The regulator’s examination will assess whether the collaboration constitutes an “acquisition of control,” implying substantial influence of one party over another.

Cryptocurrency Financial News

The regulator’s examination will assess whether the collaboration constitutes an “acquisition of control,” implying substantial influence of one party over another.

Comparisons of Google’s Gemini and OpenAI’s ChatGPT continue to flood internet social spaces, so we decided to put them to the test with questions of our own.

After Google launched its new high-performance AI model Gemini and claimed it to be far superior to OpenAI’s GPT-4 users on social media began to challenge those claims.

The grants are supposed to give developers a “focus on building resilient technology and more equitable systems.”

Singapore released an updated version of its national AI strategy that includes plans for boosting government competency, building a smart nation and increasing compute capacity.

Cointelegraph spoke with architect and designer Tina Marinaki about her work using generative AI and text-to-image prompts to reimagine the ancient Athenian cityscape.

The billionaire mogul also claimed that OpenAI was lying about its training methods, but interviewer Andrew Ross Sorkin may have flubbed the question.

The battle continues as artists amend a lawsuit previously struck down by court authorities against major AI companies who have allegedly violated creative copyright laws.

Cointelegraph reflects on the artificial intelligence pause that never happened, a lawsuit that could change the entire AI industry, and the Sam Altman firing and rehiring drama.

Sam Altman addressed his employees in a company memo on Nov. 29, marking his official return to the top leadership position at OpenAI.

The guidelines suggest cybersecurity practices AI firms should implement when designing, developing, launching, and monitoring AI models.

Julian Sancton, an author and Hollywood reporter, accuses Microsoft of being aware of OpenAI’s indiscriminate internet crawling for copyrighted material.

“I’m looking forward to returning to openai, and building on our strong partnership with msft (Microsoft),” Altman said in a post early Wednesday.

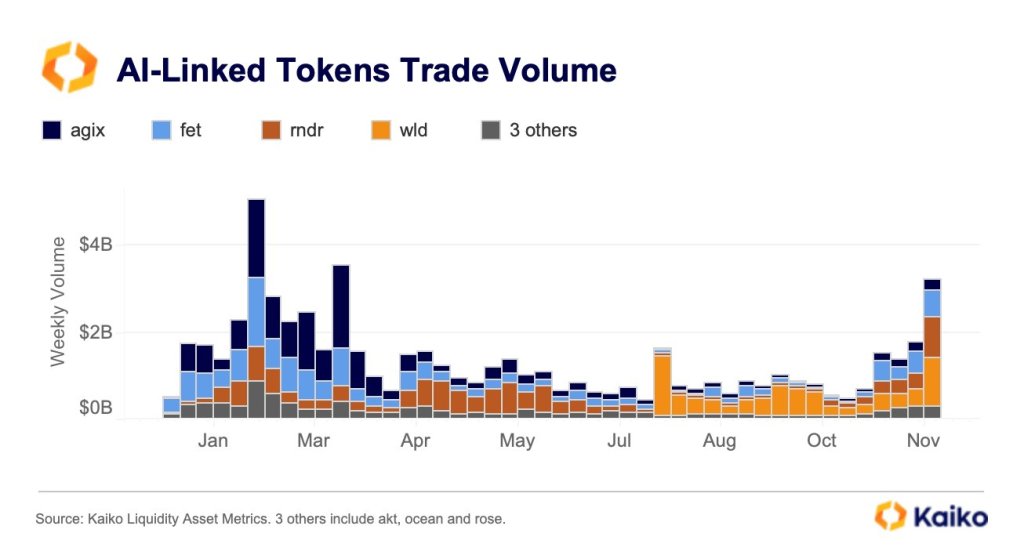

The recent saga surrounding OpenAI and its co-founder Sam Altman has sparked a surge of interest in AI tokens, with total weekly trade volume surpassing $2 billion for the first time since March, fresh data from Kaiko, a blockchain analytics platform, shows.

According to statistics, WLD, the native token on Worldcoin, a project co-founded by Altman, and other tokens, including FET, the primary coin behind the AI-reliant blockchain, Fetch.ai, appear to be primary gainers. Even so, WLD prices remain below November 2023 lows when writing.

Even so, looking at market data, the spike in crypto AI trading volume seems driven mainly by WLD activity. Looking at the project’s share, trading volume comprises over 33% of all related crypto AI trading volume.

While there is a noticeable spike in activity, it remains below the all-time high of above $4 billion in Q1 2023. Then, traders and investors were keen on AGIX, the SingularityNET token. However, over the months, Worldcoin has since taken over as investor interest shifted to WLD, evidenced by the gradual rise of trading volume.

Looking at WLD price action over the past three days, prices have been volatile, though trading volume has been mostly up from November 13. Following news of Altman’s removal as CEO of OpenAI, prices fell before slightly expanding with news of negotiations to return to the role, followed by his appointment to lead Microsoft’s AI team.

All these events have contributed to the market’s heightened interest in WLD. Accordingly, trading volume across the broader crypto AI scene stands above the $2 billion level for the first time since March.

