Despite generating hundreds of thousands of dollars in daily fees, Runes has only surpassed $1 million in total fees twice in the last twelve days, signaling a notable decline.

Cryptocurrency Financial News

Despite generating hundreds of thousands of dollars in daily fees, Runes has only surpassed $1 million in total fees twice in the last twelve days, signaling a notable decline.

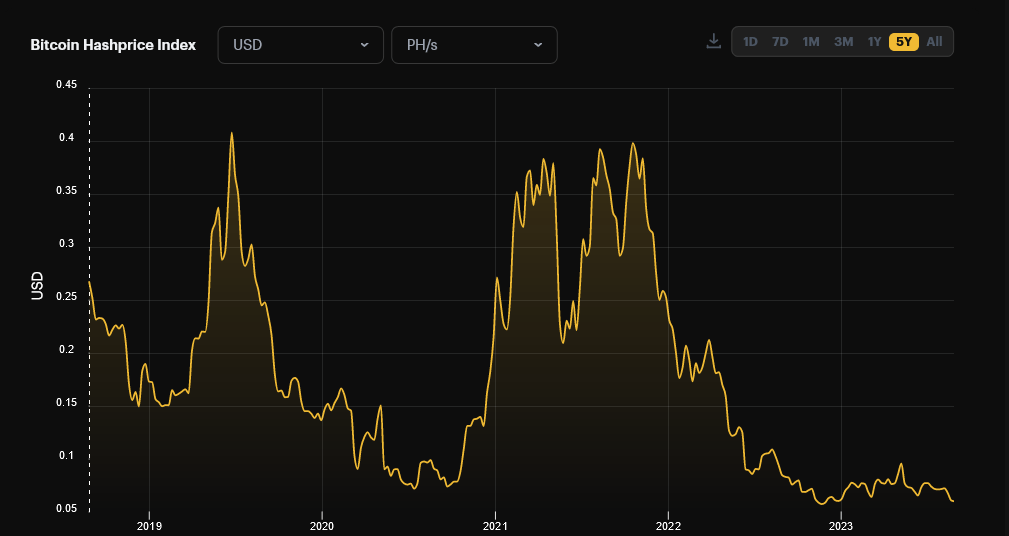

Bitcoin miners are churning less in revenue, looking at trackers on August 28. According to Hashrate Index data, a platform that tracks the correlation between hash rate and revenue accrued by miners over time, income generated from Bitcoin mining operations is at near record lows.

At $0.059 per Tera Hash (TH) daily, the trend doesn’t look exciting for Bitcoin miners as it is cents away from $0.056, a level recorded in late November 2022.

At the depth of last year’s crypto winter when prices fell, cracking below $16,000, hash price, which measures the potential revenue expected from deploying 1 Tera Hash of hash rate to the Bitcoin network per day, crumbled to the lowest point in three years.

While BTC supporters are optimistic, expecting prices to recover in the second half of 2023, miners must contend with lower revenue. How this impacts their operations is yet to be seen because miners depend on income generated from deploying hash rate to cater for operational expenses and sometimes pay shareholders.

On May 8, the hash price rose to $0.095, the highest level in 2023, but has since contracted, dropping by over 40%. As the hash price falls, it could mean miners are having a hard time competing. The trend, as it is visible, comes when the hash rate has been rising to record levels as more miners power up their mining rigs.

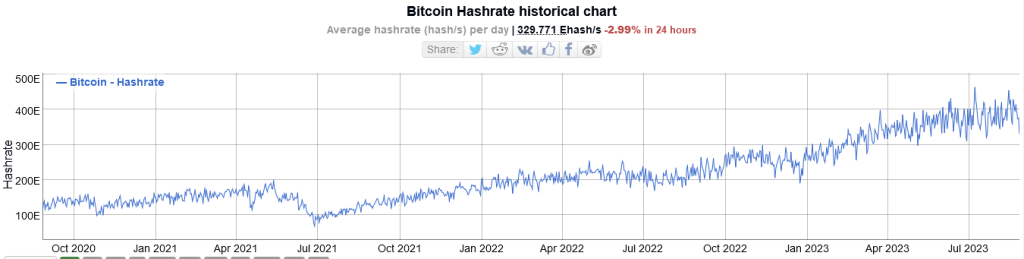

Throughout 2023, the total Bitcoin hash rate, a metric measuring the computing power channeled to the network, rose from 269 EH/s in early January 2023 to 465 EH/s in early July 2023. The hash rate has since dropped around 329 EH/s, a level that’s still higher than 2022 highs.

With a rising hash rate, the Bitcoin network automatically adjusted the mining difficulty to the highest level last week. Trackers show the network’s difficulty is now at 55.62 T, following a 6% increment.

For the better part of the year, difficulty levels have been rising amid an increase in hash rate. As prices recovered in January and the hash rate rose, the network increased difficulty levels by 10%, the highest spike this year.

Hash rate will likely continue rising in the months ahead. Tether Energy, an affiliate of Tether Holdings, issues USDT, plans to connect their rigs in Latin America. Their launch translates to more competition for existing miners, including Riot Blockchain.

