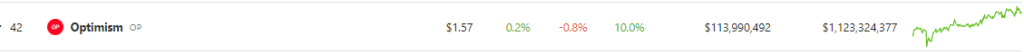

In a month marked by a challenging correction in the crypto market, Layer 2 (L2) blockchain protocol Optimism has emerged as a standout performer. Within the past 24 hours, Optimism’s native OP token skyrocketed by 9%, positioning it as the best-performing token among the top 100 cryptocurrencies.

Behind this surge lies venture capital firm a16z, which has reportedly invested around $90 million in Optimism’s OP token, signaling further institutional support for the layer 2 protocol.

OP Receives Major Investment

Sources familiar with the matter have revealed to Unchained that a16z has acquired a significant stake in Optimism’s OP token.

The investment, which comes with a two-year vesting period, underscores a16z’s interest in the Layer 2 protocol and aligns with its growing involvement in crypto. Notably, a16z’s portfolio already includes crypto exchange Coinbase.

The investment by a16z comes amidst notable activity and growth within the Optimism ecosystem. Optimism’s OP Stack has experienced increased usage, further validating its value proposition. The protocol’s ability to increase scalability and reduce fees on the Ethereum blockchain has also garnered significant attention.

Optimism’s spokesperson expressed enthusiasm for the investment, acknowledging the energy and momentum surrounding the protocol. The partnership with a venture capital firm like a16z is expected to fuel further development and innovation within the Optimism ecosystem.

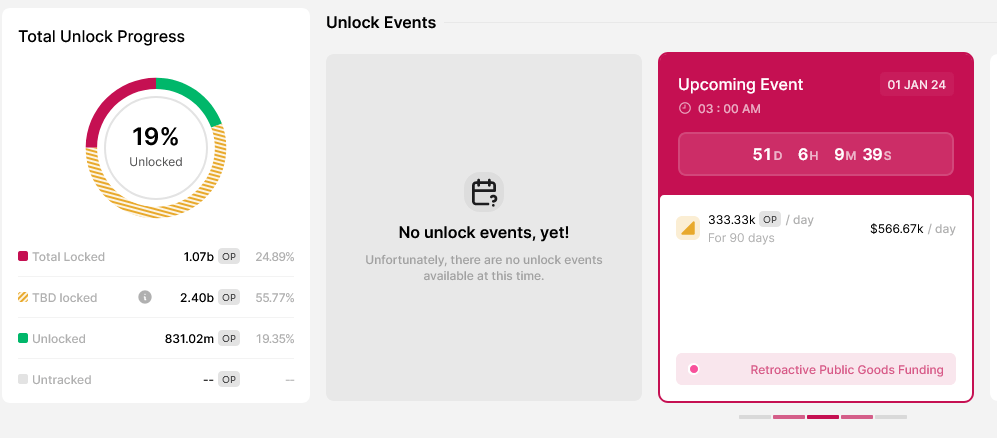

On March 7, the Optimism Foundation disclosed the sale of approximately 19.5 million OP tokens, valued at nearly $90 million, to an undisclosed buyer.

These tokens were reportedly sourced from a 30% pool of OP’s original treasury, dedicated to the foundation’s working budget. Reports indicated that the buyer could delegate their tokens to third parties, enabling them to participate in Optimism’s governance.

The foundation clarified that, due to the private nature of the sale, specific details regarding the terms and purchaser were not disclosed.

Key Levels To Watch For Optimism

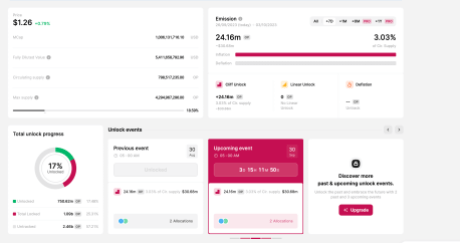

Despite the recent surge in the Optimism ecosystem and its native token OP, the token still trades well below its all-time high (ATH) reached on March 6, 2024, currently down over 47% from that level.

However, OP’s trading volume has experienced a notable surge, indicating continued interest in the token. According to CoinGecko data, the OP trading volume has increased by over 113% compared to the previous trading day on April 30, amounting to nearly $600 billion in 24 hours.

