In a recent announcement on the social media platform X (formerly Twitter), MakerDAO, the Ethereum-based protocol responsible for issuing the DAI algorithmic stablecoin, provided insights into the performance of the Maker Protocol following recent changes.

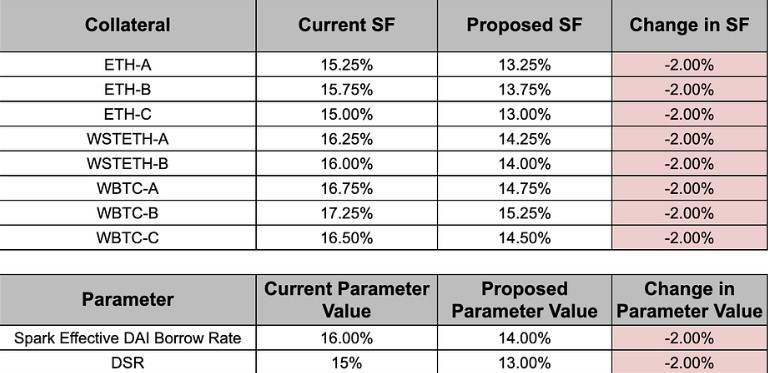

Over the past few weeks, MakerDAO has implemented significant updates to the protocol and the DAI stablecoin.

Introducing the Accelerated Proposal and the direct deposit module (D3M) to Spark’s Metamorpho Vault has notably impacted the ecosystem.

Increased DAI Supply And Demand

Looking at key metrics that demonstrate the effects of these changes to the protocol, the DAI supply in circulation currently stands at nearly 5 billion, reflecting a growth of approximately 300 million over the past month. This growth indicates continued demand for the stablecoin.

On the other hand, the Dai Savings Rate has significantly increased since implementing the Accelerated Proposal.

Approximately 1.54 billion DAI are currently deposited in the Dai Savings Rate, of which approximately 976 million DAI are sDAI, representing an increase of roughly 400 million DAI in deposits.

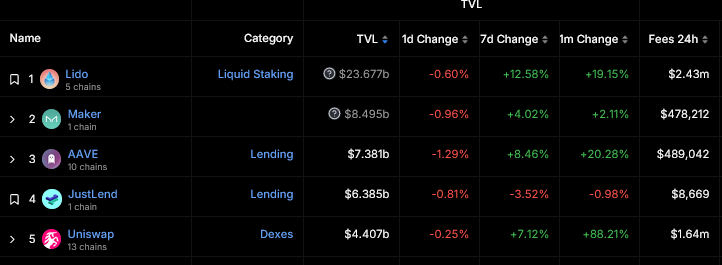

The Maker Protocol’s total value locked (TVL) amounts to approximately $8.4 billion across various vault types. This TVL growth can be attributed to strategic deployments in D3M modules, significant contributions from Ethereum-based collaterals, and the integration of real-world assets. These developments have enhanced the protocol’s diversification and resilience.

MakerDAO Ethereum Vaults Thrive

A notable addition to the MakerDAO ecosystem is the Morpho DM3, which enables the Morpho Vault to mint DAI. Currently, the lending pool has deployed 200 million DAI.

According to the protocol’s post, this allocation is projected to generate approximately 50 million in annual income for the Maker Protocol, making it the second-largest core vault in terms of annualized fees. It will play a significant role in generating revenue and contributing to the Maker Protocol’s sustainability.

Among the Ethereum vault types within the MakerDAO ecosystem, the ETH-C vault stands out with the largest value locked in crypto collateral at approximately $1.88 billion.

This vault generates approximately $43 million in annual fees, underscoring its importance within the Maker ecosystem and contribution to the protocol’s revenue streams.

Another important component is the Spark D3M, which is supplied with around 970 million DAI. This module is projected to generate an annual income of approximately 28 million.

These recent changes have positively impacted the Maker Protocol. The increase in DAI supply, growth in the Dai Savings Rate, expansion of collaterals, and introduction of different vault types have contributed to the protocol’s growth and development.

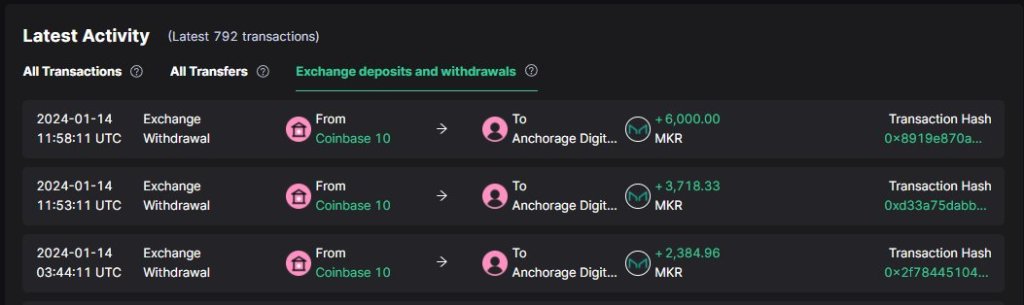

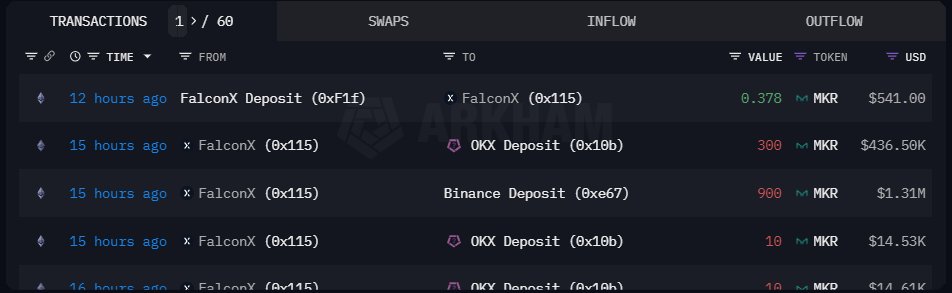

Despite the growth in the MakerDAO ecosystem, the native token MKR has experienced a continuous 5.9% price decline over the past fourteen days.

In the last seven days alone, the token has recorded a significant 17% price drop, resulting in its current trading price of $3,355.

However, despite the price decline, Token Terminal data reveals positive trends. The protocol’s market capitalization currently stands at $3.3 billion, reflecting a notable 28% increase over the past 30 days.

Additionally, trading volume for the MKR token has experienced a substantial surge, reaching $5.9 billion, representing a 119% increase over the same time frame.

Featured image from Shutterstock, chart from TradingView.com