Bitcoin is becoming a yield-generating asset, thanks to new token standards like Runes, which may only be a stepping stone for Bitcoin DeFi.

Cryptocurrency Financial News

Bitcoin is becoming a yield-generating asset, thanks to new token standards like Runes, which may only be a stepping stone for Bitcoin DeFi.

USDh is the first Bitcoin-native synthetic dollar with yield-generating capabilities. Is the 25% yield sustainable?

Runes recovered to account for the lion’s share of transactions on the Bitcoin network.

The pool mined the first block after last week’s halving, winning an “epic” sat in the process.

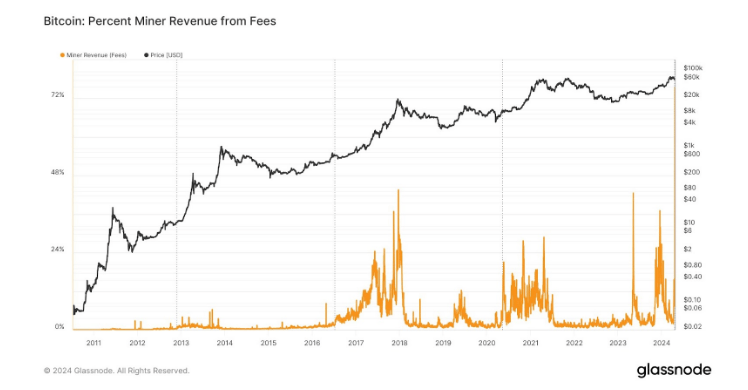

Bitcoin miners have struck a proverbial goldmine, reaping an astonishing $107 million in profits, according to data from Glassnode, a leading analytics platform. This unprecedented windfall, amassed on April 20th, underscores a significant shift in the revenue dynamics of Bitcoin mining operations.

The meteoric rise in transaction fees serves as a bellwether for the evolving economic landscape of Bitcoin mining. As the network adapts to new market demands and technological advancements, transaction fees have emerged as a crucial revenue stream for miners. This trend is particularly noteworthy given the scheduled reductions in block rewards, highlighting the resilience and adaptability of Bitcoin’s economic model.

According to glassnode, affected by the Runes minting activity, on April 20, Bitcoin miner revenue reached US$106.7 million, of which 75.444% came from network transaction fees, both reaching record highs. https://t.co/lVSyqn1UaE pic.twitter.com/xjkkTor2I9

— Wu Blockchain (@WuBlockchain) April 21, 2024

Driving this surge in profitability is a recent minting spree focused on Runes, a pivotal development that has left a tangible mark on the network’s dynamics. Reports indicate that a staggering 75% of the total profits stemmed from transaction fees, marking a new pinnacle in the distribution of revenue among BTC miners.

Runes is similar to Ordinals; they both let users permanently store data directly on the Bitcoin blockchain, like an inscription etched in stone. But there’s a key distinction in what they store: Ordinals are one-of-a-kind digital collectibles, similar to fancy trading cards.

Runes, on the other hand, are designed to act more like meme coins, those widely tradable and often humorous tokens that have been a recent craze in the crypto world.

This paradigm shift in income composition underscores the growing importance of transaction fees as a vital income source, especially as block rewards face planned reductions in the context of Bitcoin’s halving system.

This financial triumph comes amidst ongoing debates surrounding the sustainability and profitability of mining activities. With escalating energy demands and mounting regulatory scrutiny, the viability of mining operations has been called into question. However, the recent data paints a reassuring picture of the economic vitality of Bitcoin mining, demonstrating its resilience in the face of external pressures.

Beyond the immediate financial gains, the surge in transaction fees holds profound implications for the future trajectory of Bitcoin. The unprecedented collection of fees signifies robust network activity and user engagement, indicating strong demand and utilization of the Bitcoin blockchain.

This bodes well for the long-term sustainability and development of Bitcoin as a prominent digital currency, bolstering confidence among stakeholders and enthusiasts alike.

Featured image from VistaCreate, chart from TradingView

The Bitcoin “halving” was supposed to dramatically chop revenue of bitcoin mining companies. Instead, the simultaneous launch of Casey Rodarmor’s Runes protocol has ignited a flurry activity on the oldest and largest blockchain, driving up fees.

