The platform is adding four features designed to make trading faster, cheaper and more customized.

PancakeSwap Plans ‘Affiliates’ for Expansion; Cake Holders To Benefit

CAKE token holders will benefit from the success of affiliate forks as they will receive native DEX tokens from affiliates, if things go as planned.

PancakeSwap To Burn 300 Million CAKE, Why Is This Whale Moving Coins?

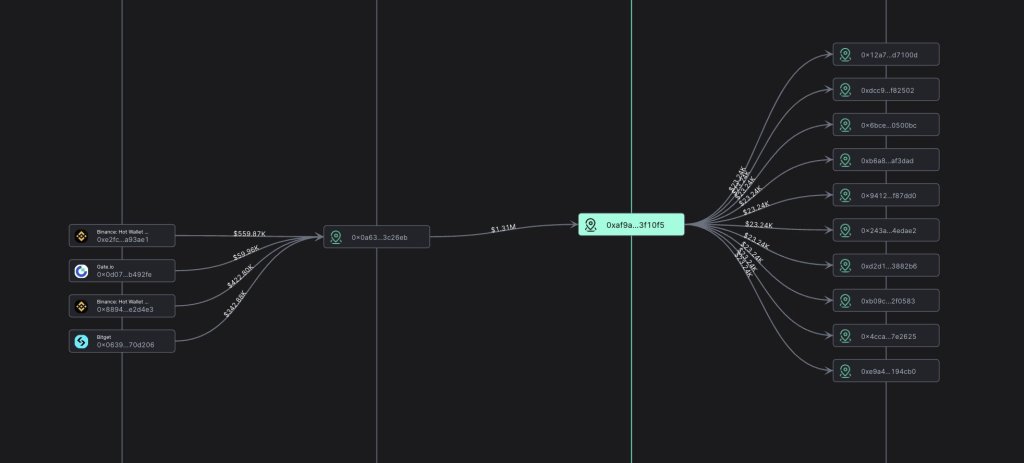

Amidst PancakeSwap’s proposal to burn 300 million CAKE and reduce the total supply from 750 million to 450 million CAKE, on-chain data indicates that a whale has been moving a significant amount of CAKE, the decentralized exchange’s governance token.

Whale Is Moving Tokens As Key PancakeSwap Voting Event Proceeds

According to a report from Scopescan, a blockchain analytics platform, a whale has moved approximately 1.7 million CAKE worth $1.3 million in the past week from Binance, Gate.io, and Bitget to a series of crypto addresses. The timing of this transfer is noteworthy since it coincides with key voting that would permanently shape PancakeSwap’s tokenomics.

The proposed token burn is gathering significant support, with over 90% of CAKE holders in agreement. According to the proposer, reducing the total supply to 450 million CAKE is reasonable. It would also ensure sufficient supply for future growth while achieving “ultrasound CAKE.”

Herein, the idea is to make CAKE deflationary over the long term, and this may support prices as PancakeSwap continues to play a vital role in token swapping in the broader BNB Chain ecosystem.

According to DeFiLlama data, PancakeSwap is the largest DEX in the BNB Chain ecosystem, with a total value locked (TVL) of $1.6 billion, commanding roughly half of the network’s TVL of around $3.5 billion. Notably, PancakeSwap has been resilient and continues to evolve, shaking off competition even after the deployment of Uniswap v3 on the BNB Chain.

In the past 24 hours, PancakeSwap has generated over $815,000 in fees, more than 7.5X that of Venus, a lending protocol, the second largest in the BNB Chain ecosystem.

Is CAKE Ready For $10?

Notably, the token burn proposal also comes when PancakeSwap is undergoing significant changes, including the recent introduction of veCAKE and Voting gauges, whose voting concluded on November 22. With this proposal passing with over 99% community support, veCAKE holders can now vote on where future CAKE farm emissions will be directed.

This gives CAKE holders greater governance influence. Supporters maintain that this crucial decision makes the DEX more decentralized and community-facing.

Ahead of PancakeSwap’s plans to burn 300 million CAKE, prices have been rallying. From the weekly chart, CAKE is up by over 260% from 2023 lows, roaring as demand increases. While bullish, bulls are yet to reverse losses of this year. A critical resistance level remains at around $5. A solid, high-volume break above this line could propel CAKE to around $10 in the coming months.

