Bitfinex CTO Paolo Ardoino explained that if the hacking group was telling the truth, they would have asked for a ransom, but he “couldn’t find any request.”

Cryptocurrency Financial News

Bitfinex CTO Paolo Ardoino explained that if the hacking group was telling the truth, they would have asked for a ransom, but he “couldn’t find any request.”

Tether’s brand new division, Tether Evo, has completed a $200 million strategic investment in the neural implant firm.

Tether, the issuer of the ubiquitous USDT stablecoin, cemented its dominance in 2023, ballooning its market share to a staggering 71%. This explosive growth, however, comes with a chilling undercurrent: a United Nations report linking USDT to a surge in cybercrime and money laundering in Southeast Asia.

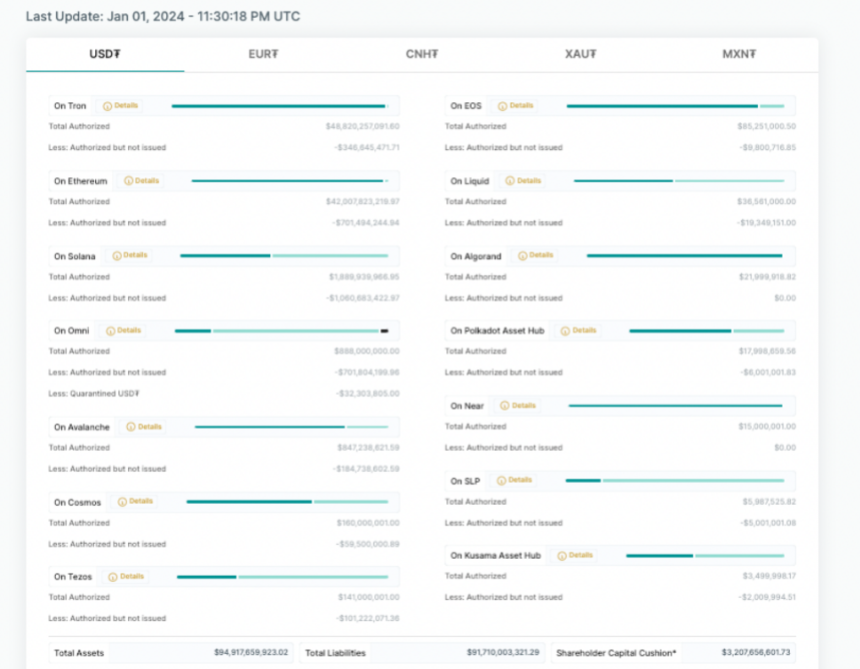

Glassnode data paints a stark picture of Tether’s ascent. Its market capitalization reached a record $95 billion in January 2024, fueled by a 40% increase in USDT supply over the past year. Meanwhile, competitors like Circle’s USDC saw their market share shrink, with USDT now commanding over 7 times the circulation of its nearest rival.

Paolo Ardoino, Tether’s new CEO, has prioritized cooperation with U.S. law enforcement. The company boasts of freezing wallets linked to sanctions lists and recovering over $435 million in illicit funds.

However, the UN report casts a shadow on these efforts, detailing how USDT facilitates “sextortion,” “pig butchering” scams, and underground banking across Asia.

While Tether has proactively banned over 1,260 addresses linked to criminal activity, the sheer volume of illicit transactions raises concerns about the effectiveness of these measures.

Critics point to Tether’s opaque reserve backing as a breeding ground for misuse, calling for greater transparency to combat money laundering.

The stablecoin market, once touted as a bridge between traditional finance and the crypto world, now faces a reckoning. Tether’s dominance is undeniable, but its association with criminal activity threatens to erode trust and trigger stricter regulations.

Meanwhile, Circle’s recent IPO filing hints at a potential shift in the landscape. With regulatory scrutiny intensifying, Tether’s future hinges on its ability to address concerns about transparency and combat illicit activity.

Can it clean up its act and maintain its crown, or will the tide turn towards its more transparent rivals? Only time will tell if Tether’s reign as the king of stablecoins will weather the storm of controversy.

With its historic 71% market share, Tether’s reign over the stablecoin realm is undeniable. Yet, the shadow of illicit activity threatens to eclipse its success.

As regulators sharpen their focus and competitors like Circle step into the ring, the question looms: will Tether clean house and retain its crown, or will this be the tipping point for a stablecoin revolution, reshaping the future of crypto itself?

Only time will tell if Tether’s dominance signals a bright new era for digital currencies or serves as a cautionary tale, paving the way for a more transparent and accountable crypto landscape. The gloves are off, and the fight for the future of stablecoins is just beginning.

Featured image from Shutterstock

A year ago, our team sat down with Paolo Ardoino, CTO at crypto exchange Bitfinex, to talk about the Bitcoin price and the events that, for many, triggered the long crypto winter: the FTX collapse, and the downfall of major companies in the space.

Now, we sat down with Ardoino once again to talk about the underlying reasons fueling the current Bitcoin price rally, Bitfinex’s partnership with El Salvador, their ambition for the long term, and his new position as CEO at Tether, the company behind stablecoin USDT.

Ardoino draw a parallel between Bitcoin adoption and the legacy financial market, saying that adoption happens “slowly” but much more in the traditional system. In addition, he claims to be unbothered by his new role to focus more on the work. This is what he told us:

Q: What does your new position mean for you personally and for Bitfinex as a company? Will there be any changes for the users?