Key levels to monitor for the token soon include OP’s significant resistance at the $2.62 price mark and a potential retest of the $3 zone.

However, a clear indication of a positive trend for the Optimism token would require a successful consolidation above the $3.92 zone, marking the end of the month-and-a-half downtrend structure.

Conversely, the $2.37 zone has proven to be a crucial support level for OP, as it has held for the past five days and prevented further price decline for the token.

Digging deeper, the $2.25 mark is also a key support, with the most critical support level at $2.11. This level holds the key to Optimism’s macro bullish structure, as it initiated the token’s current uptrend.

Featured image from Shutterstock, chart from TradingView.com

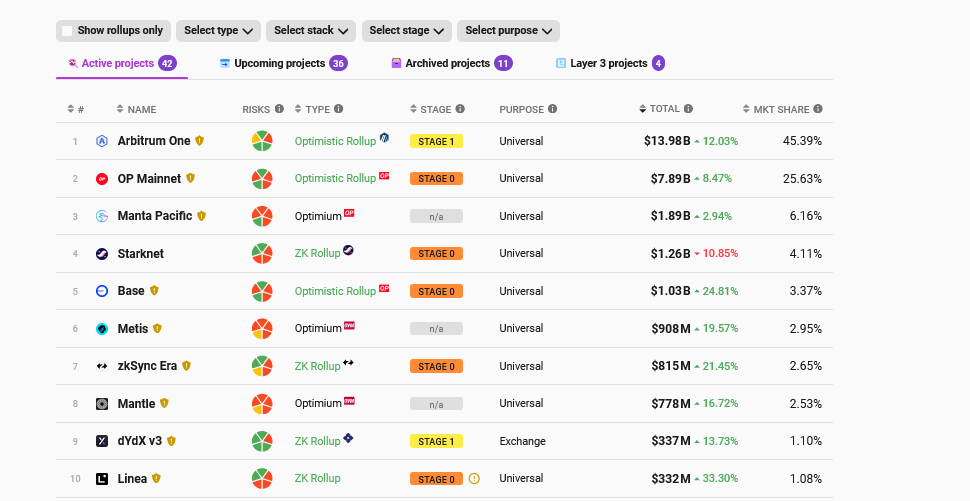

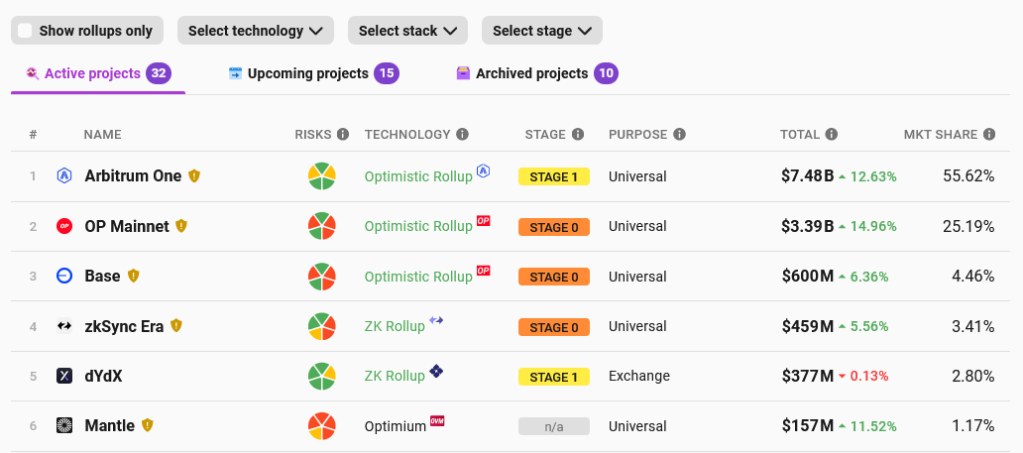

THE TVL BETWEEN TOP LAYER 2 ON ETHEREUM

THE TVL BETWEEN TOP LAYER 2 ON ETHEREUM  ,

, )? Let’s comment below

)? Let’s comment below