PancakeSwap Proposes to Reduce CAKE Token Supply by 300 Million

More than 99.95% of the community, representing 70,000 votes from CAKE holders, favored the proposal shortly after it went live.

PanCakeSwap Soars Over 50% After 10 Million Tokens Burned – Details

The recent increase in value of PancakeSwap has captured the attention of the cryptocurrency community, as its token, CAKE, witnessed an extraordinary 54% surge in just the past seven days.

With a robust market capitalization of nearly $900 million and an impressive fully diluted valuation of $1.3 billion, PancakeSwap has solidified its position as a significant player in the decentralized finance (DeFi) space.

Strategic Token Burn Propels PanCakeSwap Ascendancy

One of the key strategies contributing to PancakeSwap’s success lies in its proactive approach to managing token supply.

In a strategic move to boost scarcity and create a more attractive investment proposition, PancakeSwap executed a token burn, incinerating more than 10 million CAKE tokens, valued at approximately $34 million, on December 26.

This deliberate reduction in the total supply by 40% has not only impressed investors but also earned PancakeSwap the endearing title of “everyone’s favorite DEX” (Decentralized Exchange).

10,166,225 $CAKE just burned – that’s $34M!

Trading fees (AMM V2): 132k CAKE ($438k) -29%

Trading fees (AMM V3): 79k CAKE ($260k) -23%

Trading fees (Non-AMM like Perpetual, Position manager etc): 4k CAKE ($1k) -98%

Prediction: 34k CAKE ($112k) -27%

Lottery &… pic.twitter.com/veRsDhcFFB

— PancakeSwap

Everyone’s Favorite DEX (@PancakeSwap) December 26, 2023

Despite prevailing market consolidation, the CAKE token has managed to defy the odds, maintaining a price above $2.1 and extending its recovery trend. Within just one week, the coin’s price soared to the current trading value of $3.37, breaking decisively from a falling wedge pattern.

This latest burn has resulted in a notable reduction in the circulating supply of CAKE tokens, decreasing from 275 million to 265 million. Consequently, this development propelled the CAKE price by 18%, pushing its market cap to $894 million.

Crypto burns play a pivotal role in the digital assets sector by reducing asset supply, thereby creating heightened demand and boosting the value and prices of cryptocurrencies.

Although a proposal to cap the maximum supply at 450 million was previously made by the network to recover losses suffered by CAKE crypto, it is yet to be implemented. Meanwhile, the team will continue with substantial burns to support price movement until an alternative decision is reached.

Weekly Token Burns Signal PanCakeSwap’s Commitment

The PancakeSwap team has further disclosed their intention to continue these token burns on a weekly basis, demonstrating a commitment to this approach until a decision is made to alter it.

This diminishing supply, coupled with the optimistic technical outlook, is anticipated to sustain a robust recovery trend in CAKE price.

Meanwhile, the coin’s 24-hour trade volume increased by 37% to $284 million, with one-month gains exceeding 50%. Moreover, the token reached a new 30-day peak of $3.65 on Tuesday.

As of the latest update, CAKE maintains a bullish stance, registering a 27% increase in the previous day’s trading and gaining over 6% within one hour of the most recent token burn.

The altcoin has also garnered increased crowd interest, with daily volume soaring by 75% to $330 million, although it remains 90% down from its April 2021 all-time high of $44.20.

Featured image from Shutterstock

Pancakeswap implements new ‘Gauges’ voting system and sunsets vCAKE metric

The decentralized exchange launched a new feature that allows governance token holders to vote on which pools will receive the most rewards.

PancakeSwap Targets GameFi With Release of Gaming Marketplace

The marketplace will allow developers to directly build, publish, and update games on the platform.

Altcoins Rally: What’s Next After The Breakout

Altcoins have witnessed a significant surge recently, with their collective market capitalization rising from $575 billion to $615 billion in just a few days – an increase of 7%. This momentum hints at the potential for further growth in the Altcoin sector.

Breakout From Descending Triangle

The Altcoin market capitalization had been trading within a descending triangle pattern since its yearly peak in April. This technical pattern, characterized by a series of lower highs but consistent lows, typically signals a bearish sentiment – suggesting that each rally is met with increasing selling pressure, keeping upward price movements in check.

Related Reading: November Outlook For Bitcoin Price: Another Pump Or Retrace?