Paolo: No changes at all. I mean, I think on the Bitfinex side, again, my role didn’t change, and so things are progressing at the same pace, with the same attention to our user base. Same excitement for Bitcoin adoption and building Bitcoin infrastructure. So, absolutely no changes on the side. And also on the other side, I’ve been involved in strategy decisions for the last few years. I have always been excited to not just do development but also work on the strategy and the business side. So, also no changes there (…) Given the fact that I’ve been, anyway, leading the strategy made sense to just adjust the title on the Tether side as well.

For me. I mean, I’m the same guy that keeps working, keeps coding, keeps doing things that he likes all day long (…) So I like to think that for me, nothing changes. I’m not the type of guy that goes around with fanfare for title changes. I just like to work. I like the two companies that I’m working in. My passion is my work; it is my hobby.

Q: Having celebrated two years since the Bitcoin Law made BTC legal tender in El Salvador, do you believe it has significantly impacted the population? Are more people using Bitcoin now compared to 2021?

Paolo: So that’s a good question. So first of all, I am always carefully explaining that while we all want change, that is fast change can never be fast. People are historically by nature are reluctant to change. So I think it’s important that people keep that in mind because. I lived part of my time in Switzerland and I was talking to a few banks and local administrations in Switzerland and they were confirming that even for the credit cards and debit cards, it took 15 years to be widely used because people the first time they had the debit cards and credit cards in their pockets, and we are talking about Switzerland, that is basically the country of finance and banks, yet the adoption was so low because people didn’t trust that the piece of plastic that they have in their pockets. So with Bitcoin it’s the same, right?

So it’s about earning trust over time. I don’t think Bitcoiners need to push Bitcoin down people’s throats. I think Bitcoiners have to be patient, to explain things in a way that is simple to understand. Sometimes we bitcoiners are a bit too hard to comprehend or too hard to follow just because we like to use big words and complex explanations but that is not what we should be doing. We should be crafting education that is good for a kindergarten teacher or a taxi driver, school bus driver who is selling groceries. That is the real adoption takes time to understand, to get this type of feedback and to adapt the educational processes for that. So I’m sure that the Bitcoin adoption will come. There is a lot of new companies that I’m meeting this, that are moving here in El Salvador to help with the process, to provide further infrastructure, to invest themselves in education. So it’s just a process that takes time and sometimes you have mainstream media trying to demonize the work, pace, and speed at which things are moving here. But again, they are always forgetting that in traditional finance things always move even slower than these. So, I would say that Bitcoin adoption in Salvador is a success and will be even more successful in the next years.

Q: Could you share details about Bitfinex’s partnership with El Salvador? What initiatives are you currently working on, and what projects do you hope to develop in the coming years?

Paolo: We partnered with two educational projects. One is called Torogoz Dev, which focuses on leveraging the expertise of developers here to instruct and teach other developers. And so to create a community of developers that understand really well Bitcoin, the importance of that is that we want El Salvador to be able to grow its internal knowledge and internal infrastructure and software development base. It’s fine to bootstrap it with people coming from that side, but it’s more and more important to have knowledge and a strong base of developers drawing from the inside. And then also Mi Primer Bitcoin is another partnership that we achieved for a location that is more suitable for the broader public.

Then we obtained a securities license so that our goal there is to make sure that El Salvador will become the central financial hub for Central and South America. And I think it has all the chances to do that because the local administration, the president, the government are really forward looking. They seem to think things are on the right track to bring companies or have companies that can leverage securities here in El Salvador to raise capital for their companies, for their enterprises. And it’s quite unique because imagine the United States, if you are a small company that has around between $500,000 and $10 million of market cap, it’s almost impossible to get a loan or to raise capital publicly because then you would need to go to a bank. But the banks are extremely expensive and they will take huge fees and it would cost too much in lawyers for you. So people don’t do that, small companies don’t do that, but Bitfinex Securities aims to create a more democratic access for companies that want to raise capital through securities.

Q: Turning to Bitcoin’s current market activity, there’s a widespread belief that the potential approval of a spot Bitcoin ETF has bolstered the rally. What is your perspective on this? Do you sense a shift in the market dynamics?

Paolo: So I think that since 2022 after FTX, Bitcoin has been extremely oversold. So I think that slowly but steadily it has recovered over the last months. We don’t see much Bitcoin (supply) the sell side right now. Institutions are accumulating Bitcoin left and right. So that is also one of the reasons, in my opinion, why the price is going up. And even with the Bitcoin ETF even further, you can argue easily that that will drive Bitcoin adoption. So I think it’s normal to see the price moving also considering the Halving next year.

I think people started to realize that there is a big difference between Bitcoin and everything else, every other token. So people are going for something that maybe doesn’t do 100x in a few days as some random tokens, but is a certainty, right? Is something that is stable, has a strong user base, has strong fundamentals, and that cannot be said for all the other tokens. So that’s why we are seeing this growing excitement around Bitcoin.

As of this writing, Bitcoin trades at $36,400 after cooling off during the day. The cryptocurrency reached a yearly high north of $38,000.

Cover image from Unsplash, chart from Tradingview

Taproot Assets is “how we bitcoinize the dollar and the world’s financial assets,” says Ryan Gentry, director of business development at Lightning Labs.

Paolo Ardoino appointed new CEO at Tether.

Tether’s chief technology officer, Paolo Ardoino dropped a hint that the operations are based in South America, but hesitated to reveal any more details beyond that.

Tether, the company behind the USDT stablecoin, may now be the 11th largest bitcoin holder in the world. This comes after the stablecoin issuer recently published its attestation report for Q2 2023.