Though there is no direct connection between OpenAI and Worldcoin, crypto participants focus on events at OpenAI and how the board handled Altman as a factor catalyzing WLD’s activity.

The general lack of clarity on why the board ousted Altman as CEO worsens the situation, sparking speculation that this could also impact WLD’s prices and how Worldcoin is governed, considering the former CEO is also behind the crypto AI project.

Looking at the co-founder’s previous role as the team leading Worldcoin’s developments, Altman also holds significant sway, contributing to discussions on how the government should regulate AI at the end of the day.

Altman’s influential role has impacted Worldcoin and its prices since the blockchain project aims to create a global identity system. Worldcoin’s operations would rely on AI, including fraud prevention, data analysis, verification, and more.

OpenAI’s future remains uncertain as employees threaten a walkout over the firing of former CEO and co-founder Sam Altman.

Executives at OpenAI have been trying to settle disputes with employees and are in “intense discussions” over how to move forward after the abrupt departure of former CEO Sam Altman.

24 hours ago, prediction markets were almost certain that Altman wouldn’t be back as OpenAI’s CEO. Now the market’s answer to that question has changed twice.

Former OpenAI CEO Sam Altman has reportedly agreed to a position with Microsoft while Nvidia reaps the benefits of big tech’s scramble to build a better chatbot.

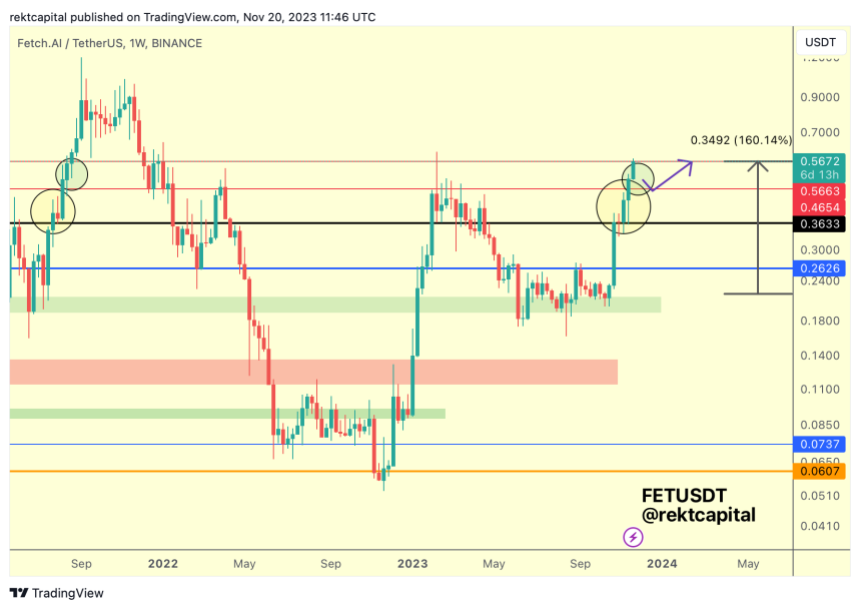

The Artificial Intelligence (AI) sector in the crypto space has enjoyed one of the most prominent rallies despite the debacle with OpenAI. The company behind ChatGPT fired one of its founders and CEO, Sam Altman, sparkling downside pressure for AI-based tokens, such as FET.

The native token for Fetch.ai, FET, has been trending to the upside following the general market sentiment. Over the past month, the cryptocurrency recorded a 160% rally, and it’s poised for further profits as it breaches critical resistance levels.

Data from Coingecko indicates that FET’s bullish momentum took a hit last week as news about Sam Altman leaving OpenAI broke. The token has been moving with any development from the broader AI sector, and the uncertainty surrounding this company has impacted its performance on low timeframes.

Over the weekend, FET regained its bullish momentum and reclaimed territory, extending a more significant rally. In that sense, a pseudonym trader looked into FET’s potential target as the cryptocurrency continues “its rally without a dip.”

In the past week, FET breached the resistance at $0.56, targeting its 2022 highs, as seen in the chart below. If the bullish momentum continues, the token could rise to its 2021 highs between $0.70 and $0.90.

Our Editorial Director and analyst, Tony Spilotro, has been bullish on FET’s trajectory. The analyst believes FET could rise 2x to 4x before losing steam and re-visiting support.

In the past, whenever the token followed a similar trajectory, printing a buy signal above the monthly Bollinger Band, as Spilotro stated, FET corrected by an impressive 80%. Thus, the analyst recommended new investors to tread carefully. Spilotro said:

(…) its safe more than likely to buy FET at such levels, so long as you have a plan to get out before the next 70+% correction happens. Otherwise, price could retrace back to your entry here. Be smart and don’t expect the rally to go on forever.

Today, Microsoft announced the hiring of Sam Altman to spearhead a new AI division. The company will commit to providing resources for the new division, which could ignite a new bull era for AI and AI-based tokens.

Cover image from Unsplash, chart from Tradingview