However, this past weekend marked a pivotal change. The market capitalization decisively broke through the pattern’s upper resistance line, surging by 7%. Such a breakout from a descending triangle is a bullish pattern, often indicating a reversal of the prior downtrend. With this breakout, the market cap is now eyeing the target set by the initial peak of the pattern, which could mean an additional increase of 7%.

The significance of this breakout is further highlighted by the fact that the Altcoin market cap has not only broken through the resistance but also surpassed the previous high set in July. This breach could signal that the market is transitioning from a bear-dominated phase to a bullish one, where buyers are regaining control and pushing the market to new heights.

Bitcoin Decreasing Dominance

Bitcoin’s dominance on the market has recently slipped to 52.50%, down from its annual peak of 54%. This is a normal market fluctuation, considering Bitcoin had been on a ten-week streak of increasing dominance.

Related Reading: Bitcoin Season: Leading The Charge In The Crypto Market

Yet, it’s crucial to note that Bitcoin’s market share has dipped below the pivotal 53% support level. Should Bitcoin fail to reclaim dominance above this support level, we could anticipate a further decrease to the next support at 49%, opening the door for Altcoins to capture a greater portion of the cryptocurrency market cap.

In bear markets, Bitcoin’s dominance tends to increase as the market pulls back, which suggests that if Bitcoin manages to hold or increase its price, Altcoins could experience further rallies.

Conversely, an increase above the 53% support could set Bitcoin out for the next resistance at 58%, at the expense of Altcoins’ market share.

Historically, bull markets often begin with Bitcoin leading the way due to events like the halving event, which reduces the inflow of new Bitcoin.

Nonetheless, there are still phases when Altcoins rapidly gain momentum, experiencing significant and rapid price increases. The current market breakout, along with a reduction in Bitcoin’s dominance, hints that such a phase could potentially unfold now.

Top Altcoins Gains

In the past week, many Altcoins have witnessed remarkable gains. Here are the top performers:

- Pancake Swap: +95%

- Trust Wallet Token: +53%

- Neo: +48%

- MultiversX: +46%

- Blur: +45%

Predycto is the author of a cryptocurrency newsletter. Sign up for free. Follow @Predycto on Twitter.

PancakeSwap adds portfolio manager function in partnership with Bril

The crypto exchange added a feature that allows users to deposit single assets into a vault, which are then automatically invested into diverse liquidity pools.

Pancakeswap integrates Transak for fiat onboarding on multiple chains

Pancakeswap now allows users to purchase crypto with debit card, Google Pay, Apple Pay, and other methods through Transak.

PancakeSwap V3 Takes The Stage On Ethereum’s Layer 2 Linea Mainnet

PancakeSwap, a leading decentralized finance (DeFi) platform, has officially launched its anticipated Version 3 (V3) on the Linea Mainnet.

According to the announcement, the collaboration between PancakeSwap and Linea aims to provide a seamless trading experience with lower fees, increased liquidity provider returns, and enhanced capital efficiency.

PancakeSwap V3 On Linea

Linea, formerly known as ConsenSys zkEVM, stands as Layer 2 scaling solution powered by ConsenSys. Linea achieves faster transaction speeds and reduced gas costs while ensuring security by utilizing zero-knowledge proofs and maintaining full Ethereum Virtual Machine (EVM) equivalence.

Developers can seamlessly create or migrate Ethereum apps without code modification or smart contract rewriting. With native integrations of popular tools like MetaMask and Truffle, Linea empowers developers with flexibility and scalability on the zkEVM.

The collaboration has provided PancakeSwap users with insights into Layer 2 scaling solutions and the Linea platform, contributing to the development and adoption of decentralized financial solutions.

Per the announcement, PancakeSwap v3 on Linea introduces two key features: advanced Swap and Liquidity Provision functionalities. These features enable users to trade tokens and participate in liquidity provision directly on the platform.

The core principle of PancakeSwap v3 is maximizing capital efficiency, allowing liquidity providers to concentrate their capital within specific price ranges where most trading occurs.

By optimizing asset utilization, liquidity providers can enhance their earnings. PancakeSwap v3 enables liquidity providers to achieve a capital multiplier of up to 4000x compared to its predecessor, v2, thus maximizing returns.