According to the report, Tether recorded an increase in excess reserves, which grew by $850 million. This brought the company’s total excess reserves to approximately $3.3 billion.

These excess reserves are profits that the company does not distribute to shareholders as dividends. Instead, Tether keeps them to shore up its 100% reserves, which are used to back all USDT in circulation and keep the token stable.

In the last quarter, Tether published that it held more than $1.5 billion worth of BTC (about 53,495 BTC) in its reserves. Based on the latest quarterly report, this figure has grown by more than $176 million, bringing the company’s Bitcoin holdings to roughly $1.676 billion (around 55,022 BTC).

Tom Wan, a research analyst at 21.co, found in the last quarter that Tether may be holding all their Bitcoin in one wallet, making them the 12th largest BTC holder at the time. Fast forward to Q2 2023, it appears that the analyst has confirmed his initial speculations.

In the first quarter, the BTC holdings of Tether’s “possible” wallet address matched the BTC amount published in the company’s attestation report. The BTC balance of this address has also increased in the second quarter, corresponding with the amount provided in Tether’s Q2 report.

The analyst noted that only one Bitcoin address matches the figures of Tether’s BTC reserves. And this address, which may belong to the stablecoin issuer, is now the 11th largest Bitcoin holder in the world.

While Wan sought Tether and the company’s CTO Paolo Ardoino to corroborate his findings, there has been no official confirmation from the stablecoin issuer.

This significant amount of BTC Tether holds in its reserves comes as no surprise, especially as the firm has always been clear about its Bitcoin investment intentions. In May, the stablecoin issuer announced plans to invest 15% of its future profit in Bitcoin.

Tether’s CTO Paolo Ardoino, a vocal supporter of Bitcoin, stated that the cryptocurrency’s resilience is the reason for the company’s continuous investment in the asset.

Ardoino said:

The decision to invest in Bitcoin, the world’s first and largest cryptocurrency, is underpinned by its strength and potential as an investment asset. Bitcoin has continually proven its resilience and has emerged as a long-term store of value with substantial growth potential. Its limited supply, decentralized nature, and widespread adoption have positioned Bitcoin as a favored choice among institutional and retail investors alike.

However, there have been concerns about Tether and USDT’s exposure to risks due to increased investment in a highly volatile asset such as Bitcoin.

As of this writing, USDT is the largest stablecoin in the cryptocurrency market, with a market cap of roughly $83.81 billion.

Tether’s CTO Paolo Ardoino believes that artificial intelligence would choose to use Bitcoin over more centralized cryptocurrencies like stablecoins.

Rival stablecoin tether (USDT) has grown to its most dominant since May 2021, now representing 60% of all stablecoins in circulation.

What happened here was not a mistake; it is not that they were hacked. They took several decisions to put at risk customer assets.

The crypto industry saw dark days over the past week. FTX, the former second-largest exchange in the world, crumbled. The fallout continues to ripple across the industry, with FTX-backed companies filing for bankruptcy, users filing for lawsuits, and regulators sharpening their claws.

In this context, we sat with Paolo Ardoino, Chief Technical Officer (CTO) for Tether and crypto exchange Bitfinex to get his opinion about recent events. Paolo joined us from El Salvador, the first country to make Bitcoin legal tender, a historical place for the nascent asset class.

Two major events in the industry’s history came together from this location, the celebration of mainstream adoption by a nation-state and the fall from grace of one of its golden boys, Sam Bankman-Fried. Paolo gave his perspective on real adoption in the Latin American Country, and the recent events that ushered in the collapse of FTX.

His message revolved around education, self-custody, and the work ahead for crypto exchanges, users, and all actors across the crypto space. This is what he told us:

Q: You were on the ground in El Savador, the first country to make Bitcoin legal tender. Are people using Bitcoin for daily payments? How do you see things down there in terms of adoption?

PA: So adoption, you know, so we see adoption in among, first of all, commercials, and businesses. The adoption when it comes to people and retail, the consumers, is still not widespread. I think it’s normal.

So is fully normal, you know, thinking and pretending that after just one year, everyone in the streets would use Bitcoin. That is super far-fetched. The usage of Bitcoin comes with infrastructure, and building infrastructure requires time, even when Europe moved from, you know, all the different currencies of the different countries to one single currency called Euro. It took several years up to six years to prepare everyone for the passage. And that was, you know, a forced passage to a single option that was Europe and is in El Salvador.

Bitcoin is being used as an option for dollars. So, my point is that it will take several years in order to create adoption, and that is completely normal. And the only thing we can do is to keep building infrastructure and support and make the user experience more seamless.

Q: How are you guys contributing to crypto adoption?

PA: First, we have supported different educational platforms like “Mi Primer Bitcoin.” We are working directly with the government to try to set up courses at different levels from universities and high schools for Bitcoin education, right?

We cannot pretend that adoption will happen by itself, it will happen only when people understand why Bitcoin matters. We at BitFinex are devoting resources. Well, of course, we devoted resources when it came to, you know, helping the families affected by the Pandemic or by the hurricane, but that is just the first step.

The important part is starting with all the educational projects that we have, and so also we are kind of excited because more and more with all the different things that will happen in the next months. El Salvador will stay on the map and we will become more prominent because there is also a securities law (to be introduced) that will enable companies to raise capital and create a securities tokens like you know, issue bonds issue or stocks and raise capital through Bitcoin. So more and more so. The infrastructure has to be at all levels, it cannot be just retail, it cannot just be consumer, it cannot just be shops, (there has to be) a full immersion of Bitcoin as a payment option as a capital raise option for companies here.