Institutions launching Bitcoin ETFs this year have buoyed the bitcoin price to record levels. Does that mean the impact of the halving — the four-year slashing of the bitcoin reward — will be relatively muted this time, as any pontential bump is “priced in”?

Rodarmor created last year’s breakout Ordinals protocol, which is used to create non-fungible tokens (NFTs) on Bitcoin. Now, he says the relevance of protocols like his new Runes, used to create fungible tokens, is set to grow.

Bitcoin’s once-every-four-years “halving” this week may be very different from those of earlier epochs, typically ho-hum affairs. Now, an intense competition is underway to mine the first block after the halving, which could contain a rare and collectible fragment of a bitcoin known as an “epic sat.”

“There exists a large, untapped pool of capital within the Bitcoin ecosystem that remains dormant,” Wintermute’s OTC desk told CoinDesk.

With the halving and new tech set to give Ordinals a further lift, Bitcoin-based inscriptions are demonstrating staying power and some advantages over NFTs. Christie’s is taking notice with a new initiative.

Cryptocurrency exchange Binance will cease support for bitcoin-based non-fungible tokens (NFTs) as it undergoes a process to “streamline” its product offerings.

As BTC gets Wall Street approval and developers build new applications on the network, Bitcoiners are ditching some of their previous siege mentality.

Governance on BRC-20 and on Bitcoin general is often a thorny subject, as highlighted at the start of this year when Ordinals marketplace UniSat and Domo came into a potential conflict.

Bitcoin transaction fees have experienced an unprecedented surge, doubling in just one week, as the market rallies towards the coveted $70,000 mark. This surge cannot be solely attributed to the upward trajectory of Bitcoin’s price but is significantly influenced by the sudden rise in Ordinals transactions.

Amidst the fervor of Bitcoin’s price rally, Ordinals transactions have emerged as a driving force behind the surge in transaction fees. Our in-depth analysis reveals that Ordinals, which started the week with approximately 48,000 daily inscriptions, witnessed an extraordinary surge, surpassing 93,000 by March 8th.

This surge in daily inscriptions has not only contributed to a substantial increase in fees, with the daily average fee standing at around eight BTC but has also added a staggering $3.8 million to the total network fees for the week.

Bitcoin’s fee trend for the week has been nothing short of dynamic. While the initial daily fees stood at around 46 BTC, the momentum gained pace around March 5th, surging to an impressive 103 BTC. Towards the end of the week, the daily fee decreased slightly to around 40.7 BTC.

Despite the decline, the overall trend indicates a significant increase in daily fees compared to the preceding week, showcasing the dynamism and resilience of the Bitcoin market.

Bitcoin’s Ascent Towards $70K And Its Ripple Effect

As Bitcoin teeters on the edge of the $70,000 price range, the cryptocurrency market is on the brink of a potential breakthrough. At the time of reporting, Bitcoin was trading at about $68,950, marking a 10% increase in the last seven days.

A Closer Look At Bitcoin’s Fee Surge

Examining data provided by IntoTheBlock, it becomes evident that Bitcoin’s recent fee surge is not merely a consequence of its price rise. The notable increase in transaction fees, doubling compared to the previous week, is closely tied to the upward movement in the price of BTC.

Bitcoin fees more than doubled this week, with Ordinals-related transactions hitting a monthly high. pic.twitter.com/YXh9oMMYSK

— IntoTheBlock (@intotheblock) March 9, 2024

This movement has propelled transaction volumes to their highest levels in months, with NewsBTC’s analysis revealing a staggering volume surpassing $100 billion on March 5th and 6th, a level not witnessed since November 2022.

Ordinals’ Remarkable Contribution To Bitcoin Fees

NewsBTC’s detailed evaluation of Ordinals transactions over the past week sheds light on the remarkable contribution of this sector to Bitcoin’s escalating fees. With daily inscriptions skyrocketing and daily fees averaging around eight BTC, Ordinals has made a significant impact on the cryptocurrency landscape, contributing over $430 million in fees to date.

Featured image from Karolina Grabowska/Pexels, chart from TradingView

OrdiZK, a project that set out to become a bridge between the Bitcoin, Ethereum and Solana blockchains, appears to have pulled an exit scam, according to blockchain security firm CertiK.

The new offering will expedite the process of large and non-standard transactions.