While the provision of Linea incentives to PancakeSwap has not been communicated at this point, if they are provided, PancakeSwap intends to share them with various stakeholders, including the CAKE community, CAKE stakers, projects contributing to PancakeSwap’s development, and ecosystem contributors. The protocol’s “Chefs” concluded the announcement by stating:

We anticipate the exciting opportunities ahead as PancakeSwap v3 takes its momentous leap onto Linea. We are thrilled to work hand in hand with other projects, developers, builders, and our vibrant community as we continue to push the boundaries of Multichain DeFi. Together, we can foster innovation, drive adoption, and shape the future of decentralized finance. We invite you all to join us on this remarkable journey as we unlock new realms of possibility and create a thriving ecosystem that benefits everyone involved.

Currently priced at $1.28, PancakeSwap’s token (CAKE) has experienced a slight downward movement in the past 24 hours, with a decrease of 0.02%.

Over 7 days, it has seen a decline of 7.89%, and over 30 days, a decrease of 13.85%. Looking at a longer timeframe, PancakeSwap has encountered significant volatility, with a decline of 68.79% over the past 180 days.

Featured image from Unsplash, chart from TradingView.com

PancakeSwap Version 3 Goes Live on Ethereum Layer 2 Linea Mainnet

PancakeSwap v3 introduces advanced Swap and Liquidity Provision functionalities, enabling users to trade tokens seamlessly and maximize capital efficiency.

PancakeSwap Deploys on Ethereum Scaling Network Arbitrum in Expansion Drive

The decentralized exchange has expanded to several networks this year in the search for new users and revenue streams.

PancakeSwap Joins The Ranks Of DeFi Giants On zkSync Era: Here’s Why It Matters

Decentralized Exchange (DEX) PancakeSwap (CAKE), has announced the launch of PancakeSwap v3 on zkSync Era, a Layer 2 scaling solution that promises to deliver improved scalability, efficiency, and cost-effectiveness to its users.

According to the announcement, with the popularity of ZK rollups increasing and users and builders increasingly looking to L2 solutions, PancakeSwap is thrilled to offer users and developers even more reasons to build and trade on its DEX.

The Benefits Of PancakeSwap v3’s Swap Feature On zkSync Era

PancakeSwap v3 on zkSync Era comes with several exciting features, including Swap, Liquidity Provision (LP), Farms, and Initial Farm Offering (IFO).

The Swap feature allows users to enjoy quick and cost-effective token swaps through a user-friendly interface. With multi-tier fee structures ranging from 0.01% to 1%, traders can select the fee structure that aligns best with their trading preferences and liquidity pool engagement.

With low trading fees, users can trade their favorite tokens seamlessly while enjoying enhanced liquidity and reduced slippage.

Moreover, the Liquidity Provision feature lets users become part of PancakeSwap’s thriving decentralized exchange ecosystem by providing liquidity. Liquidity providers earn passive income through trading fees when people use their liquidity pool to complete swaps.

Per the announcement, with the scalability of zkSync Era, users can maximize their returns, achieving an impressive capital multiplier of up to 4000x.

Users can engage in Swap, LP, and social media tasks to earn loyalty points and unlock exclusive NFTs. The Galxe campaign provides an opportunity to explore and experience the power of PancakeSwap on this ecosystem, unlocking the full potential of the platform.

Ultimately, the integration with zkSync Era allows PancakeSwap to increase its transaction capacity and reduce congestion on the Ethereum network. As the popularity of DeFi continues to grow, the Ethereum network has become congested, leading to high gas fees and slower transaction times.

By leveraging Layer 2 scaling solutions like zkSync, PancakeSwap can significantly increase its transaction capacity, reduce congestion, and offer users a more reliable and cost-effective trading experience.

What’s more, the integration with zkSync Era is expected to pave the way for the mass adoption of DeFi. By offering users faster and cheaper transactions, PancakeSwap can attract more users to the platform, increasing the adoption of DeFi as a whole.

PancakeSwap’s Revenue Hit By Market Conditions

PancakeSwap has experienced some fluctuations in its market performance recently. According to Token Terminal data, PancakeSwap’s circulating market cap is currently $313.88 million, with a 1.16% decline in the past 24 hours.

Meanwhile, its fully diluted market cap has declined by 3.22% in the same period, currently standing at $1.12 billion.

Similarly, the total value locked on the platform has also decreased by 0.77% in the past 24 hours, currently sitting at $1.23 billion.