Q: Do you believe the last week, with FTX collapsing, users losing millions on the platforms, and regulators coming after the industry, will change anything for crypto adoption?

PA: Well, I think that the last week just showed that there is a big difference between Bitcoin and everything else. We have seen an exchange that actually devoted itself to altcoins with some debatable approaches to the point where they were actually managing these tokens to go bankrupt. The sad, sad story is that many people had bitcoins on those exchange and that exchange, and they thought they had Bitcoins on that exchange, but now they realize they don’t have any more Bitcoins.

It shows the (importance) of holding your bitcoins in your private wallet, right? So, not everyone can do that yet, right? Because there is some user experience challenges because no one is comfortable, and not everyone is comfortable to store its own bitcoins privately, but I think that what happened is making more and more the case of for companies to research in building applications that can help the self custody of Bitcoins.

And again, as I said, (the FTX collapse) also showed the difference between Bitcoin as more reliable, more secure, un-censorable money network and the rest. The industry will learn that you know, you cannot lend out other people’s money. You cannot use other people’s money to buy stuff. And so on. What happened here was not a mistake, it is not that they were hacked. They took several decisions to put at risk customer assets.

Q: What do you think will come out of this debacle, if anything? The industry likes to believe that it learned something from FTX’s mistakes, how do you spot another future Sam Bankman-Fried as a bad actor?

First of all, if something is too good to be true, that is already a problem, right? I mean, these guys were offering you know, things that all the other exchanges were not offering to grow faster, but you know, in the end really, it was too good to be true.

I think that FTX was always vocal against proof of work, and it was vocal against the usage of cryptocurrencies, including stablecoins, for decentralized finance (DeFi) or for interactions without intermediaries. So, they were quite vocal in working with regulators to increase their grip in our industry, in a sense that created some panic among the industry. We understand that regulations will come and there is some sort of need for it but we are now in a situation where we risk over-regulation.

Hence, we’re at risk of crippling the industry, the potential, and the innovation that it can create. Honestly, I’m talking to many people that are extremely pissed by the fact that we took a three years step back.

We are at the same situation of the ICO (Initial Coin Offering) era. And we have to put even more effort to regain the trust of the users and educate them on how to properly keep their funds under their own custody. So, really it is a complex process that requires energy that should be better invested in Bitcoin adoption. Yet we have to fight the fight to show that not everyone in the space is the same (as Sam Bankman-Fried). There are bad actors and good actors.

Q: Tether was one of the first to freeze FTX funds. How do you work with authorities to make that decision? Were there any red signals about FTX, Sam, and Alameda before their collapse influencing the decision?

PA: We (Tether) received a law enforcement request. You might have seen later on also the SCB, the security commission of Bahamas, issued a statement that was connected to our freezing process. We get contacted by law enforcement and we have to act, keep in mind that Tether is a centralized stablecoin. Because although it uses the decentralized transport layer is a centralized stablecoin. We have to comply with the requirements of law enforcement. And honestly, I was pleased that we were extremely quick to act to save a little bit of money of users. Because, you know, after they went bankrupt they were also hacked. So, it’s putting oil on the fire.

Q: In the wake of FTX, there are reports about massive crypto withdrawals from exchanges; Bloomberg reported over $3 billion in the past week alone. Is Bitfinex prepared to deal with a bank run? And in that sense, will the FTX incident force all major exchanges to adopt some proof of reserve mechanism and become more accountable to users?

PA: Absolutely. So with BitFinex, we released the proof of reserves that shows that BitFinex has around $7.5 to $8 billion in custody on the platform. So that, you know, for us is important to show to the jury. Just let me take a step back of those assets. The majority is in Bitcoin and Ethereum, it is not some sort of vaporware coins that you create. So that to us is quite important because shows that BitFinex probably has the second biggest wallet in the world. We have the funds that we are supposed to have under our custody.

We showed the proof of reserves and also we published or republished a project that we have been working for some time. Called “Antani”, it is an open source library that allows us to publish a proof of liabilities, because with proof of reserves, you don’t have the full picture. You also need the proof of liabilities.

But in general, a good message would be that exchanges should teach their users to keep custody of your own tokens on exchanges. 50% of the assets deposited on exchanges, probably more but to be safe, is not used for trading.

Exchanges should be used for trading, they should not be your custodians. You should have a Ledger Wallet. You should have a multi-SIG, you should try to do your own setup, and that’s what exchanges should teach. I represent an exchange. And I believe that people should learn more about self-custody.

Q: Finally, Paolo, where do you think the industry will be in 2023 and 2033? Was the collapse of FTX, as some called it, part of the industry’s “growing pains”? What changes need to be implemented to take the next step forward in adoption?

PA: The industry has to mature. In one way or the other, it will need to mature and I think that the work that we are doing at BitFinex is actually going in that direction; to try to lead the way in this maturing process.

We are providing the tools, our mission is to (help) companies and even governments, like what we are doing elsewhere with the traditional financial system right we want to create more options for people and governments to access capital. And we want to reinforce our focus on Bitcoin.

Of course, we are an exchange we have to provide options, but in our heart is Bitcoin. We will always keep Bitcoin as our priority. More and more BitFinex will be considered the place to go if you want to you know interact with Bitcoin, learn about Bitcoin, learn about financial inclusions, and to educate yourself.

What happened here was not a mistake; it is not that they were hacked. They took several decisions to put at risk customer assets.

