space.

A recent job advertisement posted on Ripple’s website reveals their search for a Senior Manager in business Development, with a focus on institutional decentralized finance (DeFi). The role includes spearheading cryptocurrency-related ETF initiatives with internal trading teams and relevant partners.

XRP’s Future Potential – From $0.5299 To $27?

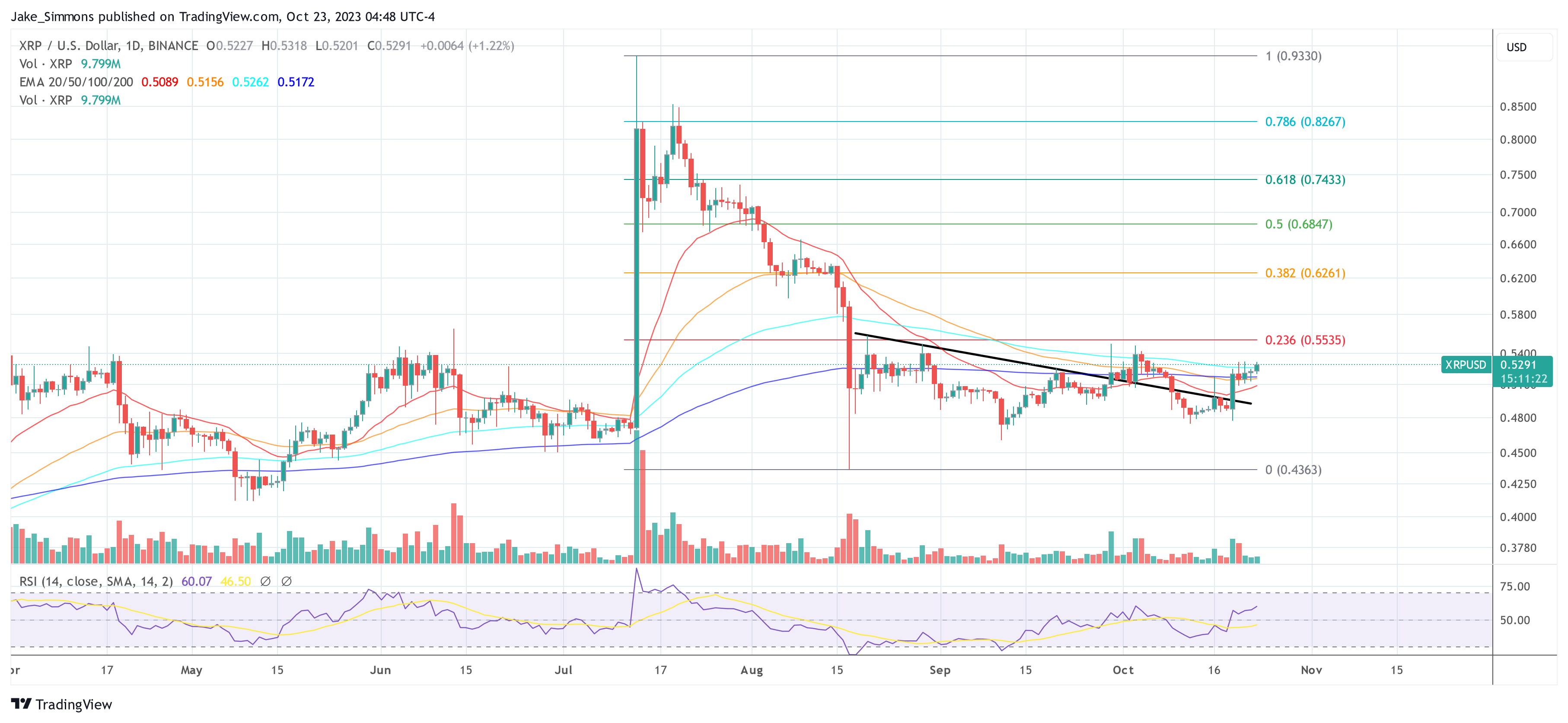

Crypto market analyst EGRAG crypto has conducted a comprehensive price analysis of the XRP token. Despite peaking in 2023, when the price reached a high of $0.9376 on July 13, the token has retraced more than 15% since the start of 2024 to a current trading price of $0.5299.

However, according to EGRAG, the 21 Exponential Moving Average (EMA) on the monthly time frame is a significant indicator for assessing XRP’s price movement.

The analysis focuses on three price levels: $3.5, $6.5, and $27. Based on previous instances (labeled A, B, and C), EGRAG extrapolates potential future price movements using the same percentage increases observed in the past.

The first potential scenario is a significant price surge to $27, representing a massive 4500% increase. This prediction is based on a similar percentage move observed in the past (from previous instance A), seen in the chart above.

The second scenario suggests a more conservative projection, with XRP potentially experiencing a solid 1000% increase to $6.5. This projection is based on historical patterns observed in previous instance B.

In the third scenario, EGRAG anticipates a significant 500% rise in XRP’s price, reaching $3.5. Based on previous instance C, this projection indicates a significant upward movement for the token.

Whether the XRP token can successfully surpass the upper resistance levels that have impeded its rise to the $0.600 mark since late December remains to be seen.

Additionally, the market eagerly awaits a catalyst that could prompt a breakthrough in XRP’s seven-month downtrend structure, potentially resulting in a price surge above $0.700.

Featured image from Shutterstock, chart from TradingView.com