Over the past 30 days, PancakeSwap has generated $1.20 million in revenue, representing a decline of 26.02%. Its annualized revenue has also decreased by 32.11% to $14.55 million. The trading volume on PancakeSwap for the past year is $40.22 billion, indicating a 16.00% decline.

The fully diluted P/F ratio of PancakeSwap has increased by 31.2% to 26.21x, while its P/S ratio has also increased by 29.1% to 76.46x. In the past 30 days, PancakeSwap has generated $3.49 million in fees, representing a decline of 27.23%. Its annualized fees have decreased by 32.59% to $42.45 million.

These figures suggest that PancakeSwap’s performance has been impacted by recent market trends. Despite the decline in revenue and trading volume, the platform’s P/F and P/S ratios have increased, indicating a higher valuation for the company.

Featured image from Unsplash, chart from TradingView.com

PancakeSwap Expands to zkSync Era Network

The DEX, initially launched on BNB Chain, is now available on five blockchains.

SEC crackdown on Binance and Coinbase surge DeFi trading volumes 444%

Total daily trading volumes on decentralized exchanges have surged by nearly $800 million over the past two days.

Decentralized exchange PancakeSwap moves into GameFi

The DEX has partnered with BNB GameFi protocol Mobox to create a blockchain tower defense game.

PancakeSwap (CAKE) Plummets 24% Amidst Debate Over Reduced Staking Rewards

PancakeSwap (CAKE) token holders have been on a roller coaster ride as stakers brace for reduced rewards. The community is debating a change in the token’s economic model.

Over the past week, governance token, CAKE, has suffered a continuous downward trend, dropping by 24%. Though the proposed change appears favorable to PancakeSwap, the heated debate has impacted the token’s value.

Community Debate Over Slashed Staking Rewards

PancakeSwap is a decentralized exchange (DEX) built natively on the Binance Smart Chain (BSC). It allows users to trade cryptocurrencies, provide liquidity on trading pools, and earn rewards in the form of CAKE tokens.

Though the DEX has gained popularity recently due to its low fees, fast transactions, and innovative features, the economic proposal has brought uncertainty to its investors. According to the proposal, the developers will reduce CAKE’s inflation rate from above 20% to 3-5%.

This move is aimed at improving PancakeSwap’s “long-term health.” However, at the same time, it will lower the amount of tokens stakers can earn, leading to a decline in staking rewards. Voting for the proposal began on April 26 and is scheduled to conclude tomorrow, April 28th.

The community has already given a thumbs up to the “aggressive reduction” of staking rewards, which would reduce more than half the number of tokens emitted.

Notably, Staking rewards are a vital component of any cryptocurrency. They incentivize token holders to keep their tokens in a platform or wallet rather than sell them on the market. Staking rewards are similar to interest earned on savings in a bank account.

PancakeSwap’s staking rewards have been a significant selling point for the project, ranging from 50% to 200% per annum, depending on the trading pool. The proposed change has sparked a debate within the community, with some arguing that reduced staking rewards will drive investors away from the project, leading to a decline in demand.

Although the proposed change aims to enhance tokenomics by reducing the dilution of CAKE’s supply, it has led to an exodus of stakers. As a result, the token’s price has dropped concurrently with the amount of CAKE unstaked, as seen in the chart below.

Meanwhile, the tokenomics change proposed by the team on April 19 has also significantly reduced staking activity. The amount of CAKE staked fell from 1.007 billion to 677.851 million CAKE as of April 27.

CAKE Plummets 24% In A Week

The PancakeSwap (CAKE) token has experienced a sharp decline of over 24% in the past week following the proposed proposal to reduce the token’s inflation rate. CAKE has dropped by 24% in the past seven days, from a high of $3.43 on April 20 to a low of $27.57 on April 27.

The token’s market cap has also dropped from a high of $636 million to a low of $506 million over the same period. The sudden drop in CAKE’s price reflects the crypto community’s perception of the proposed change. If passed, the proposed change will significantly affect the project’s stakes earnings and likely reduce the token’s demand.

Featured image from iStock, Chart from TradingView

PancakeSwap wants to cap token inflation rate between 3% to 5% per annum

“Staking Allocation to target approx. 0.35 – 1 CAKE/block instead of 6.65 CAKE/block,” developers wrote.

PancakeSwap Leaders Propose Cutting CAKE Token Inflation Target to 3%-5%

The significant change to CAKE’s tokenomics would move PancakeSwap’s native token toward a deflationary model.