The crypto industry saw dark days over the past week. FTX, the former second-largest exchange in the world, crumbled. The fallout continues to ripple across the industry, with FTX-backed companies filing for bankruptcy, users filing for lawsuits, and regulators sharpening their claws.

In this context, we sat with Paolo Ardoino, Chief Technical Officer (CTO) for Tether and crypto exchange Bitfinex to get his opinion about recent events. Paolo joined us from El Salvador, the first country to make Bitcoin legal tender, a historical place for the nascent asset class.

Two major events in the industry’s history came together from this location, the celebration of mainstream adoption by a nation-state and the fall from grace of one of its golden boys, Sam Bankman-Fried. Paolo gave his perspective on real adoption in the Latin American Country, and the recent events that ushered in the collapse of FTX.

His message revolved around education, self-custody, and the work ahead for crypto exchanges, users, and all actors across the crypto space. This is what he told us:

Q: You were on the ground in El Savador, the first country to make Bitcoin legal tender. Are people using Bitcoin for daily payments? How do you see things down there in terms of adoption?

PA: So adoption, you know, so we see adoption in among, first of all, commercials, and businesses. The adoption when it comes to people and retail, the consumers, is still not widespread. I think it’s normal.

So is fully normal, you know, thinking and pretending that after just one year, everyone in the streets would use Bitcoin. That is super far-fetched. The usage of Bitcoin comes with infrastructure, and building infrastructure requires time, even when Europe moved from, you know, all the different currencies of the different countries to one single currency called Euro. It took several years up to six years to prepare everyone for the passage. And that was, you know, a forced passage to a single option that was Europe and is in El Salvador.

Bitcoin is being used as an option for dollars. So, my point is that it will take several years in order to create adoption, and that is completely normal. And the only thing we can do is to keep building infrastructure and support and make the user experience more seamless.

Q: How are you guys contributing to crypto adoption?

PA: First, we have supported different educational platforms like “Mi Primer Bitcoin.” We are working directly with the government to try to set up courses at different levels from universities and high schools for Bitcoin education, right?

We cannot pretend that adoption will happen by itself, it will happen only when people understand why Bitcoin matters. We at BitFinex are devoting resources. Well, of course, we devoted resources when it came to, you know, helping the families affected by the Pandemic or by the hurricane, but that is just the first step.

The important part is starting with all the educational projects that we have, and so also we are kind of excited because more and more with all the different things that will happen in the next months. El Salvador will stay on the map and we will become more prominent because there is also a securities law (to be introduced) that will enable companies to raise capital and create a securities tokens like you know, issue bonds issue or stocks and raise capital through Bitcoin. So more and more so. The infrastructure has to be at all levels, it cannot be just retail, it cannot just be consumer, it cannot just be shops, (there has to be) a full immersion of Bitcoin as a payment option as a capital raise option for companies here.

Q: Do you believe the last week, with FTX collapsing, users losing millions on the platforms, and regulators coming after the industry, will change anything for crypto adoption?

PA: Well, I think that the last week just showed that there is a big difference between Bitcoin and everything else. We have seen an exchange that actually devoted itself to altcoins with some debatable approaches to the point where they were actually managing these tokens to go bankrupt. The sad, sad story is that many people had bitcoins on those exchange and that exchange, and they thought they had Bitcoins on that exchange, but now they realize they don’t have any more Bitcoins.

It shows the (importance) of holding your bitcoins in your private wallet, right? So, not everyone can do that yet, right? Because there is some user experience challenges because no one is comfortable, and not everyone is comfortable to store its own bitcoins privately, but I think that what happened is making more and more the case of for companies to research in building applications that can help the self custody of Bitcoins.

And again, as I said, (the FTX collapse) also showed the difference between Bitcoin as more reliable, more secure, un-censorable money network and the rest. The industry will learn that you know, you cannot lend out other people’s money. You cannot use other people’s money to buy stuff. And so on. What happened here was not a mistake, it is not that they were hacked. They took several decisions to put at risk customer assets.

Q: What do you think will come out of this debacle, if anything? The industry likes to believe that it learned something from FTX’s mistakes, how do you spot another future Sam Bankman-Fried as a bad actor?

First of all, if something is too good to be true, that is already a problem, right? I mean, these guys were offering you know, things that all the other exchanges were not offering to grow faster, but you know, in the end really, it was too good to be true.

I think that FTX was always vocal against proof of work, and it was vocal against the usage of cryptocurrencies, including stablecoins, for decentralized finance (DeFi) or for interactions without intermediaries. So, they were quite vocal in working with regulators to increase their grip in our industry, in a sense that created some panic among the industry. We understand that regulations will come and there is some sort of need for it but we are now in a situation where we risk over-regulation.

Hence, we’re at risk of crippling the industry, the potential, and the innovation that it can create. Honestly, I’m talking to many people that are extremely pissed by the fact that we took a three years step back.

We are at the same situation of the ICO (Initial Coin Offering) era. And we have to put even more effort to regain the trust of the users and educate them on how to properly keep their funds under their own custody. So, really it is a complex process that requires energy that should be better invested in Bitcoin adoption. Yet we have to fight the fight to show that not everyone in the space is the same (as Sam Bankman-Fried). There are bad actors and good actors.

Q: Tether was one of the first to freeze FTX funds. How do you work with authorities to make that decision? Were there any red signals about FTX, Sam, and Alameda before their collapse influencing the decision?

