Tokyo-based Bitcoin exchange, Mt. Gox is preparing to release a substantial amount of Bitcoin (BTC) into the market, signaling the upcoming disbursement of payments to creditors who had been affected by its hack attack in 2011.

Mt. Gox Set To Release 142,000 Bitcoin Into Market

Reports from Reddit reveal that the Kraken Bitcoin (BTC) and Bitcoin Cash (BCH) API interface have signaled that Mt. Gox is getting ready to release its substantial cryptocurrency and fiat holdings, which include 142,000 BTC and 143,000 BCH, and 69 billion yen.

As of May 13, the interface began reading “payment in preparation,” indicating that funds would soon be distributed to creditors. The date for the anticipated disbursement has also been slated for October 31, 2024.

This decision comes after years of undergoing legal proceedings and negotiations aimed at reimbursing creditors who lost funds following the Bitcoin exchange’s crash. Earlier in 2011, Mt. Gox was hacked, resulting in the loss of 850,000 BTC now worth over $51 billion. Shortly after the unfortunate attack, Mt. Gox filed for bankruptcy and has since been gathering funds to compensate creditors.

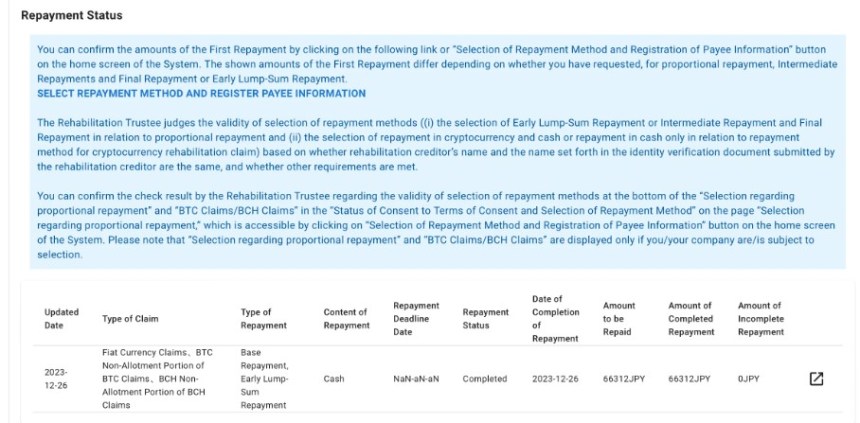

Reports from a few customers have revealed that the exchange has begun distributing funds in fiat currency. One particular Reddit user disclosed earlier in April, that he had received USD payments into an HSBC currency account with zero fees.

While the long-awaited distribution process comes as great news to creditors, the release of such a large amount of Bitcoin could have a significant effect on the current Bitcoin market.

Additionally, discussions about whether creditors would sell or retain their Bitcoin holdings once they receive their funds have been circulating. Nonetheless, the disbursement process presents a step towards closure and recovery for victims of the exchange’s hack and bankruptcy.

Will Creditors Sell Or Hold?

With the Bitcoin market presently in a fragile position after experiencing a series of declines following the halving event on April 20, the possibility of a large-scale sell-off could lead to drastic changes in the market, potentially resulting in a crash.

Commenting on Mt. Gox’s 142,000 BTC distribution plans, a Reddit community member suggested that the exchange’s upcoming repayments could become a catalyst for the next BTC dump in 2024.

In response, another Reddit user expressed doubt about the likelihood of a widespread sell-off, especially at the beginning of the bull market. The user surmised that investors who have been waiting for Mt. Gox’s payments for over a decade are unlikely to sell off their Bitcoin holdings quickly.

Instead, he suggested that many creditors, like himself, would be more inclined to HODL their Bitcoin holdings, having acquired a deeper understanding of the pioneer cryptocurrency during the decade-long wait.