Decentralized application (dApp) platform Near Protocol exhibited notable growth in key metrics during the first quarter (Q1) of 2024, driving its native token NEAR to reclaim a crucial key level and paving the way for a potential retest of its all-time high (ATH) from January 2022.

According to a recent report by Messari, NEAR experienced significant increases in market capitalization, revenue, active addresses, and Total Value Locked (TVL), solidifying its position among the top players in the cryptocurrency market.

NEAR Outperforms Bitcoin And Ethereum

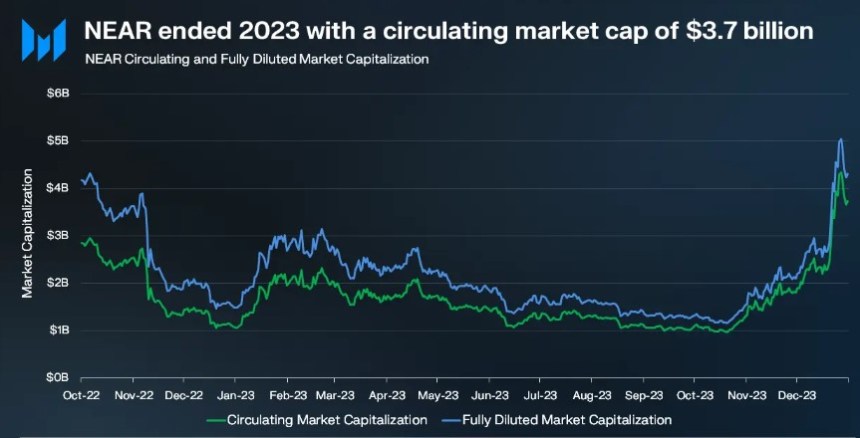

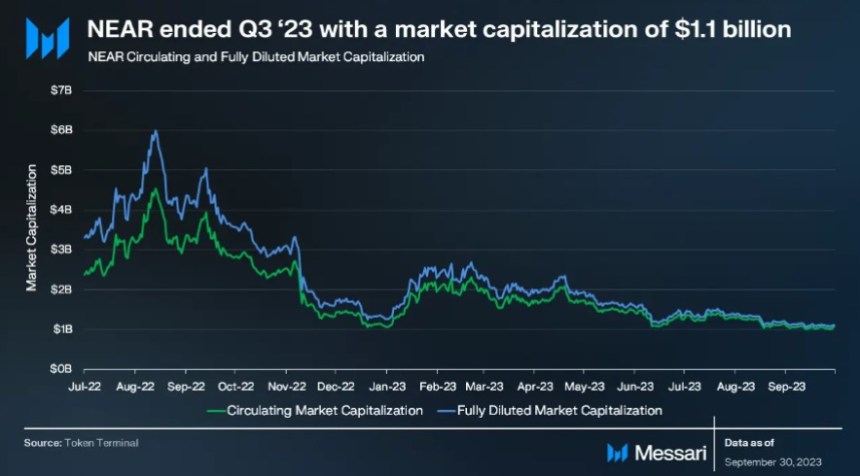

In Q1 2024, NEAR’s circulating market cap surged to $7.2 billion, marking a 94% quarter-on-quarter (QoQ) increase. The fully diluted market cap also witnessed substantial growth, reaching $8.2 billion, representing a 91% QoQ increase. These numbers propelled NEAR to secure a spot among the top 20 cryptocurrencies by market capitalization.

Notably, NEAR outperformed Bitcoin (BTC) and Ethereum (ETH), which recorded QoQ growth rates of 69% and 53%, respectively. Additionally, NEAR’s revenue, derived from network transaction fees, witnessed an 82% QoQ increase, reaching $1.9 million.

NEAR continued its address growth trend in Q1 2024, with average daily active addresses reaching 1.2 million, representing a robust 42% QoQ increase.

The network also witnessed a surge in daily new addresses, totaling 236,000 (a 37% QoQ increase), and surpassed the milestone of 100 million total accounts.

According to Messari, contributions from established protocols like KAIKAINOW, Sweat, and Playember and the adoption of HOT Wallet, averaging over 350,000 daily active addresses in March and nearly 3 million total wallets, drove this expansion.

Stablecoin Market Cap Soars In Q1

Per the report, the protocol experienced a sustained increase in transaction activity throughout Q1 2024, with daily transactions reaching 4.3 million, representing a 78% QoQ increase and a 538% increase over the last six months.