PA: We (Tether) received a law enforcement request. You might have seen later on also the SCB, the security commission of Bahamas, issued a statement that was connected to our freezing process. We get contacted by law enforcement and we have to act, keep in mind that Tether is a centralized stablecoin. Because although it uses the decentralized transport layer is a centralized stablecoin. We have to comply with the requirements of law enforcement. And honestly, I was pleased that we were extremely quick to act to save a little bit of money of users. Because, you know, after they went bankrupt they were also hacked. So, it’s putting oil on the fire.

Q: In the wake of FTX, there are reports about massive crypto withdrawals from exchanges; Bloomberg reported over $3 billion in the past week alone. Is Bitfinex prepared to deal with a bank run? And in that sense, will the FTX incident force all major exchanges to adopt some proof of reserve mechanism and become more accountable to users?

PA: Absolutely. So with BitFinex, we released the proof of reserves that shows that BitFinex has around $7.5 to $8 billion in custody on the platform. So that, you know, for us is important to show to the jury. Just let me take a step back of those assets. The majority is in Bitcoin and Ethereum, it is not some sort of vaporware coins that you create. So that to us is quite important because shows that BitFinex probably has the second biggest wallet in the world. We have the funds that we are supposed to have under our custody.

We showed the proof of reserves and also we published or republished a project that we have been working for some time. Called “Antani”, it is an open source library that allows us to publish a proof of liabilities, because with proof of reserves, you don’t have the full picture. You also need the proof of liabilities.

But in general, a good message would be that exchanges should teach their users to keep custody of your own tokens on exchanges. 50% of the assets deposited on exchanges, probably more but to be safe, is not used for trading.

Exchanges should be used for trading, they should not be your custodians. You should have a Ledger Wallet. You should have a multi-SIG, you should try to do your own setup, and that’s what exchanges should teach. I represent an exchange. And I believe that people should learn more about self-custody.

Q: Finally, Paolo, where do you think the industry will be in 2023 and 2033? Was the collapse of FTX, as some called it, part of the industry’s “growing pains”? What changes need to be implemented to take the next step forward in adoption?

PA: The industry has to mature. In one way or the other, it will need to mature and I think that the work that we are doing at BitFinex is actually going in that direction; to try to lead the way in this maturing process.

We are providing the tools, our mission is to (help) companies and even governments, like what we are doing elsewhere with the traditional financial system right we want to create more options for people and governments to access capital. And we want to reinforce our focus on Bitcoin.

Of course, we are an exchange we have to provide options, but in our heart is Bitcoin. We will always keep Bitcoin as our priority. More and more BitFinex will be considered the place to go if you want to you know interact with Bitcoin, learn about Bitcoin, learn about financial inclusions, and to educate yourself.

Tether is also looking to become more transparent, having hired a new accounting firm to conduct regular audit and attestation reports to ensure its stablecoin is properly backed by the USD.

Paolo Ardoino alleged some hedge funds are trying to create pressure “in the billions” to “harm Tether liquidity” so that they can eventually buy back tokens at a much lower price.

“It was clear to me, it was clear to many that I know that it was a bad idea,” said Tether and Bitfinex CTO Paolo Ardoino.

Bitfinex and Tether CTO, Paolo Ardoino spoke to Cointelegraph about cryptocurrency adoption in Europe.

The City of Lugano in Switzerland, the most important Italian-speaking city outside of Italy, is not playing around. The goal of their “Plan B” is to “make Lugano the blockchain hub for the entire Europe,” according to Tether’s Paolo Ardoino. And it will probably succeed. The city wants to attract investment and talent, attract wealth and smart minds, and they’re putting their money where their mouth is.

Why do they have to brand their plan using bitcoin’s name, though? In NewsBTC’s previous article about the project we were very critical, and even raised the possibility of this being an affinity scam. Bitcoin name is heavily used in all promotional materials, but the protagonists talk about blockchain and crypto like there’s no tomorrow. Why would Tether Ltd. and its partners not make this a crypto project and call it a day?

We closed said article giving them the benefit of the doubt:

“And here comes the Mayor of the city of Lugano and Tether to sing bitcoin’s praises. A “blockchain not bitcoin” guy and the organization behind the most controversial stablecoin. Even though it’s suspicious, let’s give them the benefit of the doubt and hear what they have to say. They might surprise us at the March 3rd conference. Maybe Lugano has a Plan B after all.”

Do they have a Plan B? Let’s find out.

Bitcoin Legal Tender In Lugano. And USDT. And LVGA

The story’s headline is that Bitcoin, Tether, and LVGA, the city’s own cryptocurrency, will be legal tender in Lugano. Residents will be able to “pay all personal and corporate municipal taxes” in any of those cryptocurrencies. Besides that, the city’s authorities have already onboarded 200+ shops and businesses to accept them.

There’s more though. You’ll be able to use bitcoin, USDT, and LVGA to pay for: public services, parking tickets, dog taxes, ID and passport issuance fees, naturalization fees, construction permit fees, boat docking fees, tuition and meal fees, garbage taxes, signature authorization, access to public infrastructure, access to public events, rental spaces for events, and cemetery taxes.

Who Presented The News And What Did They Say?

The panel consisted of:

The Mayor said that “Lugano is, historically, a land of technological innovation and freedom.” He believes that “Bitcoin, blockchain, and crypto” should be “disseminated and accessible to all.” And he’s convinced “that this journey will bring benefits to all the citizens and that’s why this is our commitment.”