After the continuous sink in the mining profitability of both digital assets year-on-year, Bitcoin miners have been set back to seats as Ethereum miners consecutively surpassed them in mining revenue and recorded a gap of $224 million in April 2022.

This month was not so good for Bitcoin miners as they were able to generate around $1.16 billion only. Notably, this figure is down by $44 million from the previous month’s mining revenue of Bitcoin. The last month saw $1.7 billion in recorded income.

Related Reading | TA: Ethereum Bears Aim Big After Recent Breakdown Below $2.5K

Bitcoin miners’ total profitability was down by 31% from April 2021 to the present. In that time, $1.7 billion in revenue was recorded.

Similarly, the single-day high of BTC mining revenue in April was 3% low than the peak value of March. As per YCharts, the best-day high in March 2022 lasted at around $47.54 million and $46.01 million in April. And it dropped 23% from the best-day high of January, which saw $60.16 million.

Unlike Bitcoin, Ethereum mining revenue in April increased by 3% generating $1.39 billion. While Bitcoin, at the same time, recorded $1.16 billion in mining revenue.

Bitcoin currently trading at $30,700 with a 9.6% decline over the past 24 hours | Source: BTC/USD chart from Tradingview.com

Still, the Ethereum mining revenue has decreased yearly from its previous marks recorded till April. The mining revenue of Ethereum in April 2022 is 17% below the previous year’s mining income of April 2021. Last year it was around $1.68 billion.

Ethereum Becomes Preferred Choice Of Miners In 2022

Although Bitcoin stands as the largest and most popular digital asset, Ethereum has become the most preferred choice of the miners seeing a higher income generated in 2022.

It was not the first time Ethereum outpaced Bitcoin in mining revenue; it surpassed BTC mining by $260 million in January, $190 million in February, and $130 million in March 2022.

To understand the reason behind disparities in the mining incomes of two digital assets, first, it needs to consider the fact that mining revenue is calculated per the value of cryptocurrency and earned coins within a specific timeframe.

Likely, Ethereum mining revenue increased in March 2022 and traded between $3,000 to $4,000 until most of April. And it traded in the range of $2,900 and $3,400 in March.

On the other side, the Bitcoin price in April traded between $37,000 and $44,000. And in March, it had a higher trading value ranging from $43,000 to $48,000.

Related Reading | Bitcoin Price Plummets To Lowest Point In 2022, Will $33,000 Hold?

Crypto mining is the process of verifying and adding new transactions to the blockchain for a cryptocurrency. The miner who wins the competition gets rewards with some amount of the currency and/or transaction fees.

Featured image from Pixabay and chart from TradingView.com

Bitcoin mining is an important part of the bitcoin ecosystem. Miners who participate in mempools help to confirm transactions for which they receive a reward once a transaction is cleared. Usually, the mempool is ‘free’ and transactions go through easily with low fees but there are times when the mempool fills up causing transactions fees to surge. This was what took place at the start of March.

Bitcoin Transaction Fees Surge

At the beginning of the month, bitcoin had experienced higher transaction fees. These higher fees were as a result of transaction clustering in the mempool. Once the mempool has filled to a point where there were too many transactions to confirm, fees had invariably gone up given that transactions are confirmed based on the fee they carry. So transactions with higher fees had been confirmed first.

Related Reading | Why Is Bitcoin So Volatile, Anyway? Fidelity Digital Assets Explains

In order to compete in this pool that had filled up, incoming transactions had to carry a higher transaction fee per vByte (virtual byte) which is the size of the transaction. This caused fees to climb starting on March 1st and continuing for the next two days. These increased transaction fees had seen the average transaction fees per day rise for the past week to $691,000.

BTC recovers above $40K | Source: BTCUSD on TradingView.com

This volume had packed on the second day, March 2nd, where transactions fees climbed as high as $1.3 million. However, by the third day, miners had been able to clear all of the transactions in the mempool, although at high transaction fees, and the mempool was empty by the third day, March 3rd. Transaction fees had subsequently fallen flowing this clearance.

Miner Revenues Up

Bitcoin transaction fees were not the only that to record a surge as miner revenues had also recorded an uptick. Daily miner revenues for the same time period had also gone up by 6%. However, this was actually due to the price recovery that BTC had seen over the past week as hashrate had fallen once again in the same save-day period.

BTC hashrate falls | Source: Arcane Research

As for the transaction fees, even though there had been a significant uptick over this one-week period, fees were still comparatively low. They have been at one of their lowest for the last seven months and the recent surge did not come close to the high points recorded in the history of the digital asset.

Related Reading | Crypto Market Crumbles To Extreme Fear, Is It Time To Buy?

Transactions per day were also up 3.04% from the previous week. Fees per day jumped 99.81% and the average number of transactions was up by 2.54%. Only the number of blocks per hour was down for the time period, falling slightly by 1.67%.

Featured image from Investopedia, chart from TradingView.com

Bitcoin miners earn windfall income amid the price rally.

Miners generated an estimated $328 million in September.

Miners generated an estimated $368 million in August.