Monero (XMR), an open-source, privacy-oriented cryptocurrency launched in 2014, managed to reach the $151 marker on November 2 as it briefly rallied before it experienced slight price correction.

Here’s a quick glance at XMR trajectory:

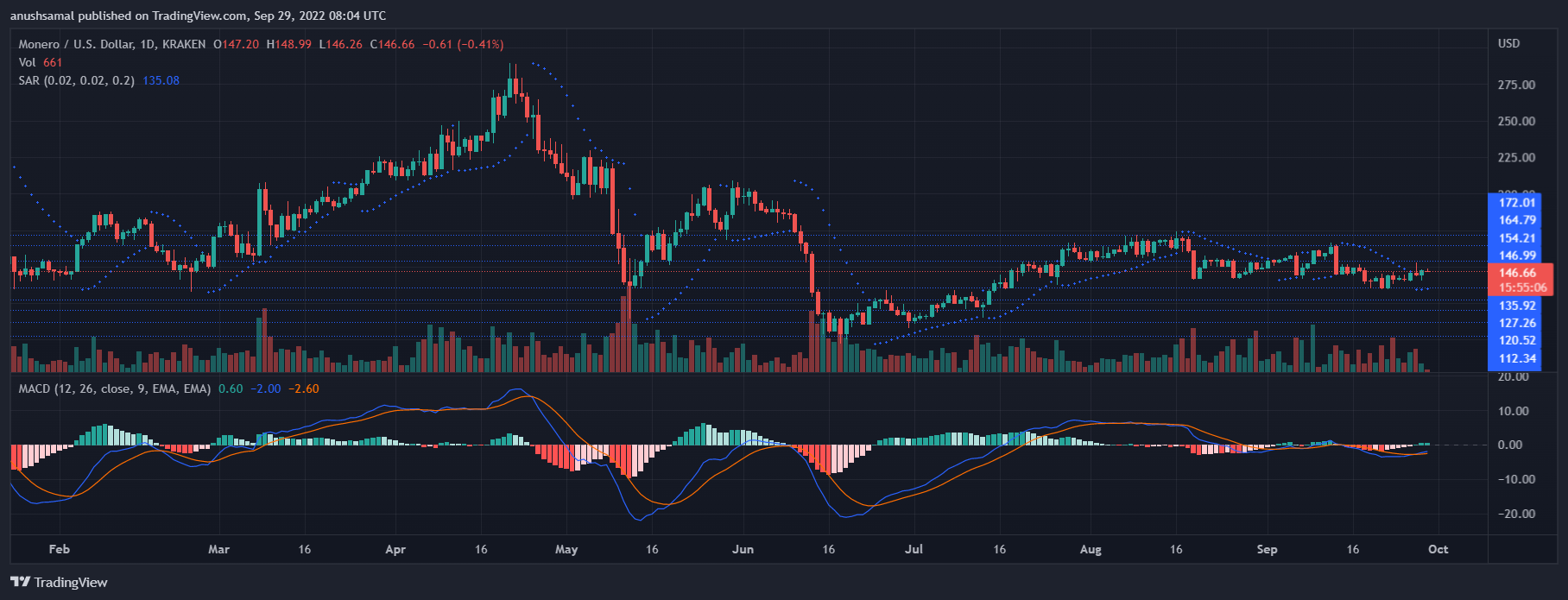

- Over the last two months, Monero traded at a narrow range that peaked at $152

- Surpassing the crucial $156 marker will enable XMR to climb all the way to $172

- Failure in increasing trading volume will most likely pull the crypto down to $148

At the time of this writing, according to tracking from Coingecko, the altcoin is changing hands at $149.10, going down by almost 1% over the last 24 hours.

The digital currency’s weekly, biweekly and monthly performance is relatively well, considering the crypto market was on an extended bearish momentum before the October 25 rally.

During the last seven days, Monero managed to go up by 1.5% while over the last two weeks, the asset increased by 2.8%. On a month-to-date gauge, XMR is on the midst of a 5.4% price surge.

Even with this kind of showing, the cryptocurrency is still nowhere close to its January 9, 2018 all-time high (ATH) of $542.33, already losing more than 72% of that value.

Monero Bulls Are Struggling

Since September, Monero traded within the narrow range of $152 and $136 as it was the subject of numerous bearish signals during the month, including a significant decrease in transaction count.

But XMR technical indicators now are showing signs of good buying pressure that may soon translate into a bullish rally.

Source: TradingView

Source: TradingView

For instance, the 12-hour Relative Strength Index (RSI) of Monero managed to climb above the 50-nuetral zone indicating that bulls, which struggled to break the resistance marker for the asset, were finally able to gain solid footing in the market.

Furthermore, XMR OBV was able to move past the resistance zone, denoting that the altcoin is primed for an upward momentum.

In summary, if the digital coin manages to reach, sustain and surpass the $156 marker, it will confirm the bullish signals sent by its technical indicators and will surge all the way up to $172.

However, should this happen without accompanying trading volume increase, the earlier thesis will be invalidated and XMR will be pulled back down to $148.

Price Forecast For Monero Also Bullish

Online crypto tracker Coincodex’s forecasts for XMR conform to the above technical analysis for the asset’s price movement.

Accordingly, over the next five days, the virtual coin is expected to reach its crucial resistance marker as it is forecasted to trade at $152.9.

Meanwhile, the next 30 days appears to be good for the digital asset as its spot trading price is seen to climb to even higher levels.

Coincodex believes Monero will trade at $159.12 30 days from now as it will enter the last month of 2022 with a value that is closer to the $172 target.

XMR total market cap at $2.7 billion on the daily chart | Featured image from Reddit, Chart: TradingView.com

Disclaimer: The analysis represents the author’s personal understanding of the crypto market and should not be construed as investment advice.