Jan Ludovicus van der Velde briefly recapitulated bitcoin’s history and talked about the value of open-source software. About cryptocurrencies, he said that while the adoption is wide scaled, in practice, “we lack the ability to exchange with the local bakeries and tailors. We lack the ability to pay for higher education or automobiles. We’re stuck waiting for the world to catch up to the future of financial freedom.”

About “Plan B” specifically, van der Velde said, “We envision blockchain touching every facet of this city.”

NEW: Switzerland's City of Lugano will "roll the red carpet" for #Bitcoin businesses and enthusiasts  pic.twitter.com/2hujg4V4wm

pic.twitter.com/2hujg4V4wm

— Bitcoin Magazine (@BitcoinMagazine) March 3, 2022

Paolo Ardoino stated that “with this Plan B we want to show that the tooling, the instruments, that we’re creating can be actually put to work in a local, controlled, vibrant environment like the City of Lugano.” While Pietro Poretti said that the plan was to “create the ideal conditions for companies to thrive.” They both carried the conference and announced everything else in this article.

Ardoino also explained why they chose Lugano. Among other things:

BTC price chart for 03/04/2022 on Coinbase | Source: BTC/USDT on TradingView.com

What Does Lugano ‘s “Plan B” Consists Of, Exactly?

The only mention of something bitcoin-specific goes to Paolo Ardoino, who sang the Lightning Network’s praises and expressed his wishes for Lugano to be the “first wide adopter.” We know he meant after the legendary Bitcoin Beach in El Salvador, of course.

Ardoino also announced a 100 million CHF fund “for start-ups that want to relocate here and want to put their headquarter here.” “Infrastructure partners like Polygon” made the fund possible. One of USDT’s versions runs on the Ethereum Layer 2 chain, and in this conference, we learned that LVGA, the city’s coin, also runs on Polygon rails.

Besides that fund, Lugano’s “Plan B” consists of:

Announcing The Bitcoin World Forum

From October 26th to 28th, at Lugano’s Palazzo dei Congressi, there will be a huge conference. So far, the confirmed speakers are Blockstream’s Adam Back, bitcoin ambassador Samson Mow, and the controversial Max Keiser. More guests are to be announced.

Keep your eye on NewsBTC for following stories about the Bitcoin World Forum and Lugano’s “Plan B.”

Featured Image: Lugano’s Plan B announcement, screenshot from the video | Charts by TradingView

What’s “Lugano’s Plan B”? The 9th biggest city in Switzerland plans to become Europe’s Bitcoin city. And Tether is there to help. How will the two entities accomplish that? On March 3rd, Tether’s Paolo Ardoino and Michele Foletti, the Mayor of the city of Lugano, will unveil the plan at a live-streamed conference.

#bitcoin and stablecoins are revolutionizing the financial sector. #tether and The City of Lugano @luganomycity are teaming up to transform Lugano into the European #bitcoin capital.

@luganomycity are teaming up to transform Lugano into the European #bitcoin capital.

Every city needs a plan. Join Lugano's Plan ₿ pic.twitter.com/wmhFVePcPo

— Tether (@Tether_to) February 21, 2022

Announcing the event, Tether summarized the situation as follows: “bitcoin and stablecoins are revolutionizing the financial sector. Tether and The City of Lugano are teaming up to transform Lugano into the European bitcoin capital.” For their part, the city’s official Twitter said, “The journey of the City of Lugano continues to discover the innovative sector #blockchain #Bitcoin #StableCoin.”

Continua il percorso della Città di #Lugano alla scoperta del settore innovativo #blockchain #Bitcoin #StableCoin Prossimo incontro il 3 marzo 2022, ore 17 al LAC, su iscrizione, oppure streaming @Tether_to @LuganoLivingLab https://t.co/g3NYTffvAT

Prossimo incontro il 3 marzo 2022, ore 17 al LAC, su iscrizione, oppure streaming @Tether_to @LuganoLivingLab https://t.co/g3NYTffvAT

— Lugano (@luganomycity) February 21, 2022

“We at Tether_to and the Administration of the City of Lugano have been tirelessly working together to prepare Lugano’s Plan ₿!,” completed Tether’s Paolo Ardoino. He was also bold enough to predict, “100% crypto will relocate to Lugano.”

We at @Tether_to and the Administration of the City of Lugano  have been tirelessly working together to prepare Lugano's Plan ₿!

have been tirelessly working together to prepare Lugano's Plan ₿!

3rd March 2022 , I'll join @MicheleLugano (mayor) in a live conference, to disclose the plan!100% #crypto will relocate to Lugano  #Bitcoin

#Bitcoin

https://t.co/dely2sBeNM

https://t.co/dely2sBeNM

— Paolo Ardoino (@paoloardoino) February 21, 2022

This all sounds wonderful, but, are they selling smoke? Even though bitcoin is prominently shown in all of the promotional material, a deeper look at the player’s words suggests the Lugano plan is to be a crypto city. Which is very different from a bitcoin city.

Related Reading | USDC Leaves Tether Behind In Terms Of Market Cap And Becomes First On Ethereum

How Much Bitcoin Will Lugano‘s Plan B Have?

In a recent Twitter exchange, Michele Foletti responded to the worst question possible. Someone asked the Mayor of the city of Lugano about the usual bitcoin FUD, that it’s slow and expensive like the Lightning Network doesn’t exist. That it’s bad for the environment like that narrative didn’t collapse a while back. How did Foletti respond?

“We focus on our 3Achain, more sustainable, public and open to all with limited costs http://3achain.org Blockchain for us is an opportunity for all those who look to the future with curiosity.”