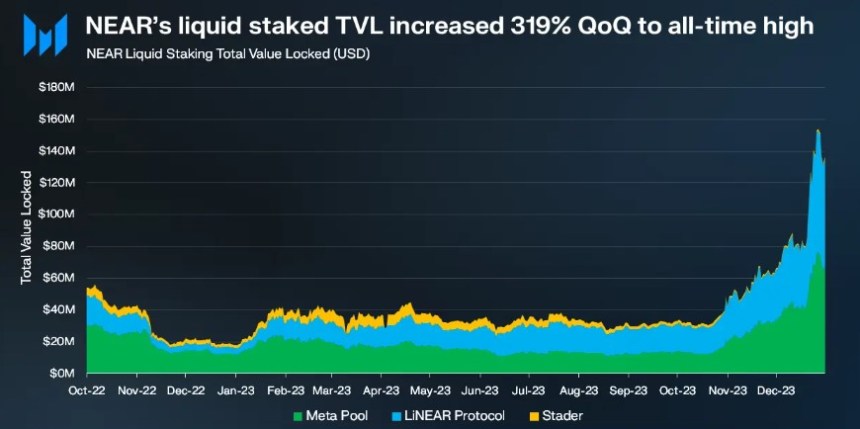

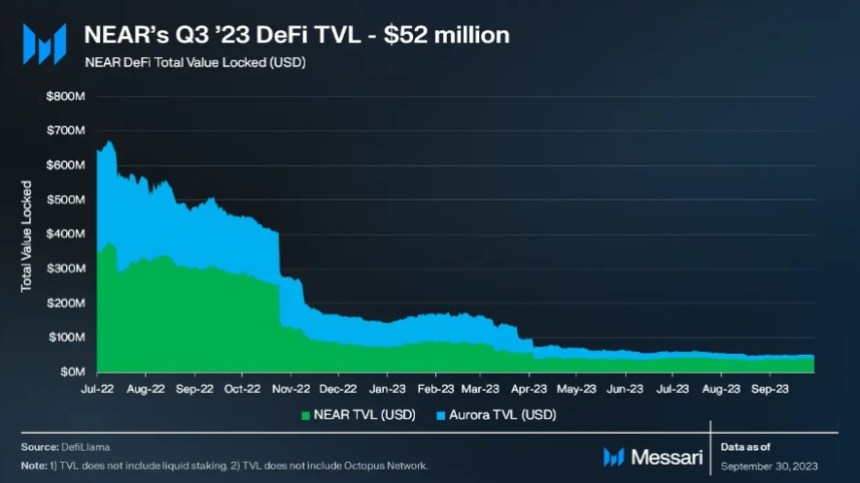

Similarly, NEAR’s TVL witnessed substantial growth, ending the quarter at $335 million, a 163% increase from the previous quarter and a 547% increase over the last six months.

Furthermore, NEAR’s decentralized exchange (DEX) volume experienced a notable surge, with an average daily volume of $8 million, representing a 95% QoQ increase. Ref Finance emerged as the leading DEX on the protocol, with $6 million daily volume, surpassing Orderly Network.

Lastly, NEAR observed a significant increase in its stablecoin market cap during Q1 2024, soaring 176% QoQ to $214 million. Notably, USDT experienced a significant surge, with its market cap increasing by 1,155% QoQ, reaching $88 million.

Outperforming Top 20 Cryptocurrencies

Regarding price action, NEAR Protocol’s native token has exhibited strong performance, surpassing the top 20 cryptocurrencies in the market with a 9.4% uptrend in the past seven days. Meanwhile, Bitcoin has experienced a minor 1.5% price correction over the past 24 hours.

This positive trend has enabled NEAR to reclaim the significant $7.40 price level, which is important for bullish investors.

Looking ahead, the $7.60 mark may present a potential resistance level for the token, serving as a crucial barrier to monitoring. It could pave the way for a retest of the $8 mark, signaling further upward momentum if successfully breached.

Conversely, the $6.80 mark has demonstrated its significance as a key support level. It was previously tested over the weekend and effectively prevented a more significant price decline.

Despite the optimistic outlook, it is important to note that the token remains down by over 64% from its all-time high of $20.4, reached in 2022.

Featured image from Shutterstock, chart from TradingView.com