Ma noi puntiamo sulla nostra 3Achain, più sostenibile, pubblica e aperta a tutti con costi limitati https://t.co/r6HS5Fs42a Blockchain per noi è un’opportunità per tutti coloro che guardano al futuro con curiosità https://t.co/EQHtidHgcW

— Michele Foletti (@MicheleLugano) February 21, 2022

He basically said “blockchain, not bitcoin.” Why name the program “Plan B” and promise a “European bitcoin capital,” then? And what’s all this about a Proof-of-Authority, completely centralized blockchain that describes itself as “the institutional blockchain platform promoted by the City of Lugano”?

BTC price chart for 02/22/2022 on Bittrex | Source: BTC/USD on TradingView.com

Institutional Blockchain Platform Promoted By The City Of Lugano

In an article about the recent Lugano NFT Week, an event that also points at crypto, the Europa Press agency quotes Michele Foletti saying:

“We have always followed the development of new technologies very closely and we have identified blockchain as a topic of great interest for both multinational and local companies, citizens and businesses. We believe that a city must be at the service of citizens and with these initiatives we intend to place Lugano as a top-level player on the international scene, for all applications related to this technology.”

Does this man even know about bitcoin? Or is Lugano’s Plan B project using bitcoin in an affinity scam?

Snow in #lugano pic.twitter.com/G5bFEXuIQ5

— Paolo Ardoino (@paoloardoino) February 15, 2022

Let’s go to 3Achain’s website to find out if “the institutional blockchain platform promoted by the City of Lugano” respects bitcoin. This quote summarizes it all:

“It’s not about replacing public (so-called permissionless) blockchains, but about complementing them with a permissioned architecture that guarantees the parties involved not so much through the integrity of the algorithm that validates transactions through computing power, but through the validation of blocks by an independent authority.”

What do they mean by “so-called permissionless”? And, in other words, they’re announcing they solved the blockchain trilemma by getting rid of decentralization. By adding a third party. Have you heard anything more anti-bitcoin?

Conclusion And Disappointment

Bitcoin is a Proof-Of-Work system. To understand it, you have to put in the work. El Salvador was the first country to adopt bitcoin as legal tender. It’s remarkable, almost a miracle, that President Bukele seems to understand the value proposition. Politicians don’t usually have the time for the necessary deep dive, so the world ends up disappointed. With disasters like MiamiCoin and the NY Mayor saying he’s pro bitcoin, but against bitcoin mining.

Related Reading | Cryptocurrency Firms In Switzerland To Offer Tokenized Products On Tezos

And here comes the Mayor of the city of Lugano and Tether to sing bitcoin’s praises. A “blockchain not bitcoin” guy and the organization behind the most controversial stablecoin. Even though it’s suspicious, let’s give them the benefit of the doubt and hear what they have to say. They might surprise us at the March 3rd conference. Maybe Lugano has a Plan B after all.

Featured Image: Snow In Lugano, By Paolo Ardoino. From this tweet. | Charts by TradingView

The new Bitfinex STO trading platform is now ready to operate in Kazakhstan. It will allow investors access the tokenized securities and blockchain-based equities.

Popular Bitfinex cryptocurrency exchange has announced its plans to launch a trading platform that focuses on STOs (Security Token Offerings).

Bitfinex recently announced that they scheduled the new platform to operate in compliance with Kazakhstan financial laws. This is in line with the provision of (AFSA) Astana Financial Services Authority.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

The Security Token Offerings exchange is also known as Bitfinex Securities Ltd. Its launch is seen as one of the company’s efforts in supporting the growth of the world’s financial industry.

Securities Features And Offerings of Bitfinex

Bitfinex Securities is to run a 24/7 operation similar to others in the digital market. The company deployed technologies that will boost efficiency, reduce transaction costs and enhance the success rate on the platform.

Investors will have the opportunity of accessing an International Security trading market via the STO platform. Interested investors will also have the opportunity of diversifying their portfolios. In addition, the STO will provide them access to varieties of financial products like bonds and equities.

Issuers of the Security tokens take advantage of the platform when they raise capital through the tokenized security offerings. The information was according to an announcement, and the idea was to raise capital.

The Bitfinex Chief Technology Officer stated that the STO exchange seeks to offer a positive contribution. It will assist the trading platform in becoming the best of its kind in the world.

Paolo Ardoino added that Bitfinex Securities Ltd offers a new regulated platform that serves medium-cap and small companies. It targets the ones that are currently underserved by already existing capital markets that are inefficient.

Restricted Countries

Kazakhstan will regulate the exchange. It will allow global investors to trade different tokenized securities publicly.

However, investors in Canada, Switzerland, Australia, the British Virgin Islands, the United States, Italy, and Venezuela have restrictions. According to the legal statement from Bitfinex, they are not allowed to utilize the platform.

Related Reading | Survey Shows 25% Of US Teens Prefer Cryptocurrency Investment

More so, other countries under the embargo of Iran, Kazakhstan, the United States, and Cuba, etc., are also restricted access.

Rising Demand For Tokenized Securities

A security token is an investment contract representing real-life assets such as digital artwork and real estate.

The popularity of this asset class is increasing among investors, with various crypto-related firms joining the market. These firms offer different tokenized securities.

Traditional financial institutions have noticed the increasing demand for these securities. As a result, they have started issuing their security tokens like other crypto-related companies.

Featured Image From Pixabay

Is the price of bitcoin and other cryptocurrencies inflated because the backing of tether may not be as strong as people think it is?